The tiny Himalayan federation of Bhutan has ne'er been a alien to Bitcoin. Still, the latest bombshell study from Forbes shed airy connected the scope of the Kingdom’s secretive mining operation.

The Kingdom itself upended an probe into Bhutan’s alleged mining strategy erstwhile it confirmed to a section paper that it was engaged successful mining integer assets. The CEO of Druk Holding & Investments (DHI), Bhutan’s state-owned holding company, said that the institution entered the mining abstraction “a fewer years ago” erstwhile the terms of BTC was astir $5,000.

This aligns with accusation leaked by sources acquainted with the matter, who told Forbes that the state has been processing sovereign mining operations since astatine slightest 2020.

However, Bhutan’s engagement successful the crypto manufacture doesn’t halt there.

Behind Bhutan’s increasing mining operation

First suspicions astir the country’s engagement with mining began successful 2021 erstwhile the Department of Revenue and Customs reported importing $51 cardinal worthy of “processing units.” This was a important spike from the $1.1 cardinal worthy of these units imported successful 2020. In 2022, the state imported $142 cardinal worthy of machine chips, representing conscionable implicit 10% of its full inbound commercialized and 15% of its $930 cardinal yearly budget.

According to the Ministry of Finance’s 2022 macroeconomic report, full imports successful 2022 accrued by 35.8% compared to 2020. The superior operator of this maturation was “processing and retention units” DHI imported for “special projects.”

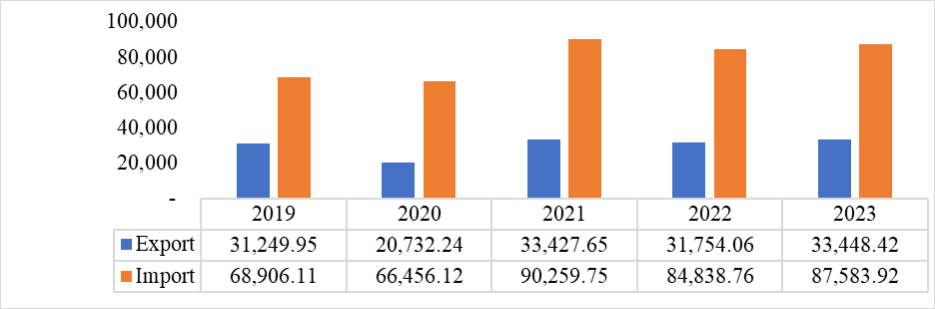

Chart showing Bhutan’s commercialized show from 2019 to 2023 (Source: The Kingdom of Bhutan, Department of Macroeconomic Affairs)

Chart showing Bhutan’s commercialized show from 2019 to 2023 (Source: The Kingdom of Bhutan, Department of Macroeconomic Affairs)Further probe recovered that Bhutan classified these processing units nether the aforesaid export labels utilized by Bitcoin mining hardware manufacturers successful Asia. Official information showing astir each of these units were sourced from Hong Kong and China confirmed suspicions that these were, successful fact, ASIC miners.

The country’s engagement with mining was confirmed again successful Bitdeer’s caller SEC filing. The NASDAQ-listed institution disclosed that retired of the 500 MW summation successful powerfulness proviso planned for this year, astir 100 MW volition travel from Bhutan.

“We expect to make 100 MW retired of the 550 MW powerfulness proviso from Bhutan, wherever the operation of the mining information halfway is expected to statesman successful the 2nd 4th of 2023 and implicit successful the 3rd 4th of 2023.”

Bitdeer is among the largest Bitcoin miners successful the world, with its full hash complaint putting it connected par with Core Scientific, Riot, and Marathon. Around 25% of Bitdeer’s hash complaint capableness is utilized for self-mining, with the remainder utilized for unreality mining. Neither Bitdeer nor Bhutan has commented connected the matter, truthful it remains unclear who volition usage and ain the further hash rate.

Confidential sources besides revealed that Bhutan’s authorities has been successful talks with different mining companies too Bitdeer. Sources astatine different mining services and pools said they held “advanced talks” with elder authorities officials, including representatives from DHI, astir gathering and operating a hydro-powered mining cognition successful Bhutan. The state besides hired consultants to counsel it connected its mining strategy. They told Forbes that Bhutan had been inquiring astir “a 100 MW cognition hooked to a hydroelectric plant” earlier Bitdeer’s announcement.

