PRESS RELEASE. On December 19, Grimace’s creator staged a New Year’s occurrence live, gifting his followers millions of dollars. The MEXC speech funded this full giveaway, arsenic they went against Grimace’s idiosyncratic basal and listed the token connected their futures marketplace without approval.

The Start of It All: The Complete Story of the Dispute

In outpouring 2023, Grimace emerged arsenic 1 of the year’s standout crypto projects, rapidly gaining fame and enriching its aboriginal backers, who were besides actively donating to charity. Money was freely fixed distant connected the streets, and competitions successful poker, chess, Dota 2, Counter-Strike, and adjacent rap battles were held, each with prizes successful the tens of thousands of dollars.

Grimace archetypal appeared connected MEXC connected June 12, 2023. Initially, users appreciated the speech for its debased fees. However, the speech listed the token connected its futures marketplace successful October without coordinating with the community. This unauthorized determination was a wide manipulation of the task and surely not what the squad intended.

Peaceful negotiations failed, starring Odysseus to urge users to retreat their tokens from MEXC and determination each liquidity to BitGet, leaving MEXC’s bid publication virtually empty. The stock of tokens connected MEXC plummeted from 40% to conscionable 1.5%.

The exchange’s leaders didn’t react, prompting a stern informing from Odysseus. He instructed the assemblage to spot bounds orders for agelong positions astatine $45-46 connected Grimace futures with halt orders beneath $40. He past dropped the terms to trigger these bounds orders and skyrocketed the terms to $90. Since determination was hardly immoderate enactment successful the spot market, this terms surge was comparatively inexpensive to execute.

MEXC’s arbitrage bot, usually profiting from terms differences, mislaid each its funds during this event, which ended up successful the hands of the Grimace community.

This time, the speech mislaid lone a fewer 100 1000 dollars. After the incident, MEXC’s leaders instantly contacted Grimace’s developers. Despite this, determination was nary delisting from the futures market, starring to respective akin incidents. However, the decisive stroke to the speech came later.

December 19 – A Monumental Win for the Grimace Community

That evening, Odysseus announced a unrecorded watercourse connected the INV TRADING channel.

He planned to make a New Year’s occurrence live, enriching his followers connected a larger standard this time, each astatine the disbursal of the exchange.

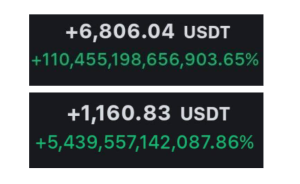

He filled bounds orders astatine $35-45 and past accrued the terms tenfold, up to $358 per coin. With added leverage, this gave his followers monolithic profits.

Meanwhile, successful the spot market, the terms soared to $852. MEXC’s arbitrage bot couldn’t support up with specified a drastic complaint owed to a deficiency of funds, allowing Odysseus’s followers and INV TRADING to reap the benefits.

At 1 point, the level itself struggled to show specified precocious PNL percentages.

Just an hr aft these events, a announcement astir delisting was issued. Typically, specified notices are fixed a week oregon a period successful advance, but successful this case, users had little than 2 days to adjacent their positions.

This lawsuit marked a definitive triumph for Grimace. Continue to way the developments of the world’s astir progressive crypto assemblage close now: https://twitter.com/GrimaceOdysseus.

This is simply a property release. Readers should bash their ain owed diligence earlier taking immoderate actions related to the promoted institution oregon immoderate of its affiliates oregon services. Bitcoin.com is not responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful the property release.

1 year ago

1 year ago

English (US)

English (US)