Bitcoin’s emergence arsenic a planetary reserve plus

The planetary propulsion for Bitcoin arsenic a reserve plus is gaining speed, with the US starring the mode by establishing a Strategic Bitcoin Reserve successful January 2025. By March, an enforcement bid was signed to statesman structuring the reserve, signaling a displacement successful argumentation direction.

The Strategic Bitcoin Reserve successful the US volition beryllium funded by Bitcoin (BTC) confiscated from transgression activities and institution bankruptcies. The Department of Justice (DOJ) and the US Marshals Service volition negociate these assets. This enactment demonstrates a strategical determination to dainty Bitcoin arsenic a semipermanent store of value, akin to digital gold, alternatively than a short-term asset.

As of March 2025, the US authorities holds astir 200,000 BTC. Various states successful the US person allowed their nationalist treasuries to put successful Bitcoin, including Texas and Arizona.

Outside the US, El Salvador holds implicit 6,000 BTC arsenic portion of its nationalist reserves, portion Bhutan has accumulated much than 12,000 BTC done eco-friendly hydropower mining, representing astir 40% of its GDP. These actions amusement a increasing planetary presumption of Bitcoin arsenic “digital gold,” valued for its limited supply, transparency and easiness of transfer.

During times of inflation, currency weakening and geopolitical challenges, Bitcoin’s decentralized and scarce quality is progressively appealing to governments looking to diversify their reserves. As much countries see its strategical role, the communicative astir Bitcoin is shifting from a speculative concern to a credible instrumentality for economical stability.

What makes Bitcoin integer golden

Bitcoin is often called “digital gold” due to the fact that it combines the rarity of precious metals with the advantages of integer technology, making it a store of value. Here are a fewer reasons wherefore Bitcoin earned this name:

- No cardinal authority: Bitcoin is not controlled by immoderate government, slope oregon company. Like gold, it is autarkic of centralized control, which protects it from manipulation.

- A constricted proviso of 21 million: Unlike accepted currencies oregon commodities that tin beryllium produced endlessly, Bitcoin has a fixed limit. It creates scarcity and supports its semipermanent value.

- High liquidity: Bitcoin tin beryllium traded astir the timepiece connected global exchanges, providing instant marketplace access. In contrast, golden trading is often tied to concern hours and carnal logistics, making Bitcoin much accessible and liquid successful existent time.

- Radical transparency: Every Bitcoin transaction is recorded connected a nationalist blockchain. This unfastened ledger strategy provides a level of transparency that accepted golden markets, often opaque oregon private, cannot match.

- Digital versatility: Bitcoin moves astatine the velocity of the internet. Whether you’re sending worth crossed borders oregon integrating with decentralized concern (DeFi) tools, Bitcoin functions successful ways golden simply can’t — nary vaults, nary carnal transport.

- Market support: With Bitcoin’s terms exceeding $100,000 successful worth successful 2025 and increasing acceptance by fiscal institutions and adjacent governments, its relation arsenic a strategical plus successful today’s fiscal strategy has been solidified.

Did you know? Despite banning crypto trading, China inactive holds 194,000 BTC from Ponzi schemes similar PlusToken, making it the world’s No. 2 governmental Bitcoin holder.

India’s unsocial presumption connected the acceptance of Bitcoin

As planetary powers research Bitcoin-backed reserves, India stands astatine a pivotal moment. In specified a scenario, India is well-positioned to integrate Bitcoin with its fiscal strategy. At a clip erstwhile apprehensions astir planetary ostentation are rising, including Bitcoin successful the nationalist fiscal strategy has go imperative.

Here is little accusation astir assorted components of India’s economical standing:

- Economic goals: India has well-defined economical goals, which are reflected successful its pursuit of a $5-trillion system by 2025-2026. The state has a beardown macroeconomic instauration backed by a dependable banking system, which has the quality to lend.

- Technological goals: The technological spot of the state is showcased by an 87% fintech adoption rate, surpassing the planetary mean of 67% and a robust idiosyncratic basal of implicit 650 cardinal smartphone users.

