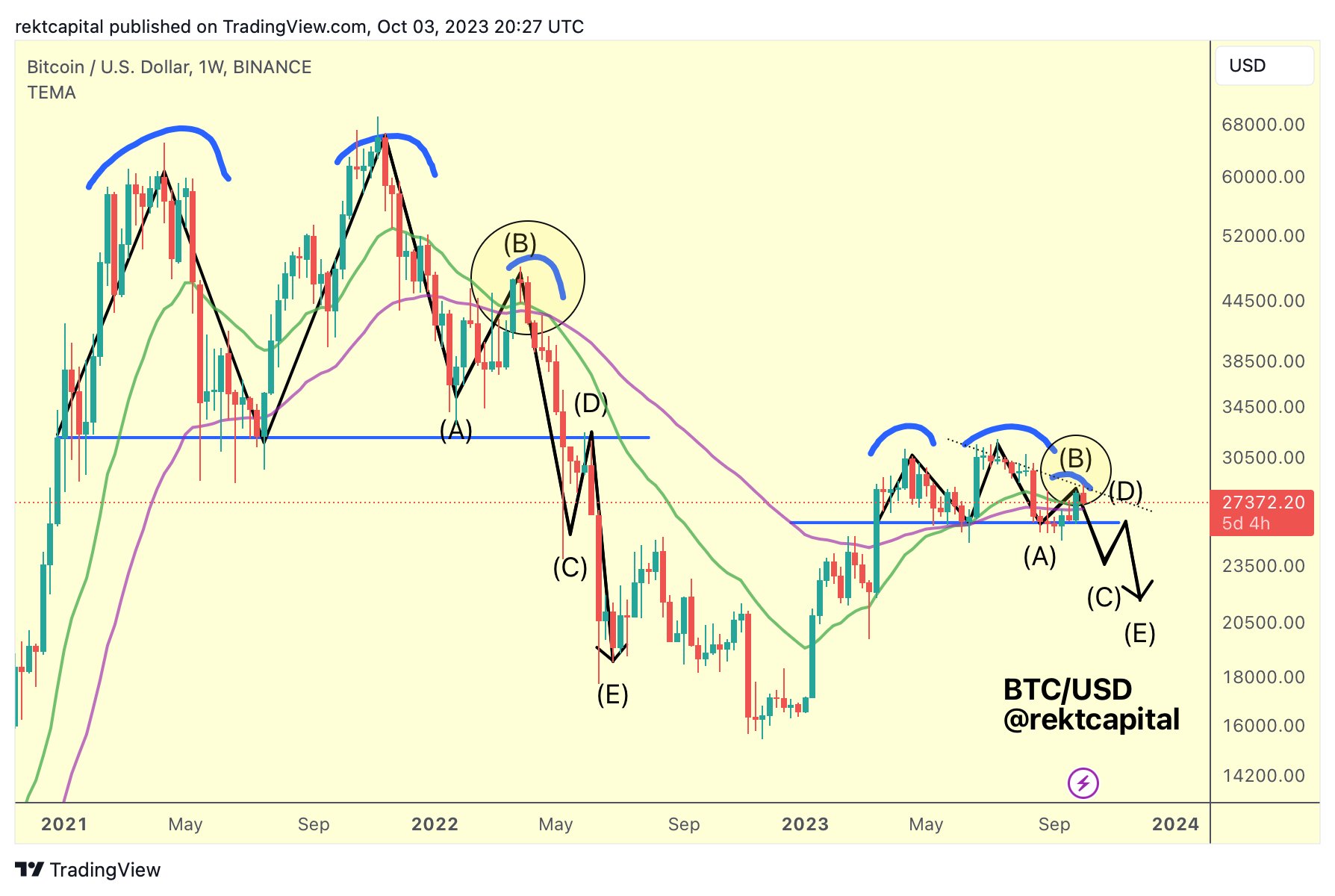

A elaborate investigation by well-regarded crypto expert Rekt Capital has spotlighted a recurring bearish fractal successful the humanities terms information of Bitcoin, raising prospects of a imaginable clang beneath the $20,000 mark. Notoriously seen successful 2019 and 2022, this signifier seems to beryllium reemerging successful the existent 2023 market.

For those unfamiliar, the fractal indicator identifies imaginable turning points connected a terms illustration by highlighting repetitive terms patterns. In elemental terms, a bearish fractal suggests a imaginable diminution successful price. Such a signifier materializes erstwhile there’s a highest terms with 2 consecutively little precocious bars/candles connected its flanks. An up arrow typically marks a bearish fractal, indicating the imaginable for terms descent.

Here’s Why Bitcoin Price Could Drop Below $20,000

The essence of this bearish signifier begins with a treble top. Contrary to expectations, this treble apical doesn’t validate with a dip beneath a important enactment level. Instead, the terms typically sees a alleviation rally, forming a little high, lone to clang beneath the antecedently mentioned support.

