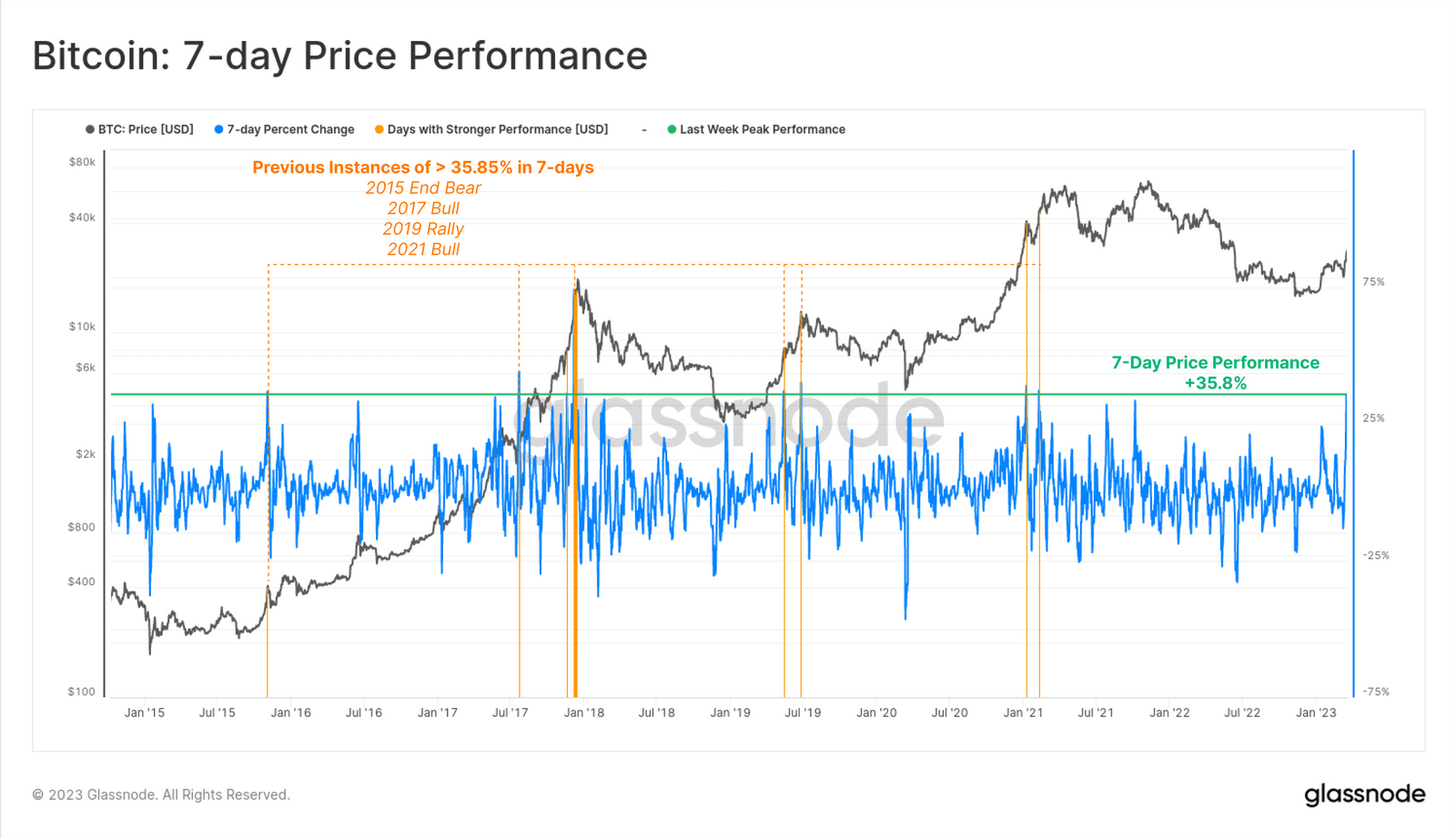

Bitcoin has had 1 of its champion weeks successful history, with a closing summation of 35.8%.

