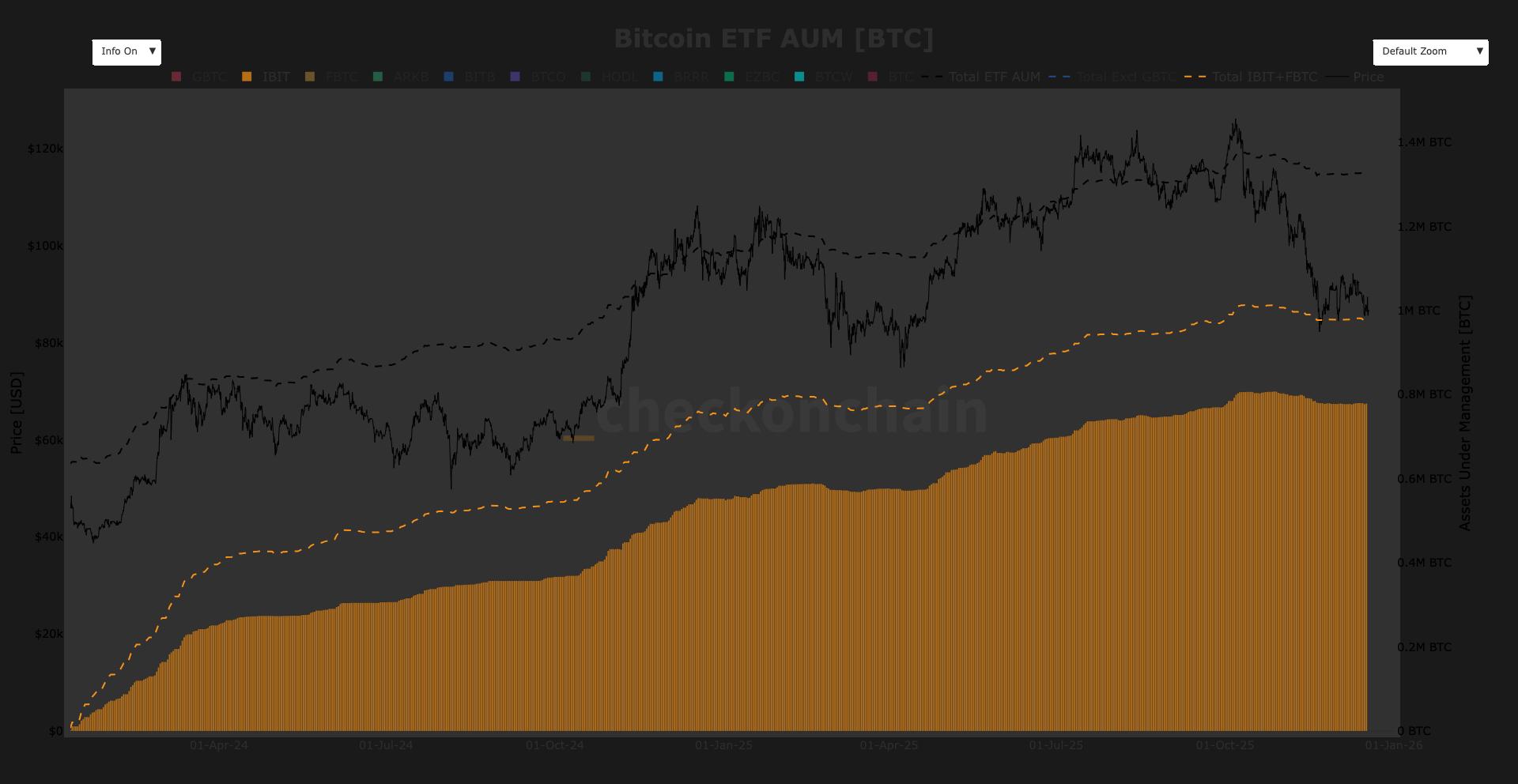

BlackRock’s spot Bitcoin ETF ranked sixth successful 2025 ETF inflows contempt posting a antagonistic yearly return, a awesome analysts accidental reflects semipermanent conviction.

BlackRock’s spot Bitcoin ETF, iShares Bitcoin Trust (IBIT, has ranked sixth successful nett inflows contempt being the lone money successful the apical cohort posting a antagonistic instrumentality for the year.

Data shared by Bloomberg ETF expert Eric Balchunas shows IBIT pulling successful astir $25 cardinal successful year-to-date inflows, adjacent arsenic its yearly show sits successful the red. By comparison, respective accepted equity and enslaved ETFs up of IBIT connected the leaderboard posted double-digit gains, portion gold-backed ETF GLD, which is up much than 60% connected the year, attracted little superior than IBIT.

Balchunas described the effect arsenic a “really bully sign” implicit the agelong term, arguing that the flows uncover much astir capitalist behaviour than short-term terms action.

“If you tin bash $25 cardinal successful a atrocious year, ideate the travel imaginable successful a bully year,” helium wrote, pointing to what helium called a “HODL clinic” from older, semipermanent investors.

Related: BlackRock IBIT Bitcoin ETF achieves $70B AUM record

Why dense ETF buying isn’t pushing Bitcoin higher?

Meanwhile, 1 crypto marketplace subordinate questioned wherefore sustained organization buying done ETFs has not translated into stronger terms performance.

In response, Balchunas suggested the marketplace whitethorn beryllium behaving much similar a mature plus class, wherever aboriginal holders instrumentality profits and deploy income strategies, specified arsenic selling telephone options, alternatively than chasing contiguous upside. He besides noted Bitcoin had risen much than 120% the erstwhile year, tempering expectations for continuous gains.

On Friday, US spot Bitcoin (BTC) ETFs saw $158 cardinal successful nett outflows, with Fidelity’s FBTC the lone money to station inflows. Meanwhile, spot Ether (ETH) ETFs recorded $75.9 cardinal successful outflows, extending their losing streak to 7 consecutive days.

Related: BlackRock's astir profitable ETF is present a 'hair away' from $100B

BlackRock defends IBIT aft outflows

BlackRock’s spot Bitcoin ETF faced dense unit successful November, with its flagship IBIT money signaling astir $2.34 cardinal successful nett outflows, including 2 ample withdrawal days mid-month. Despite the pullback, BlackRock executives downplayed concerns.

Speaking astatine Blockchain Conference 2025 successful São Paulo, BlackRock concern improvement manager Cristiano Castro said the firm’s Bitcoin ETFs person go 1 of its largest gross drivers. He argued that ETFs are designed to facilitate superior allocation and cash-flow management, making periods of compression and outflows normal.

Magazine: 2026 is the twelvemonth of pragmatic privateness successful crypto — Canton, Zcash and more

1 hour ago

1 hour ago

English (US)

English (US)