Grayscale Investments‘ flagship product, Grayscale Bitcoin Trust (GBTC), serves arsenic a important span betwixt the accepted fiscal satellite and the comparatively caller realm of cryptocurrencies. GBTC offers investors vulnerability to Bitcoin without the request for nonstop ownership, efficaciously bypassing challenges similar storage, security, and regulatory concerns. By purchasing shares of GBTC, investors tin summation vulnerability to Bitcoin’s terms movements done a conveyance that trades connected accepted markets.

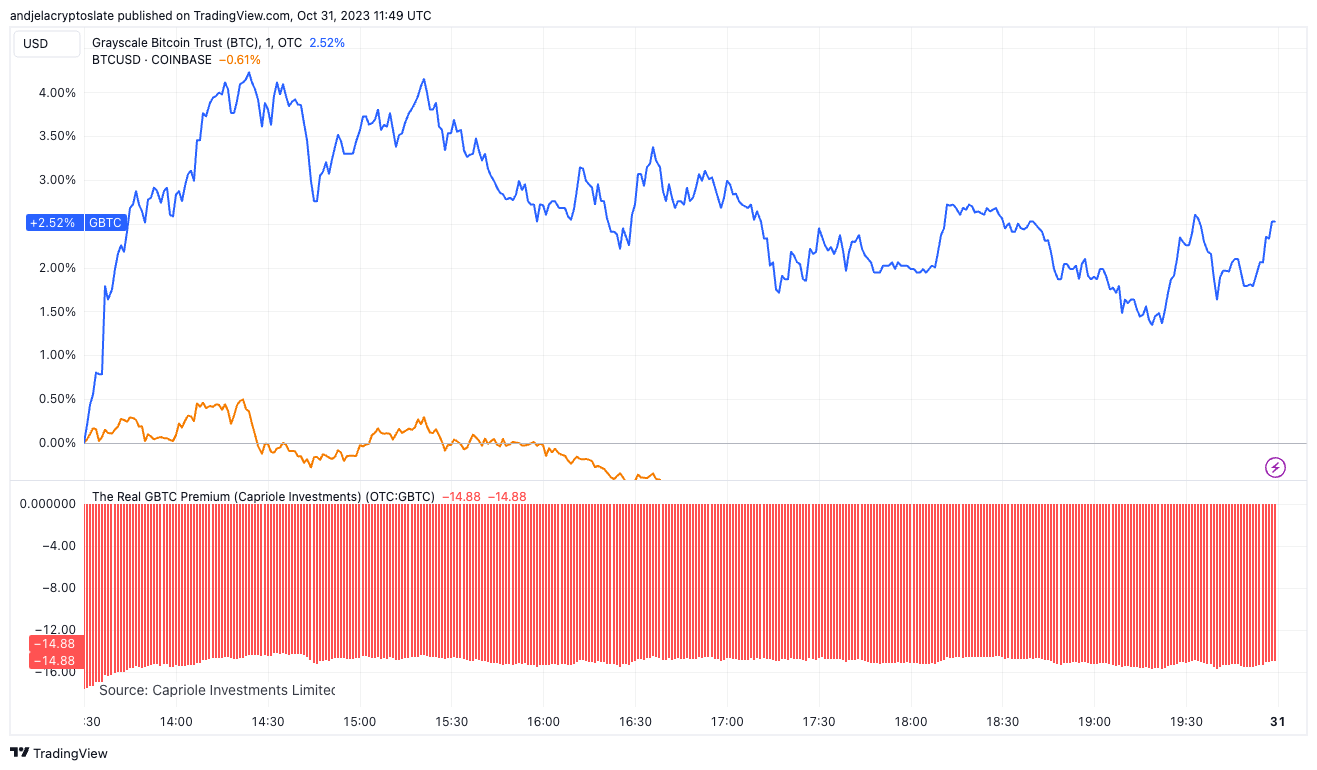

A striking reflection from caller information is the divergence betwixt GBTC’s regular show and that of Bitcoin (BTC). On Oct. 30, portion GBTC accrued by 2.52%, Bitcoin saw a diminution of 0.61%. Such a divergence raises questions astir marketplace dynamics and capitalist sentiment. Does this mean the accepted market’s appetite for Bitcoin exposure, arsenic seen done GBTC, is stronger than the nonstop cryptocurrency market?

Graph showing the percent summation for GBTC and spot BTC, arsenic good arsenic the GBTC premium connected Oct. 30, 2023 (Source: TradingView)

Graph showing the percent summation for GBTC and spot BTC, arsenic good arsenic the GBTC premium connected Oct. 30, 2023 (Source: TradingView)The information seems to suggest so, particularly erstwhile we grow our lens to longer timeframes.

