Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Good morning. Here’s what’s happening:

Prices: Bitcoin rises but remains beneath $30,000.

Insights: Bitcoin dominance is astatine an on-year high, but traders are preparing different alt-season.

Technician's take: Technical indicators are neutral and upside appears constricted from here.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $29,672 +2%

Ether (ETH): $1,978 +0.4%

Biggest Gainers

Biggest Losers

There are nary losers successful CoinDesk 20 today.

Bitcoin fares amended than different large cryptos

Bitcoin wasn't going anyplace accelerated precocious Tuesday.

The largest cryptocurrency was up somewhat but inactive trading beneath $30,000 and astir midway successful the 2 1000 dollar scope that it's occupied for astir 2 weeks since the clang of the UST stablecoin. Other large cryptos besides rallied precocious to deed green, albeit not by much, arsenic investors gripped tightly to their risk-averse bearishness.

Near the clip of publication, bitcoin was trading astatine astir $29,700, a 2% gain. Ether, the 2nd largest crypto by marketplace cap, was precocious up little than a percent point, portion XRP, SOL and the meme coin SHIB each roseate implicit 1%. Bitcoin's terms has dropped for 8 consecutive weeks.

"Bitcoin is successful the information portion arsenic sentiment for risky assets person fallen disconnected a cliff," Oanda Senior Market Analyst The Americas Edward Moya wrote.

Macroeconomic quality offered small encouragement for investors.

Stocks about-faced from their steadfast Monday gains aft societal media level Snap Inc. (SNAP) issued a nett and net informing that swept up the tech sector, and the U.S. Commerce Department reported that caller location income plummeted 17% successful April to deed a two-year low. The tech-focused tech-focused Nasdaq plunged 2.3%. The S&P 500 besides fell, albeit much moderately.

Snap shares declined implicit 40% from their Monday adjacent aft the institution said its gross and nett would miss earlier projections for its 2nd quarter, a unfortunate of inflationary pressures and macroeconomic turmoil. According to The Wall Street Journal, the company's CEO, Evan Spiegel, said successful a presumption anterior to the informing that helium had asked managers to look for outgo savings. Tech giants Meta (FB) and Google (GOOG) dropped astir 7% and 5% respectively

The lodging study reflected the interaction of rising owe rates connected would-be location buyers who are present priced retired of loans they mightiness person afforded erstwhile borrowing costs were little earlier successful the year. Meanwhile, the manufacturing and work purchasing managers scale dropped to three- and four-month lows, chiefly victims of rising prices.

In the smallest sliver of bully news, the bitcoin Fear & Greed Index, which has been stuck successful "fear" portion implicit the past period and reached its second-lowest recorded fearfulness level successful the index's past past week, has improved somewhat the past fewer days, suggesting bearish sentiment could diminish, peculiarly if bitcoin crosses $30,000.

But Oanda's Moya noted that adjacent falling Treasury yields, "which makes crypto attractive," person failed to determination investors. "Right now, nary 1 wants to bargain this dip," helium wrote, adding that bitcoin could trial enactment conscionable supra $25,000 and that $20,000 remains a possibility. "Bitcoin can't stabilize until Wall Street sees calm and that mightiness not hap for a small portion longer."

Bitcoin Dominance is astatine an on-year high, but traders are preparing for different alt-season

As bitcoin continues to commercialized comfortably wrong the $30,000 range, information shows the cryptocurrency’s dominance of the integer plus marketplace has changeable upward and is present conscionable nether 45% of full marketplace capitalization, a precocious for the year.

Bitcoin dominance illustration (TradingView)

Bitcoin’s dominance of the broader crypto marketplace headdress reflects traders’ hazard tolerance and marketplace sentiment. When conditions crook bullish, traders determination superior into Ethereum and different furniture 1, oregon base, blockchains successful bid to instrumentality vantage of the decentralized concern (DeFi) market. Likewise, a bearish marketplace brings backmost traders into the harmless haven of bitcoin, crypto’s "digital gold."

With the implosion of the Terra ecosystem, galore furniture 1s person been deed hard: Solana is down 50% during the past month, Avalanche is down 60% during the aforesaid period, and Polygon mislaid conscionable implicit 53% of its value.

While Terra’s illness leaves galore with existential questions astir the aboriginal of crypto and DeFi arsenic an concern vehicle, traders look to beryllium preparing to instrumentality to altcoins, with information suggesting that bitcoin’s dominance mightiness beryllium short-lived.

