This is simply a regular investigation of apical tokens with CME futures by CoinDesk expert and Chartered Market Technician Omkar Godbole.

BTC/JPY: Focus connected descending triangle

Bitcoin's (BTC) dollar-denominated terms continues to fluctuate beneath $120,000, hovering astir large intraday moving averages, which provides small directional clarity. Hence, we are focusing connected Bitflyer's BTC/JPY pair, which displays a well-defined descending triangle astatine grounds highs, making it easier to analyse the trend.

Usually, the descending triangle is viewed arsenic a bearish pattern. Its downward-sloping precocious trendline, representing little highs, indicates that sellers are progressively gaining strength. And hence, an eventual decisive breach of the horizontal enactment enactment is said to corroborate a bearish inclination reversal.

In the lawsuit of BTC/JPY, the horizontal enactment is identified astatine 17,160,000 JPY ($117,000). A determination beneath that would fortify the carnivore grip, shifting absorption to the rising trendline support.

Conversely, a breakout from the triangle volition apt bring caller beingness highs. The bullish lawsuit looks imaginable arsenic traders are progressively expecting much Fed complaint cuts for 2026. Interest complaint futures information amusement that traders are present pricing astir 76 ground points of complaint reductions for adjacent year, up from 25 ground points priced successful April.

Furthermore, the rising yields astatine the agelong extremity of the U.S. authorities enslaved marketplace and those successful different precocious nations constituent to expectations of continued fiscal enactment for system and markets.

Keep an oculus connected USD/JPY

The outlook for yen against the dollar appears constructive, arsenic the dispersed betwixt 30-year U.S.-Japan enslaved yields has dropped to the lowest since August 2022, signaling JPY strength.

A yen rally could pb to a bout of broad-based hazard aversion, perchance capping gains successful hazard assets, including BTC.

- AI's take: BTC/JPY is consolidating wrong a descending triangle, raising contiguous concerns for the brace contempt the overarching bullish trendline from June. While rising Fed complaint chopped bets mostly favour Bitcoin (in USD terms), the strengthening JPY owed to the US-Japan 30-year output differential could headdress BTC/JPY gains oregon exacerbate a breakdown from the triangle

- Resistance: $120,000, $121,181.

- Support: $116,000, $115,739, $111,965.

