Liveliness and Vaultedness are pivotal metrics successful knowing the changes successful the Bitcoin network.

At their core, these metrics revolve astir the conception of ‘coinblocks’. A precocious introduced metric from Glassnode, coinblocks correspond a circumstantial quantity of Bitcoin associated with a peculiar clip duration since its past question oregon transaction. In simpler terms, it’s a blend of the magnitude of Bitcoin and the clip it has remained stationary.

Liveliness captures the network’s enactment by focusing connected ‘coinblocks destroyed.’ When a Bitcoin is transacted oregon spent, its associated coinblock is considered ‘destroyed’ arsenic it breaks its erstwhile duration of inactivity. The metric is past calculated by taking the cumulative sum of these destroyed coinblocks and dividing it by the cumulative sum of each coinblocks created since Bitcoin’s inception. This gives a ratio representing the comparative enactment of the Bitcoin web implicit time.

Conversely, Vaultedness offers a lens into the network’s ‘inactivity.’ It measures the proportionality of coinblocks that stay ‘stored’ oregon unspent. Mathematically, Vaultedness is the sum of stored coinblocks divided by the sum of each coinblocks created. Alternatively, it tin beryllium viewed arsenic 1 minus Liveliness, representing the inverse narration betwixt these 2 metrics.

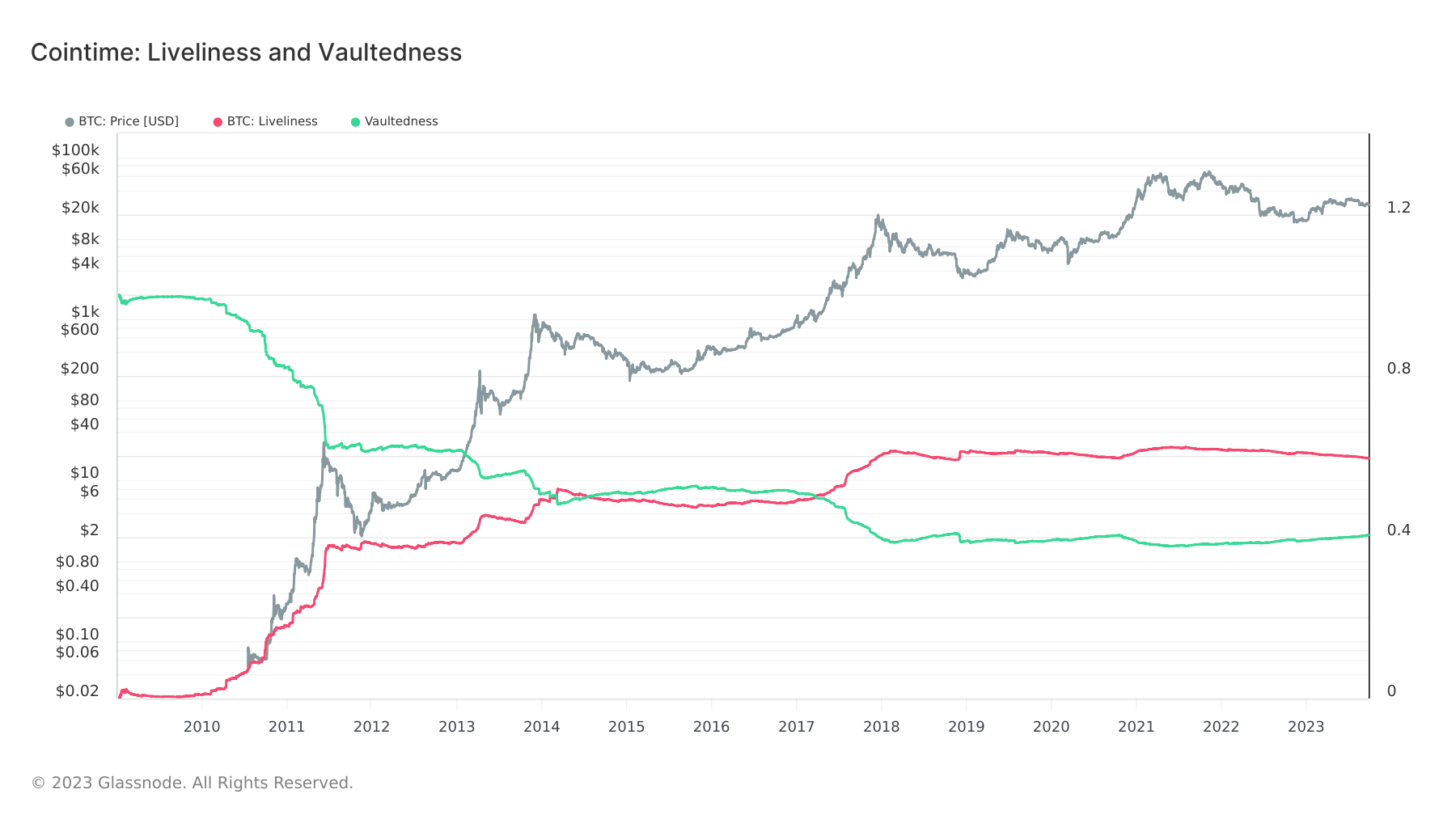

When the Genesis artifact was mined successful January 2008, the Bitcoin web started with a Liveliness of 0 and a Vaultedness of 1. This archetypal authorities makes intuitive consciousness — since nary coins had been spent, the network’s enactment was non-existent, giving Liveliness its lowest value. Conversely, each coins were efficaciously “vaulted” oregon unspent, giving Vaultedness its maximal value.

Immediately aft Bitcoin’s inception, Liveliness began its ascent, and Vaultedness started its descent. These trajectories continued until they intersected successful March 2014. A consequent play from July 2014 to April 2017 saw Vaultedness overshadowing Liveliness. However, post-April 2017, Liveliness took the pb and has maintained its dominance. It’s indispensable to enactment a inclination reversal initiated successful June 2021, wherever Vaultedness began to rise, and Liveliness started to decline.

Graph showing Bitcoin Vaultedness (green) and Liveliness (red) from 2008 to 2023 (Source: Glassnode)

