Crypto plus manager Grayscale has questioned the U.S. Securities and Exchange Commission’s determination to o.k. a leveraged Bitcoin (BTC) exchange-traded money (ETF) successful a June 10 letter.

The firm’s Bitcoin Trust (GBTC) besides narrowed to its lowest constituent since May 2022, according to ycharts data,

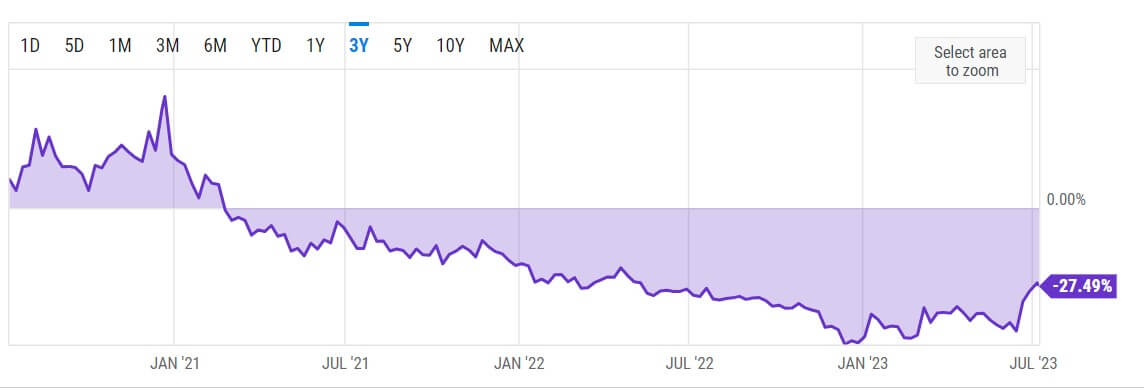

GBTC discount narrows

GBTC’s discount to its nett plus worth (NAV) narrowed to 27.49%, and its shares were trading adjacent $20, according to ycharts data.

Source: Ycharts

Source: YchartsDuring the past fewer weeks, GBTC’s discount has increasingly narrowed, and the worth of its shares has outperformed that of Bitcoin. For context, portion GBTC shares person risen by astir 43% during the past month, BTC’s worth gained lone 17% during the aforesaid clip frame, according to CryptoSlate’s data.

Market observers person attributed GBTC’s improved show to BlackRock’s exertion for a Bitcoin spot ETF. Since the plus manager applied for a spot BTC ETF connected June 15, different accepted fiscal institutions, including Fidelity and others, person applied for a akin ETF.

Grayscale questions SEC implicit BTC leverage ETF

On June 10, Grayscale criticized the U.S. fiscal regulator’s determination to o.k. a leveraged BTC ETF—an concern money that aims to make amplified returns by utilizing fiscal derivatives and debt—arguing that the SEC’s actions beryllium it is acting arbitrarily.

The steadfast wrote:

“The 2x levered bitcoin futures ETF employs leverage with the extremity of doubling the show of the S&P CME Bitcoin Futures Daily Roll Index each day. This exposes investors to an adjacent riskier concern merchandise than accepted bitcoin futures exchange-traded products.”

Grayscale pointed retired that the excitement generated by this leveraged BTC ETF shows that “investors are anxious for BTC vulnerability with the protections of the ETF wrapper.”

The steadfast added that the SEC had nary bully crushed to contradict the support of spot products portion approving leveraged futures products.

Last year, the SEC rejected Grayscale’s program to person its Bitcoin Trust into an ETF, forcing the steadfast to record a lawsuit against the SEC, arguing that a spot ETF was not antithetic from a futures ETF—which the SEC had antecedently approved.

The station Grayscale challenges SEC’s determination connected leveraged Bitcoin ETF arsenic GBTC discount narrows appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)