The Stablecoin Supply Ratio (SSR) is simply a captious marketplace indicator that has been steadily climbing since the commencement of the year, signifying a alteration successful the purchasing powerfulness of stablecoins.

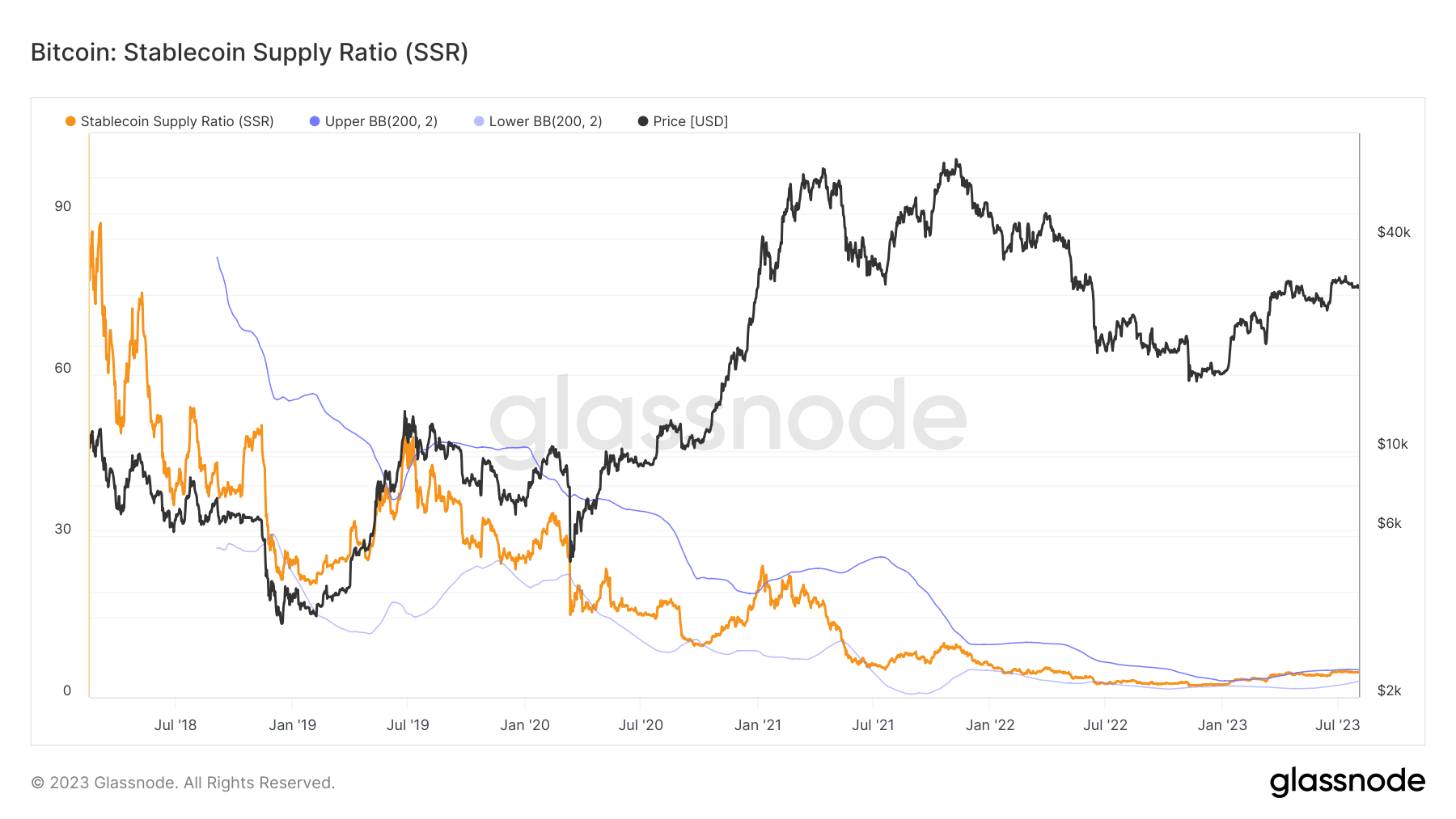

The SSR is simply a metric that provides penetration into the proviso and request dynamics betwixt Bitcoin (BTC) and the U.S. dollar. The calculation of SSR involves dividing the full proviso of stablecoins by the marketplace capitalization of Bitcoin.

When the SSR is low, it indicates that the buying powerfulness of stablecoins is high. This means that for each dollar represented by stablecoins, determination is simply a larger information of Bitcoin’s marketplace headdress disposable for purchase.

On the different hand, a precocious SSR suggests that the buying powerfulness of stablecoins is low. In this scenario, each dollar represented by stablecoins tin bargain a smaller information of Bitcoin’s marketplace cap.

