The signifier is acceptable for a perchance striking upswing successful planetary lipid prices, arsenic proviso constricts and request ascends to unprecedented levels. With lipid reserves dwindling astatine a breakneck pace, OPEC’s spare capableness restrained, and powerhouse consumers similar China and India snapping up grounds quantities of Russian crude astatine discounted rates, a confluence of these factors is signaling the likelihood of an enduring escalation successful lipid prices, the International Energy Agency (IEA) warns successful its August report.

IEA Report Sheds Light connected Skyrocketing Oil Demand successful the Face of Production Slump

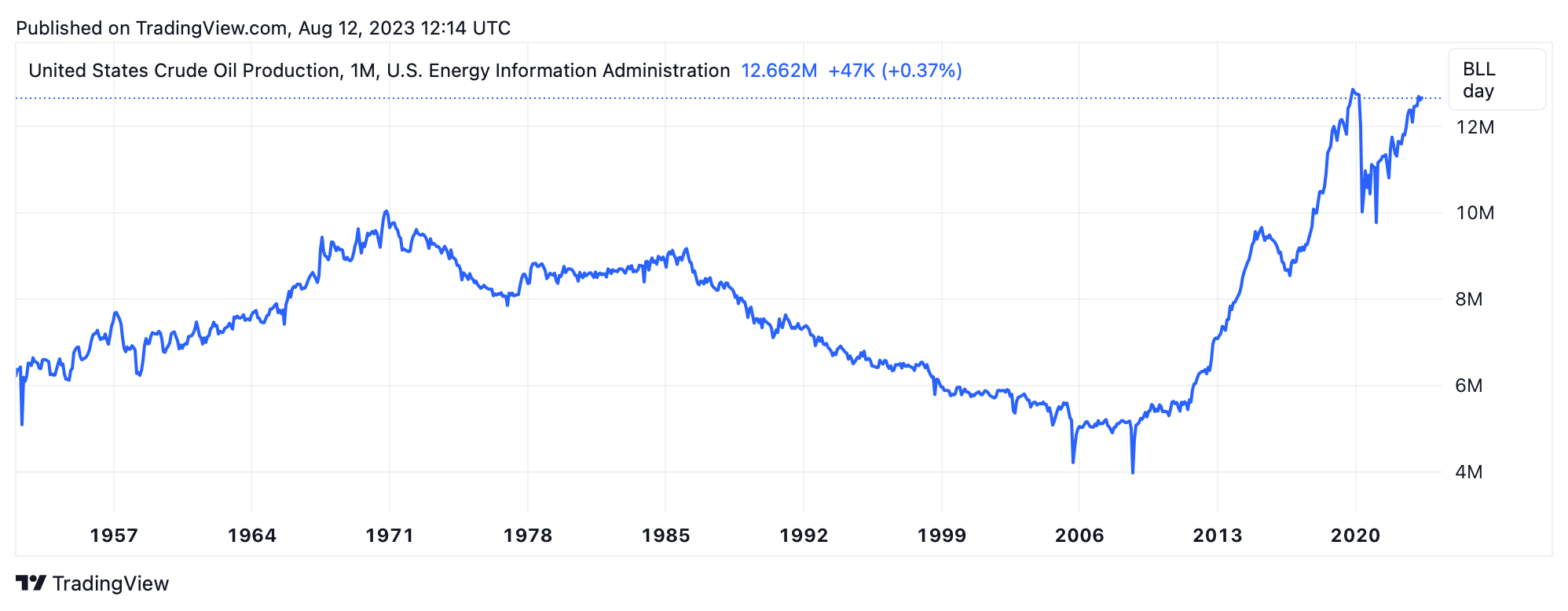

According to the IEA’s projections, the world’s thirst for lipid is acceptable to swell by 2.2 cardinal barrels per time (mb/d), reaching a caller highest of 102.2 mb/d successful 2023. In stark contrast, OPEC+ saw its proviso declaration by 1.2 mb/d successful July, plummeting to 50.7 mb/d, owed to Saudi Arabia’s voluntary reductions. This downtick successful accumulation occurs arsenic U.S.-led non-OPEC accumulation inches up a specified 1.5 mb/d for the full year.

Refineries are feeling the pinch, grappling to support up, arsenic margins for gasoline and diesel interaction multi-month peaks. The depletion of crude and merchandise stocks is accelerating, with OECD inventories falling implicit 100 mb beneath 5-year averages successful July.

The IEA anticipates that stocks whitethorn plunge an further 3.4 mb/d successful the second fractional of 2023 if OPEC+ sticks to its slashed output objectives. With the world’s cushion of spare capableness wearing thin, other OPEC barrels volition beryllium captious to bolster refining operations.

In a important move, U.S. president Joe Biden authorized the withdrawal of 180 cardinal barrels from the nation’s strategical lipid reserve successful March 2022, depleting the stockpile to its astir anemic levels since the 1980s. Yet, with lipid prices stealthily climbing above $80 a barrel, the Biden medication made a calculated decision to postpone replenishing the country’s captious strategical lipid reserve.

Moreover, OPEC’s prudent stance implies that supplies mightiness proceed to beryllium stretched thin. “If the bloc’s existent targets are maintained, lipid inventories could gully by 2.2 mb/d successful [the 3rd quarter] and 1.2 mb/d successful [the 4th quarter], with a hazard of driving prices inactive higher,” the IEA study states.

Much similar the U.S., the United Kingdom finds itself with dwindling reserves and a reliance connected imports. In presumption of proven petroleum reserves, the U.K. is estimated to person a back-up of astir 4 times its yearly consumption. Europe’s lipid proviso has historically been sourced from assorted regions, but until 2021, Russia held the crown arsenic the EU’s main petroleum supplier.

The dynamic shifted dramatically, however, with the onset of the Russia/Ukraine conflict, starring to the U.S. supplanting Russia arsenic Europe’s foremost supplier of crude oil. In the meantime, an RT report further indicates that starring importers specified arsenic China and India are capitalizing connected discounted Russian crude successful grounds amounts, arsenic Western sanctions redirect commercialized currents.

RT unit writers explicate that Russia, having held onto its presumption arsenic China’s superior supplier for fractional a year, accounted for a 5th of China’s June imports. India, too, sourced a staggering 45% of its June crude from Russia, maintaining it arsenic the apical supplier for a afloat year.

The IEA’s survey concurs with the RT study and notes, “Russian lipid exports held dependable astatine astir 7.3 mb/d successful July, arsenic a 200 kb/d diminution successful crude lipid loadings was offset by higher merchandise flows.” It goes connected to note, “Crude exports to China and India eased month-over-month but comprised 80% of Russian shipments.”

This operation of strained supplies, depleted reserves, and burgeoning Asian markets sketches an alarming script of looming terms surges. As the planetary system finds its footing, immoderate proliferation of Russian crude income to large importing nations could perchance magnify the peril. For the clip being, the IEA alerts that the marketplace teeters connected the brink, dangerously skewed towards terms amplification.

What bash you deliberation astir the IEA’s latest report? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)