This enactment past morphs into a caller absorption level, driving the terms further down. This series was observed successful some 2019 and 2022, and the existent marketplace script successful 2023 mirrors the archetypal stages of this pattern. Rekt Capital suggests that the marketplace is perchance successful the mediate of this bearish fractal, with uncertainty astir wherever the alleviation rally mightiness conclude.

From the opening of April to the extremity of August, BTC formed a double-top signifier successful the play chart. However, the Bitcoin terms held supra the neckline astatine astir $26,000. Then, successful mid-August, BTC started its alleviation rally which took the terms up to $28,600. “We’re astir apt successful the A to B [phase of the] bearish fractal,” the expert added.

Bitcoin bearish fractal | Source: X @rektcapital

Bitcoin bearish fractal | Source: X @rektcapitalDiving deeper into imaginable scenarios, the expert believes Bitcoin’s terms could rally up to astir $29,000 earlier experiencing further declines. Some cardinal events to ticker for see imaginable overextensions beyond the bull marketplace enactment band. If Bitcoin fails to retest and support this set arsenic enactment aft breaking out, the bearish fractal remains valid.

Another important constituent to show is the revisit of the little precocious resistance. Even if the terms wicks beyond this resistance, a consequent rejection would support the bearish outlook intact. There are, however, criteria that could invalidate this bearish perspective: the bull marketplace enactment set (blue) consistently holds arsenic support, a play adjacent beyond the little precocious absorption ($28,000), and breaking past the $31,000 yearly highs.

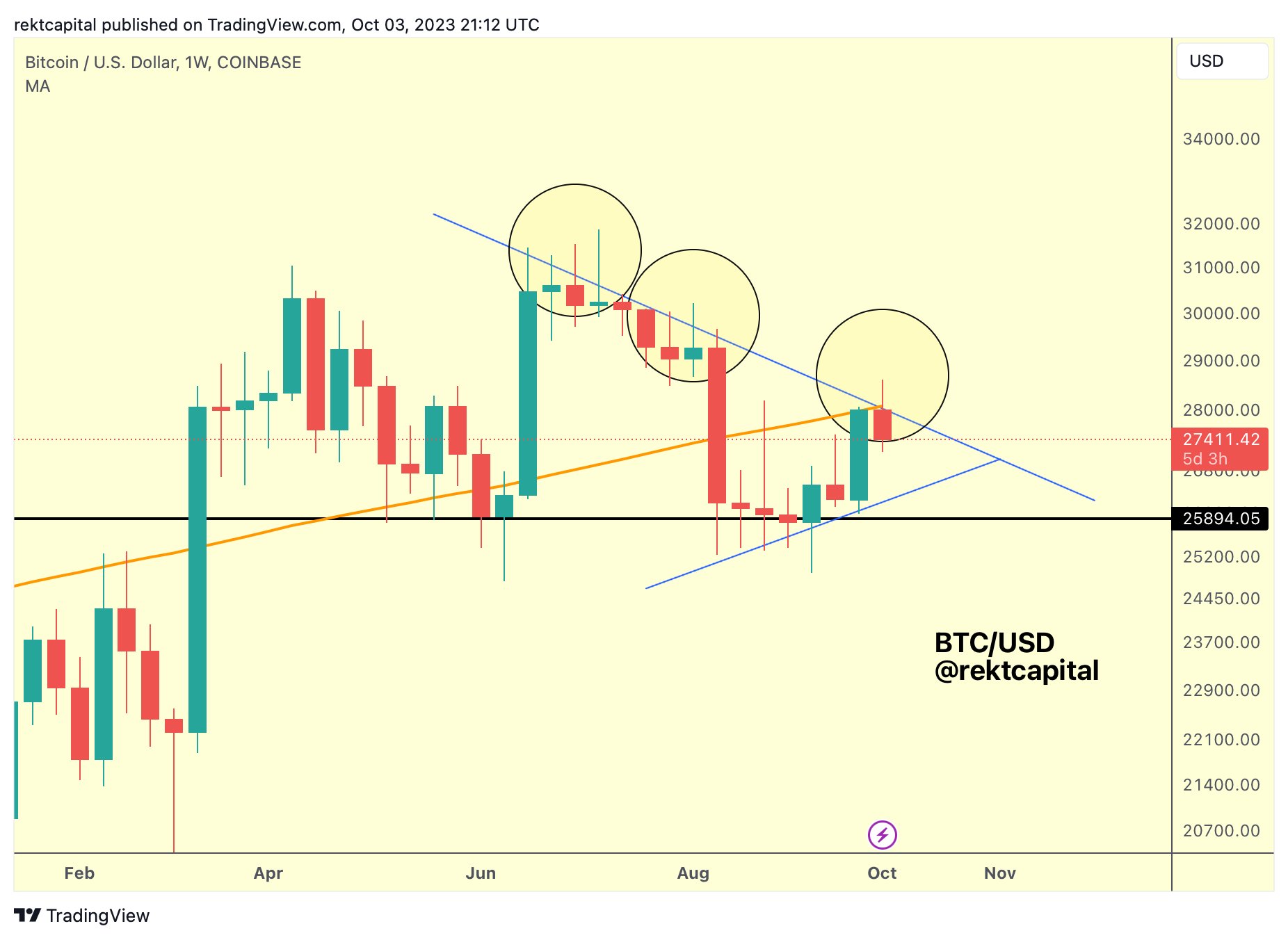

The little precocious is confluent with absorption astatine the 200-week MA | Source: X @rektcapital

