Despite the volatility Bitcoin experienced successful 2023, the extended sideways question betwixt February and July has proved to beryllium fertile crushed for accumulation. Onchain investigation showed that short-term holders (STHs) and long-term holders (LTHs) had steadily accumulated passim the past quarter, indicating a beardown belief successful the asset’s semipermanent value.

Measuring Bitcoin’s proviso successful nett and nonaccomplishment is an indispensable portion of analyzing the market. These metrics supply invaluable insights into marketplace sentiment and capitalist behaviour — a higher proviso successful nett indicates that investors are holding onto their assets, expecting further terms appreciation. Conversely, a higher proviso successful nonaccomplishment could awesome imaginable sell-offs.

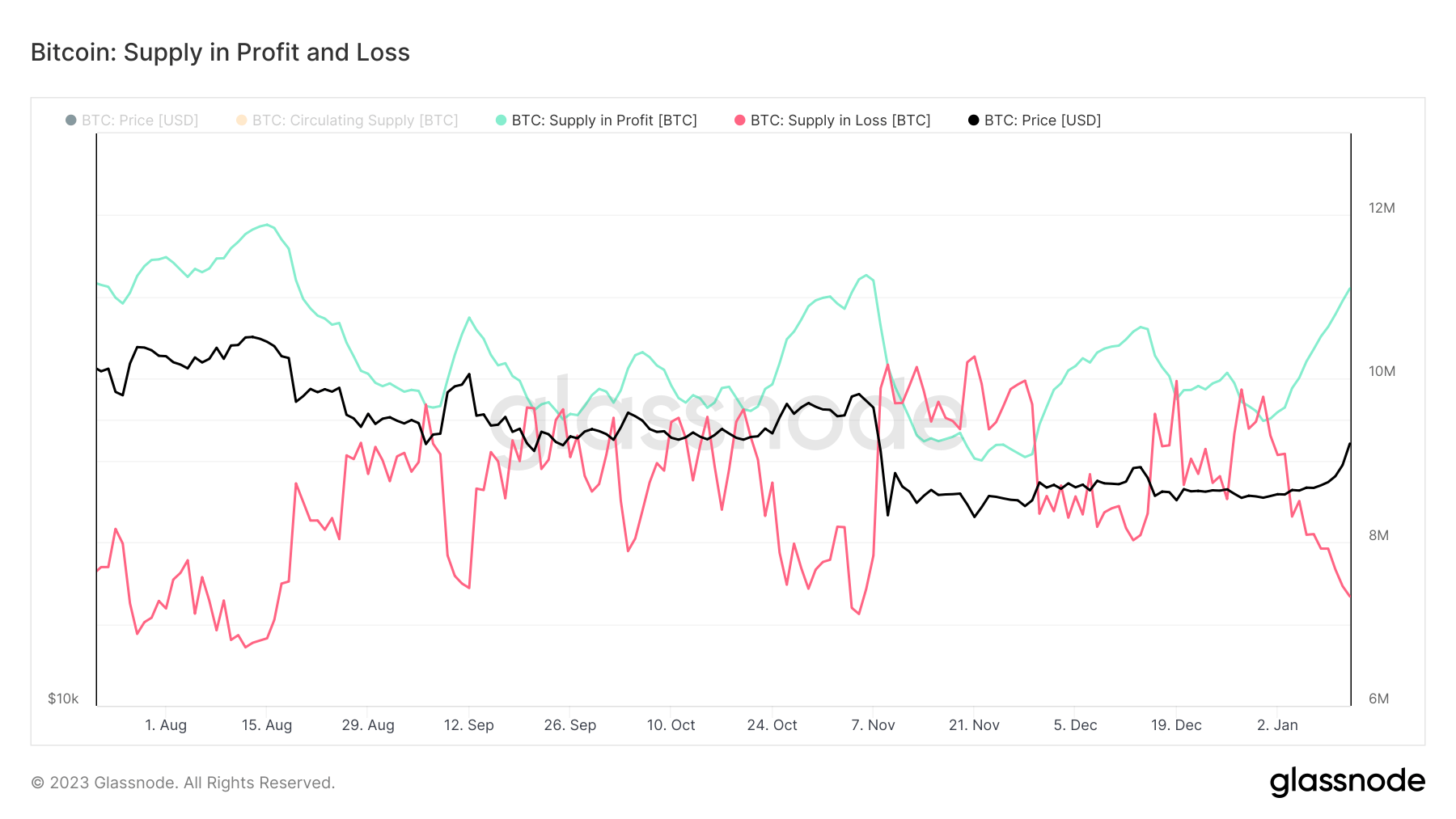

Between September and December 2022, during a play of important terms volatility, the supplies successful nett and nonaccomplishment converged aggregate times, reflecting the market’s uncertainty.