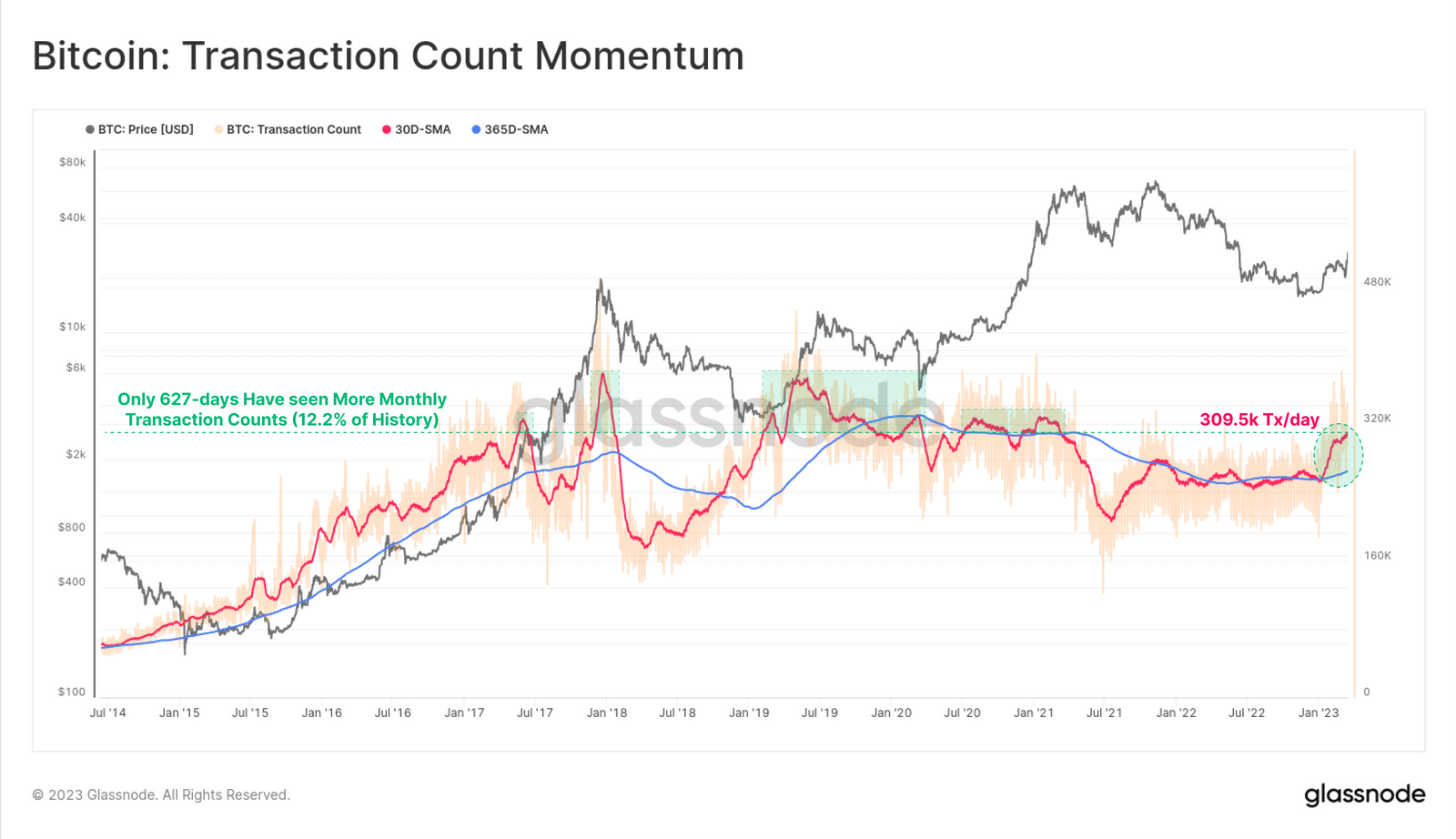

Bitcoin’s monthly mean transaction number has deed 309.5k per time — the highest level since April 2021, according to on-chain analytics steadfast Glassnode. Despite the precocious terms performance, the proportionality of ‘hot coins’ is inactive adjacent to rhythm lows — indicating that astir owners of older coins are not motivated to instrumentality profits.

But with Bitcoin’s terms present appearing to displacement towards the $30,000-32,000 range, does the latest rally mean we are retired of carnivore marketplace territory?

Glassnode information appears bullish

(Source: Glassnode)

(Source: Glassnode)On the week of March 20, the monthly mean of transaction counts reached 309.5k per time — the highest level since April 2021 and importantly supra the yearly average. Less than 12.2% of each days person seen higher transaction enactment for Bitcoin — a affirmative denotation arsenic this metric is typically linked with rising adoption rates, web effects, and capitalist activity.

(Source: Glassnode)

(Source: Glassnode)Glass Node approximates that the fig of chiseled caller entities operating connected the blockchain arsenic the champion measurement for unsocial caller users. Their investigation shows that this metric has deed 122k caller entities per day, but lone 10.2% of days person had higher adoption rates for caller users — which took spot during the 2017 highest and the 2020-21 bull run.

