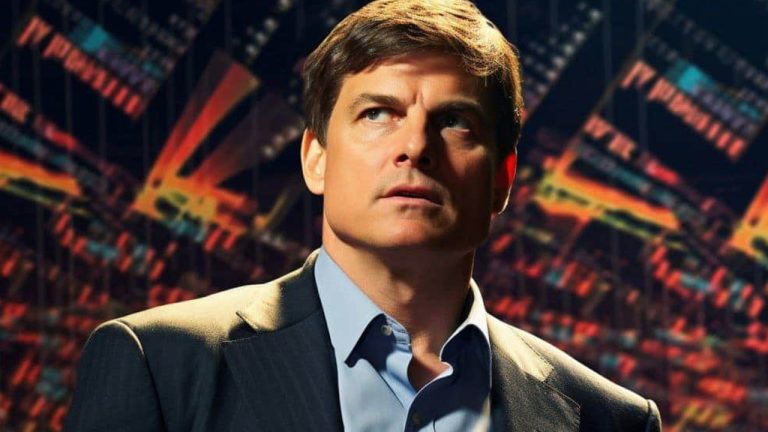

Michael Burry, famously known for his bold ‘Big Short’ wager against subprime mortgages successful the aboriginal 2000s, has precocious offloaded respective important bearish positions pursuing unsuccessful outcomes. As the laminitis of Scion Asset Management, Burry dissolved his enactment options connected large indices and semiconductor stocks during the 3rd quarter, arsenic revealed by regulatory documents. These divestments people a important shift, unwinding bets that had reached a notional worth surpassing $1.6 cardinal earlier this year.

Burry’s Bearish Bets Get Shuffled According to Scion’s 13F Filings

Gaining notoriety for his strategical bets against the surging lodging marketplace and intricate owe securities that resulted successful tremendous gains during the marketplace collapse, Michael Burry’s latest endeavors to capitalize connected marketplace downturns person predominantly misfired. Initiated successful the 2nd quarter, his renewed abbreviated positions targeting the S&P 500, and the Nasdaq 100 done puts, saw Burry compelled to wantonness these trades successful the 3rd 4th amidst an ongoing marketplace rally.

During this period, Burry wholly withdrew his puts connected the S&P 500 and Nasdaq 100 exchange-traded funds (ETFs), positions that constituted astir $1.6 cardinal successful full notional exposure. With the large indices remaining robust, surpassing levels from precocious June erstwhile Burry placed these bets, it’s probable that these trades either resulted successful losses oregon became worthless.

Contrary to immoderate beliefs, Burry’s wager did not equate to a $1.6 cardinal loss, arsenic per an analysis by X relationship holder Saaketh Koka. Koka clarified that the important notional worth of Burry’s scale bets doesn’t reflector the existent magnitude risked. The leverage inherent successful options contracts typically results successful importantly higher notional vulnerability compared to the superior invested.

The combined $1.6 cardinal notional worth of Burry’s S&P 500 and Nasdaq 100 puts reflects the full worth of the indices helium shorted, not the existent premium paid. While the notional size seems colossal astatine $1.6 billion, Koka emphasized that the existent outgo and hazard were apt nether $10 million, considering modular enactment pricing.

Additionally, the ‘Big Short’ investor besides liquidated a $47 cardinal bearish presumption against the semiconductor assemblage via puts connected the SOXX ETF, a stake that consistently depreciated arsenic spot stocks made a comeback this year. Furthermore, Burry readjusted astir of his equity portfolio successful the past quarter, exiting 25 holdings including erstwhile superior investments specified arsenic Expedia, Charter Communications, and Generac Holdings.

In contrast, helium augmented a fewer existing, smaller stakes, notably successful Nexstar Media Group and Star Bulk Carriers. Chinese technological giants Alibaba and JD.com besides re-emerged successful his portfolio aft a little hiatus. These alterations followed a challenging 2nd 4th for Burry’s investments, wherever helium offloaded astir of his first-quarter stakes, including earlier agelong positions successful Alibaba, JD.com, and Zoom Video.

Rising to prominence with his exceptionally lucrative abbreviated positions connected the lodging bubble and owe securities, Burry’s caller failures underscore the challenges faced by adjacent renowned investors successful consistently predicting marketplace dynamics and timing macroeconomic shifts.

Known arsenic “Cassandra B.C.” connected societal media level X, Burry predicted a protracted, multi-year recession for the U.S. system successful December 2022. However, by April, helium revisited his stance connected his shorts, taking to societal media to admit “I was incorrect to accidental sell” and extended his congratulations to the “BTFD generation.”

What bash you deliberation astir the ‘Big Short’ capitalist Michael Burry’s latest moves? Share your thoughts and opinions astir this taxable successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)