Graph showing Bitcoin’s proviso successful nett and nonaccomplishment converging betwixt September 2022 and December 2022 (Source: Glassnode)

Graph showing Bitcoin’s proviso successful nett and nonaccomplishment converging betwixt September 2022 and December 2022 (Source: Glassnode)However, the scenery has shifted since the opening of 2023. The supplies successful nett and nonaccomplishment person diverged, with the information of the proviso successful nett expanding by implicit 53%. According to information from Glassnode, 14.61 cardinal BTC is presently successful profit, portion 4.34 cardinal BTC is successful loss.

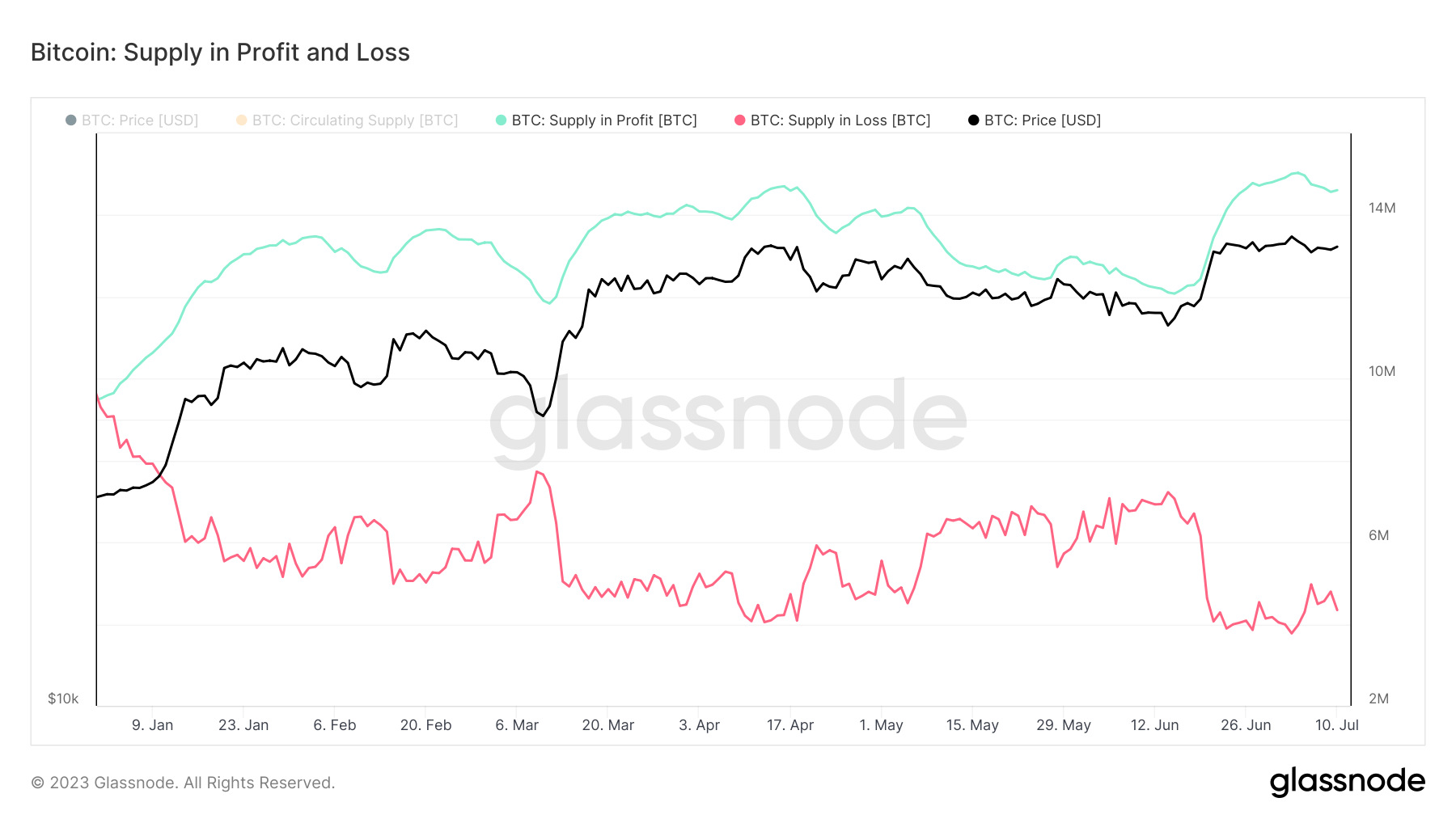

Graph showing Bitcoin’s proviso successful nett and nonaccomplishment successful 2023 (Source: Glassnode)

Graph showing Bitcoin’s proviso successful nett and nonaccomplishment successful 2023 (Source: Glassnode)As of July 11, 75% of the proviso is successful profit, leaving lone 25% successful loss. This important equilibrium is reminiscent of the scenarios witnessed during the mid-points of the 2016 and 2019 marketplace cycles. Glassnode information further revealed that 50% of Bitcoin’s trading days had seen a higher Profit-to-Loss equilibrium and 50% a little one.

