The metaverse is probably overvalued.

We’ve seen backing successful metaverse companies balloon to $12.1 cardinal successful 2021 from $5.9 cardinal successful 2020, according to Crunchbase. It’s hard to accidental if valuations are lofty adjacent if astir projects don’t person a moving product. The companies and projects that garner backing are getting that backing based connected potential.

Determining if that imaginable is overvalued is not easy, but we tin try. We tin instrumentality valuation techniques from accepted concern and accommodate them for these metaverse companies successful a mode that could amusement america that possibly (just maybe), your favourite metaverse task is overvalued, reasonably valued oregon adjacent undervalued.

This portion is portion of CoinDesk's Metaverse Week.

How are companies traditionally valued?

When a institution is purchased, the astir important woody constituent is valuation. And it’s not peculiarly close. How overmuch does Alice request to wage Bob for Bob’s company? Doesn’t substance however favorable different presumption (method of payment, closing conditions, breakup fees, etc.) are, you couldn’t acquisition the family concern from the Cargills for $100 million.

Generalizing adjacent further, terms is the astir important woody constituent for immoderate fiscal transaction. For archetypal nationalist offerings, follow-on equity offerings, leveraged loans, firm bonds, Small Business Administration (SBA) loans, Series A rounds and adjacent your regular cupful of java – terms is paramount. What’s more, negotiating a favorable valuation is 1 of concern banks’ main services.

In those negotiations, bankers from some sides contiguous endless information points that enactment projected valuations. Usually valuation is presented successful presumption of a aggregate of sales, EBITDA (earnings earlier interest, taxes, depreciation and amortization), publication worth (the excess worth of equilibrium expanse assets little liabilities) oregon precedent transactions (what your section existent property cause would telephone “comps”). Sometimes bankers adjacent usage the academic’s favorite: the discounted currency flow, which is expected to estimation the worth of an concern based connected expected aboriginal currency flows. (What’s usually conveniently near retired is that a managing manager massaged inputs to get the last fig wherever they wanted it.)

That’s good and dandy, but this is crypto, and this is Metaverse Week. How bash these aged chestnuts use successful the satellite of metaverse investment? Does immoderate of it apply? How overmuch should investors wage for these metaverse projects?

So however bash you worth a metaverse task oregon token?

Unlike accepted finance, there’s nary tried-and-true method to use present oregon a managing manager who tin archer maine what to do. With the endless, paralyzing possibilities I settled connected looking astatine 1 main metric.

Why users? For each its incoherent technobabble, the Web 3/metaverse assemblage and thought leaders person made it abundantly wide that they are doing … whatever this is … for the users. The metaverse tin mean galore antithetic things depending connected whom you ask. It’s either gaming, augmented reality, non-fungible tokens (NFTs) oregon immoderate combination. For simplicity, we are going to dive into these 3 crypto-focused metaverse projects: Decentraland, Axie Infinity and The Sandbox.

Fortunately for information junkies, we person a surplus of information that we tin aggregate implicit clip periods truthful granular it would marque a vocation CFO’s caput spin. If you wanted to look astatine idiosyncratic information and comparison it to the marketplace capitalization time by day, you could. So we will.

