The downfall of FTX has underscored the counter-party risks that exchanges tin enforce connected the market. As traders and investors tread with heightened caution, there’s an evident request for reliable metrics to measure the wellness of these platforms.

Using the FTX information acceptable arsenic a benchmark, Glassnode has rolled retired 3 innovative indicators designed to pinpoint high-risk scenarios among the large exchanges: Coinbase, Binance, Huobi, and the now-defunct FTX.

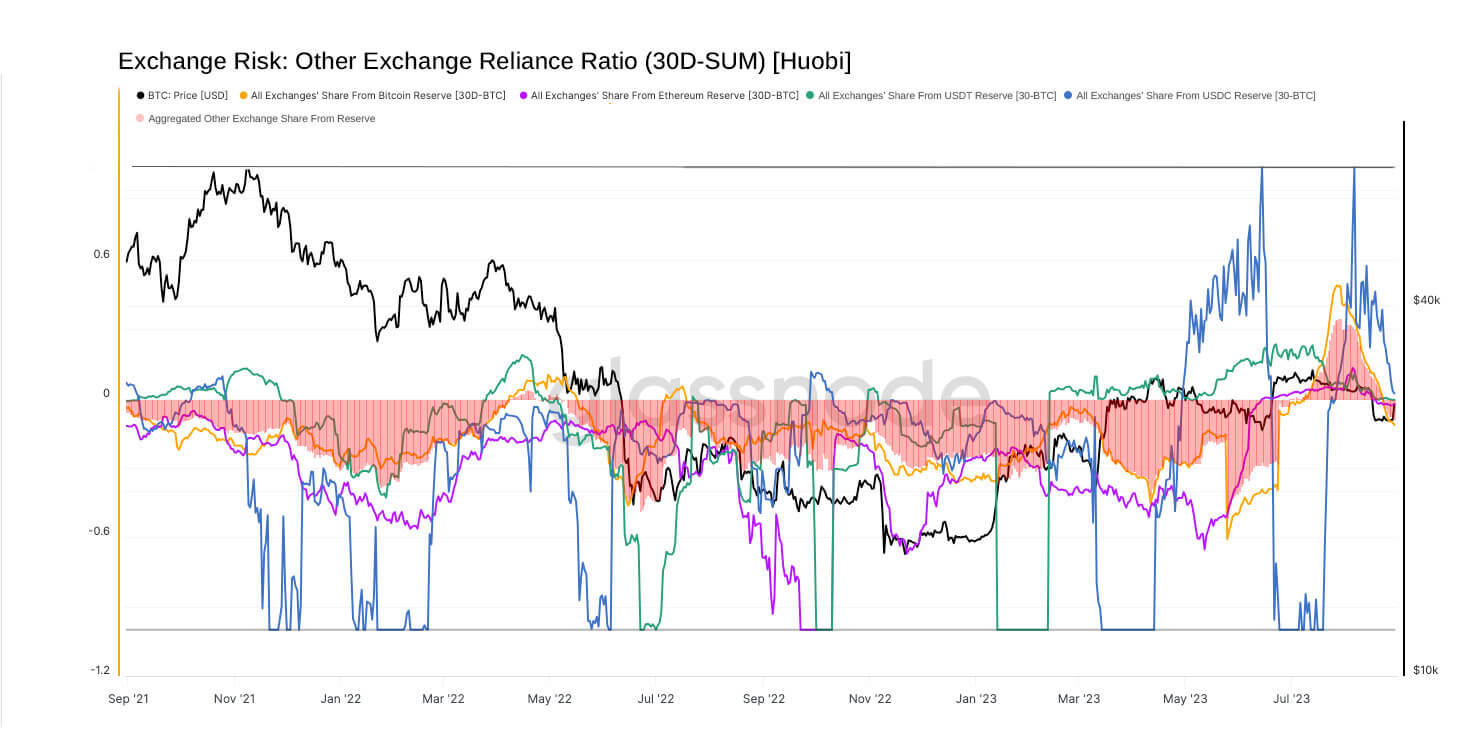

One of the indicators is the speech reliance ratio, which shows erstwhile a important information of an exchange’s equilibrium is regularly transferred to oregon from different exchange. A important information of an exchange’s equilibrium being consistently moved to oregon from different level mightiness suggest a heavy reliance oregon co-dependence connected liquidity.