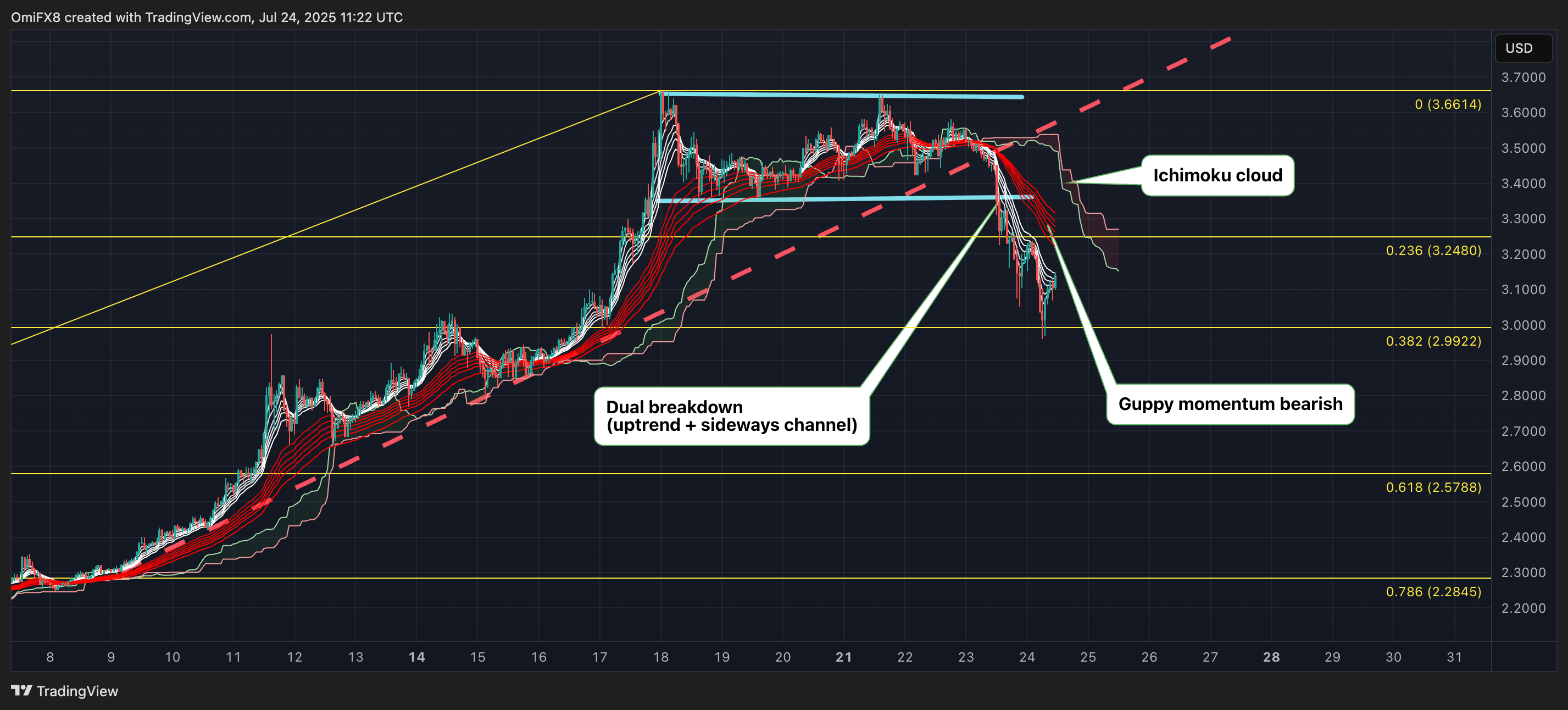

XRP: Focus connected 38.2% fib retracement

XRP has crashed implicit 10% successful the past 24 hours, accordant with bearish signals from the terms illustration aboriginal Wednesday. The terms sell-off recovered enactment astatine astir $2.99 aboriginal today, which corresponds to the 38.2% Fibonacci retracement of the important rally from $1.90. However, the consequent betterment to $3.10 whitethorn not person legs arsenic momentum, represented by the Guppy aggregate moving mean indicator, has flipped bearish. Further, some the Guppy averages and prices are present decisively successful the bearish territory beneath the Ichimoku cloud.

Therefore, a re-test of $2.99 appears likely, which, if it fails to hold, could pb to prices sliding to $2.57, the 61.8% Fibonacci retracement. On the higher side, a determination supra $3.35 is needed to invalidate the bearish bias.

- AI's take: The cardinal takeaway from the XRP illustration is that the dual breakdown of some its erstwhile uptrend and sideways transmission signals a confirmed bearish displacement successful momentum.

- Resistance: $3.35, 3.65, $4.00

- Support: $2.99, $2.65, $2.57

Ether: Moves little done a descending channel

Ether continues to people little highs and little lows connected the hourly chart, establishing a downward-trending channel. The 50- and 100-hour SMAs person produced a bearish crossover and the 200-hour SMA is accelerated losing its bullish slope. In addition, prices person established a foothold beneath the Ichimoku cloud. All things favour a continued dilatory and dependable descent. Only a determination supra $3,740, which would instrumentality prices backmost supra the cloud, would revive the contiguous bullish outlook.

- AI's take: Traders should oculus the 200-hour SMA arsenic important support; a interruption beneath it could awesome an extended downtrend.

- Resistance: $3,740, $4,000, $4,109.

- Support: $3,593 (the 200-hour SMA), $3,480, $3,081.

