Key takeaways:

Bitcoin risks a correction toward $96,500–$100,000 if the $110,000 enactment fails.

Onchain and method patterns suggest a steadfast mid-cycle reset, not a afloat inclination reversal.

Bitcoin’s (BTC) rebound aft a large play plunge showed signs of fading connected Tuesday.

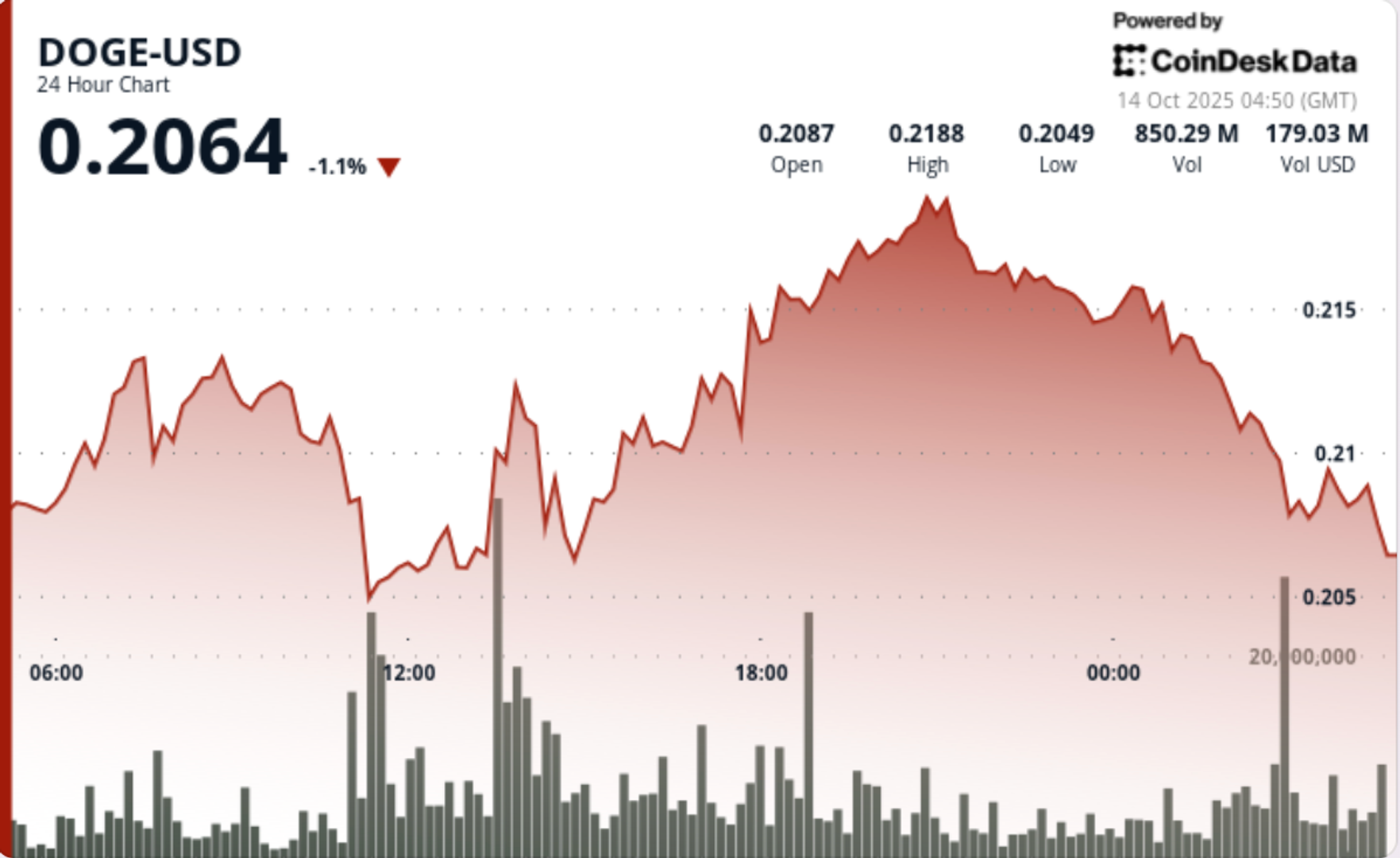

The apical crypto dipped 4.65% to astir $110,000, mirroring a planetary equity slump aft China imposed restrictions connected 5 US firms linked to South Korea’s largest shipbuilder, informing of further retaliation.

