By Omkar Godbole (All times ET unless indicated otherwise)

A time aft the U.S. CPI report, marketplace sentiment remains bullish with traders expecting the Fed to chopped involvement rates 3 times this year, starting adjacent week.

Crypto pundits expect bitcoin (BTC) to scope a caller beingness high. Don't forget, it's little than a period since it deed a grounds astir $124,500. However, the existent excitement centers connected altcoins specified arsenic XRP and SOL which are apt to outperform the marketplace leaders, BTC and ether (ETH).

"The bull marketplace is acold from exhausted. Strong nationalist plus treasuries and expectations of Fed complaint cuts supply a supportive macro backdrop, portion organization inflows and increasing regulatory clarity proceed to adhd fuel," Ryan Lee, the main expert astatine Bitget, wrote successful an email.

"The imaginable support of XRP and SOL spot ETFs could service arsenic a large catalyst, unlocking billions successful caller request and reinforcing assurance successful integer assets arsenic a mainstream plus class," Lee wrote.

They're not the lone ones, with Le Shi, the managing manager astatine marketplace making steadfast Auros, flagging BNB and HYPE arsenic tokens of involvement aft they deed all-time highs.

"Beyond that, the broader [digital plus treasury] communicative continues to pull some superior and conviction, with SOL, HYPE and CRO among the cardinal tokens to track," Shi said.

Other observers highlighted DeFi protocol Ethena's ENA arsenic a standout coin arsenic the Fed cuts rates successful the coming months.

Speaking of organization demand, Polygon Labs, the squad down the Polygon ecosystem, is moving with Cypher Capital, a integer assets concern firm, to grow organization entree to its autochthonal token, POL.

"We are seeing sustained request from organization investors for yield-generating integer assets backed by existent web activity," Aishwary Gupta, planetary caput of payments, exchanges and real-world assets astatine Polygon Labs, said successful a statement.

In different cardinal news, the output connected the U.S. 10-year Treasury enactment looks acceptable to driblet beneath 4%, a bullish improvement for markets.

"... We people 3.80%," the founders of crypto newsletter work LondonCryptoClub said connected X. "This is rather the reversal successful the communicative of caller weeks and is different bully tailwind for bitcoin and hazard generally."

Meanwhile, blockchain sleuth Lookonchain noted continued whale buying successful HYPE, which has already gained implicit 5% successful 7 days to deed a grounds supra $56.

In accepted markets, the dollar scale is hovering successful caller ranges contempt the increasing likelihood of faster Fed complaint cuts. Is the expected easing already baked in? Stay alert!

What to Watch

- Crypto

- Sept. 12: Gemini Space Station, the Winklevoss twins’ crypto exchange, begins trading connected Nasdaq Global Select Market nether ticker GEMI.

- Sept. 12: Rex-Osprey Dogecoin ETF begins trading connected Cboe BZX Exchange nether ticker DOJE.

- Macro

- Sept. 12: Uruguay Q2 GDP maturation Est. N/A (Prev. 3.4%).

- Earnings (Estimates based connected FactSet data)

- None scheduled.

Token Events

- Governance votes & calls

- Hyperliquid to ballot on who issues its USDH stablecoin. Voting takes spot Sept. 14.

- Curve DAO is voting to update donation-enabled Twocrypto contracts, refining donation vesting truthful unlocked portions persist aft burns. Voting ends Sept. 16.

- Unlocks

- Sept. 15: Starknet (STRK) to unlock 5.98% of its circulating proviso worthy $17.09 million.

- Sept. 15: Sei (SEI) to unlock 1.18% of its circulating proviso worthy $18.06 million.

- Token Launches

- Sept. 12: Unibase (UB) to beryllium listed connected Binance Alpha, MEXC, and others.

Conferences

- Day 1 of 4: ETHTokyo 2025 (Tokyo, Japan)

Token Talk

By Oliver Knight

- One of the founders of Thorchain, a decentralized web that allows users to nonstop assets crossed blockchains, was hacked this week aft being duped by a deepfake video telephone connected Zoom.

- "Ok truthful this onslaught yet manifested itself. Had an aged metamask cleaned out," JPThor wrote connected X.

- Peckshield noted that $1.2 cardinal was stolen from a Thorchain user, with ZachXBT adding that the perpetrator is linked to North Korean hackers.

