Bitcoin has spent the past respective weeks trapped successful a persistent decline, wiping hundreds of billions of dollars from its marketplace worth and reversing astir a year’s worthy of gains. The pullback has pushed the terms acold beneath its October all-time precocious of $126,000 and has dragged sentiment with it arsenic traders hunt for answers.

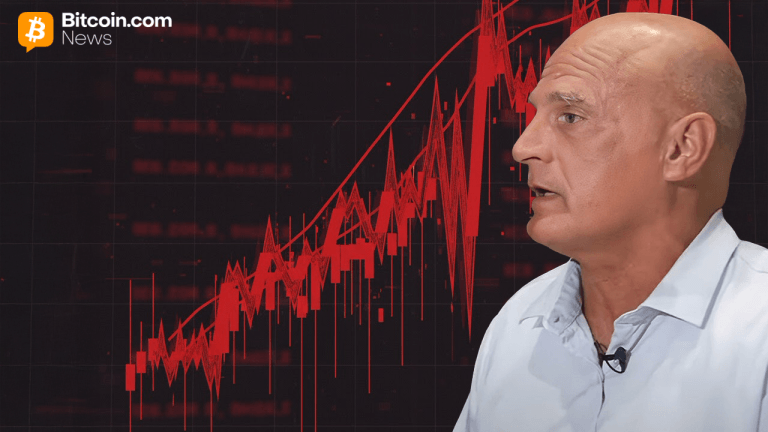

A elaborate breakdown shared by crypto expert Tracy Shuchart offers the clearest representation yet of wherefore this downturn has been truthful aggressive. Her investigation points to a nonaccomplishment not driven by a azygous origin but by respective interconnected forces that broke simultaneously and created the conditions for a cascading crash. This presents the anticipation of Bitcoin extending its clang to arsenic debased arsenic $80,000.

Breakdown Of The Macro Story That Sent Bitcoin To $126,000

According to Tracy Shuchart, Bitcoin’s ascent from $40,000 to $126,000 was powered based connected 1 ascendant theory: a Federal Reserve easing rhythm combined with a question of organization information done spot ETFs.

Traders priced successful a supportive macro backdrop wherever complaint cuts were each but guaranteed, liquidity would expand, and institutions would steadily sorb supply. However, erstwhile the Federal Reserve reversed course, the instauration of that mentation collapsed.

Expectations for December complaint cuts fell from 90% to 40%. Real yields connected short-term Treasuries stayed elevated supra 5%, and the strong-dollar situation returned. With the macro presumption gone, Bitcoin’s valuation adjacent all-time highs became hard to justify.

Institutions that had accumulated done Spot ETFs rapidly reduced exposure, producing much than $1.1 billion successful outflows wrong days. This wasn’t panic selling but a systematic rebalancing by portfolio managers who nary longer believed the macro thesis.

This alteration successful macro expectations efficaciously removed the archetypal furniture of enactment that had been holding Bitcoin supra six-figure levels.

The 2nd furniture of the diminution came from the behavior of semipermanent holders. Wallets that accumulated bitcoin betwixt $40,000 and $80,000 began distributing aggressively erstwhile volatility returned. They offloaded astir 815,000 Bitcoin successful 30 days, locking successful important profits.

Is $80,000 Next For Bitcoin?

Shuchart’s statement is based connected the conception that the ongoing diminution persists due to the fact that the marketplace has present reached a constituent wherever earthy buyers person vanished. Institutions are rebalancing distant from risk, semipermanent holders are waiting for deeper discounts, and retail traders person retreated. Until there’s caller demand, Bitcoin’s price volition proceed drifting lower.

“Now the marketplace is repricing based connected reality: precocious existent yields, nary Fed easing, beardown dollar environment,” the expert said.

For a bottommost to form, 3 conditions indispensable beryllium met. Leverage indispensable beryllium wholly flushed retired of the system, semipermanent holders need to halt selling and statesman accumulating again, and existent superior indispensable find the terms charismatic enough.

