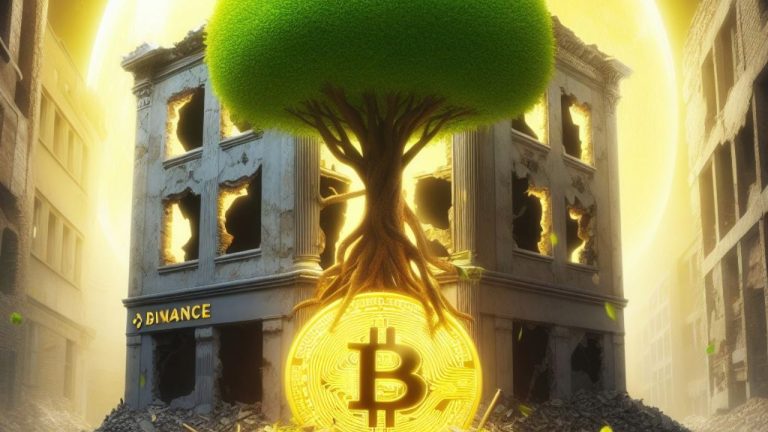

While the caller colony betwixt Binance, its erstwhile CEO Changpeng Zhao, and the U.S. Department of Justice (DOJ) has shocked the full crypto manufacture owed to the expected wealth laundering and terrorism-related fiscal implications it has, galore analysts and execs judge this is yet a bully outcome, considering that it volition origin the crypto abstraction to turn absent uncertainties related to 1 of its largest actors.

Analysts Argue Binance Settlement Signals Growth successful the Industry

The landmark settlement betwixt Binance, 1 of the largest cryptocurrency exchanges successful the world, its erstwhile CEO Changpeng “CZ” Zhao, and the U.S. Department of Justice (DOJ) connected the charges of wealth laundering and coercion financing mightiness bring a caller epoch to the cryptocurrency industry, according to analysts and crypto executives.

Brian Armstrong, CEO of Coinbase, stressed that this enactment mightiness unfastened caller roads for the industry, which volition person to beryllium built with compliance successful focus. Armstrong stated:

Today’s quality reinforces that doing it the hard mode was the close decision. We present person an accidental to commencement a caller section for this industry. We took a batch of arrows operating present successful the U.S. owed to the deficiency of regulatory clarity, and my anticipation is that today’s quality serves arsenic a catalyst to yet execute that.

Coinbase is besides facing ineligible actions from the U.S. Securities and Exchange Commission (SEC), which alleges the speech operates arsenic an unregistered securities broker, evading U.S. regulations for years.

More Reactions

Analysts astatine JPMorgan, led by Managing Director Nikolaos Panigirtzoglou, besides judge the colony is important for the cryptocurrency environment, eliminating aboriginal uncertainties related to the largest crypto actor. In statements offered to The Block, JPMorgan analysts declared:

We spot the imaginable of colony arsenic affirmative arsenic uncertainty astir Binance itself would subside and its trading and BNB Smart Chain concern would benefit.

Furthermore, the $4.3 cardinal woody helps to dispel the imaginable “systemic risk” of a hypothetical illness of Binance, according to JPMorgan.

Other analysts judge that with Binance nether the DOJ’s surveillance and being forced to exit the U.S. completely, the accidental for yet greenlighting a spot Bitcoin ETF is upon the crypto market. Michael Rinko, probe expert astatine Delphi Digital, told CNBC:

If you’re actively investigating the institution and the CEO who’s telling everyone the terms of these assets, however are you past going to greenlight an ETF? Having this colony down america could beryllium the last big, large measurement needed for this ETF.

What bash you deliberation astir the authorities of the crypto manufacture aft Binance’s plea deal? Tell america successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)