On March 2, 2023, FTX debtors released their 2nd stakeholder presentation, which contains a preliminary investigation of the now-defunct cryptocurrency exchange’s shortfalls. The latest presumption reveals a important shortfall, arsenic astir $2.2 cardinal of the company’s full assets were recovered successful FTX-related addresses, but lone $694 cardinal is considered “Category A Assets,” oregon liquid cryptocurrencies specified arsenic bitcoin, tether, oregon ethereum. In addition, John J. Ray III, FTX’s existent CEO, stated that the debtor’s effort had been significant, and helium added that the exchange’s assets were “highly commingled.”

A Preliminary Summary of What Contributed to FTX’s $8.9 Billion Shortfall

FTX debtors and CEO John J. Ray III person released a broad presumption documenting FTX’s shortfalls. The preliminary study mentions the cyber onslaught that occurred the time aft FTX filed for Chapter 11 bankruptcy extortion connected November 11, 2022. In a now-deleted Telegram chat channel, FTX US wide counsel Ryne Miller described the speech being hacked and that the level was unsafe. The preliminary shortfall investigation refers to this circumstantial cyber onslaught throughout.

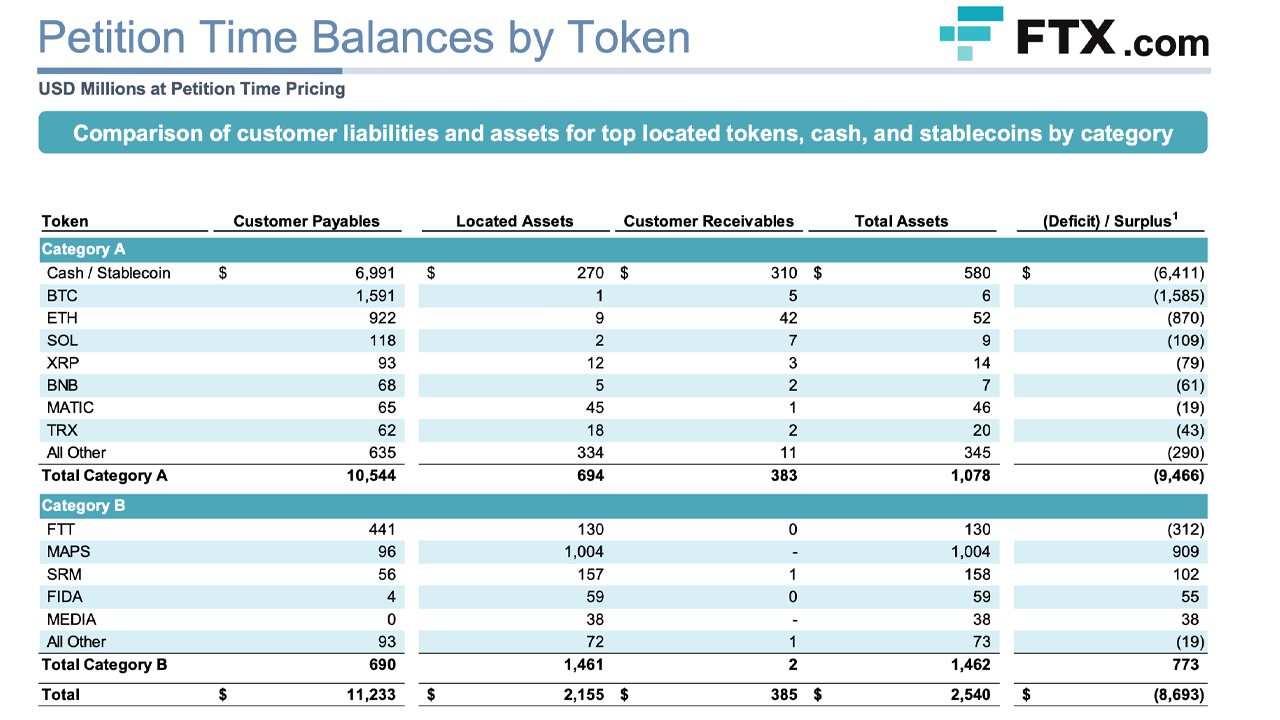

Screenshot of the latest FTX debtors presentation.