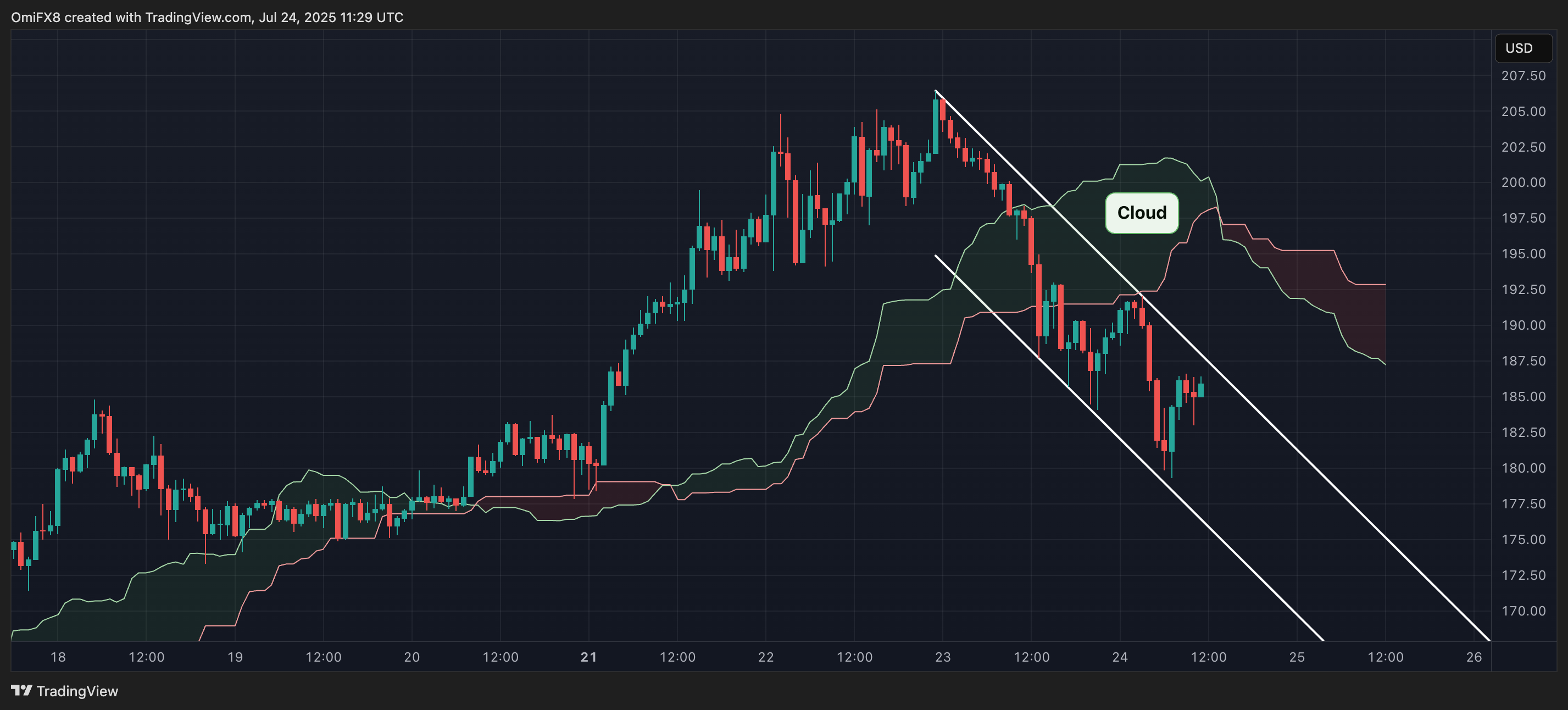

Solana: Ether-like moves

SOL's hourly illustration resembles ether's, with prices moving done a downward-sloping channel, having established a foothold beneath the Ichimoku cloud. In addition, the Guppy indicator is present positioned decisively bearish. The contiguous bias remains bearish arsenic agelong arsenic prices stay beneath the little precocious of $192.

- AI's take: Recovery rallies wrong this transmission could conscionable absorption astatine the channel's precocious bound and the underside of the cloud, indicating continued bearish pressure.

- Resistance: $192, $200, $218.

- Support: $179 (daily low), $163 (the 200-day SMA), $145.

3 months ago

3 months ago

English (US)

English (US)