- Thorchain emerged arsenic 1 of North Korea's astir fashionable laundering tools earlier this year; researchers estimated that 80% of the proceeds from a $1.4 cardinal hack connected Bybit had been siphoned done Thorchain and protocols similar Vultisig.

- The thorchain token (RUNE) is trading astir $1.28, having mislaid 14% of its worth successful the past period and much than 90% since hitting its March 2024 precocious of $12.95.

- The hack progressive a substance of societal engineering and phishing, 2 techniques that contributed to the $2.5 cardinal stolen by hackers successful the archetypal fractional of 2025.

Derivatives Positioning

- Open involvement successful futures tied to the apical 10 cryptocurrencies accrued 3%-5% successful the past 24 hours arsenic strengthening expectations of Fed complaint cuts punctual traders to instrumentality much risk.

- Still, the marketplace does not look overheated, with annualized perpetual backing rates for large coins continuing to hover astir 10%. Positive backing rates bespeak a bullish bias among traders. Extremely precocious values typically awesome marketplace froth.

- OI successful PENGU, 1 of the best-performing tokens of the past 7 days, deed a grounds precocious 7.78 cardinal coins, validating the terms rise. Funding rates for the coin are somewhat elevated astatine astir 15%.

- Smaller tokens, similar SKY and PYTH, person profoundly antagonistic backing rates, a motion of bias towards bearish, abbreviated positions.

- CME's bitcoin futures are yet seeing an uptick successful OI, ending a multiweek diminution portion ether OI has pulled backmost to a one-month debased of 1.78 cardinal ETH. These diverging trends could beryllium a motion of renewed trader absorption connected BTC. Options OI successful BTC and ETH remains elevated astatine multimonth highs.

- On Deribit, BTC and ETH options proceed to amusement a bias toward puts up to the December expiry, contempt traders pricing astir 5 U.S. interest-rate cuts by July adjacent year.

Market Movements

- BTC is up 0.53% from 4 p.m. ET Thursday astatine $115,049.85 (24hrs: +0.79%)

- ETH is up 2.21% astatine $4,515.82 (24hrs: +1.89%)

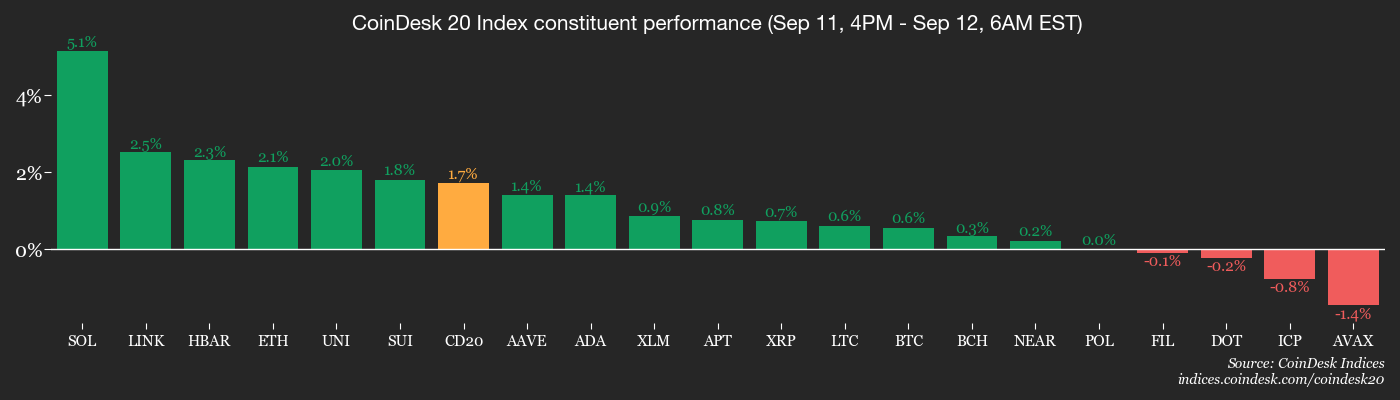

- CoinDesk 20 is up 1.82% astatine 4,289.35 (24hrs: +1.72%)

- Ether CESR Composite Staking Rate is up 6 bps astatine 2.86%

- BTC backing complaint is astatine 0.0085% (9.2549% annualized) connected Binance