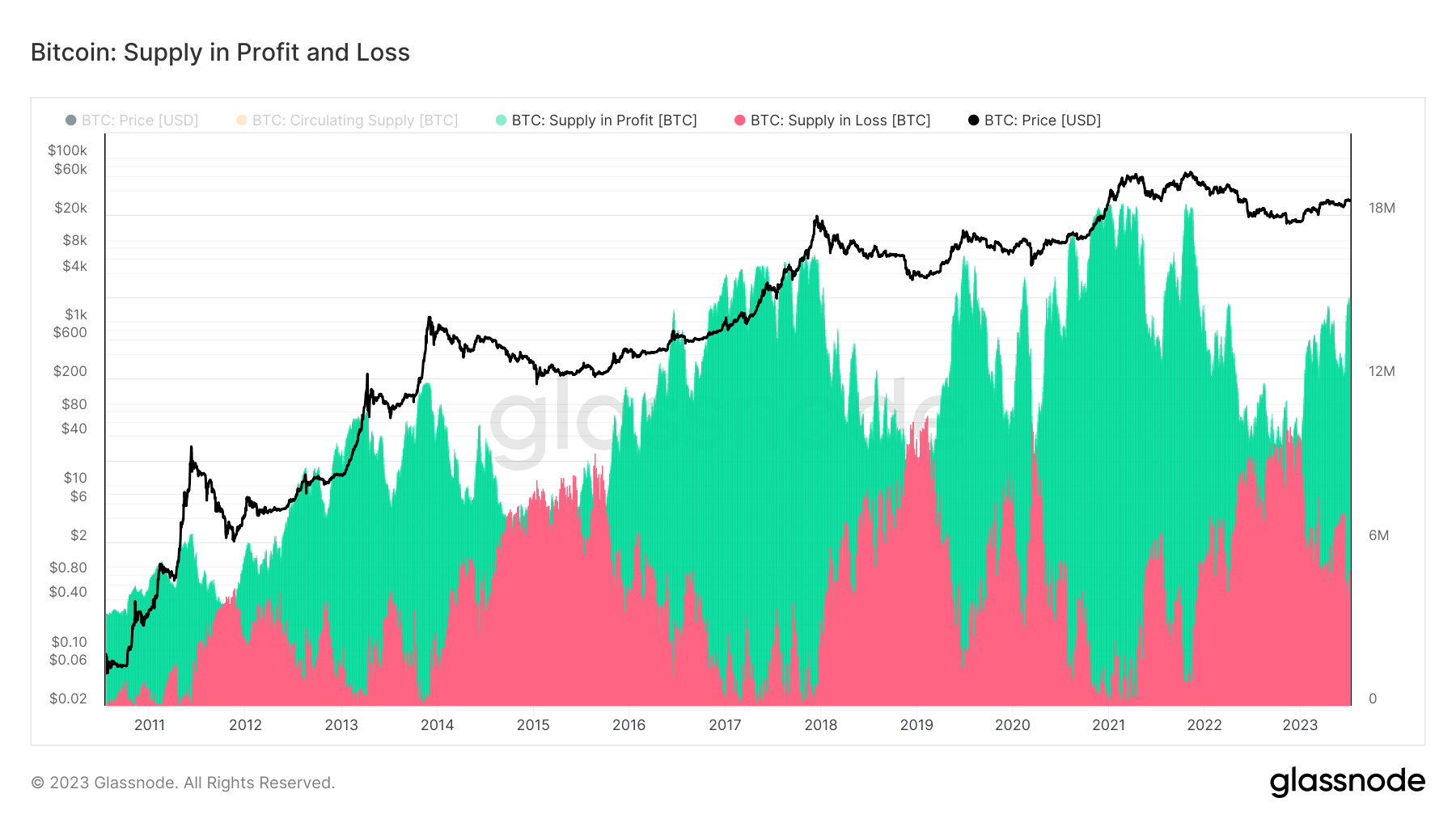

Graph showing Bitcoin’s proviso successful nett and nonaccomplishment from 2011 to 2023 (Source: Glassnode)

Graph showing Bitcoin’s proviso successful nett and nonaccomplishment from 2011 to 2023 (Source: Glassnode)The existent accumulation signifier and the resulting 75% of Bitcoin’s circulating proviso being successful nett is simply a promising motion for the cryptocurrency. If humanities patterns continue, this could beryllium the mid-point successful Bitcoin’s current marketplace cycle, suggesting that a bottommost has been reached and the marketplace is presently gearing up for a rally.

However, it’s important to see that portion humanities patterns supply utile context, they whitethorn not ever foretell aboriginal movements. Today’s Bitcoin marketplace is influenced much than ever by a big of macro factors, specified arsenic regulatory developments and broader economical conditions.

The station Heavy accumulation puts 75% of Bitcoin’s circulating proviso successful profit appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)