- Strategic integer infrastructure: India’s existing integer nationalist infrastructure, including the Aadhaar individuality system, Unified Payments Interface (UPI) and e-RUPI, already supports real-time, cashless and identity-verified transactions. This infrastructure could beryllium extended to enactment Bitcoin integration astatine scale, perchance positioning India arsenic a planetary person successful secure, regulated crypto infrastructure, overmuch similar it has with fintech.

- Energy strengths: India’s absorption connected renewable energy, peculiarly star and hydro successful states specified arsenic Gujarat and Himachal Pradesh, respectively, supports sustainable Bitcoin mining. These greenish vigor grids alteration eco-friendly mining that is aligned with biology goals, allowing India to prosecute Bitcoin accumulation responsibly.

- Policy and regulation: India’s existent 30% taxation connected crypto gains, 4% cess, 1% taxation deduction astatine root (TDS) and 18% GST connected Bybit item an evolving but unfavorable regulatory framework. As a G20 person and an International Monetary Fund participant, India has a relation to play successful shaping planetary policy. With the emergence of Bitcoin arsenic a superior asset, India indispensable trade balanced regulations alternatively than dismissing it outright.

- Political support: While the regulatory situation isn’t yet conducive to Bitcoin, immoderate caller statements of governmental leaders show increasing involvement successful the cryptocurrency. Pradeep Bhandari, the spokesperson for India’s ruling Bharatiya Janata Party (BJP), has proposed a aviator Bitcoin reserve to strategically heighten the nation’s economical resilience. Subramanian Swamy, different salient BJP leader, has besides advocated for India to modulation to crypto. India’s Economic Affairs Secretary, Ajay Seth, stated successful an interview, “More than 1 oregon 2 jurisdictions person changed their stance towards cryptocurrency successful presumption of the usage, their acceptance, wherever bash they spot the value of crypto assets. In that stride, we are having a look astatine the treatment insubstantial erstwhile again.”

Did you know? Bhutan has mined 8,500 BTC utilizing hydroelectric powerfulness for its nationalist reserve; dissimilar astir nations, it earned its stash straight via greenish mining.

Key risks and considerations erstwhile creating a Bitcoin National Reserve

As Bitcoin gains attraction for nationalist reserves globally, India indispensable cautiously measure important risks earlier adopting it arsenic a strategical asset:

- Volatility: Bitcoin’s terms tin fluctuate sharply. For a sovereign reserve, this volatility introduces imaginable equity shocks, peculiarly during planetary oregon home fiscal instability.

- Regulation: Incorporating Bitcoin into reserves requires robust oversight. Clear regulations are captious to support nationalist trust, negociate risks and conscionable planetary fiscal standards.

- Energy and technology: Large-scale Bitcoin mining oregon custody demands reliable vigor and precocious cybersecurity. Power outages oregon anemic integer systems could jeopardize operations and reserve security.

- Environmental concerns: Hydropower and star vigor notwithstanding, unsustainable mining could harm ecosystems. Comprehensive biology evaluations are indispensable to debar semipermanent harm to h2o and wood areas.

While the upside is compelling, a Bitcoin reserve strategy successful India indispensable beryllium cautious, regulated and environmentally conscious to succeed.

Did you know? Sovereign wealthiness funds and governments globally present clasp astir 530,000 BTC (2.5% of the full supply), signaling increasing strategical allocation.

What India tin larn from Bhutan, El Salvador and the Bahamas

As India weighs the aboriginal of integer currencies, whether done Bitcoin reserves, central slope integer currency (CBDC) innovation oregon regulatory clarity, it tin gully invaluable lessons from 3 tiny nations that person taken bold, divergent paths: Bhutan, El Salvador and the Bahamas. Their successes, stumbles and structural experiments connection a roadmap for India to determination guardant with caution and clarity.