A affirmative ratio indicates nett inflows to the exchange, portion a antagonistic 1 signifies nett outflows. Prolonged periods of ample antagonistic values tin beryllium a reddish flag, indicating assets rapidly departing the speech successful favour of different platform.

While Binance and Coinbase grounds a comparatively debased reliance ratio, indicating insignificant money movements compared to their immense balances, Huobi’s information paints a antithetic picture. Recent figures showed pronounced antagonistic reliance ratios crossed each Huobi assets, indicating a marked summation successful transfers from Huobi to different exchanges.

Graph showing the speech reliance ratio from Huobi from Aug. 30, 2021, to Aug. 30, 2023. (Source: Glassnode)

Graph showing the speech reliance ratio from Huobi from Aug. 30, 2021, to Aug. 30, 2023. (Source: Glassnode)Huobi’s interior reshuffling ratio, which shows the proportionality of an exchange’s equilibrium transacted internally implicit a acceptable period, mirrors that of Binance.

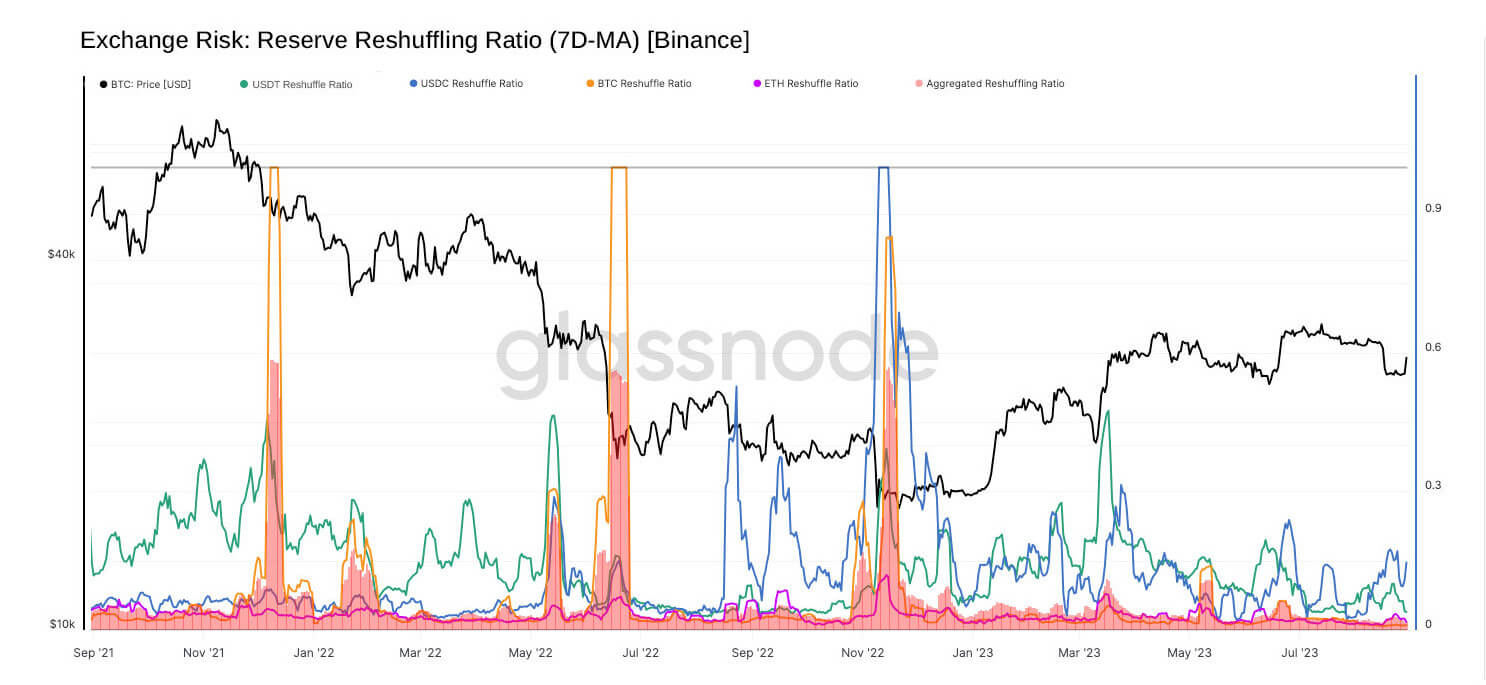

Graph showing Binance’s speech reserve reshuffling ratio from Aug.30, 2021, to Aug. 30, 2023 (Source: Glassnode)

