Grayscale’s Bitcoin Trust (GBTC) has go a important instrumentality successful the cryptocurrency satellite since its motorboat by Grayscale Investments. As 1 of the pioneers successful providing a span betwixt the accepted concern scenery and the nascent cryptocurrency domain, GBTC allows investors to pat into the Bitcoin marketplace without straight buying, storing, oregon managing it. Monitoring GBTC’s terms question has go paramount, particularly for analysts aiming to gauge marketplace sentiment.

Crafted successful the mold of a accepted concern trust, GBTC’s unsocial proposition lies successful its method of holding Bitcoin. Instead of idiosyncratic investors grappling with cryptographic keys and wallets, Grayscale centralizes the holding process, utilizing high-security measures, including acold retention mechanisms, to guarantee the information of the assets.

GBTC shares, representing ownership of a fraction of the trust’s underlying Bitcoin, are traded connected the OTCQX market. The OTCQX, oregon the Over-The-Counter QX, is simply a top-tier, regulated marketplace for stocks and securities that don’t commercialized connected conventional, large-scale exchanges. It offers a level for companies to entree U.S. investors portion complying with precocious fiscal standards and disclosure practices.

One distinguishing diagnostic of GBTC, mounting it isolated from immoderate ETFs (Exchange Traded Funds), is its deficiency of a redemption mechanism. In elemental terms, investors can’t speech their GBTC shares straight for Bitcoin. Instead, they tin lone commercialized these shares connected the unfastened market. This plan prime immunodeficiency successful providing much terms stability, preventing ample investors from abruptly cashing retired and importantly affecting the marketplace dynamics.

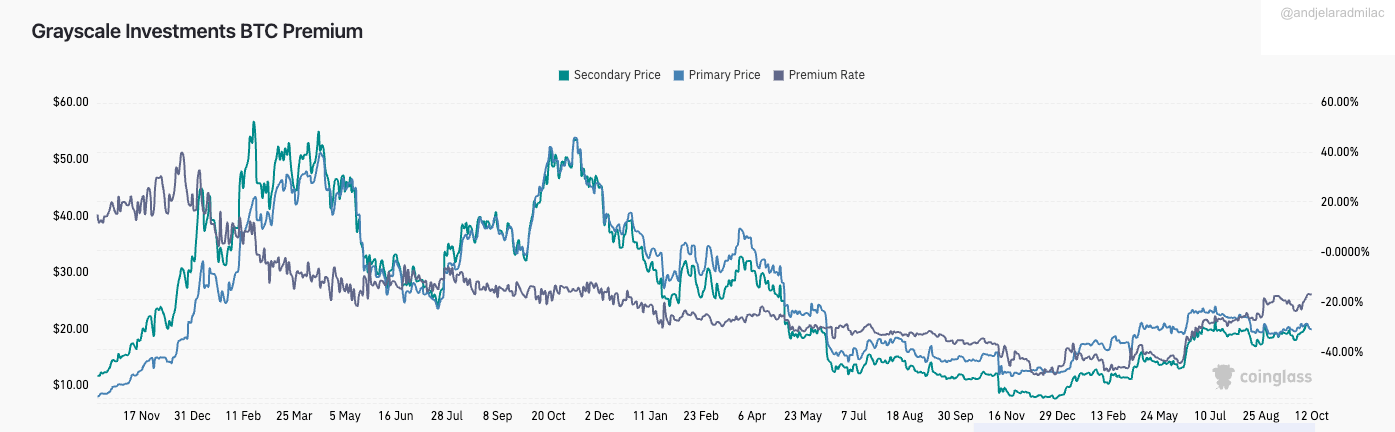

The uniqueness of GBTC lies successful its premium, a word denoting the quality betwixt the marketplace terms of GBTC shares and the existent worth of the Bitcoin it holds, known arsenic the Net Asset Value (NAV).

Graph showing the GBTC Bitcoin premium from Oct. 11, 2022, to Oct. 11, 2023 (Source: CoinGlass)

Graph showing the GBTC Bitcoin premium from Oct. 11, 2022, to Oct. 11, 2023 (Source: CoinGlass)This premium arises owed to respective factors. Initially, GBTC was 1 of the scarce channels for organization players to entree Bitcoin exposure, particularly successful restricted jurisdictions. This exclusivity led to GBTC trading astatine a important premium. Moreover, GBTC’s liquidity and convenience added to its appeal, driving a wedge betwixt its terms and the existent Bitcoin value. However, this premium isn’t static and tin oscillate based connected marketplace conditions and alteration into a discount.

