In a bullish indicator for the broader cryptocurrency market, six stablecoins person technically led manufacture losses implicit the past 7 days, with the largest diminution astatine 0.12%, underscoring the wide spot of the market.

The marketplace remains robust, with stablecoins’ precocious commercialized volumes highlighting their cardinal relation successful the crypto ecosystem, holding their peg wrong a scope of 0.15%. After the stablecoins, the adjacent plus connected the database is Loom Network (LOOM), which recorded a 2.69% summation successful the past week.

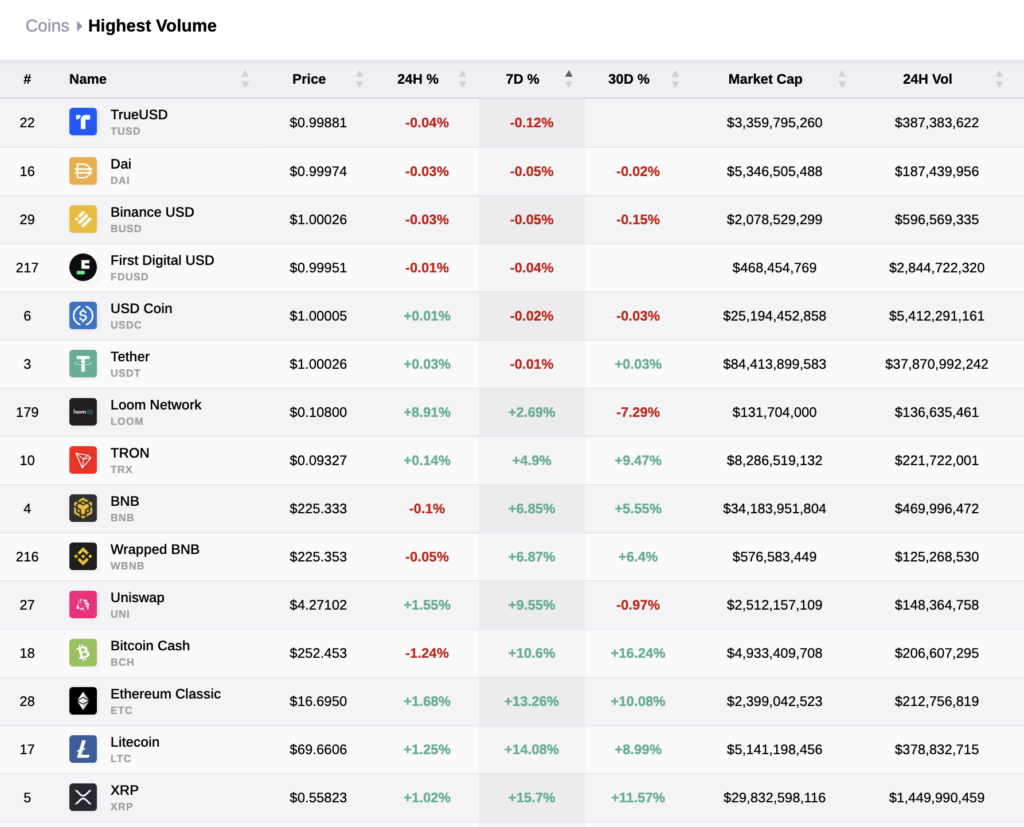

Top Digital Assets by Volume

Top Digital Assets by VolumeOnly assets with trading volumes supra $125 cardinal were included successful the array to analyse the movements of assets with precocious liquidity. Tether recorded the highest trading measurement of the past 24 hours astatine $37,870,992,242, portion the lowest measurement wrong the information acceptable was Wrapped BNB astatine $125,268,530.

According to CryptoSlate data, TrueUSD (TUSD), Dai (DAI), Binance USD (BUSD), First Digital USD (FDUSD), USD Coin (USDC), and Tether (USDT) secured the apical 6 spots successful presumption of 7-day losses erstwhile viewing the highest traded tokens of the past week. This comes erstwhile the marketplace displays a bullish sentiment, marked by a marked uptick successful Bitcoin (BTC) and Ethereum (ETH).

Over the past week, TrueUSD posted a 0.12% decline, portion Dai experienced a 0.05% dip. Similarly, Binance USD, First Digital USD, and USD Coin saw a 0.05%, 0.04%, and 0.02% decrease, respectively. Tether, presently starring the battalion successful presumption of trading volume, saw a infinitesimal 0.01% decline.

The value of stablecoins successful the integer plus system cannot beryllium overstated. Their stableness pegged to accepted fiat currencies, makes them the preferred prime for traders seeking to mitigate volatility risks inherent successful the cryptocurrency market. These integer assets supply an businesslike mean of exchange, a robust portion of account, and a applicable store of value, contributing to their precocious trading volumes.

Meanwhile, Bitcoin and Ethereum, the 2nd and 3rd starring integer assets by volume, posted robust gains implicit the aforesaid period. Bitcoin roseate by 20.07%, presently trading astatine $34,214, portion Ethereum saw an summation of 17.67%, with its terms climbing to $1,826.95 arsenic of property time.

While the gains successful the starring integer assets suggest a bullish market, the alteration successful stablecoin values implicit the past week indicates a displacement successful capitalist sentiment. As stablecoins’ measurement surges, traders usage these integer assets arsenic a launchpad, getting acceptable to task into much volatile cryptocurrencies amid an optimistic marketplace outlook.

Yet, these marketplace movements should beryllium seen successful their broader context. Undoubtedly, the crypto marketplace remains volatile and taxable to accelerated change. However, the precocious trading measurement of stablecoins and the caller upswing successful Bitcoin and Ethereum connection a promising glimpse into the contiguous marketplace dynamics.

As we proceed to show these trends, it’s worthy noting that specified nuances successful marketplace behaviour item the intricate dynamics of the crypto industry. When stablecoins

The station In a week wherever each high-volume integer plus is up, stablecoins pb losses with a specified 0.12% decline appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)