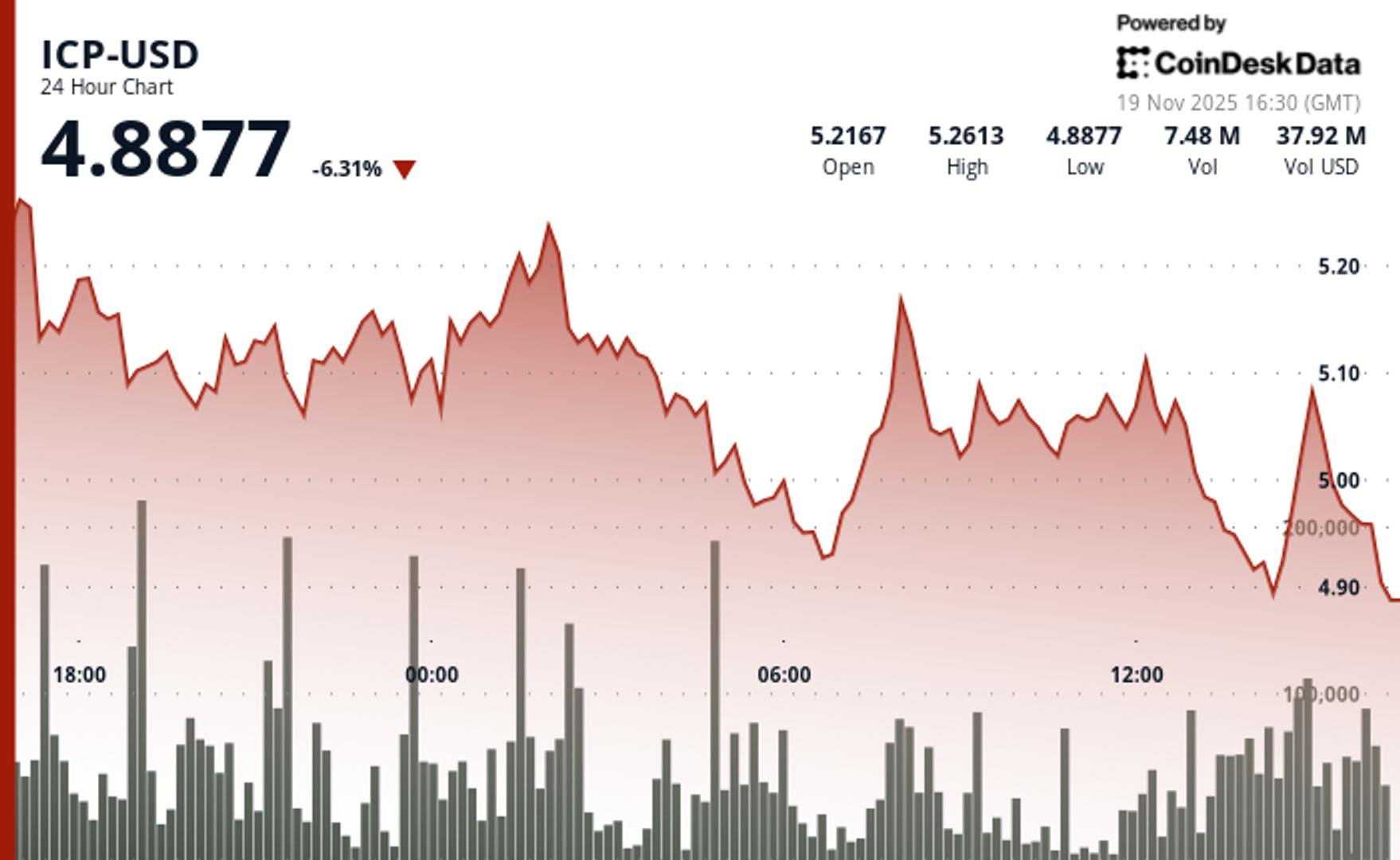

As it stands, Bitcoin is inactive trading supra the $90,000 terms level. However, caller terms enactment saw it concisely gaffe beneath that threshold connected November 18, touching lows adjacent $89,000 earlier recovering. That determination shows that the downtrend is already probing for little enactment successful the $80,000 zone. At the clip of writing, Bitcoin is trading astatine $91,080.

Featured representation from Pixabay, illustration from Tradingview.com

1 hour ago

1 hour ago

English (US)

English (US)