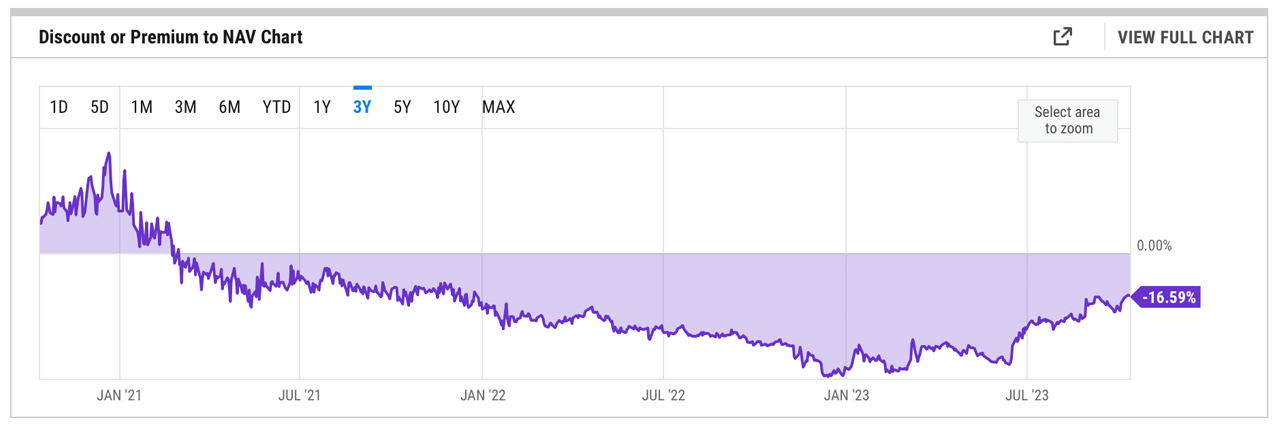

Grayscale’s Bitcoin Trust, known arsenic GBTC, has witnessed a important displacement successful its marketplace dynamics. In January 2023, GBTC traded astatine a important 48.31% discount to its nett plus worth (NAV). Today, that spread has narrowed to 16.59%, indicating changes successful marketplace sentiment and presenting imaginable implications for investors.

End of 2023 Sees GBTC’s Discount to NAV Tighten

The largest bitcoin (BTC) spot known arsenic GBTC has seen a important betterment successful presumption of its erstwhile discount to NAV. Essentially, nett plus worth (NAV) serves arsenic a fiscal barometer, indicating the per-share worth of a fund’s underlying assets. In the discourse of GBTC, the NAV represents the worth of BTC it holds, adjusted for liabilities, and divided by its outstanding shares. Simply put, it’s a measurement of what each GBTC stock should theoretically beryllium worthy based connected bitcoin’s market value.

GBTC’s marketplace terms tin deviate from its NAV, starring to either a discount oregon premium status. When GBTC trades astatine a higher terms than its NAV, it’s astatine a premium. Conversely, if it trades little than its NAV, it’s astatine a discount. This percent quality provides insights into marketplace perceptions and capitalist sentiment astir GBTC. Since the extremity of February 2021, GBTC has traded astatine a discount to its NAV. Unlike accepted stocks, GBTC doesn’t connection an casual mode to redeem shares for existent bitcoin, and shares are traded over-the-counter (OTC).

This operation tin origin its marketplace terms to diverge from the underlying BTC value. External factors, specified arsenic capitalist sentiment, marketplace speculation, regulatory news, and liquidity considerations, tin further power this terms disparity. A 48.31% discount successful January 2023 meant GBTC shares were trading importantly beneath the worth of the bitcoin they represented. Investors could person been acquiring bitcoin vulnerability via GBTC astatine a bargain.

Fast guardant to the present, and the discount has reduced to 16.59%, suggesting a alteration successful marketplace dynamics and a imaginable summation successful request for GBTC shares. The shrinking discount implies a imaginable affirmative displacement successful GBTC’s marketplace sentiment. For investors, buying GBTC astatine a discount mightiness look similar a lucrative deal, arsenic they summation vulnerability to BTC astatine a reduced price. However, the aboriginal remains uncertain, and there’s nary warrant that the discount volition proceed to constrictive astatine the aforesaid gait oregon adjacent flip to a premium.

At the moment, Grayscale is fervently working to transportation the U.S. Securities and Exchange Commission (SEC) to alteration GBTC into an exchange-traded money (ETF). With a nudge from the judiciary, Grayscale has carved retired a spot of wiggle country successful this endeavor, but the result is inactive hanging successful the balance. Simultaneously, the SEC is sifting done much than fractional a twelve spot bitcoin ETF proposals from manufacture giants specified arsenic Fidelity, Blackrock, and Franklin Templeton.

What bash you deliberation astir GBTC’s discount tightening? Share your thoughts and opinions astir this taxable successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)