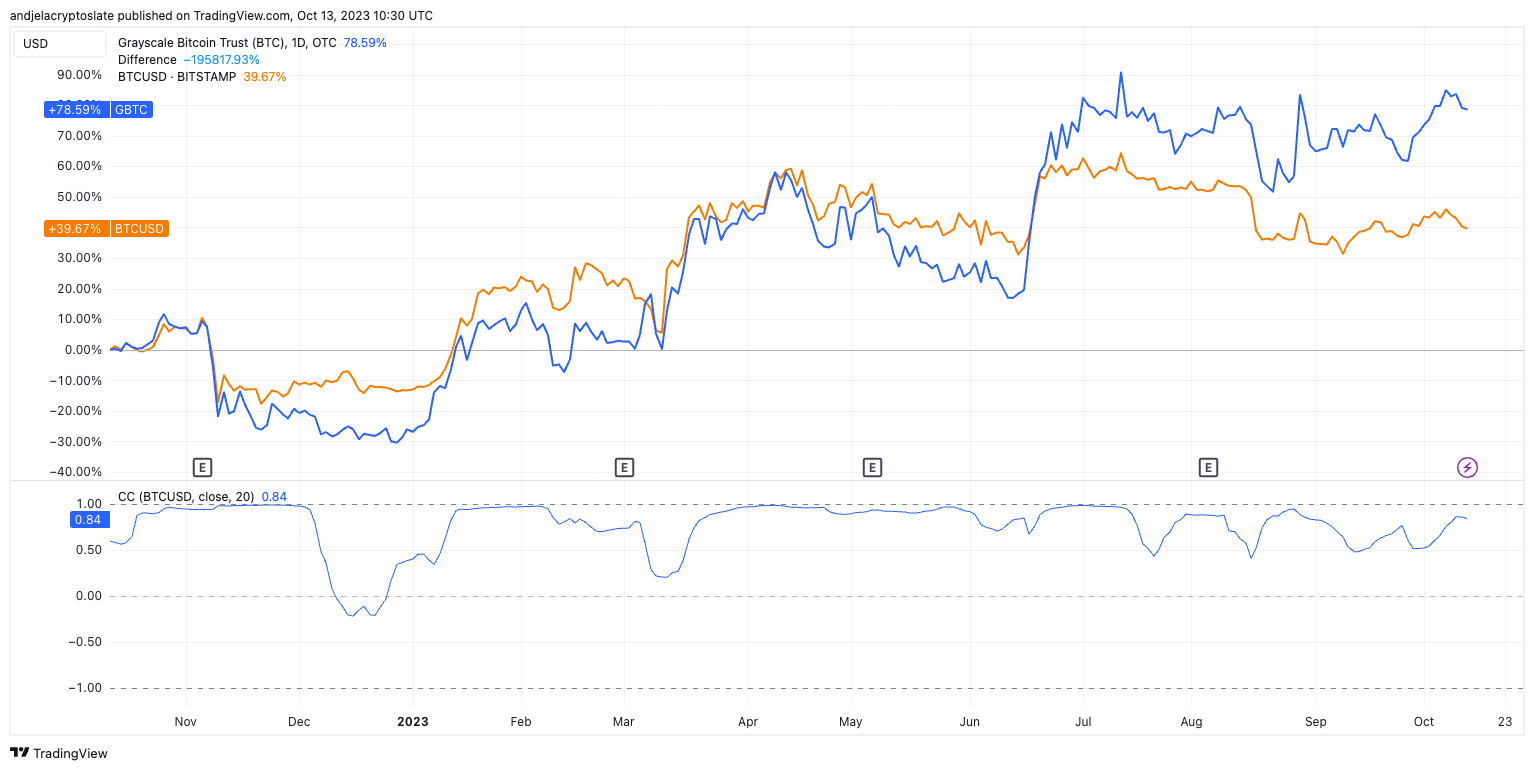

Historically, GBTC has shown a precocious grade of correlation with Bitcoin (BTC). This is expected since the superior plus underlying GBTC is Bitcoin. As BTC prices move, the worth of the Bitcoin held by the spot besides shifts, influencing GBTC’s NAV. However, the marketplace terms of GBTC, affected by proviso and request dynamics for its shares, tin deviate from this NAV, starring to the mentioned premium oregon discount.

Graph showing the percent summation and correlation betwixt GBTC and BTC from Oct. 11, 2022, to Oct. 11, 2023 (Source: TradingView)

Graph showing the percent summation and correlation betwixt GBTC and BTC from Oct. 11, 2022, to Oct. 11, 2023 (Source: TradingView)If regulations astir cryptocurrency concern vehicles change, it could impact GBTC’s attractiveness to investors, starring to price movements autarkic of Bitcoin’s price. As much cryptocurrency concern vehicles emerge, particularly those offering features GBTC doesn’t (like redemption features), it could trim request for GBTC, affecting its correlation with BTC.

One specified looming regulatory determination is the imaginable approval of a Grayscale spot Bitcoin ETF. The marketplace is abuzz with speculation, with galore believing that Grayscale mightiness beryllium the frontrunner successful securing this approval. This translation would code the longstanding premium/discount contented and service arsenic a monumental measurement successful integrating cryptocurrencies into mainstream finance.

The imaginable benefits are manifold. An ETF operation would streamline the trading process, perchance bringing successful a caller influx of organization money. Moreover, it would further solidify Bitcoin’s presumption arsenic a morganatic and recognized plus class.

However, a Grayscale Bitcoin ETF could besides present heightened volatility, particularly during its archetypal days, arsenic the marketplace adjusts to the caller dynamics. And portion the GBTC premium has historically been a bellwether for marketplace sentiment, an ETF conversion mightiness dilute this indicator’s potency.

The station Grayscale’s GBTC: Understanding its premium and marketplace impact appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)