Last week, Bitcoin’s terms dropped from $29,400 to a debased of $25,000. While this diminution mightiness look humble fixed Bitcoin’s humanities volatility, it signifies a notable departure from the choky trading scope observed implicit the past 2 months.

Yet, adjacent amidst this volatility, the confidence of semipermanent holders remains unshaken, a sentiment that is important to show arsenic it often serves arsenic a barometer for the market’s underlying health.

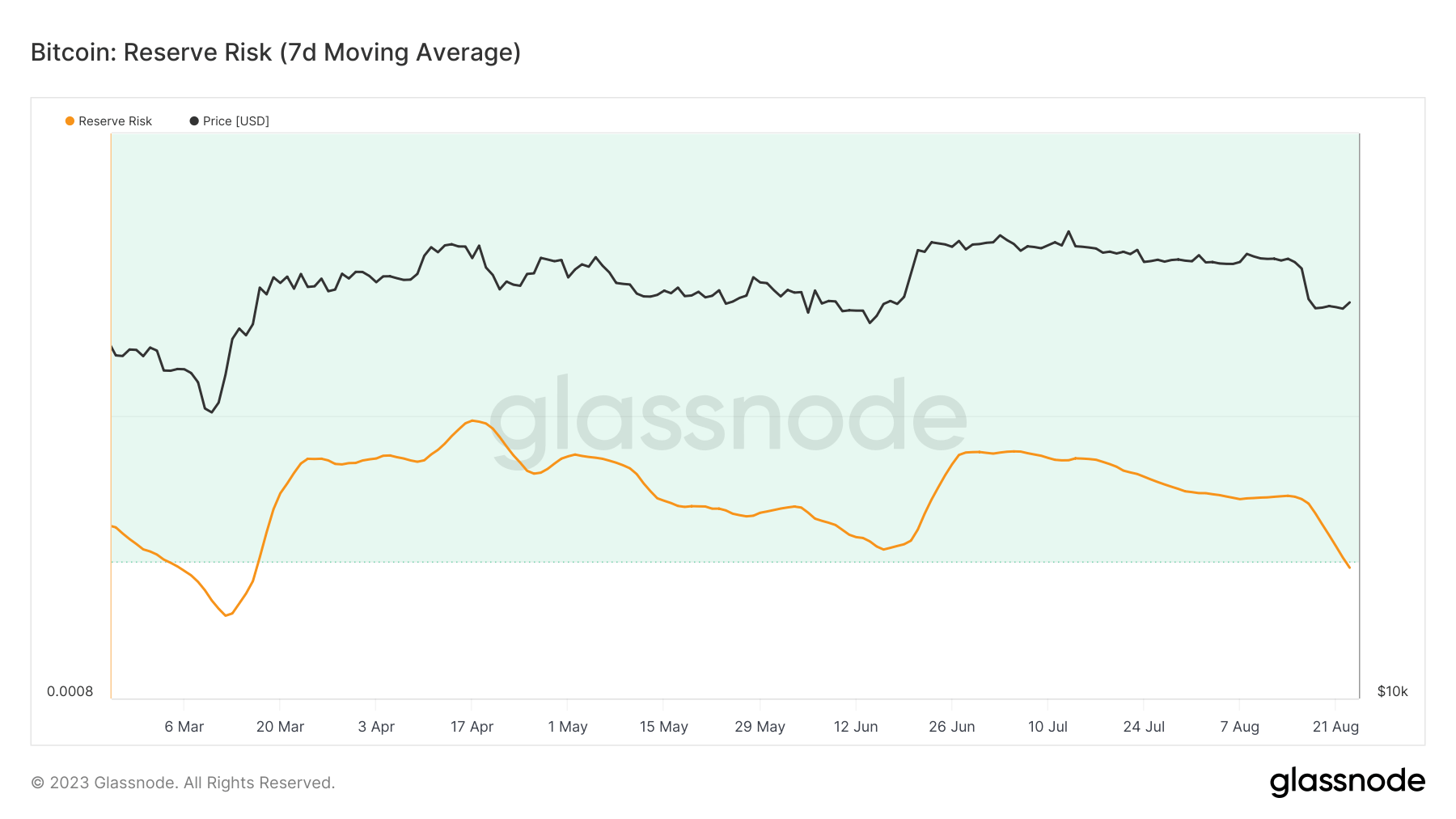

This unwavering assurance is seen successful Bitcoin’s reserve risk, an often underutilized on-chain metric.

Reserve hazard is simply a metric utilized to measure the risk/reward ratio of investing successful Bitcoin astatine immoderate fixed constituent successful time. It’s calculated by dividing the terms of Bitcoin by the HODL Bank. The HODL slope represents the worth of each coins successful presumption of their property (i.e., however agelong they person been held without being spent). The much coins are being held for longer periods, the higher the HODL Bank.

The metric fundamentally gauges the assurance of semipermanent holders successful narration to the coin’s existent price. A debased Reserve Risk indicates that semipermanent holders are assured successful the asset, and the existent terms is seen arsenic charismatic for investment. Conversely, a precocious Reserve Risk suggests that semipermanent holders mightiness beryllium little confident, and the terms mightiness beryllium considered precocious comparative to that confidence.

From Aug. 14 to Aug. 23, Bitcoin’s reserve hazard plummeted from 0.0011 to 0.00098. Bitcoin’s terms besides decreased during this aforesaid period, moving from $29,400 to $26,400. To enactment this successful perspective, the past lawsuit erstwhile Bitcoin’s reserve hazard touched these levels was connected March 15, with the terms astatine $25,050.

Graph showing Bitcoin’s hazard reserve from Feb. 24 to Aug. 24, 2023 (Source: Glassnode)

Graph showing Bitcoin’s hazard reserve from Feb. 24 to Aug. 24, 2023 (Source: Glassnode)The driblet successful some Bitcoin’s terms and reserve hazard implies that adjacent arsenic the terms dipped, the assurance of semipermanent holders surged. This tin beryllium interpreted arsenic semipermanent holders perceiving the terms driblet arsenic a lucrative buying window, reinforcing their content successful Bitcoin’s semipermanent value.

Other on-chain information further supports this, astir notably the supply of Bitcoin held by semipermanent holders.

Despite the terms slump, the fig of Bitcoins held by semipermanent holders has increased, increasing from 14.62 cardinal to 14.64 successful the past week. It’s important to enactment that this uptick continues an upward inclination that began successful July 2022.

Graph showing the semipermanent Bitcoin proviso from March 2022 to August 2023 (Source: Glassnode)

Graph showing the semipermanent Bitcoin proviso from March 2022 to August 2023 (Source: Glassnode)The diminished reserve hazard and the accrued semipermanent proviso bespeak a prevailing sentiment that the existent terms offers a favorable risk/reward equilibrium for investment.

While marketplace fluctuations are inherent to the volatile quality of cryptocurrencies, metrics similar reserve hazard connection a deeper dive into the underlying sentiments. The caller information underscores a bullish outlook for Bitcoin, showing that its semipermanent holders stay steadfast successful their content successful its semipermanent value, adjacent during short-term terms declines.

The station How Bitcoin’s falling reserve hazard counters its terms decline appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)