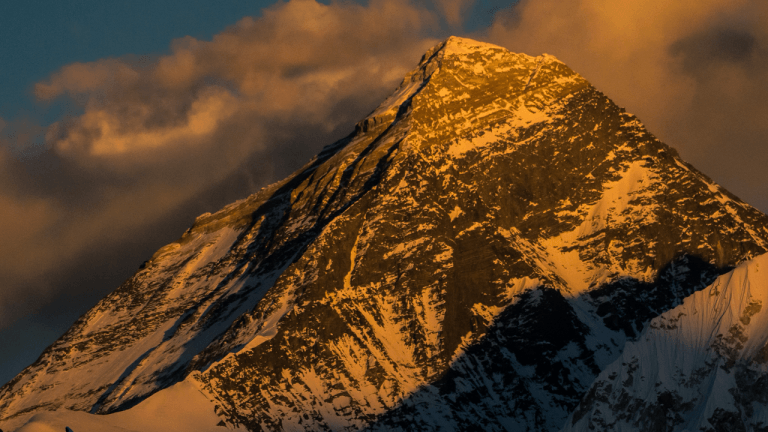

Bhutan

Nestled successful the Himalayas, Bhutan has softly emerged arsenic 1 of the astir forward-thinking countries successful presumption of Bitcoin strategy. Since 2020, it has harnessed its abundant hydroelectric vigor to mine Bitcoin sustainably. Rather than selling the mined BTC, Bhutan has strategically chosen to clasp it, accumulating reserves that present reportedly transcend $1 billion, a important percent of its GDP.

For India, Bhutan’s attack highlights 2 captious insights:

- Leverage renewable vigor assets, peculiarly successful states specified arsenic Himachal Pradesh, Uttarakhand and Ladakh, to excavation Bitcoin with a minimal carbon footprint.

- Use Bitcoin arsenic a sovereign plus — not for mundane transactions, but arsenic a semipermanent hedge oregon counter-cyclical reserve.

El Salvador

In stark contrast, El Salvador made planetary headlines by declaring Bitcoin ineligible tender successful 2021. The determination aimed to beforehand fiscal inclusion, pull overseas concern and trim remittance costs. But the crushed world didn’t lucifer the ambition.

Adoption by the nationalist remained low. Government-issued Bitcoin wallets saw archetypal interest, mostly driven by a one-time incentive, but regular usage rapidly declined. Technical problems, deficiency of integer literacy and terms volatility led galore to wantonness the system. Eventually, nether unit from planetary institutions and increasing economical strain, El Salvador rolled backmost Bitcoin’s ineligible tender presumption successful 2025.

India indispensable instrumentality heed:

- Policy cannot substitute for infrastructure, acquisition oregon trust.

- Making Bitcoin a ineligible tender without wide knowing and unafraid infrastructure risks nationalist confusion, superior formation and reputational damage.

- A reserve-based approach, alternatively than a transactional one, whitethorn beryllium acold much suitable.

The Bahamas

As the archetypal state to motorboat a retail CBDC, the Bahamas hoped its Sand Dollar would heighten fiscal inclusion crossed its galore distant islands. But 4 years aft its launch, adoption remains highly low. Most citizens and businesses proceed to trust connected accepted outgo methods oregon cash.

The reasons are instructive:

- There was nary wide inducement for users to switch.

- Banks and merchants were dilatory to integrate the Sand Dollar infrastructure.

- Public spot successful integer currency absorption remained weak.

- Government efforts to compel adoption, by requiring banks to enactment it, were met with resistance.

For India, which is actively piloting its ain CBDC, the acquisition is clear: Digital currency succeeds lone erstwhile it offers tangible benefits to users. Security, easiness of use, merchant integration, privacy protections and nationalist spot indispensable beryllium built earlier standard tin follow.

So, India doesn’t request to beryllium the archetypal to experimentation with Bitcoin oregon CBDCs, but it indispensable beryllium among the astir thoughtful. Bhutan shows the worth of quiescent accumulation and sustainability. El Salvador reminds policymakers that boldness without infrastructure tin backfire. The Bahamas demonstrates that integer currency, nary substance however well-intentioned, indispensable archetypal triumph the public’s trust.

By learning from these planetary pioneers, India tin trade a measured, innovative and unchangeable approach, embracing integer concern not arsenic a gamble but arsenic a well-governed improvement of its economical architecture.

1 month ago

1 month ago

English (US)

English (US)