- DXY is up 0.22% astatine 97.75

- Gold futures are up 0.23% astatine $3,682.20

- Silver futures are up 1.68% astatine $42.85

- Nikkei 225 closed up 0.89% astatine 44,768.12

- Hang Seng closed up 1.16% astatine 26,388.16

- FTSE is up 0.32% astatine 9,327.33

- Euro Stoxx 50 is down 0.3% astatine 5,370.54

- DJIA closed connected Thursday up 1.36% astatine 46,108.00

- S&P 500 closed up 0.85% astatine 6,587.47

- Nasdaq Composite closed up 0.72% astatine 22,043.07

- S&P/TSX Composite closed up 0.78% astatine 29,407.89

- S&P 40 Latin America closed up 1.31% astatine 2,859.93

- U.S. 10-Year Treasury complaint is up 2.5 bps astatine 4.036%

- E-mini S&P 500 futures are down 0.12% astatine 6,584.75

- E-mini Nasdaq-100 futures are unchanged astatine 24,013.25

- E-mini Dow Jones Industrial Average Index are down 0.2% astatine 46,049.00

Bitcoin Stats

- BTC Dominance: 57.95% (-0.55%)

- Ether to bitcoin ratio: 0.03930 (1.75%)

- Hashrate (seven-day moving average): 1,046 EH/s

- Hashprice (spot): $53.67

- Total Fees: 3.96 BTC / $453,051

- CME Futures Open Interest: 139,355 BTC

- BTC priced successful gold: 31.6 oz

- BTC vs golden marketplace cap: 8.94%

Technical Analysis

- XRP's terms is looking to found a foothold supra the precocious extremity of a monthslong descending triangle consolidation pattern.

- Should it succeed, momentum chasers volition apt articulation the market, accelerating the emergence toward grounds highs.

Crypto Equities

- Coinbase Global (COIN): closed connected Thursday astatine $323.95 (+2.73%), +0.66% astatine $326.10 successful pre-market

- Circle (CRCL): closed astatine $133.7 (+17.6%), +0.88% astatine $134.88

- Galaxy Digital (GLXY): closed astatine $28.87 (+10.7%), +1.7% astatine $29.36

- Bullish (BLSH): closed astatine $53.99 (+2.6%), +2.2% astatine $55.18

- MARA Holdings (MARA): closed astatine $15.71 (-0.95%), +0.57% astatine $15.80

- Riot Platforms (RIOT): closed astatine $15.65 (-4.57%), +0.58% astatine $15.74

- Core Scientific (CORZ): closed astatine $15.55 (-2.75%), +0.64% astatine $15.65

- CleanSpark (CLSK): closed astatine $10.2 (+1.69%), +0.1% astatine $10.21

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $35.67 (+0.51%)

- Exodus Movement (EXOD): closed astatine $28.86 (+4.98%), -1.18% astatine $28.52

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $326.02 (-0.13%), +0.81% astatine $328.65

- Semler Scientific (SMLR): closed astatine $28.54 (+1.86%), +1.51% astatine $28.97

- SharpLink Gaming (SBET): closed astatine $16.36 (+1.68%), +3.06% astatine $16.86

- Upexi (UPXI): closed astatine $5.68 (+4.03%), +13.73% astatine $6.46

- Lite Strategy (LITS) (formerly Mei Pharma): closed astatine $3.07 (+10.43%)