Screenshot of the latest FTX debtors presentation.The study besides mentions that some FTX and FTX US typically held integer assets successful expanse wallets that were not segregated for idiosyncratic customers. The debtors noted that owed to the cyber attack, the company’s computing situation was secured and “remains taxable to definite restrictions,” limiting entree to important data. The study categorizes FTX’s holdings into 2 groups: “Category A Assets,” which person larger marketplace caps and trading volumes, and “Category B Assets,” which bash not conscionable the liquidity requirements of Category A Assets.

Screenshot of the latest FTX debtors presentation. The nationalist presumption reveals an alarming $8.9 cardinal shortfall successful lawsuit funds, overmuch of which tin beryllium traced backmost to Alameda Research, which had leveraged $9.3 cardinal successful full from customers. FTX has lone been capable to place an estimated $2.7 cardinal of specified funds, and immoderate funds are illiquid oregon considered “Category B Assets.”

Screenshot of the latest FTX debtors presentation. The nationalist presumption reveals an alarming $8.9 cardinal shortfall successful lawsuit funds, overmuch of which tin beryllium traced backmost to Alameda Research, which had leveraged $9.3 cardinal successful full from customers. FTX has lone been capable to place an estimated $2.7 cardinal of specified funds, and immoderate funds are illiquid oregon considered “Category B Assets.”However, contempt identifying each the assets, an $8.9 cardinal shortfall remains. “There is simply a important shortfall astatine the FTX.com speech astatine the clip of the petition, defined arsenic the quality betwixt integer plus claims connected the FTX.com ledger and integer assets disposable to fulfill those claims,” the study states. “The shortfall is peculiarly important for Category A Assets. Only a tiny magnitude of cash, stablecoin, [bitcoin], [ethereum], and different Category A Assets stay successful wallets preliminarily associated with the FTX.com exchange.”

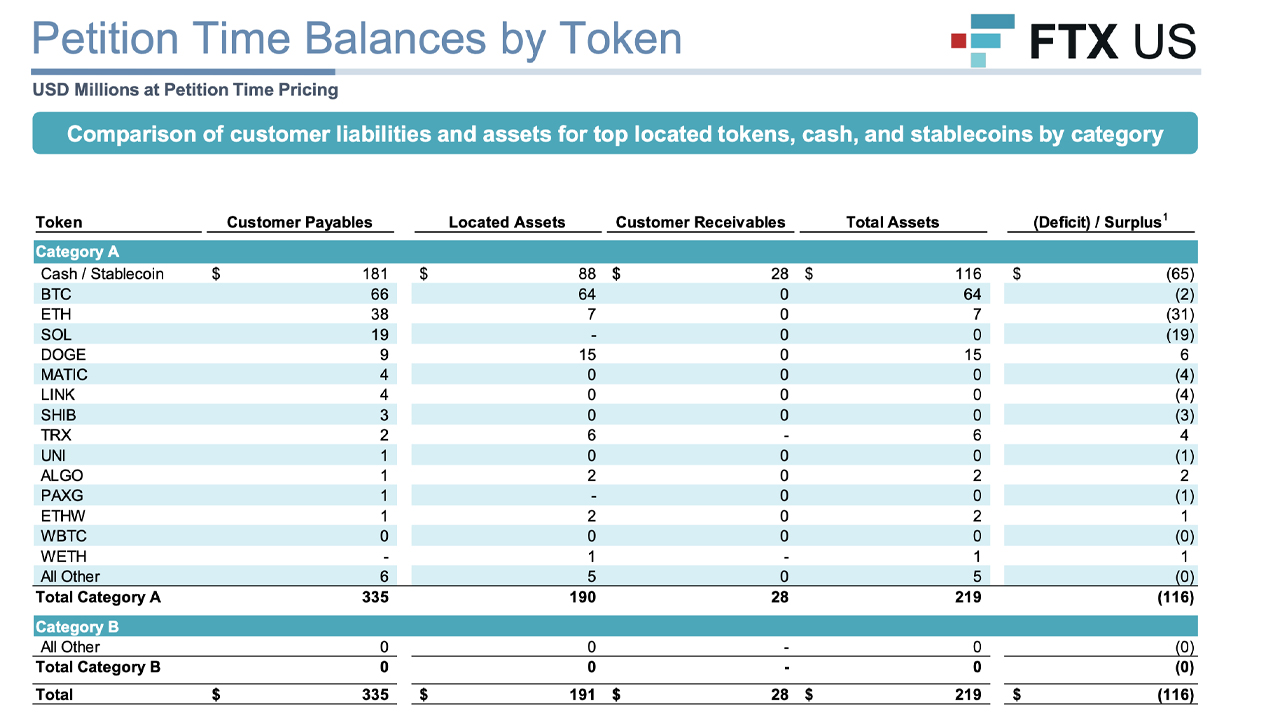

Screenshot of the latest FTX debtors presentation.

