Gold, historically viewed arsenic a store of worth and a hedge against economical turbulence, is often the benchmark plus against which galore others are gauged. In the crypto age, Bitcoin (BTC) and Ethereum (ETH) person emerged arsenic contenders to gold’s throne, not arsenic nonstop replacements but arsenic modern alternatives representing a caller breed of integer assets.

Evaluating their show against golden provides insights into marketplace sentiment, the evolving scenery of investment, and the imaginable risks and rewards associated with some accepted and integer assets. In 2023, the trajectories of Bitcoin, Ethereum, and golden were notably distinct.

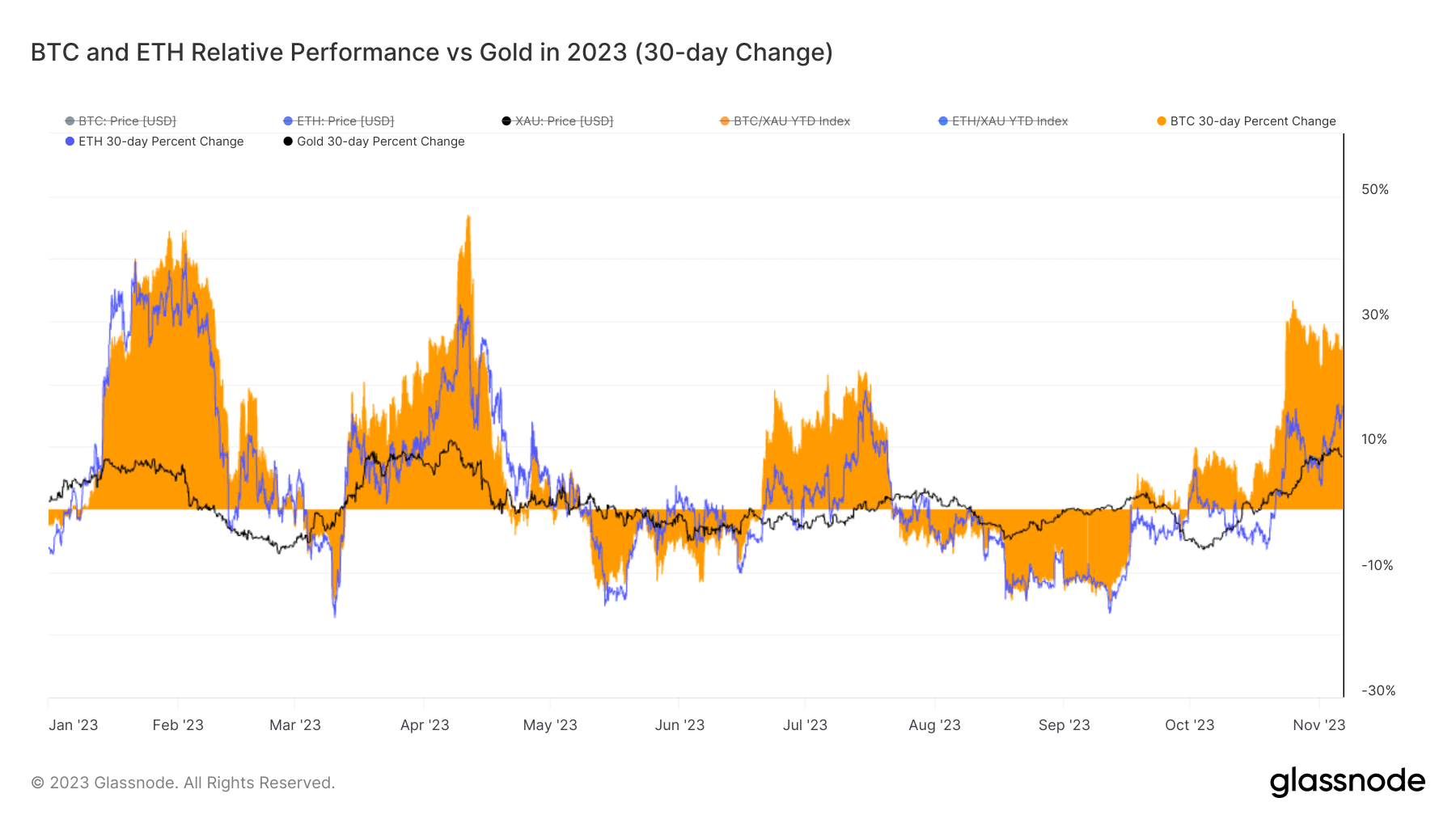

Bitcoin showed its volatile quality passim the year. On average, BTC grew by 6.90% monthly. In April, it reached a singular highest show of 46.99%, but the winds shifted successful June, pushing it to a dip of 14.99%. Ethereum followed a akin pattern, albeit with somewhat subdued fluctuations. Ethereum’s monthly mean ascent was 3.70%. Its highest was successful May, touching 40.82%, but by July, it faced a diminution of 17.34%.

Contrasting sharply with the 2 starring cryptocurrencies, golden moved with much predictability. Across 2023, its mean monthly terms accommodation was a humble 0.87%. March witnessed its highest surge, hitting 11.04%, portion September observed a dip of 7.09%.

Graph showing the 30-day percent alteration for BTC, ETH, and golden successful 2023 (Source: Glassnode)

Graph showing the 30-day percent alteration for BTC, ETH, and golden successful 2023 (Source: Glassnode)Reflecting connected the full year, Bitcoin’s assertive beingness successful the crypto marketplace was undeniable. By November, it surged 111.76%. Ethereum, portion not mirroring Bitcoin’s meteoric rise, inactive recorded a year-to-date maturation of 58.72%. Gold, ever the dependable performer, accrued by 8.84% since the opening of the year.

These dynamics underscore respective pivotal marketplace narratives. Firstly, the pronounced volatility successful cryptocurrencies underscores some their imaginable for important returns and their susceptibility to crisp declines. This dual-edged quality of integer assets is simply a testament to their nascent signifier successful the fiscal ecosystem, influenced by factors ranging from regulatory developments to technological advancements.

Gold’s humble yet dependable show reinforces its estimation arsenic a stabilizing asset, 1 little susceptible to the accelerated marketplace movements often associated with cryptocurrencies. It remains a favored prime for investors seeking a hedge against broader marketplace uncertainties, adjacent arsenic its returns are overshadowed by the much assertive maturation trajectories of integer assets.

The station Gold remains unchangeable portion volatility rocks Bitcoin and Ethereum’s 2023 appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)