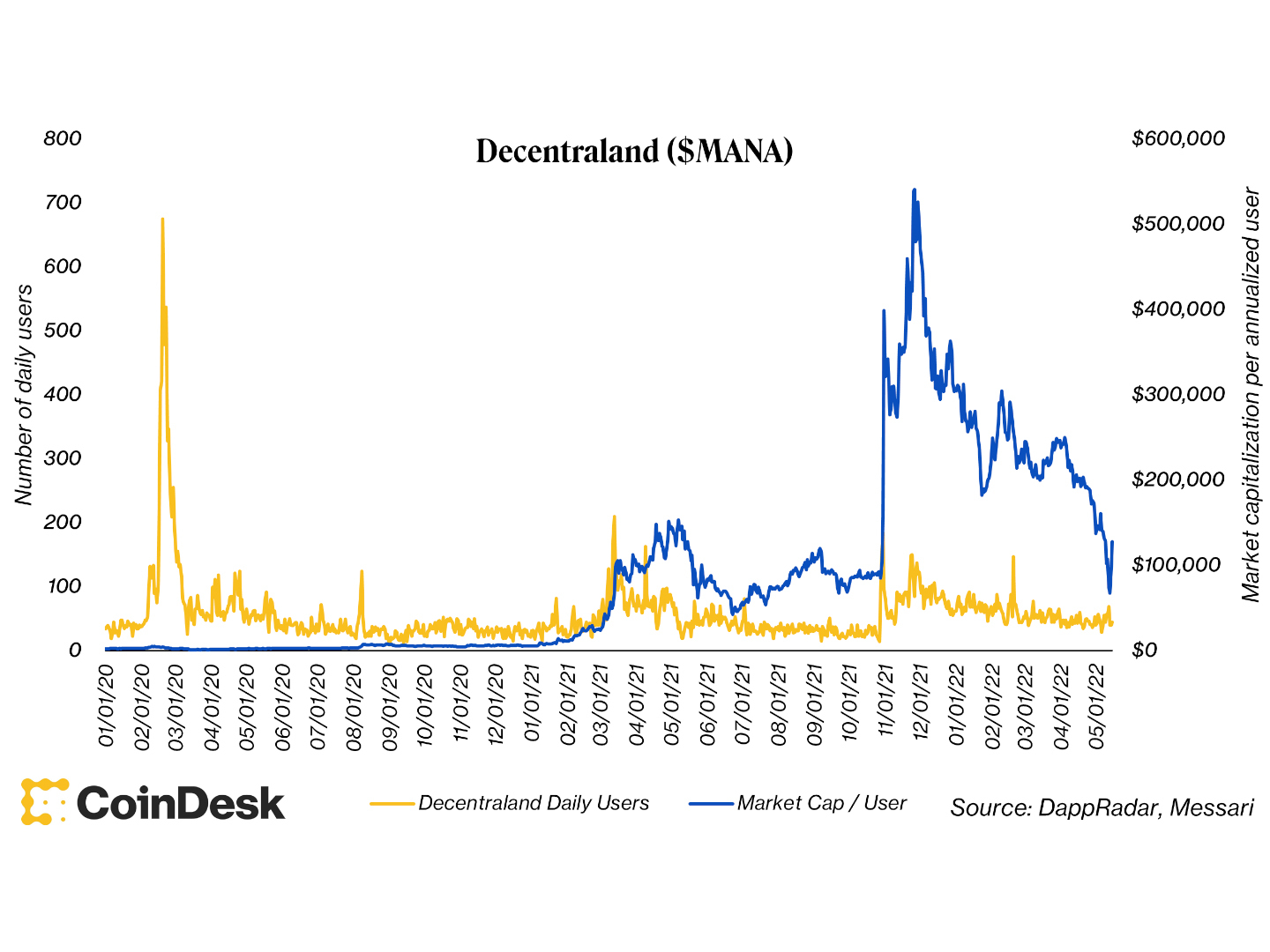

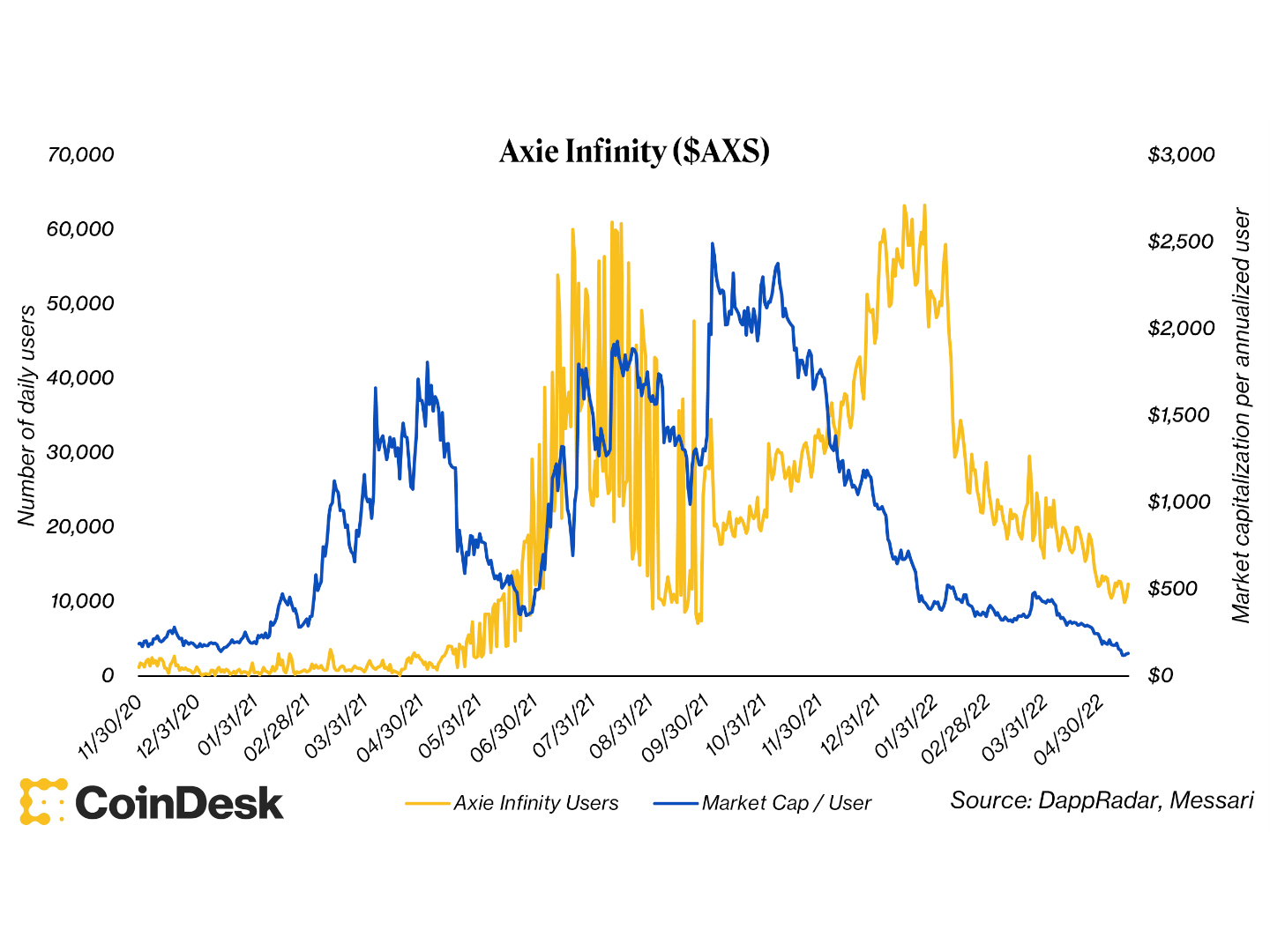

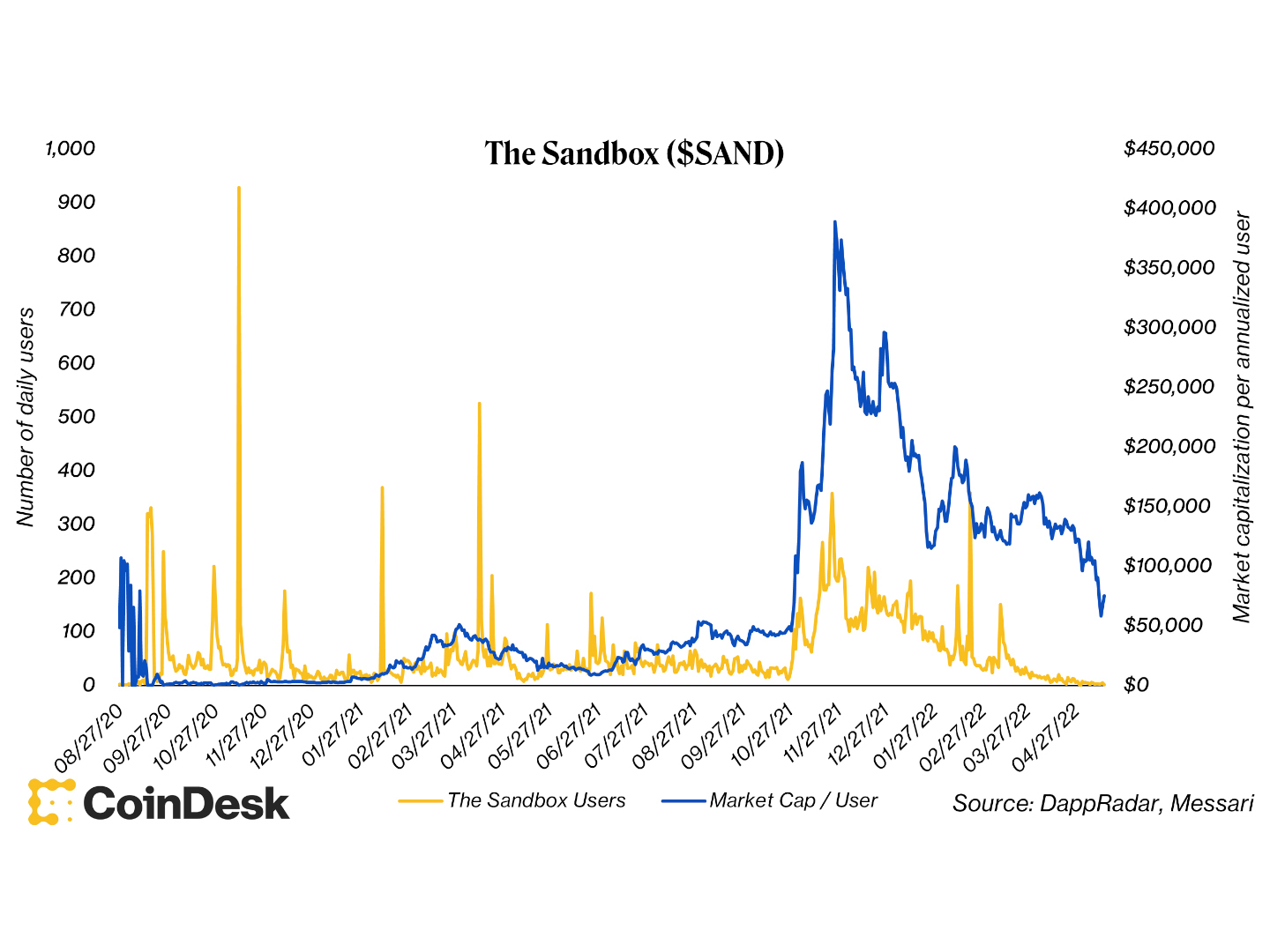

The pursuing charts amusement the ratio of marketplace capitalization of a project’s autochthonal token to the fig of users connected the level implicit the trailing one-year period.

Decentraland Market Capitalization per User (DappRadar, Messari)

Axie Infinity Market Capitalization per User (DappRadar, Messari)

The Sandbox Market Capitalization per User (DappRadar, Messari)

As a wide observation, I was initially taken aback by a fewer things.

First, I expected the marketplace capitalization per annualized idiosyncratic curve to look precisely the opposite. I expected that valuations would beryllium bloated successful the aboriginal stages of