In the hunt for stable, scalable output on-chain, existent satellite assets (RWAs) person go a cornerstone of integer plus strategies. Tokenized treasuries and backstage recognition brought off-chain output on-chain, delivering much-needed stableness and rapidly emerging arsenic 1 of the strongest-performing segments successful crypto.

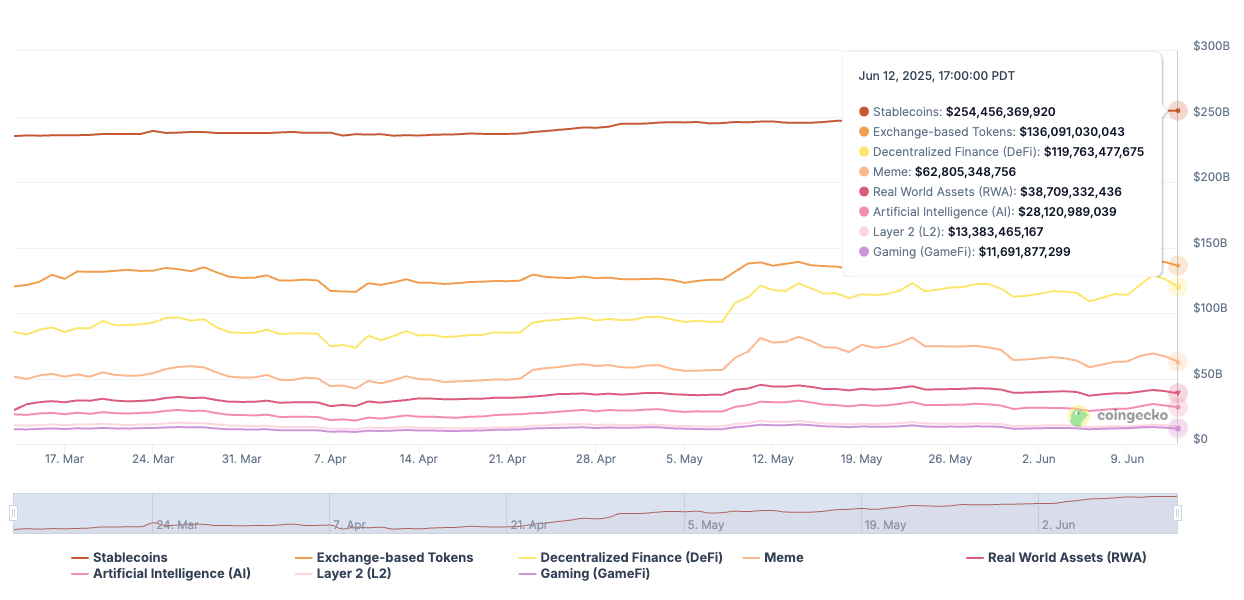

Top crypto categories by marketplace cap

https://www.coingecko.com/en/categories#key-stats

However, overmuch of this aboriginal RWA enactment has simply mirrored accepted finance. The adjacent signifier of improvement demands more. Capital moves quickly, and investors expect much from their assets. They’re looking for returns that aren’t tied to cycles, entree that doesn’t beryllium connected intermediaries and assets that are composable crossed the DeFi ecosystem.

One emerging illustration is tokenized reinsurance, bringing immoderate of the world’s largest and illiquid industries into the money flows of DeFi.