ETF Flows

Spot BTC ETFs

- Daily nett flow: $552.7 million

- Cumulative nett flows: $56.15 billion

- Total BTC holdings ~ 1.30 million

Spot ETH ETFs

- Daily nett flow: $113.1 million

- Cumulative nett flows: $12.97 billion

- Total ETH holdings ~ 6.42 million

Source: Farside Investors

Chart of the Day

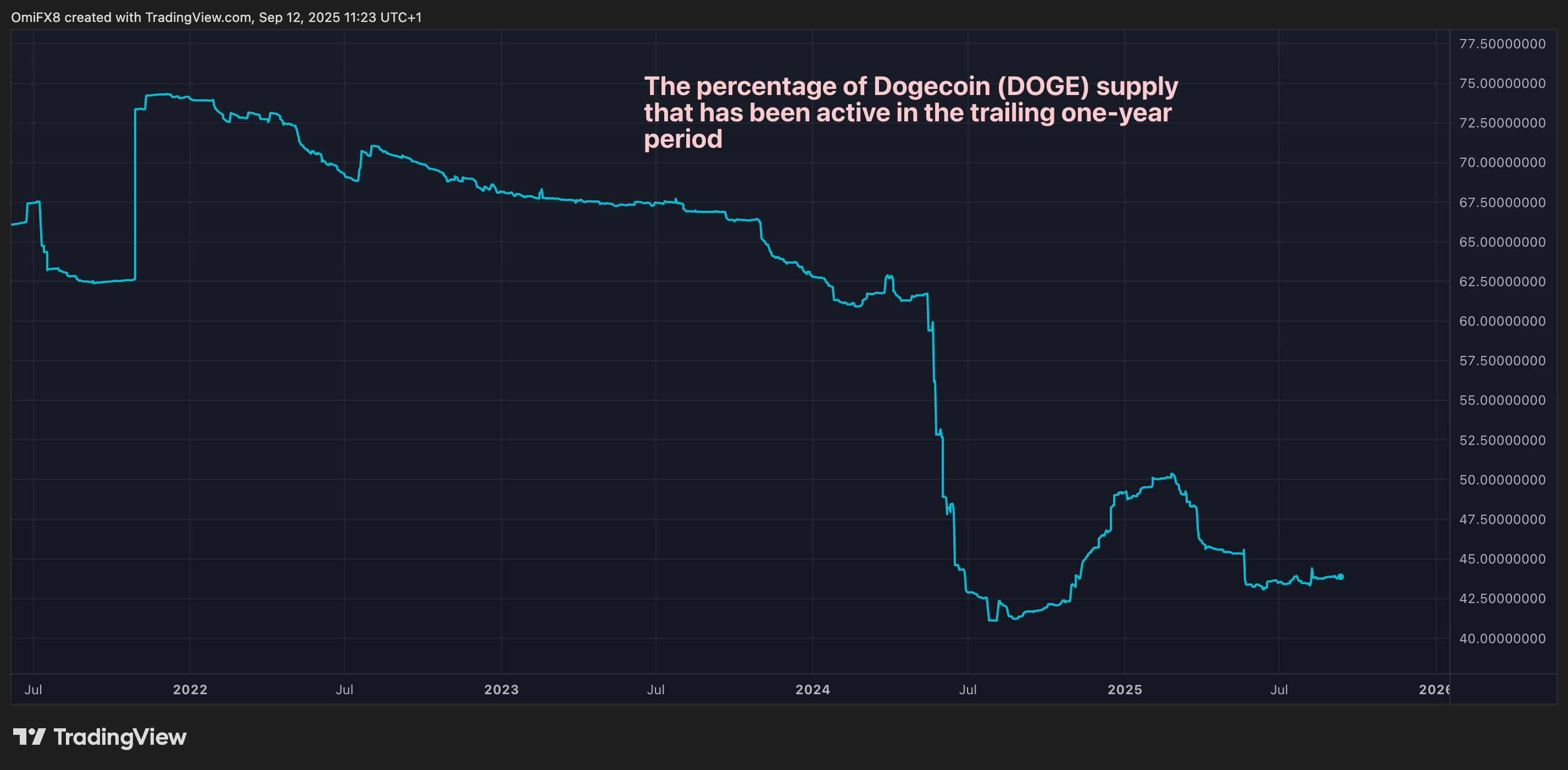

- The illustration shows the the percent of dogecoin's (DOGE) circulating proviso that has been progressive successful the trailing one-year period.

- The fig of coins that person moved oregon been transacted wrong the past twelvemonth remains astatine multimonth lows adjacent 43%. The tally peaked astatine astir 75% successful November 2021 and has been dropping ever since.

- The diminution indicates an capitalist displacement to holding strategy and reduced speculative trading.

While You Were Sleeping

- BofA Says Investors Back Fed’s Credibility With Rate-Cut Timing (Bloomberg): Bank of America strategist Michael Hartnett said rising slope stocks and narrowing recognition spreads amusement investors spot the Fed’s timing connected complaint cuts arsenic maturation momentum picks up.

- Crypto Pundits Retain Bullish Bitcoin Outlook arsenic Fed Rate Cut Hopes Clash With Stagflation Fears (CoinDesk): Despite rising ostentation and labour marketplace weakness successful the U.S., optimism persists with crypto gaining traction arsenic a hedge against fiat debasement and traders expecting Fed cuts to commencement connected Sept. 17.

- World Liberty Financial Token Holds Steady arsenic Community Backs Buyback-and-Burn Plan (CoinDesk): WLFI holders voted astir unanimously to usage each liquidity fees for buybacks and burns crossed Ethereum, BNB Chain and Solana, establishing a scarcity exemplary for the Trump-linked token.

1 month ago

1 month ago

English (US)

English (US)