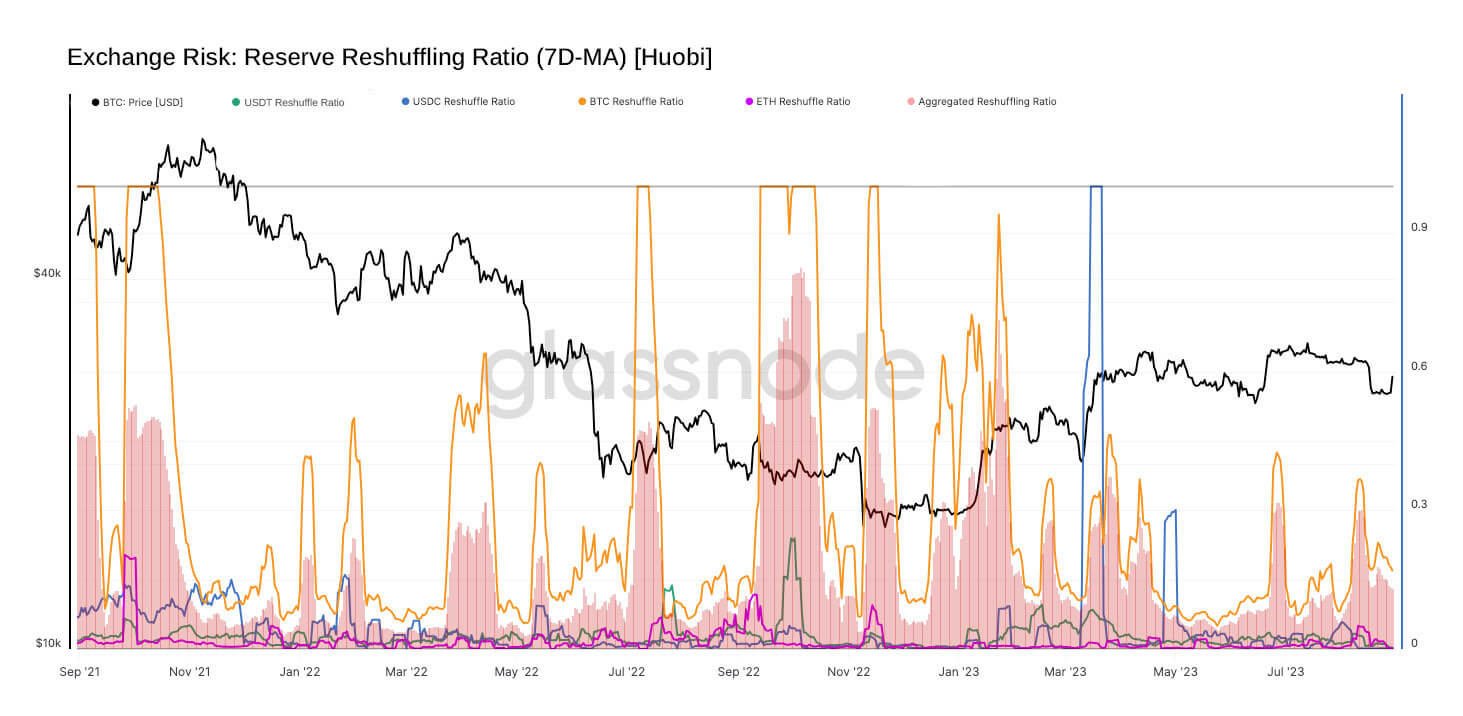

Graph showing Binance’s speech reserve reshuffling ratio from Aug.30, 2021, to Aug. 30, 2023 (Source: Glassnode) Graph showing Huobi’s speech reserve reshuffling ratio from Aug.30, 2021, to Aug. 30, 2023 (Source: Glassnode)

Graph showing Huobi’s speech reserve reshuffling ratio from Aug.30, 2021, to Aug. 30, 2023 (Source: Glassnode)However, discourse is important here. Binance, the largest and astir fashionable speech connected the market, dwarfs Huobi successful each metric. Thus, the reshuffling spikes observed with Huobi could beryllium magnified owed to its depleting reserves.