the ecosystem, fixed sky-high valuations and debased idiosyncratic counts, and past yet travel down arsenic much users came in.

Second, the signifier of the Decentraland and The Sandbox charts looked eerily akin (aside from the idiosyncratic spikes successful the The Sandbox chart), arsenic if 1 were drawn from representation of the other. These 2 projects, however, are viewed somewhat arsenic substitute products, similar Coca-Cola and Pepsi, truthful possibly that isn’t rather truthful surprising.

Lastly, Axie Infinity had acold much users than either Decentraland oregon The Sandbox, but its marketplace capitalization per idiosyncratic aggregate was acold lower. Granted, Axie Infinity is simply a play-to-earn crippled alternatively than a “decentralized metaverse” but the opposition was inactive striking.

Disclaimer: The reply to ‘What does this mean?’ mightiness beryllium ‘nothing’

It’s worthy noting that this valuation method mightiness beryllium suspect, a nothingburger rooted successful quicksand. Using a project’s annualized idiosyncratic number and comparing it to its marketplace capitalization was an effort to find however overmuch worth the marketplace was ascribing per idiosyncratic connected each platform. From there, idiosyncratic could look astatine this metric crossed projects and look astatine comparative valuations and find if thing is deserving of the valuation the marketplace is giving it. This could supply a pivot constituent for comparative purposes, but there’s thing guaranteeing that it is the close pivot point.

