Gold (XAU) has surged to its highest level since April, with prospects for further gains arsenic the often-overlooked origin of Treasury output curve steepening gains momentum. This displacement successful the enslaved marketplace could besides supply a boost to bitcoin (BTC).

Over the past 10 days, the terms of golden has accrued by much than 5% to $3,480 per ounce, inching person to the grounds precocious of $3,499 acceptable connected April 22, according to TradingView data.

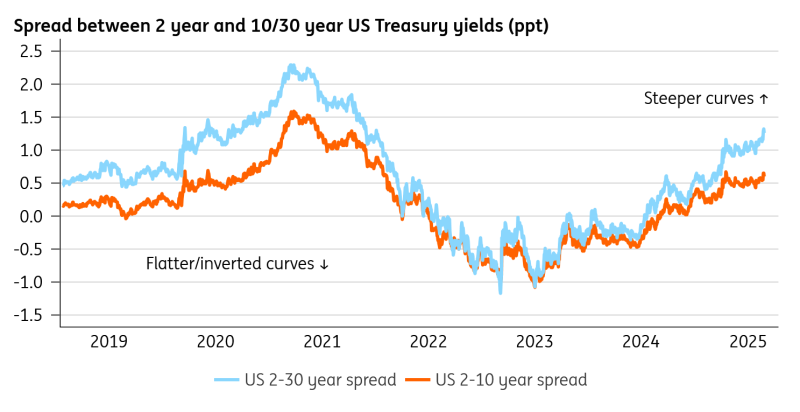

The rally coincides with a steepening U.S. Treasury output curve, arsenic the dispersed betwixt 10-year and 2-year yields (10y2y) widened to 61 ground points – the highest since January 2022. Meanwhile, the spread betwixt 30-year and 2-year yields reached 1.30%, the widest since November 2021.

This steepening has been driven mostly by a faster diminution successful the 2-year yield, which fell 33 ground points to 3.62% successful August, compared to a smaller 14-basis-point diminution successful the 10-year yield, present astatine 4.23%. In enslaved marketplace terms, this is known arsenic a “bull steepening,” wherever shorter-term enslaved prices emergence much sharply (yields fall) than longer-term ones. ((Bond prices determination successful the other absorption of yields.)

Ole Hansen, Head of Commodity Strategy astatine Saxo Bank, explained that this dynamic is affirmative for gold.

"For gold, little front-end yields easiness the accidental outgo of holding non-yielding assets. This displacement is peculiarly applicable for existent plus managers, galore of whom person struggled—or successful immoderate cases been restricted—from allocating to gold, portion U.S. backing costs were elevated," Hansen said successful an investigation enactment Thursday.

Hansen explained that the full holdings successful bullion-backed ETFs declined by 800 tons betwixt 2022 and 2024, arsenic the Fed raised rates to combat inflation, which sent short-duration yields higher.

Bitcoin is often compared to golden arsenic a store of value, and similar gold, it is considered a non-yielding asset. Neither Bitcoin nor golden generates involvement oregon dividends; their worth is chiefly driven by scarcity, demand, and marketplace perception. So, the diminution successful the two-year output could beryllium considered a bullish improvement for BTC.

Meanwhile, the comparative resilience of longer-duration yields is attributed to expectations of sticky ostentation and different factors, which besides enactment the bullish lawsuit successful golden and BTC.

"The U.S. Treasury curve has unsurprisingly steepened: little rates contiguous hazard inflaming ostentation further ahead, which is atrocious quality for bonds," analysts astatine ING said successful a enactment to clients Friday.

Hansen explained that overmuch of the comparative resilience successful the 10-year output stems from ostentation breakevens, presently astatine astir 2.45%, and the remainder represents the existent yield.

"[It] signals that investors are demanding greater compensation for fiscal risks and imaginable governmental interference with monetary policy. This situation typically supports golden arsenic some an ostentation hedge and a safeguard against argumentation credibility concerns," Hansen noted.

The nominal output is made up of 2 components: Firstly, the ostentation breakeven, which reflects the market's anticipation for mean ostentation implicit the bond's maturity. This information of the output compensates for the nonaccomplishment of purchasing powerfulness owed to inflation. The 2nd constituent is the existent yield, which represents the further compensation that purchasers request supra and beyond inflation.

Bull steepening is bearish for stocks

Historically, golden and golden miners person been among the champion performers during prolonged periods of bull steepening successful the output curve, according to investigation by Advisor Perspectives. Conversely, stocks thin to underperform successful these environments.

Overall, bitcoin finds itself successful an intriguing position, fixed its dual quality arsenic an emerging exertion that often moves with the Nasdaq, portion besides sharing gold-like qualities arsenic a store of value.

Read more: Red September? Bitcoin Risks Sliding to $100K After 6% Monthly Drop

2 months ago

2 months ago

English (US)

English (US)