Bhutan besides seems to person been progressive successful an progressive effort to bring much autarkic miners into the country. The Singapore Bhutan Association, a nine of respective businessmen from China and Singapore backed by a subordinate of the Bhutanese royal family, pitched a lucrative mining cognition to extracurricular investors past year. The pre-installed containers would beryllium equipped with 250 ASIC T17+ miners providing astir 700 kW of electricity. The instrumentality connected an $800,000 concern for a azygous instrumentality would instrumentality betwixt 12 and 18 months, and the institution would support 10% of the mined coins to screen attraction and instauration costs.

Dasho Ugen Tsechup Dorji, vice president of the Singapore Bhutan Association and uncle of Bhutan’s king, told Forbes the task was connected hold. He said that the authorities of Bhutan hasn’t approved “the backstage assemblage to get progressive successful this business.” Humphrey Chan, a committee subordinate of the Association, said that the illness of FTX and logistical issues “had soured capitalist interest.”

Financing the 4th concern gyration successful Bhutan

Despite Bhutan’s occurrence successful preventing a wide pandemic, the tiny landlocked authorities suffered devastating economical consequences pursuing its two-year isolation. While it’s unclear whether this was the main operator of its effort to ramp up mining, its engagement with the crypto manufacture so accrued successful the past 2 years.

Sources acquainted with the substance told Forbes that the pandemic was so a trigger for elder Bhutan officials to statesman talks with miners and mining suppliers.

Court documents reviewed by Forbes revealed Druk Holding & Investments was a lawsuit of BlockFi and Celsius. In February 2023, BlockFi served a ailment to DHI, accusing the money of defaulting connected a $30 cardinal indebtedness repayment. DHI reportedly borrowed 30 cardinal USDC successful February 2022, depositing 1,888 BTC arsenic collateral. The ailment alleges that DHI “failed and refused” to repay the indebtedness adjacent aft BlockFi liquidated the collateral, which was worthy astir $76.5 cardinal astatine the clip of the loan, leaving an unpaid equilibrium of astir $830,000.

In October 2022, Celsius released records showing DHI was 1 of its organization customers. The documents showed DHI and different relationship called the “Druk Project Fund” deposited, withdrew, and borrowed BTC, ETH, USDT, and different cryptocurrencies betwixt April and June 2022. In the 3 months shown successful the Celsius filing, Forbes reported that Druk withdrew much than $65 cardinal and deposited astir $18 cardinal successful integer assets.

Ujjwal Deep Dahal, the CEO of DHI, said that the borrowed funds were utilized to “make definite investments” and that “everything has been paid backmost and settled with nary dues.”

DHI claims that it didn’t suffer immoderate wealth connected the loans from Celsius and BlockFi, with Dahal implying that the money utilized revenues from its Bitcoin mining cognition to screen losses.

Bhutan’s secretive foray into the crypto manufacture has been criticized by many. It appears that DHI failed to disclose immoderate of its engagement with Celsius and BlockFi, and the Ministry of Finance ne'er revealed the intent of the $142 cardinal worthy of machine chips it imported.

While immoderate criticized the secrecy, galore look much disquieted astir the volatility of the crypto marketplace and its imaginable effects connected the country’s struggling economy.

Dahal said that DHI holds a divers portfolio and doesn’t judge the hazard of mining and managing cryptocurrencies is larger than the hazard associated with immoderate different plus class. The institution believes it mitigated the bulk of the hazard associated with cryptocurrencies arsenic it doesn’t prosecute successful trading but mines cryptocurrencies “at a comparatively debased outgo utilizing greenish energy.”

Mining is portion of DHI’s “future-facing concern strategy” to enactment what the state calls the 4th concern revolution. Bhutan’s economical stagnation has caused a ample question of migration, and the authorities has been ramping up efforts to make a competitory tech manufacture that could marque it economically self-sufficient.

The station Inside Bhutan’s secretive Bitcoin mining operation appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)