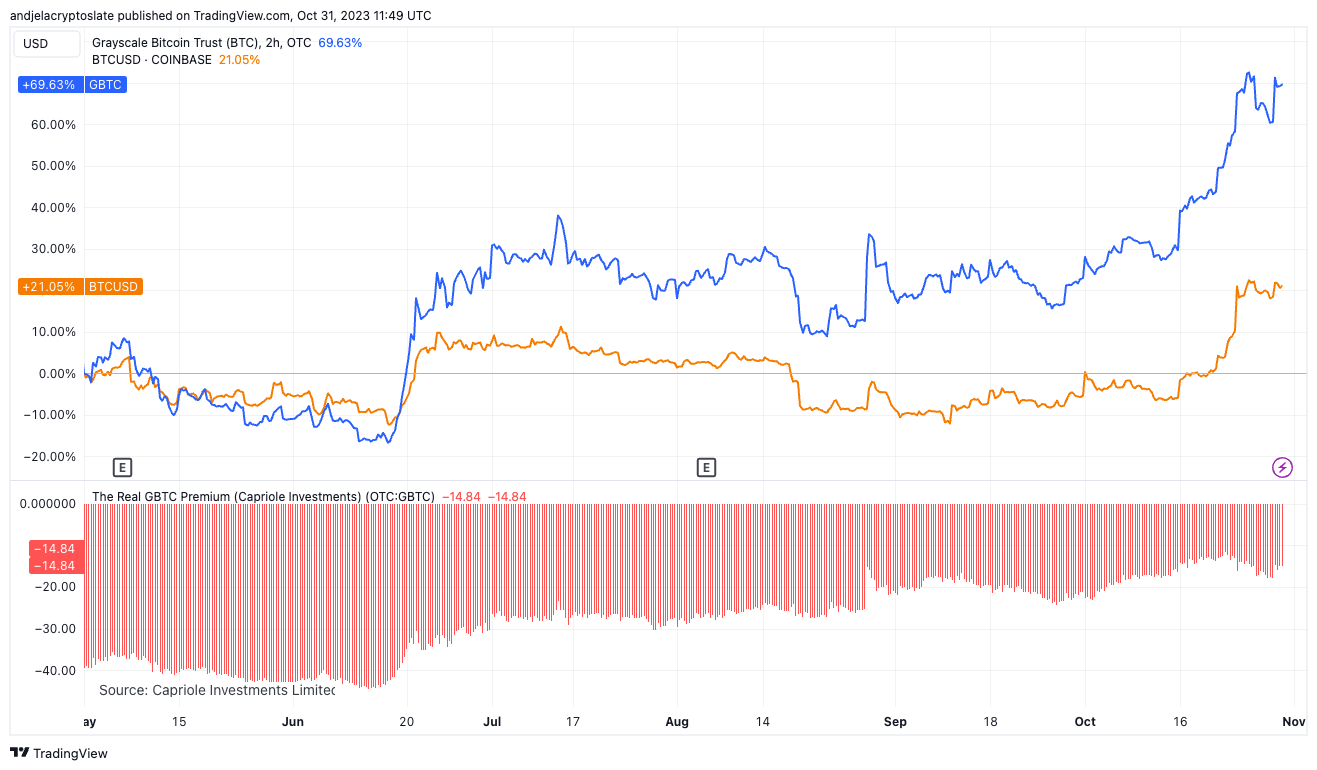

Graph showing the percent summation for GBTC and spot BTC, arsenic good arsenic the GBTC premium from May 1 to Oct. 31, 2023 (Source: TradingView)

Graph showing the percent summation for GBTC and spot BTC, arsenic good arsenic the GBTC premium from May 1 to Oct. 31, 2023 (Source: TradingView)Over the past month, GBTC roseate by 31.7% compared to Bitcoin’s 20.6%. The inclination continues implicit 3 and six months, with GBTC increasing by 39.1% and 69.6%, respectively, importantly outpacing BTC’s maturation of 17.3% and 21.1%. Year-to-date, it grew a whopping 222.9%, doubling Bitcoin’s commendable emergence of 106.9%.

| GBTC | +2.52% | +31.7% | +39.1% | +69.6% | +222.9% |

| BTC | -0.61% | +20.6% | +17.3% | +21.1% | +106.9% |

| GBTC Premium | -14.88 | -14.87 | -14.86 | -14.84 | -14.98 |

However, portion these numbers overgarment a rosy representation of GBTC’s performance, the persistent antagonistic premium offers a much nuanced narrative. Despite its stronger returns, it consistently trades astatine a discount to the existent worth of the Bitcoin it holds. This discount, hovering astir -14.88 to -14.98 crossed the board, indicates that the marketplace values the existent Bitcoin much than the GBTC shares representing it. Such a unchangeable antagonistic premium, adjacent successful the look of GBTC’s outperformance, could beryllium a manifestation of assorted concerns. Investors mightiness beryllium wary of the plus owed to its interest structure, imaginable liquidity issues, oregon the inability to redeem shares for existent Bitcoin. The consistency of this discount besides suggests that the marketplace sentiment regarding these concerns has remained unchanged.

The broader implications of this unchangeable discount are manifold. It mightiness bespeak a latent request for a much nonstop vulnerability mechanics to Bitcoin, which a U.S. Bitcoin ETF could satiate. The instauration of specified an ETF would let organization investors to summation vulnerability to Bitcoin successful a mode much aligned with the existent cryptocurrency, perchance offering much liquidity and the quality to redeem shares for existent Bitcoin. A Bitcoin ETF would besides apt person a much competitory interest structure. With the increasing involvement successful Grayscale’s Bitcoin Trust, the motorboat of a Bitcoin ETF successful the U.S. could spot a monolithic influx of organization wealth into the crypto space, further legitimizing the plus people and perchance starring to terms appreciation.

While GBTC has consistently demonstrated beardown performance, outpacing Bitcoin implicit assorted timeframes, the persistent discount to the underlying plus cannot beryllium ignored. It serves arsenic a bellwether of marketplace sentiment, indicating imaginable concerns oregon a tendency for much nonstop vulnerability mechanisms.

The station Grayscale’s GBTC paradox: Performance astatine a discount appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)