Graph showing the SSR from 2018 to 2023 (Source: Glassnode)

Graph showing the SSR from 2018 to 2023 (Source: Glassnode)The SSR is an important indicator due to the fact that it provides a snapshot of the imaginable buying powerfulness of stablecoins successful the Bitcoin market. It helps traders and investors recognize whether the marketplace is presently dominated by those holding dollar-pegged stablecoins oregon Bitcoin holders.

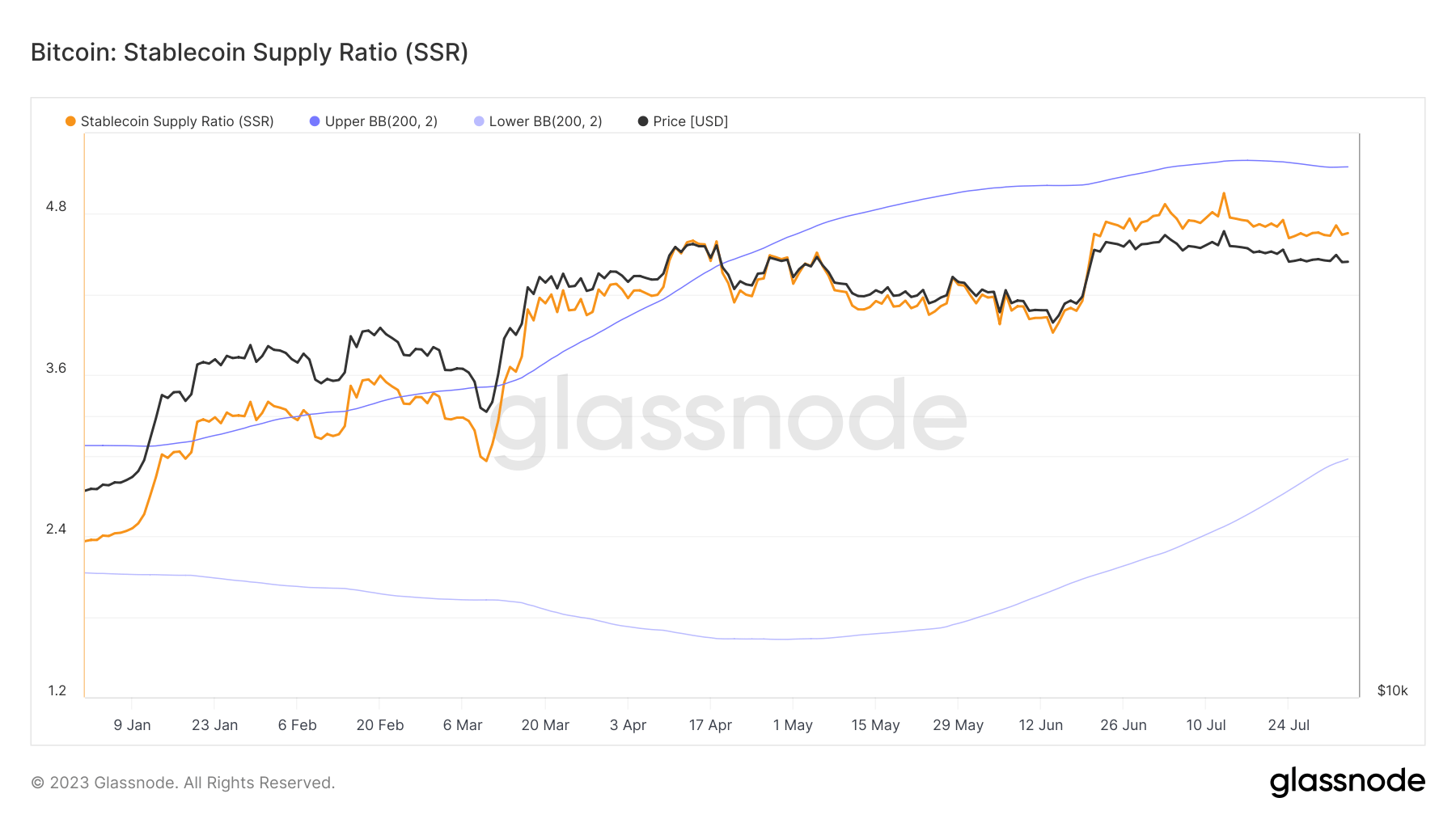

From the opening of the year, we person seen the SSR emergence from 2.36 to 4.65. This crisp summation indicates a important diminution successful the purchasing powerfulness of stablecoins. This inclination has occurred successful tandem with the rising terms of Bitcoin.

Graph showing the SSR YTD (Source: Glassnode)

Graph showing the SSR YTD (Source: Glassnode)Given the caller surge successful the SSR, it’s worthy noting the marked summation successful the proviso and prominence of definite stablecoins. As covered successful erstwhile CryptoSlate analysis, Tether (USDT) and TrueUSD (TUSD) person seen their circulating supplies scope all-time highs this year.