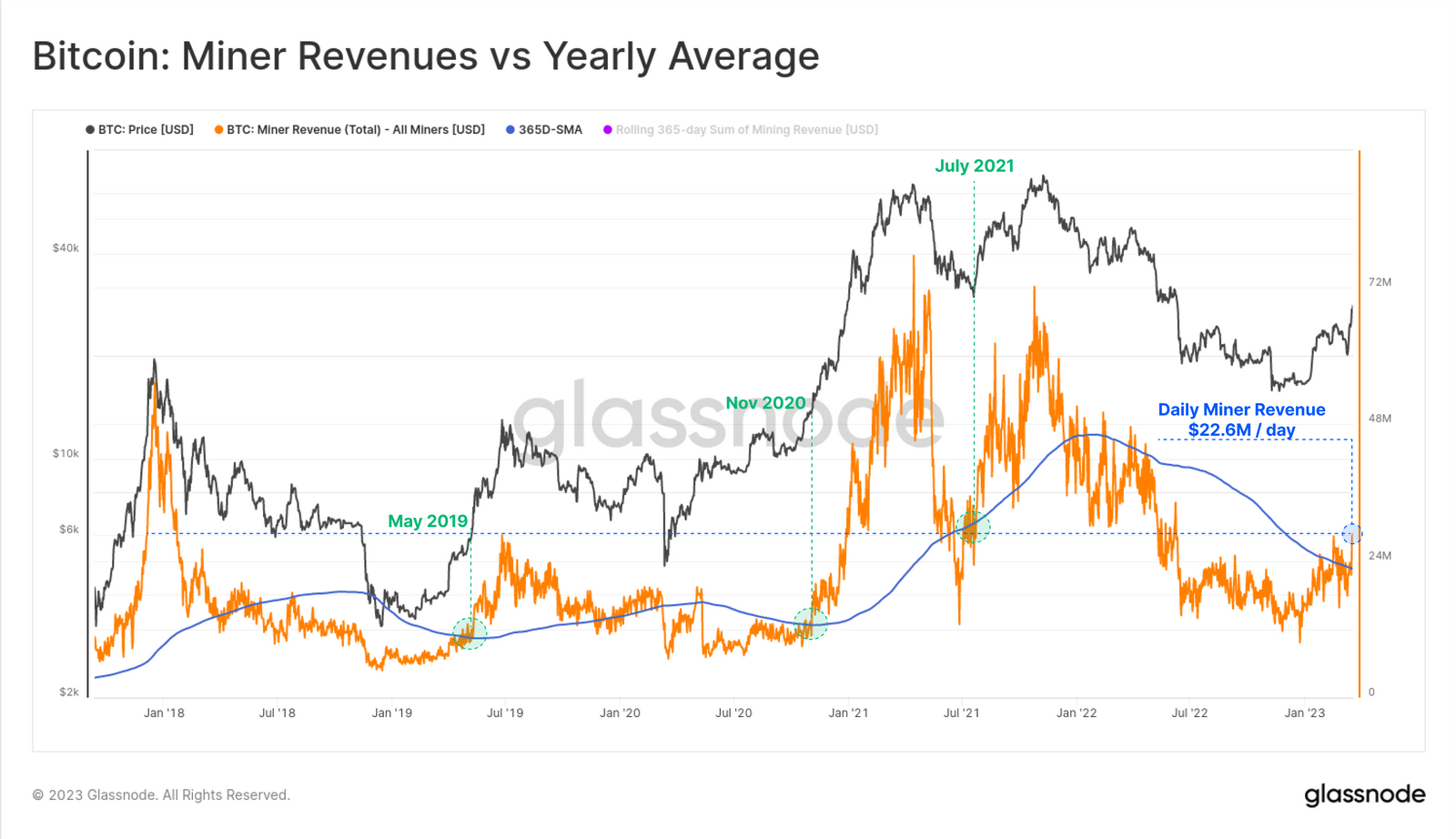

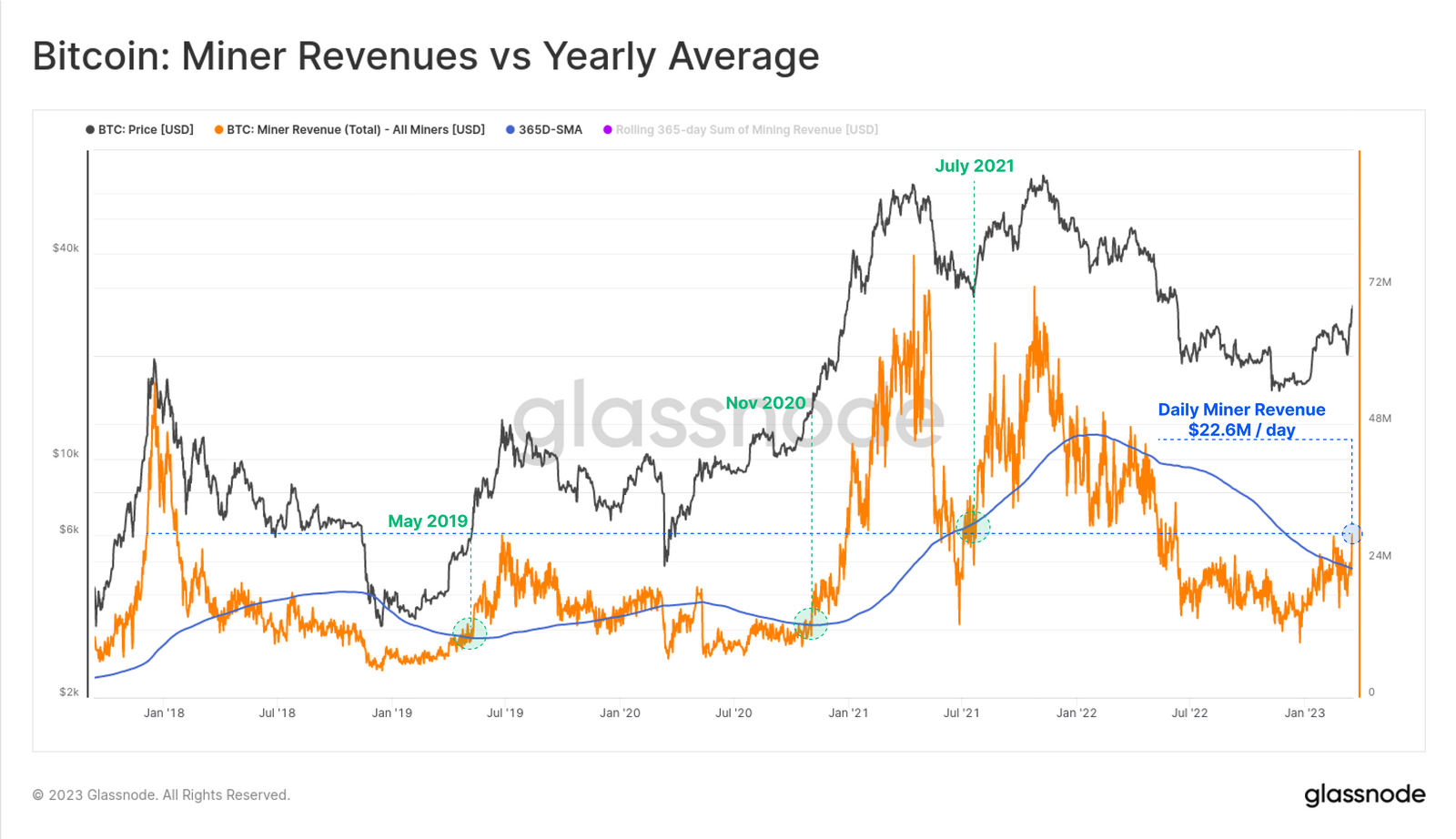

Bitcoin Miners besides seeing influx

Miners are among the superior beneficiaries of this influx, with their full gross surging up to $22.6 cardinal per day. On the week of March 20, miner revenues person risen to their highest level since June 2022 — firmly surpassing the yearly average.

Similar to the enactment models mentioned earlier, this inclination is commonly seen during modulation points towards a much favorable market.

(Source: Glassnode)

(Source: Glassnode)Mining gross successful the green

Miners are without a uncertainty 1 of the lifelines of the crypto ecosystem. However, rising mining enactment besides leads to web congestion and state fees, which are emblematic precursors to much constructive markets.

While precocious web fees tin marque tiny transactions much costly, they payment miners who person those fees for securing the blockchain.

According to on-chain data, miner gross has returned to its highest constituent since June 2022 astatine $22.6 million/day — indicating that Bitcoin is backmost successful bull territory, Glassnode says. Despite the beardown terms performance, the proportionality of ‘hot coins’ is inactive adjacent to rhythm lows — indicating that astir owners of older coins are not motivated to instrumentality profits.