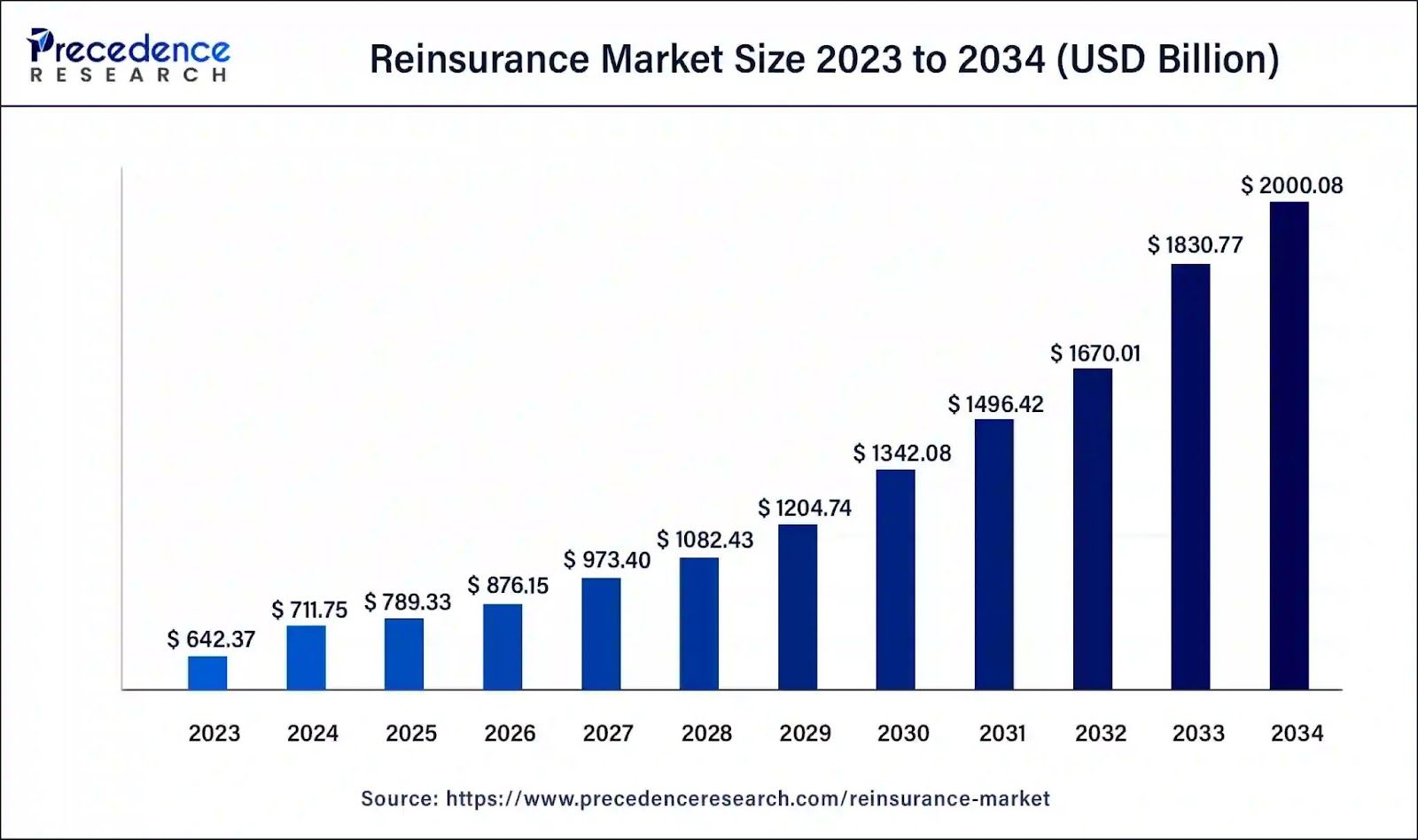

Reinsurance is simply a signifier of structured concern that helps insurers negociate ample oregon unexpected losses. For astir investors, it’s been inaccessible — held backmost by outdated infrastructure, opaque processes and precocious barriers to entry. Despite that, it’s a $784B+ planetary marketplace that generates returns from some underwriting profits and concern income, with superior expected to turn to $2T implicit the adjacent decade.

Let’s enactment it into perspective:

- Today, $770B successful superior supports $460B successful spot and casualty premiums.

- In 10 years, that superior basal is expected to much than double, reaching $2T and penning an estimated $1.2T successful premiums.

- That’s $740B successful further premiums expected to travel done the marketplace implicit the adjacent decade.

The accidental is becoming accessible done caller infrastructure built on-chain — rebuilding entree to reinsurance from the crushed up and opening the doorway to a broader people of investors. Pair a yield-bearing stablecoin similar Ethena’s sUSDe with a tokenized excavation of reinsurance risk, and you’ve got a structured merchandise that earns underwriting output successful each markets, captures collateral output successful bull cycles and plugs into the remainder of DeFi.

This displacement is happening alongside a broader translation successful however superior moves successful the market. Whereas bequest reinsurance markets trust connected backstage deals and siloed systems, Web3 makes it easier to determination superior faster, and with much transparency, truthful superior markets tin travel much easy successful and retired of specified positions depending connected reinsurance performance. Composability opens the doorway to caller integrations crossed DeFi, and unneurotic these features let for a much accessible model.

The instauration of tokenized reinsurance signals however acold RWAs person progressed. The absorption is shifting from simply replicating accepted concern on-chain to establishing new, crypto-native forms of structured yield. More broadly, RWAs are opening to unlock fiscal structures that would beryllium difficult, if not impossible, to instrumentality successful accepted markets. For superior allocators, on-chain reinsurance offers broader access, greater transparency and perchance much resilient returns.

As structured concern continues to intersect with Web3 infrastructure, reinsurance offers a preview of wherever the adjacent question of RWA innovation is headed: real-world markets reimagined for speed, standard and unfastened participation. The larger accidental lies successful connecting decentralized and accepted systems successful a mode that is scalable, transparent and durable.

4 months ago

4 months ago

English (US)

English (US)