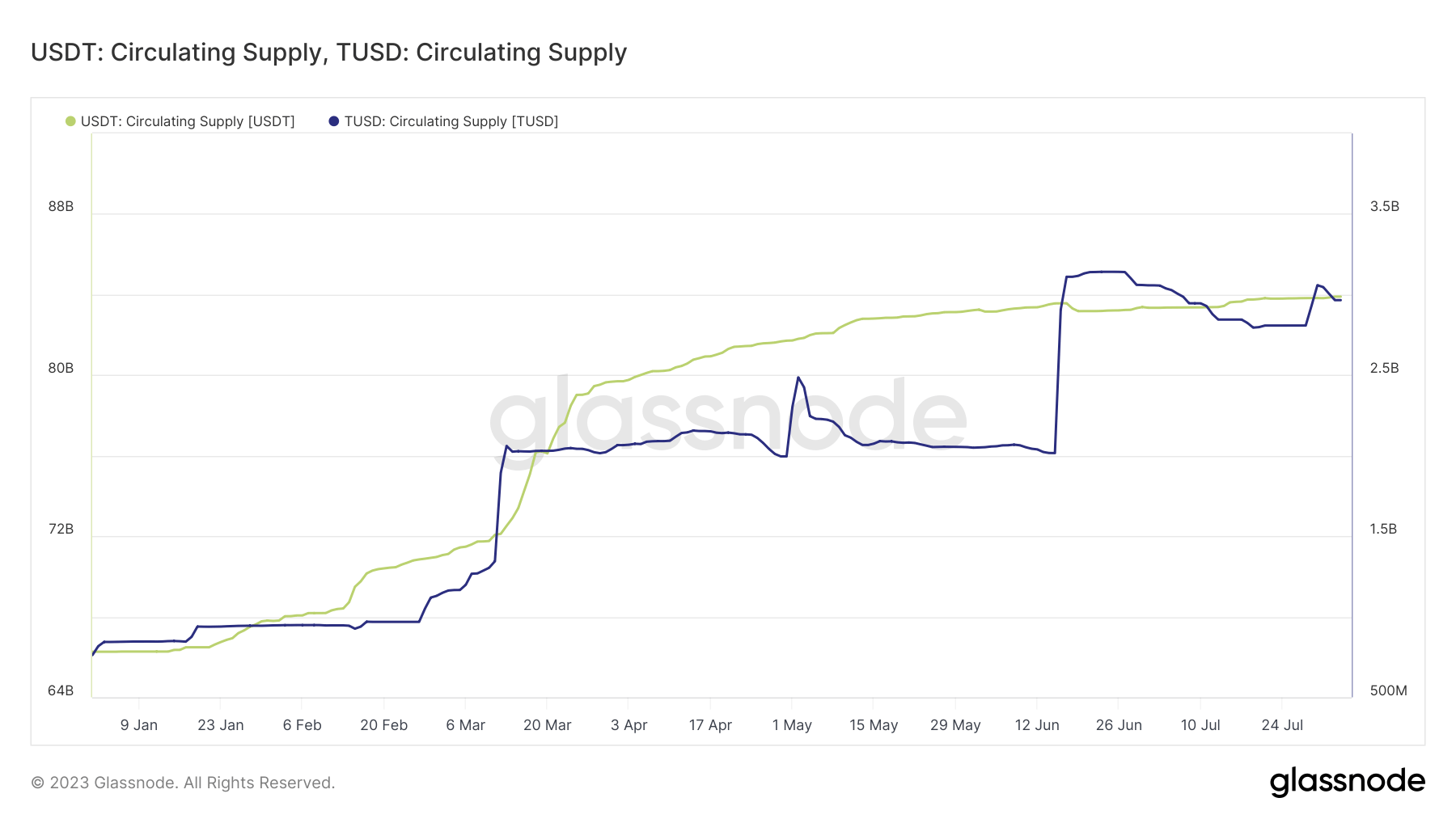

At the extremity of July, Tether’s proviso deed an all-time precocious of $83.89 billion, portion TrueUSD’s proviso peaked astatine $3.04 billion. These 2 stablecoins are peculiarly important arsenic they represent the bulk of crypto to stablecoin trading pairs connected centralized exchanges.

Graph showing the circulating supplies of USDT and TUSD YTD (Source: Glassnode)

Graph showing the circulating supplies of USDT and TUSD YTD (Source: Glassnode)The implications of this rising SSR are multifaceted and necessitate cautious analysis. On 1 hand, the increasing proviso of stablecoins indicates a robust request for these assets, which are often utilized arsenic a harmless haven during periods of marketplace volatility.

On the different hand, the rising SSR suggests that the buying powerfulness of stablecoins comparative to Bitcoin is decreasing. This could perchance pb to a alteration successful the request for Bitcoin, which successful crook could exert downward unit connected its price.

The station Growing proviso diminishes stablecoin Bitcoin buying power appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)