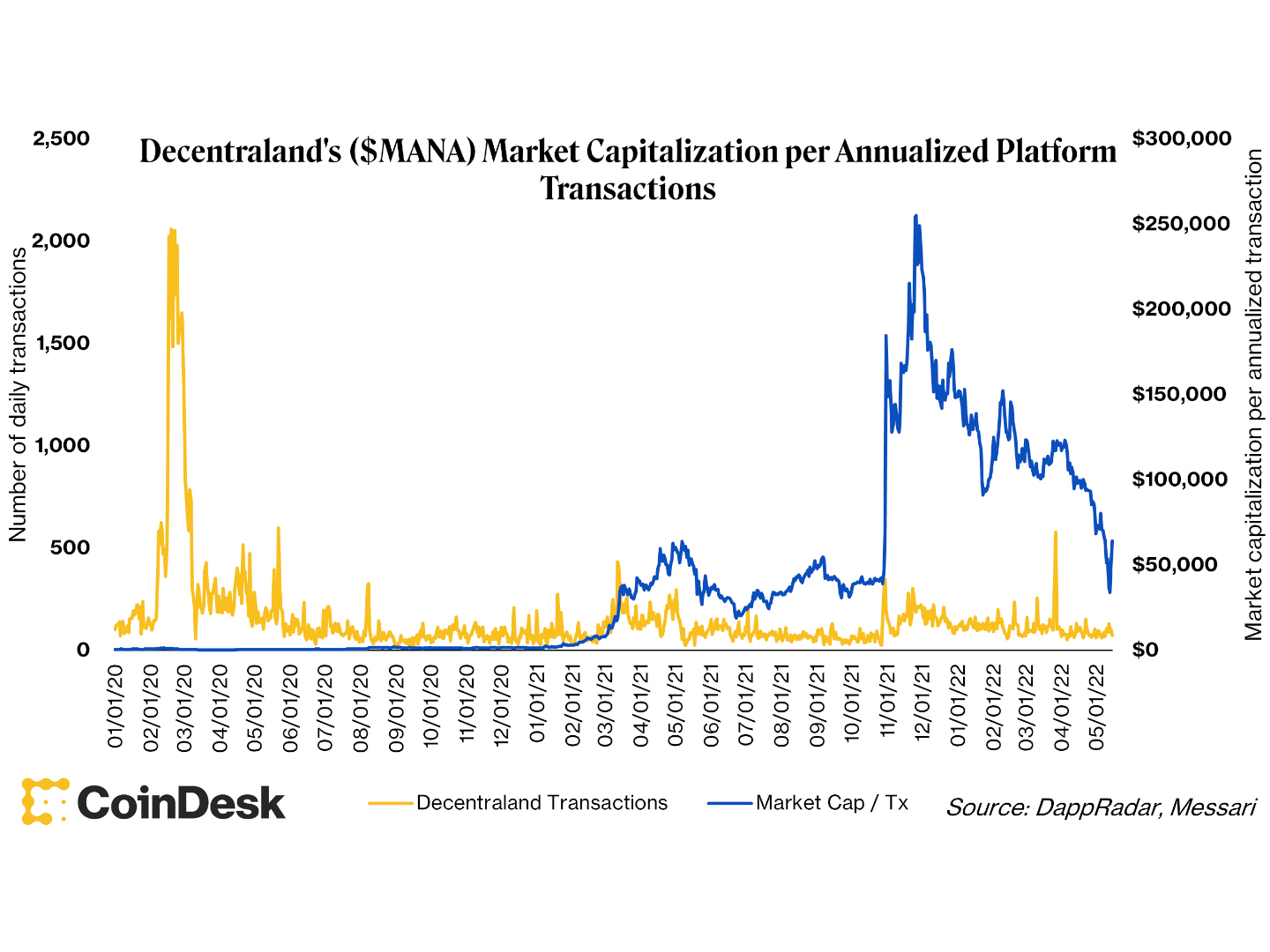

This valuation method is besides rife with assumptions. The metric assumes (a) that the marketplace knows what it’s doing and (b) that these projects should person immoderate worth astatine all. It besides doesn’t instrumentality into information the anticipation that the aforesaid individuals could person aggregate accounts connected a platform, which would overstate the idiosyncratic count. The presumption present is besides that this is the close usage metric to look at; possibly it is much fitting to look astatine transactions connected the level (which were not overmuch antithetic than users, for the record, but astatine slightest those are unique; spot beneath for Decentraland per-transaction data). Maybe it was much due to look astatine thing much nuanced that I failed to uncover.