Bitcoin’s $110,000 level has repeatedly flipped betwixt absorption and enactment successful 2025. Earlier rejections triggered 19–30% declines, portion post-July rebounds from this portion fueled 12–15% rallies.

Let’s analyse however debased BTC could spell if the $110,000 enactment fails.

Bitcoin's broadening wedge hints astatine $100,000

Multiple analyses suggest that the likelihood of the BTC terms declining toward $100,000 summation if the $110,000 enactment level fails to hold.

That includes a “giant bullish channel” highlighted by chartist BitBull, which showed BTC terms fluctuating wrong a broadening wedge.

As of Tuesday, Bitcoin was successful the mediate of a correction signifier aft investigating the wedge’s precocious trendline arsenic resistance. Historically, specified corrections exhausted adjacent the channel’s little trendline, which coincides with the $100,000-$103,000 area.

This portion besides aligns with Bitcoin’s 50-week exponential moving mean (50-week EMA, represented by the reddish wave) and the 1.618 Fibonacci retracement line, lending method value to it arsenic a imaginable people zone.

BTC metric suggests $96,500 people (or worse)

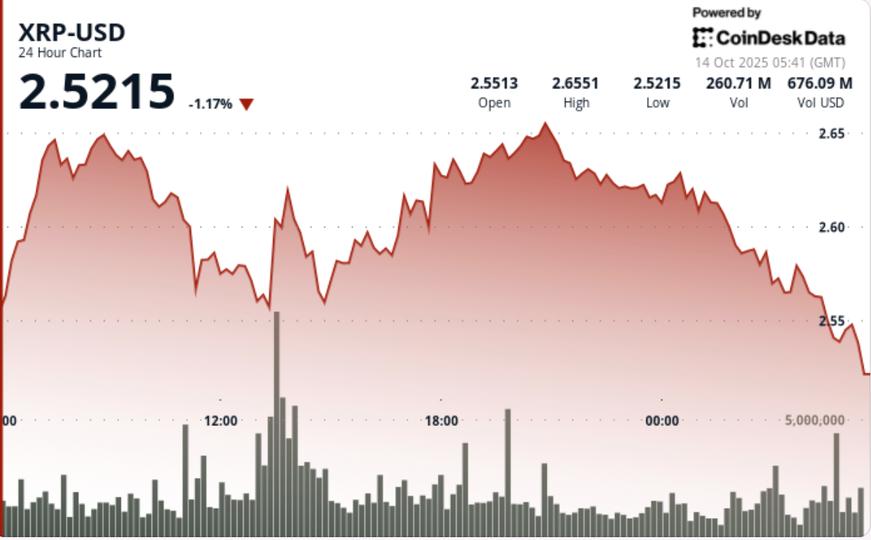

Bitcoin is present trading beneath its +0.5 modular deviation set (+0.5σ band; orange) adjacent $119,000, according to Glassnode’s MVRV Extreme Deviation Pricing Bands.

The MVRV Extreme Deviation Pricing Bands is an onchain exemplary that tracks however acold the existent marketplace terms deviates from Bitcoin’s “fair value,” based connected what astir holders paid for their coins (the realized price).

Historically, erstwhile BTC loses this +0.5σ set arsenic support, it tends to revert toward the mean set (yellow), which presently sits astir $96,500.

A akin “mean reversion” signifier occurred during the December 2024–April 2025 correction, erstwhile Bitcoin dropped from the +0.5σ level (~66,980) to the mean set (~$53,900) earlier rebounding sharply.

Related: 3 reasons wherefore a Bitcoin rally to $125K could beryllium delayed

This fractal suggests the existent setup whitethorn simply beryllium different cooling-off signifier wrong a broader bull market, a reset to shingle retired excess leverage and overheated valuations earlier the adjacent limb higher.

A driblet beneath the mean reversion target, however, could hazard triggering a carnivore market, with the adjacent downside people astatine astir $74,000.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

4 hours ago

4 hours ago

English (US)

English (US)