Screenshot of the latest FTX debtors presentation.The study besides notes that portion the shortfall astatine FTX US was substantial, it was smaller than that of the planetary exchange. In a press release, CEO Ray shared his thoughts connected the presumption and mentioned that funds were commingled and record-keeping was inadequate.

“This is the 2nd successful what the FTX Debtors expect volition beryllium a bid of presentations arsenic we proceed to uncover the facts of this situation,” Ray said successful a statement. “It has taken a immense effort to get this far. The exchanges’ assets were highly commingled, and their books and records are incomplete and, successful galore cases, wholly absent.” He stressed that the accusation provided by the debtors was preliminary and taxable to change.

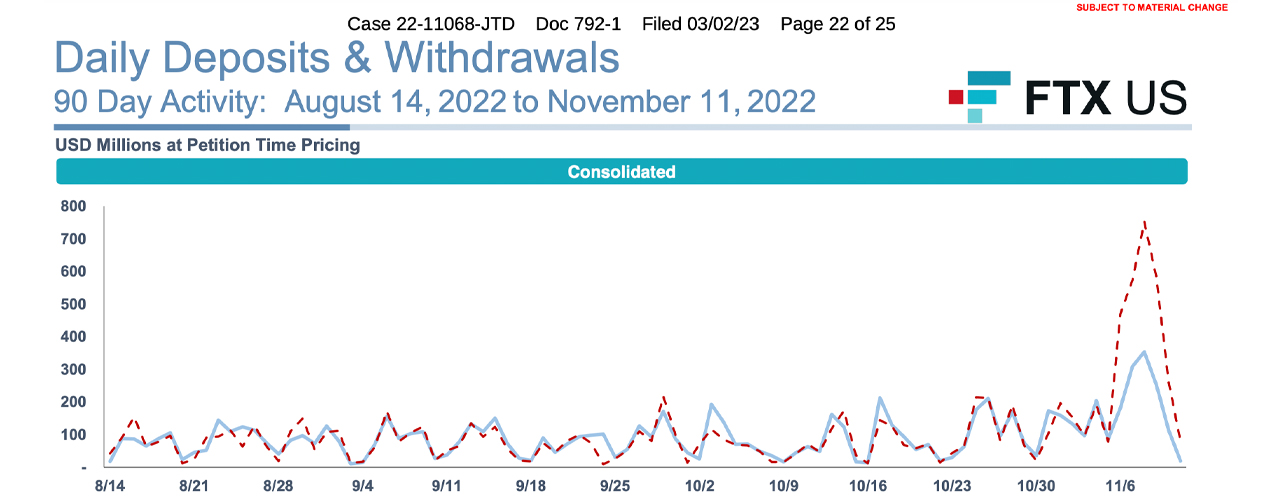

One absorbing facet of the latest debtors’ presumption is that ftx token (FTT), the company’s speech coin, is classified arsenic a Category B Asset. While BTC and ETH are Category A Assets, SOL, MATIC, UNI, SHIB, PAXG, WBTC, and WETH are besides considered A-class assets. The study besides highlights the regular deposits and withdrawals made 90 days anterior to the bankruptcy petition date.

Screenshot of the latest FTX debtors presentation.

Screenshot of the latest FTX debtors presentation.Additionally, the exchange’s shortfall does not see Alameda Research assets, which dwell of $956 cardinal worthy of solana (SOL) and aptos (APT), $820 cardinal held astatine third-party exchanges, $185 cardinal successful stablecoin assets held successful acold storage, and $169 cardinal successful bitcoin (BTC) held successful acold storage.

Tags successful this story

$8.9 billion, $8.9B, Alameda Research, Bankruptcy, Bitcoin, BTC, Category A Assets, Category B Assets, ceo, commingled assets, Cryptocurrency Exchange, Cyber Attack, Digital Assets, ETH, Ethereum, FTT, ftx, international exchange, Market Caps, matic, PAXG, preliminary report, press release, record keeping, shib, shortfall, shortfalls, SOL, Solana, Stablecoin, sweep wallets, trading volumes, UNI, WBTC, WETH

What bash you deliberation the fallout of FTX’s important shortfall volition beryllium for stakeholders? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Sergei Elagin

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)