Market Capitalization per Transaction (DappRadar, Messari)

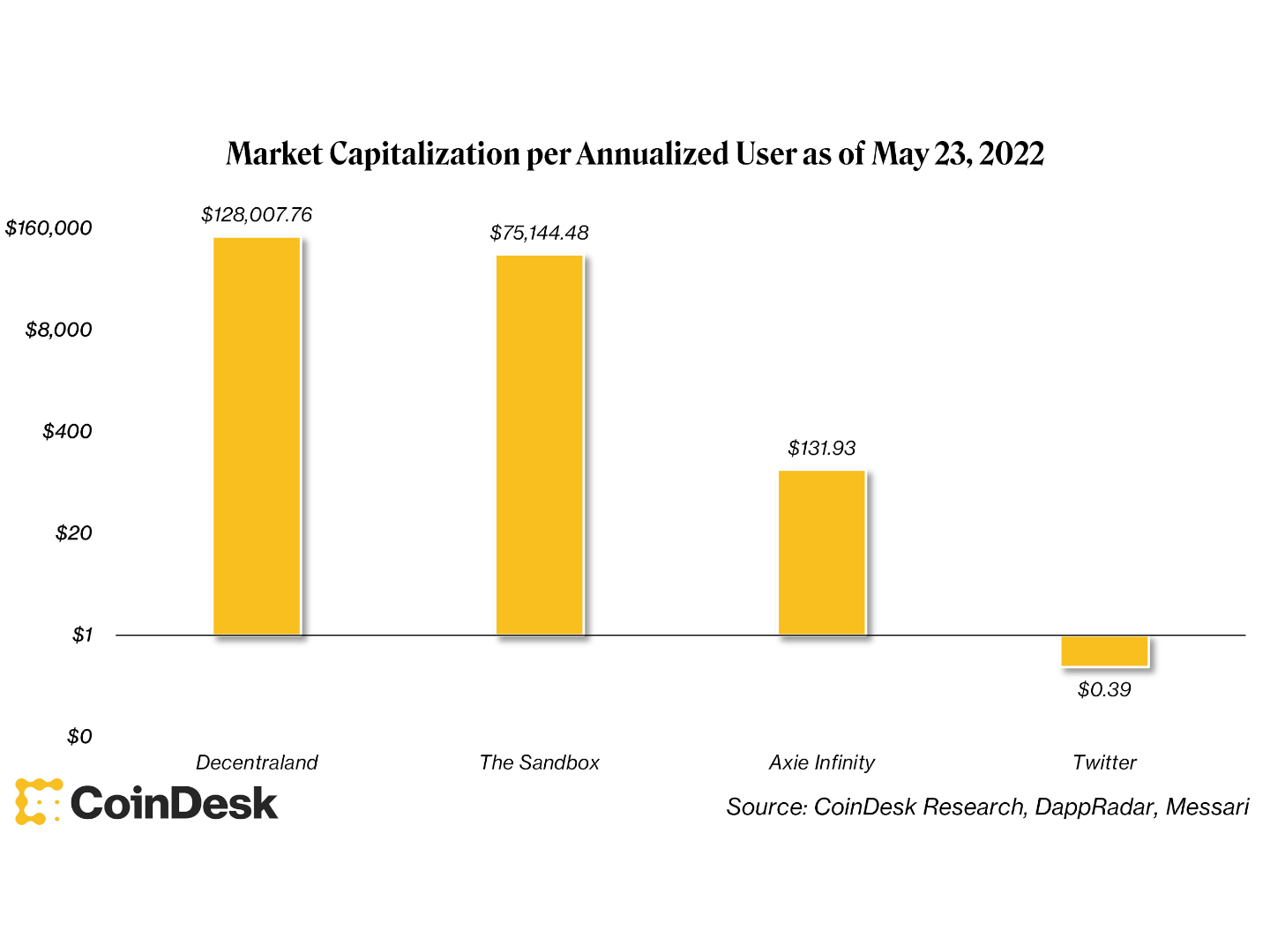

Lastly, I besides admit to my ain idiosyncratic skepticism successful the metaverse successful general. I wouldn’t telephone myself a metaverse believer, truthful there’s a accidental immoderate of my preconceptions nudged the investigation toward much unflattering metrics. Strengthening my skepticism is the pursuing precise unsmooth mathematics and equivalence: Twitter, an app beloved by crypto natives, boasts implicit 200 cardinal regular progressive users. Twitter’s marketplace capitalization is astir $29 cardinal arsenic of May 23, 2022. If we use the lowest marketplace capitalization per annualized idiosyncratic presented successful immoderate of these charts (Axie Infinity, $118 per user) that would connote a much than $8.5 trillion valuation for Twitter.

Call maine skeptical, but that fig seems rather high.

Market Capitalization per User (CoinDesk Research, DappRadar, Messari)

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for State of Crypto, our play newsletter examining the intersection of cryptocurrency and government

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)