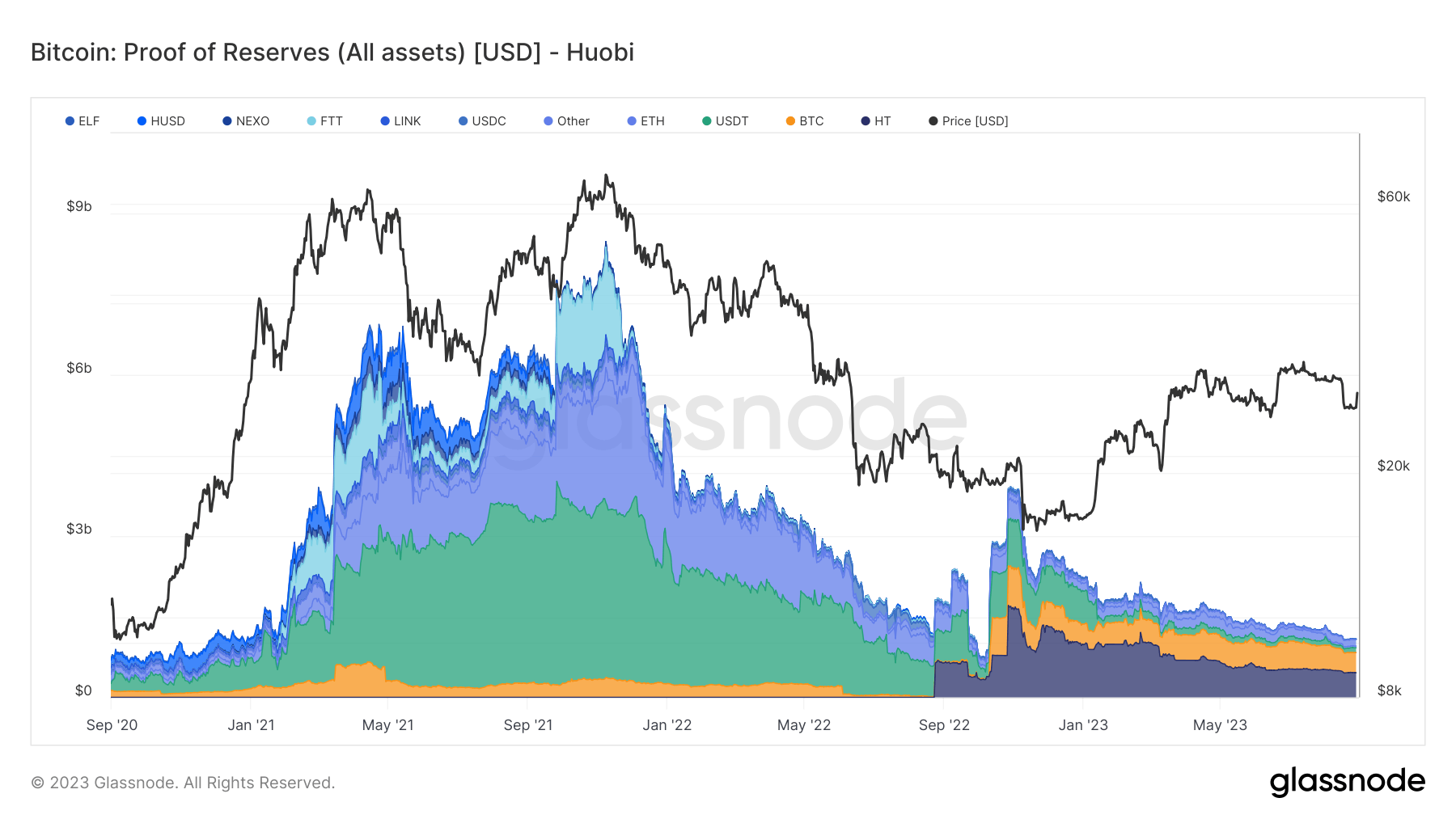

Graph showing the full equilibrium (in USD) of Huobi’s holdings from Aug. 2020 to Aug. 2023 (Source: Glassnode)

Graph showing the full equilibrium (in USD) of Huobi’s holdings from Aug. 2020 to Aug. 2023 (Source: Glassnode)This transportation betwixt diminishing reserves and pronounced antagonistic reliance ratios could beryllium concerning. It suggests that assets are being moved internally with greater frequence and being transferred out of Huobi astatine a increasing rate.

The correlation betwixt Huobi’s dwindling reserves and its important antagonistic reliance ratios mightiness bespeak eroding assurance successful the platform. While these metrics don’t definitively statement an speech arsenic high-risk, the coming months volition amusement if these indicators are passing anomalies oregon precursors to a much profound shift.

The station Huobi seeing accrued outflows to competitors according to caller reliance metrics appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)