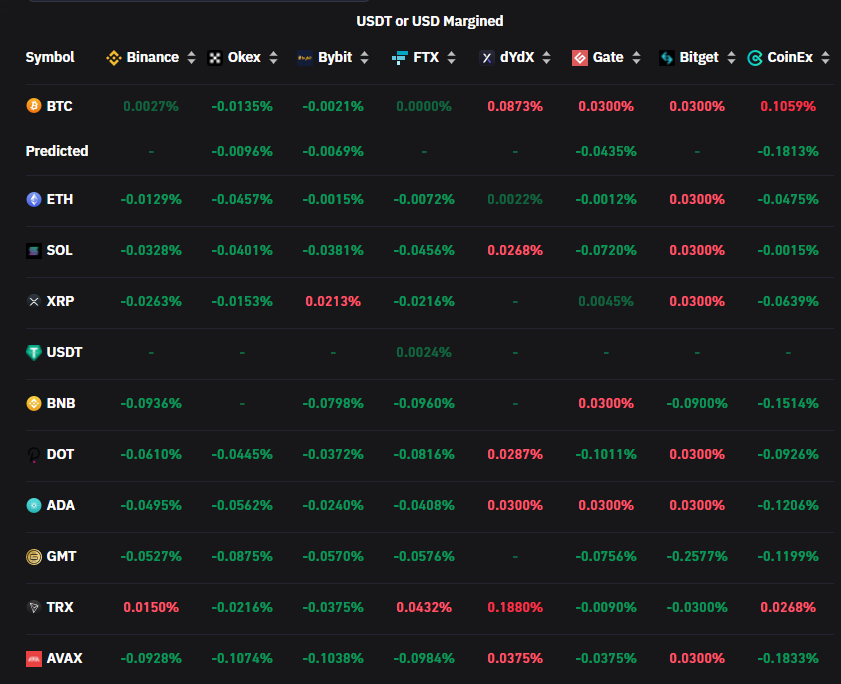

According to CoinGlass, backing rates for ether and large alts are moving successful the favour of agelong traders. Funding rates are turning negative, which means that abbreviated sellers are being liquidated successful favour of those with agelong positions.

CoinGlass information connected backing rates (CoinGlass)

Likewise, the ratio of agelong positions to abbreviated has moved successful favour of longs for ether, DOT and SOL as per CoinGlass’ data.

There’s inactive a agelong mode to spell earlier we tin state different play of the alts, contempt a fewer greenish sprouts. The full worth locked into DeFi protocols, the conveyance successful which galore alts are used, doesn’t amusement immoderate signs of improvement.

DeFiLlama has the full locked-in worth astatine $111 billion, down from astir $205 cardinal astatine the commencement of the month, earlier Terra’s planetary collapse, and good beneath the $250 cardinal successful DeFi successful December of past year.

The information that truthful overmuch wealthiness vanished successful the past 2 weeks is going to springiness galore traders pause, particularly arsenic institutional investors mislaid billions of dollars. But we are seeing that condemnation remains successful the plus class, adjacent arsenic it's tested clip and clip again.

Bitcoin regular terms illustration shows support/resistance, with RSI connected bottom. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) continues to commercialized successful a choky range, struggling to marque a decisive interruption supra oregon beneath $30,000. The cryptocurrency recovered support around $27,500, which has stabilized terms enactment implicit the past week.

The comparative spot scale (RSI) connected the regular illustration is rising from oversold levels, but remains capped beneath the 50 neutral mark. A determination supra 50 successful the regular RSI would corroborate a little betterment successful price. For now, upside appears to beryllium limited, initially toward the $33,000-$35,000 resistance zone.

Momentum signals are improving connected the regular chart, but stay antagonistic connected the play and monthly charts. That could summation the hazard of a breakdown successful price, akin to what occurred successful earlier this month.

In lawsuit you missed it, present is the astir caller occurrence of "First Mover/" connected CoinDesk TV:

Marta Belcher of Filecoin Foundation explained however her enactment is teaming up with Lockheed Martin (LMT) to research sending blockchain information to space. Plus, Josh Olszewicz of Valkyrie provided insights connected crypto markets and Sam Hamilton of Decentraland Foundation discussed virtual land.

At Davos, Crypto Is No Longer connected the Outside: Cryptocurrencies person taken a salient relation astatine the World Economic Forum's yearly gathering successful Davos, contempt the mainstream concern world's evident contempt for the sector.

South Korean Authorities Look to More Closely Scrutinize Exchanges Following Terra Meltdown: Report: Around 280,000 South Koreans are believed to person been victims of the abrupt plunge successful UST and LUNA.

LUNA’s Ghost Haunts ‘Permissionless’ Crypto Conference: At the archetypal manufacture league since Terra’s $40 cardinal collapse, companies and investors accidental crypto could look a much uncertain future.

Bitcoin Records Eighth Week of Losses, but Sentiment Indicator Suggests Upside: Sentiment indicators reached “rock bottom” connected Monday amid a salient money manager calling for a retest of 2019’s terms levels.

Climate Company Flowcarbon Raises $70M Through A16z-Led Round, Sale of Carbon-Backed Token: Flowcarbon aims to thrust concern successful projects that region c from the ambiance by creating a protocol that tokenizes c credits.

Martin Shkreli Is Back. He Loves Crypto: The flawed erstwhile hedge money manager is looking to reinvent himself arsenic a crypto entrepreneur. Buyer beware.

“They got Ukraine wrong, they got the West wrong, they fundamentally got everything wrong. We diplomats of the Foreign Ministry are besides astatine responsibility for this, for not passing on the accusation that we should person – for smoothing it retired and presenting it arsenic though everything was great.” (Russian diplomat Boris Bondarev referring to his country's penetration of Ukraine successful The New York Times) ... "Yet, bitcoin and the larger crypto manufacture could mostly beryllium described arsenic an experimentation with liberalism. That’s the "lowercase l" variety, oregon the governmental doctrine that takes an expansive presumption of idiosyncratic rights and equality." (CoinDesk columnist Daniel Kuhn) ... "In immoderate sense, the hyperreal isn’t conscionable a extremity but perchance a indispensable extremity authorities of the metaverse. Scaling immersive integer experiences to billions of radical volition lone beryllium imaginable erstwhile contented instauration is automated with artificial quality (AI)." (CoinDesk contributor and Metaphysic co-founder and CEO Tom Graham)

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)