Haliey Welch, wide recognized arsenic “Hawk Tuah,” transformed her fleeting viral fame into a formidable media empire. With a burgeoning societal media beingness (<a href="https://www.instagram.com/hawktuah_/?hl=en" target="_blank">230K followers connected Instagram</a>), lucrative marque partnerships, and the palmy podcast Talk Tuah, Welch appeared to beryllium transitioning from net property to concern mogul.

That was until the 22-year-old launched her memecoin, $HAWK. Now Hawk Tuah isn’t flying truthful high.

$HAWK was launched connected the Solana blockchain with sizeable fanfare, initially skyrocketing to a <a href="https://www.coindesk.com/markets/2024/12/04/hawk-tuah-sensation-haliey-welch-s-hawk-token-goes-live" target="_blank">$491 cardinal marketplace cap</a>. This meteoric emergence was short-lived, arsenic the coin's valuation plummeted to <a href="https://dexscreener.com/solana/exygvxvrvujjryo65vyuhlaccxhwyztkqa7jxqit2tvr" target="_blank">under $20 million</a>, according to information from DEX Screener.

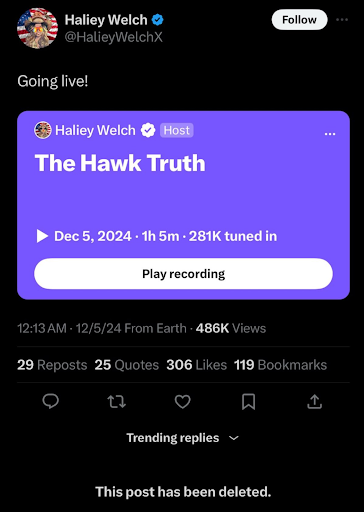

The accelerated diminution raises questions astir the project's legitimacy and the motives down its management. A now-deleted Twitter Spaces treatment further intensified suspicions, starring to <a href="https://www.bbc.com/news/articles/c89xvjkzzyvo" target="_blank">widespread allegations that $HAWK is thing much than a “celebrity rugpull.”</a>

To recognize what happened, it is archetypal indispensable to analyse the operation and decision-making processes that seemed to person underpinned the $HAWK launch.

Launching a memecoin mightiness look similar a locomotion successful the parkland (anyone tin bash it connected Pump.fun). But doing it successfully is overmuch harder. It requires capital, selling and method expertise alongside thing bully successful the archetypal place. You request teamwork. I accidental this arsenic a laminitis who’s been successful Web3 since 2013, has raised tens of millions of dollars successful task superior for projects of my own, and is simply a task capitalist astatine a ample task fund, Foresight Ventures. (For much connected however to motorboat a memecoin, spot my different caller <a href="https://www.coindesk.com/opinion/2024/12/12/memecoins-are-not-easy-money" target="_blank">CoinDesk nonfiction here</a>). $HAWK seems to person had 3 chiseled teams down it, according to net sleuth <a href="https://x.com/coffeebreak_YT?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Eauthor" target="_blank">Coffeezilla</a>:

Welch’s Web2 team, liable for her “traditional” brand

<a href="https://x.com/kbwofficial/status/1829866733743849600" target="_blank">Memetic Labs, led by laminitis Doc Hollywood</a>, managing blockchain-related activities and holding the pen connected each Web3 related decisions

and <a href="https://x.com/overHere_gg" target="_blank">overHere</a>, a caller method work supplier specifically brought successful to facilitate a caller token assertion process designed to onboard Welch’s Web2 audience.

OverHere initially engaged successful discussions with maine to supply discourse astir its relation and said it was unfastened to providing thing much successful a transparent manner.

In a since deleted X Spaces, Welch abruptly dropped disconnected astir 1:00am EST, telling listeners she was going to sleep. Doc Hollywood dominated the conversation. His institution Memetics Labs was liable for captious aspects of the token release, specified arsenic tokenomics, token minting and distribution, selling (e.g. messaging implicit superior mediums specified arsenic X), liquidity excavation creation, and trading interest settings.

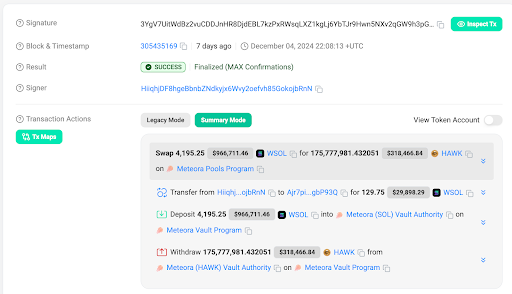

One listener asked wherefore the trading fees connected Meteora were truthful precocious (Meteora is simply a decentralized exchange, oregon DEX, wherever users tin commercialized cryptocurrencies directly, without middlemen.) Doc Hollywood said galore of the expenses were related to costs associated with overHere’s team, arsenic good arsenic costs associated with mounting up the instauration successful the Cayman Islands. A assertion partially refuted by overHere, who maintains it built the tech pro bono.

