The scarcity of the bitcoin proviso has tightened, arsenic revealed by the caller Glassnode survey connected onchain activities. Observations amusement that the inactivity of coins is touching some multi-year and unprecedented peaks, contempt a important uptick successful bitcoin’s worth passim the existent year.

Bitcoin’s Tightening Supply Defies Price Rally, Reveals Glassnode Study

Reflecting connected the inclination implicit the past year, BTC has surged by 71% and has marked a 114% summation from the commencement of the twelvemonth to date. Glassnode’s latest report indicates that contempt these surges successful price, the availability of bitcoin remains limited, dominated by steadfast holders.

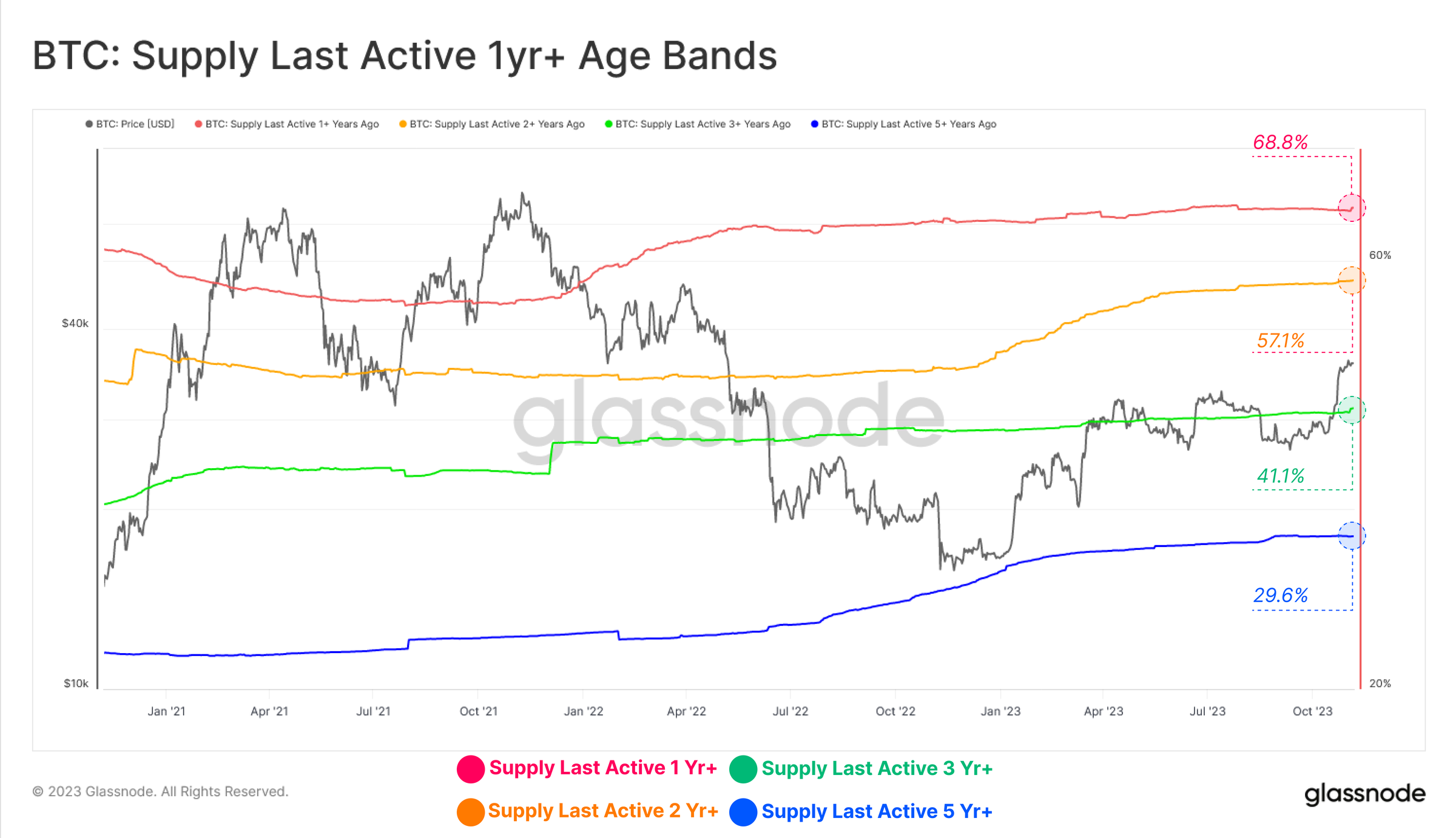

Taking a person look, the onchain study shows that a stock of bitcoin (BTC) that hasn’t moved successful implicit a twelvemonth stands astatine 68.8%, and the non-liquid proviso scale has risen to a record-breaking 15.4 cardinal BTC. The Glassnode squad has pinpointed that the cache of bitcoin held by semipermanent investors is approaching grounds levels, portion the proviso by short-term investors has plummeted to unprecedented lows.

Glassnode details that the increasing spread indicates a solidifying of supply, arsenic existent investors are showing reluctance to portion with their holdings. Since July 2022, the disparity betwixt the supplies held by long-standing and caller investors has expanded, reaching caller heights and underscoring the stark opposition betwixt dormant and circulating supplies.

Moreover, the recently introduced Glassnode metric called the Activity-to-Vaulting Ratio has been connected a diminution since June 2021, with a notable dip successful the trajectory post-June 2022. According to Glassnode, this displacement signifies the waning of the 2021-22 cycle’s marketplace “exuberance.”

The researcher’s investigation of spending patterns reveals a inclination of capitalist accumulation and retention, arsenic opposed to progressive trading. The post-rally Sell-Side Risk Ratio for short-term holders soared, signaling immoderate profit-taking successful the abbreviated run, portion this metric for semipermanent holders remains notably debased successful a humanities context.

Glassnode’s valuation of wallet enactment notes striking contributions to wallet sizes crossed the board, indicating a boost successful capitalist confidence. The “Shrimps” and “Crabs” are buying into bitcoin en masse, having absorbed 92% of the bitcoin mined since May 2022. “Shrimps” clasp little than 1 bitcoin, “Crabs” bid 1-10 BTC, and “Fish” clasp anyplace betwixt 10-100 BTC.

Concluding their observations, Glassnode analysts assert, “The bitcoin proviso is historically choky with galore proviso metrics describing ‘coin inactivity’ reaching multi-year, and adjacent all-time highs. This suggests that the [bitcoin] proviso is highly tightly held, which is awesome fixed the beardown terms show [year-to-date].”

What bash you deliberation astir Glassnode’s study concerning the tightening bitcoin supply? Share your thoughts and opinions astir this taxable successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)