Grayscale’s triumph against the U.S. Security and Exchanges Commission (SEC) triggered implicit $90 cardinal successful liquidations during the past 4 hours, importantly impacting traders betting connected the further diminution of the market.

According to data from Coinglass, abbreviated traders accounted for 88% of the $97.63 cardinal liquidations recorded successful the marketplace implicit the past 4 hours arsenic Bitcoin (BTC) and Ethereum (ETH) spiked by much than 5%, respectively.

Bitcoin and ETH cumulatively saw much than $60 cardinal of the liquidations, portion traders with positions successful assets specified arsenic BNB, XRP, Bitcoin Cash, Solana, and others recorded millions successful losses.

This is the highest liquidation level since the marketplace flash crashed connected Aug. 17. The crypto manufacture is presently undergoing 1 of its lowest volatility periods, with BTC and ETH not seeing important terms action.

Meanwhile, erstwhile the liquidation timeframe is extended to the past 24 hours, the losses magnitude to $123.52 million.

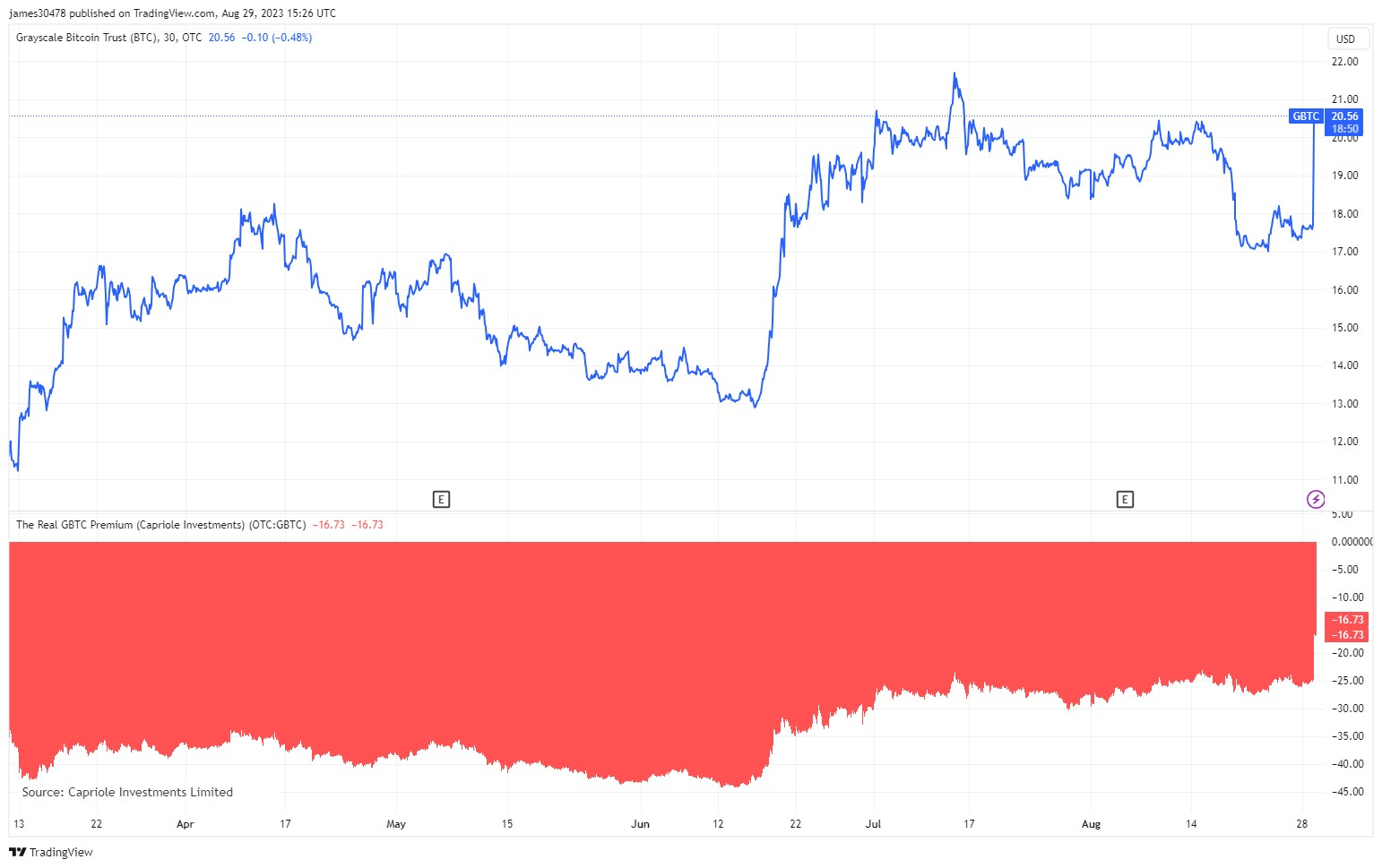

GBTC discount narrows

Meanwhile, Grayscale’s Bitcoin Trust (GBTC) reacted positively to quality of its genitor company’s victory, rapidly compressing to 18%, its lowest level successful the past 2 years.

Source: Tradingview

Source: TradingviewThe GBTC discount peaked astatine astir 50% past twelvemonth and has mostly stayed around 40% this year. However, the metric began to importantly decline pursuing BlackRock’s application for a spot BTC ETF earlier dropping beneath 20% for the archetypal clip since aboriginal 2022.

Earlier today, the United States Court of Appeals for the District of Columbia Circuit handed Grayscale a important triumph by overturning the SEC’s erstwhile order. This ruling marks a pivotal infinitesimal successful Grayscale’s suit regarding converting its Bitcoin Trust into a spot Bitcoin ETF.

The crypto concern steadfast has consistently maintained that the fiscal regulator acted “arbitrarily and capriciously” successful rejecting spot Bitcoin ETF applications portion highlighting the SEC’s “unfair discrimination” against spot Bitcoin ETF issuers.

The station Grayscale triumph against SEC sparks $90M marketplace liquidations, slims GBTC discount appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)