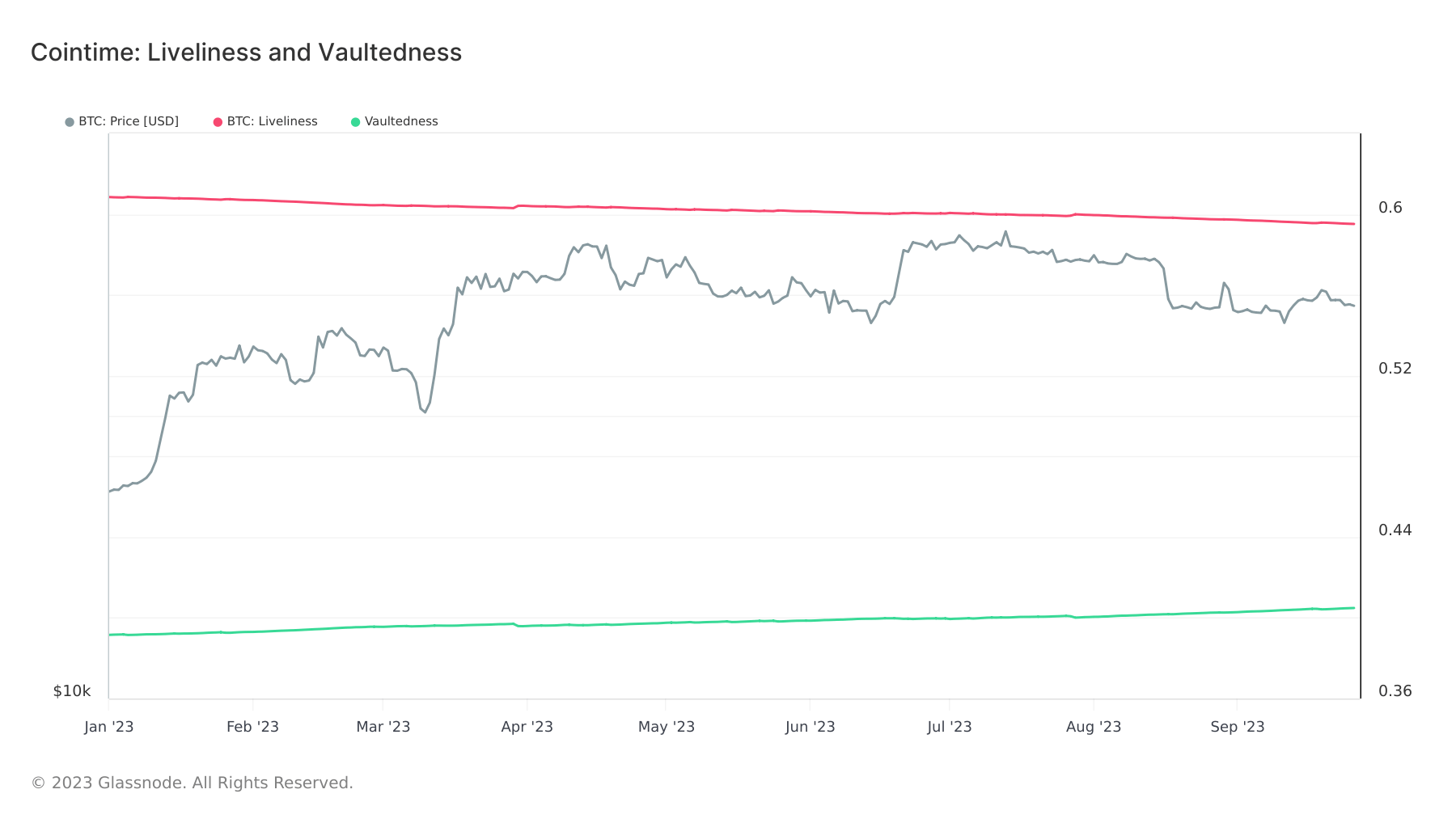

Graph showing Bitcoin Vaultedness (green) and Liveliness (red) from 2008 to 2023 (Source: Glassnode)Since the opening of the year, Liveliness decreased from 0.6 to 0.59—a comparative alteration of -2.5% erstwhile viewed against its maximal imaginable worth of 1. Meanwhile, Vaultedness accrued from 0.39 to 0.4, reflecting a comparative uptick of astir 1.64%.

Graph showing Bitcoin Vaultedness (green) and Liveliness (red) successful 2023 (Source: Glassnode)

Graph showing Bitcoin Vaultedness (green) and Liveliness (red) successful 2023 (Source: Glassnode)The summation successful Vaultedness, a inclination towards hodling, suggests increasing assurance successful Bitcoin’s worth proposition. Interestingly, the inclination of accrued Vaultedness has defied Bitcoin’s terms action, remaining accordant done some bull and carnivore markets.

The information indicates a equilibrium betwixt progressive trading and long-term holding, signaling Bitcoin’s evolving relation successful the fiscal landscape. The accordant dominance of Liveliness post-2017 and the caller inclination reversal successful 2021 mightiness bespeak a maturing marketplace and shifting capitalist sentiments. As the marketplace continues to evolve, metrics similar Liveliness and Vaultedness volition stay important successful decoding the broader communicative surrounding Bitcoin’s worth and potential.

It’s becoming evident that the cryptocurrency marketplace is not conscionable astir terms dynamics. The dominance displacement betwixt Liveliness and Vaultedness underscores Bitcoin’s travel from a speculative caller plus to a recognized store of value, with the caller trends suggesting a renewed content successful its semipermanent potential.

The station How Bitcoin’s liveliness and vaultedness amusement the power to hodling appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)