According to assorted manufacture sources who were made alert of the product’s lone caller development, the societal token inferior exertion overHere built had a caller conceptual-business model. It’s 1 that would tokenize likeness and intelligence spot tied to Web2 fans. And it’s not thing that has existed successful anterior memecoin launches, fto unsocial immoderate crypto project.

Welch’s team, apt connected the proposal of Web3 advisor Memetic Labs, implemented exorbitant excavation fees of 15% connected Meteora, a determination that drew disapproval from overHere erstwhile I archetypal contacted connected December 4. It seemed to maximize abbreviated word profits astatine the disbursal of the spot of some Welch’s existing Web2 community, arsenic good arsenic the Web3 assemblage she hoped to grow into with this launch. High trading fees undermine the project's credibility.

Another constituent of contention: the merchantability of millions of tokens post-launch by pre-sale investors, who were granted unrestricted entree to vest their tokens. This efficaciously diluted the token’s worth and raised suspicions of insider manipulation.

OverHere maintained its engagement was devoid of fiscal incentives, claiming nary profits from Meteora oregon the pre-sale, and nary entree to escaped tokens. It described its absorption arsenic establishing $HAWK arsenic a pioneering lawsuit survey for leveraging intelligence spot successful token launches. However, the project's trajectory, shaped by decisions from Welch’s Web3 team, was marred by mismanagement and missteps that made that impossible.

A deficiency of transparency emerges arsenic the astir important failing successful the $HAWK saga. The lack of a publically disclosed tokenomics and organisation program anterior to the motorboat gave emergence to accusations that the squad was insider-dealing. Critics utilized <a href="https://x.com/bubblemaps/status/1864439521523196046" target="_blank">BubbleMaps, an auditing instrumentality for DeFI and NFTs, to assertion that 96% of the tokens were allegedly allocated to the “team.”</a> overHere aboriginal said <a href="https://x.com/overHere_gg/status/1864503127019540912" target="_blank">the existent distribution</a> for “the team” was 10%, which includes allocations for the assemblage fund, reserves, and strategical purposes.

<a href="https://x.com/overHere_gg/status/1864503127019540912" target="_blank">According to overHere’s understanding</a>, the Web3 squad — which maintained sole deployer wallet entree — has denied selling these tokens. In reality, it appears this selling unit originated from definite pre-sale investors whose engagement was ne'er publically disclosed anterior to the launch. The archetypal disorder underscores a nonaccomplishment successful connection and transparency from the outset.

Another contented was fastener and vesting mechanisms were not instantly implemented, but this hold stemmed from method bugs wrong the vesting protocol. All discussions regarding the token’s fastener and vesting schedules were managed by Welch's Web3 squad successful collaboration with Magna, the work supplier overseeing these mechanisms. OverHere was intentionally uninvolved successful these decisions, emphasizing its relation arsenic a method work supplier alternatively than an operational team. It has expressed a willingness to supply extended documentation to clarify its presumption and responsibilities.

<a href="https://x.com/jarxiao/status/1865111353318609150" target="_blank">Industry experts specified arsenic Ellipsis’ Jarry Xiao</a> person said they didn’t deliberation Welch's team(s) had “malicious intent (this was intelligibly not their desired outcome). But without grounds to the contrary, this appears to beryllium a blatant currency drawback without immoderate information of the consequences to retail.”

The communicative is simply a stark reminder of the perils inherent successful merging personage power with the nascent and often unregulated cryptocurrency market. The committedness of decentralized concern backing media empires without accepted equity income is alluring, yet $HAWK exposes the fragile instauration upon which specified ventures are built. The deficiency of transparency, accountability, and ethical oversight tin swiftly alteration a promising task into a cautionary tale.

$HAWK is simply a testament to the captious request for robust governance frameworks and unwavering transparency successful Web3 initiatives. As the squad endeavors to rebuild spot and redefine $HAWK’s purpose, we, the crypto industry, indispensable heed this lesson: without wide accountability and unfastened communication, adjacent the astir promising projects are susceptible to collapse. We request to embed transparency and accountability astatine the halfway of each Web3 projects, peculiarly those of high-profile personalities who tin conscionable arsenic easy go victims of exploitation.

10 months ago

10 months ago

English (US)

English (US)