The little precocious is confluent with absorption astatine the 200-week MA | Source: X @rektcapitalOn the taxable of different method indicators, Rekt Capital highlighted that Bitcoin has precocious rallied to the 200-week MA. This moving mean (MA), however, seems to beryllium acting arsenic a existent resistance. Additionally, the 200-week MA aligns with the little precocious resistance, presenting a important juncture for Bitcoin’s terms successful the adjacent future. Despite his macro bullish stance connected Bitcoin, Rekt Capital cautions that Bitcoin has yet to flooded the $28,000 little precocious absorption successful the 1-week chart.

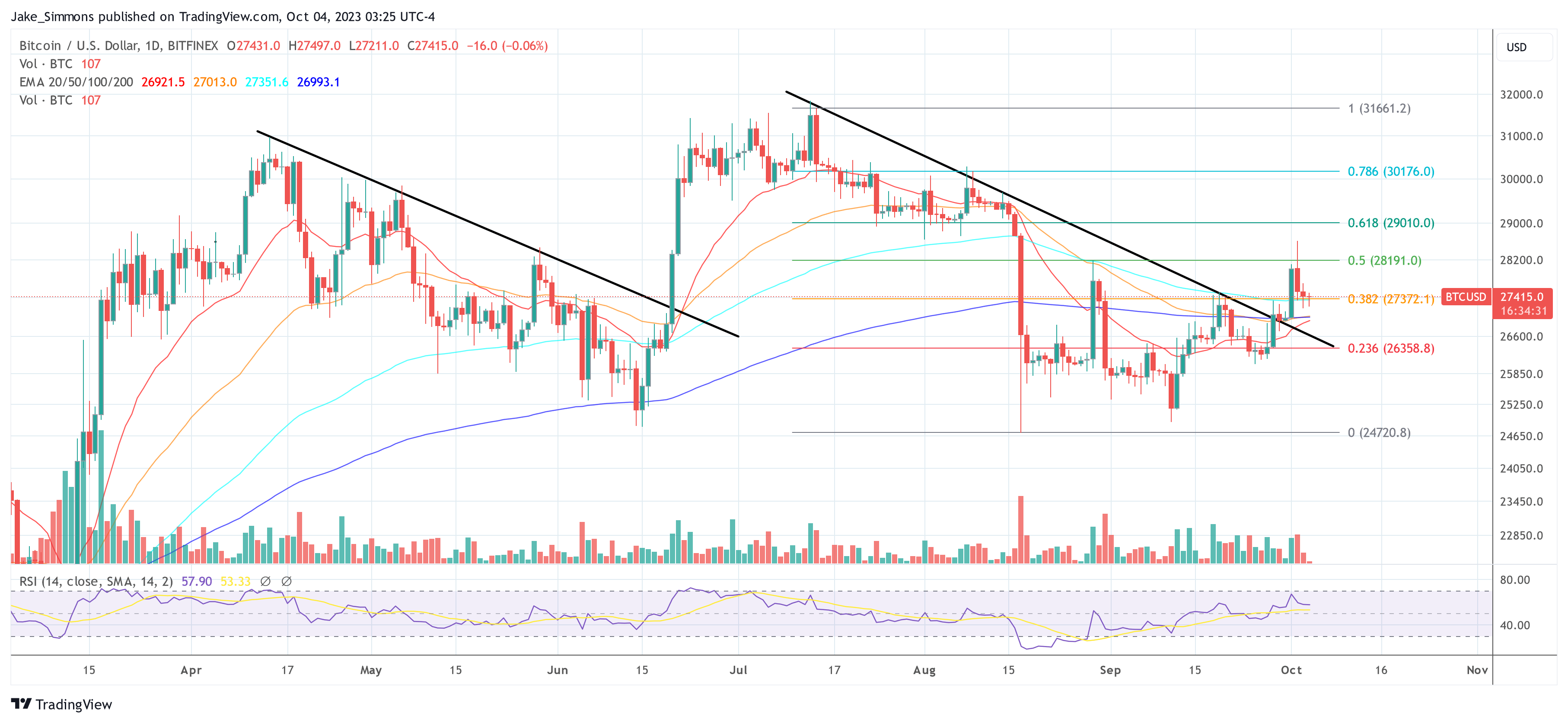

On the regular chart, Bitcoin is hovering somewhat supra the 38.2% Fibonacci retracement mark. For Bitcoin to debar a descent beneath the established inclination enactment (represented successful black), it’s important for it to support a presumption supra $27,372.

BTC hovers supra cardinal support, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC hovers supra cardinal support, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from Shutterstock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)