(Source: Glassnode)

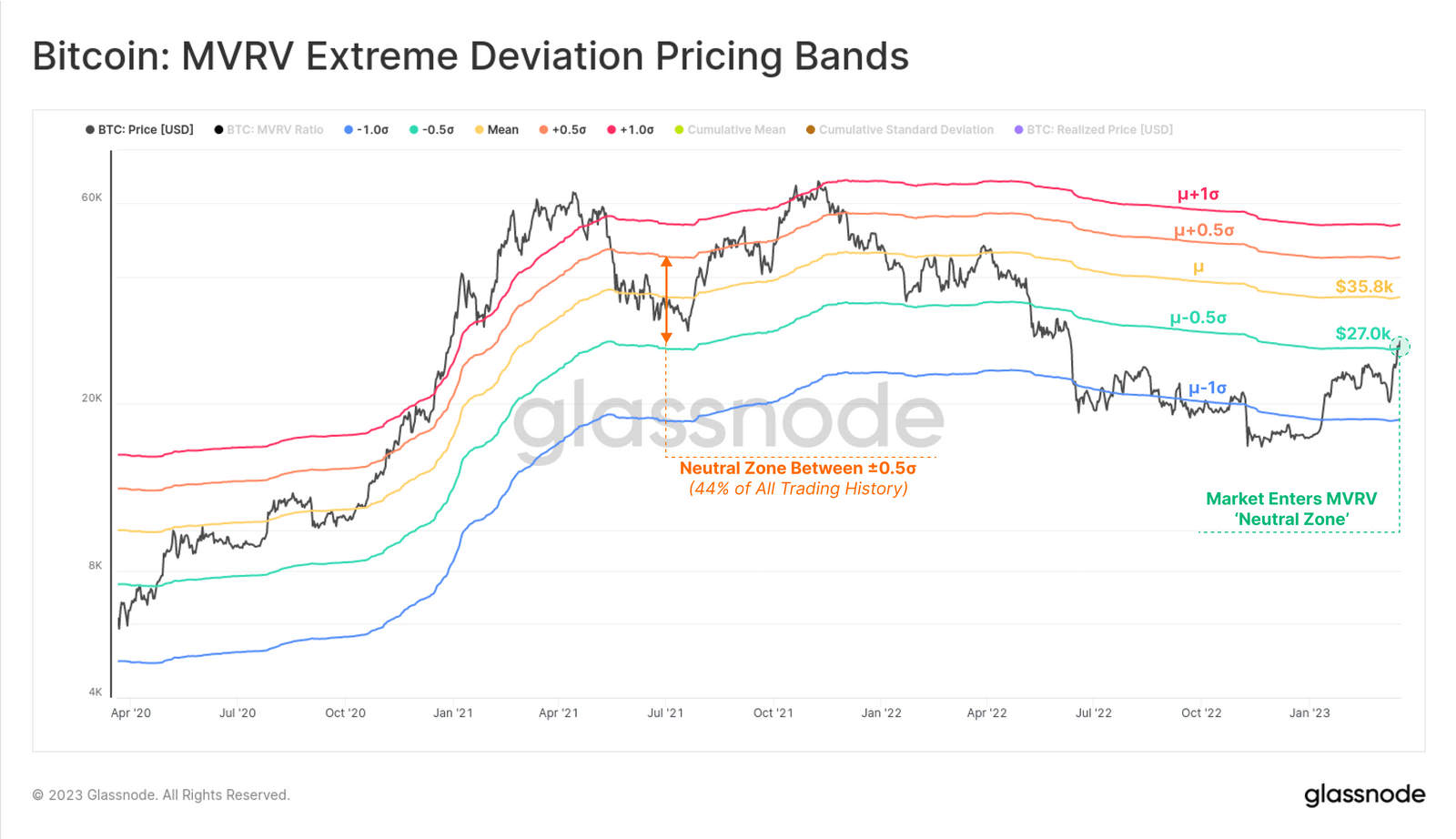

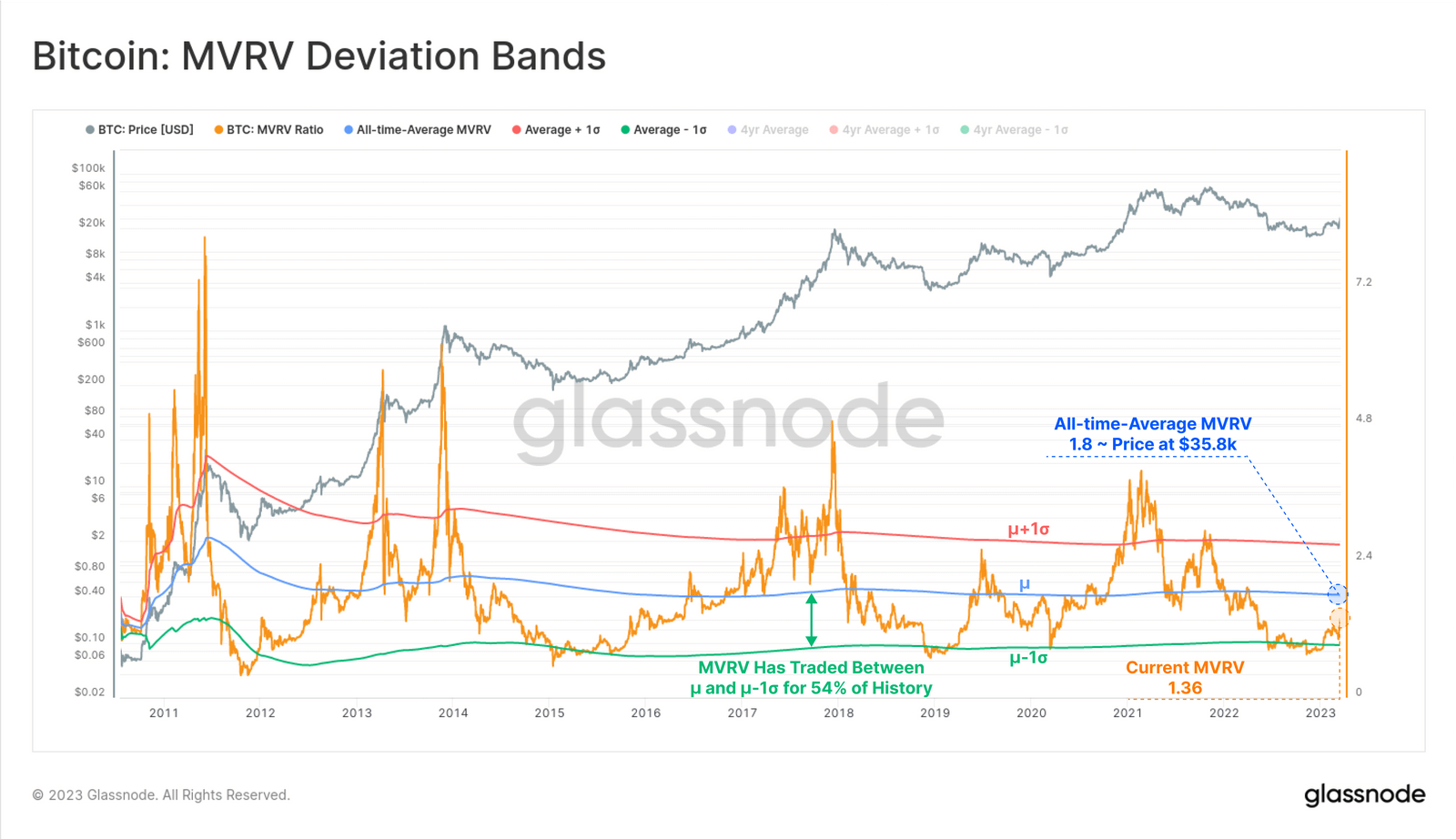

(Source: Glassnode)Glassnode’s study besides analyzed Bitcoin’s MVRV (market-value-to-realized-value) ratio — which measures the unrealized nett aggregate wrong the coin supply. The ratio has accrued to 1.36 aft surpassing $27,000 this week and has returned to its “neutral zone.” This suggests that prices are nary longer heavy discounted successful examination to the mean on-chain marketplace outgo basis.

(Source: Glassnode)

(Source: Glassnode) (Source: Glassnode)

(Source: Glassnode)Ultimately, Glassnode concludes that the aboriginal looks agleam for Bitcoin:

“Bitcoin investors person experienced 1 of the strongest one-week gains connected record, amidst a backdrop of stress, consolidation, and liquidity injections crossed the planetary banking system. Several on-chain indicators suggest that the Bitcoin marketplace is transitioning retired of conditions historically associated with heavy carnivore markets, and backmost towards and greener pastures.”

The station Glassnode information reveals bullish trends for Bitcoin amidst latest rally appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)