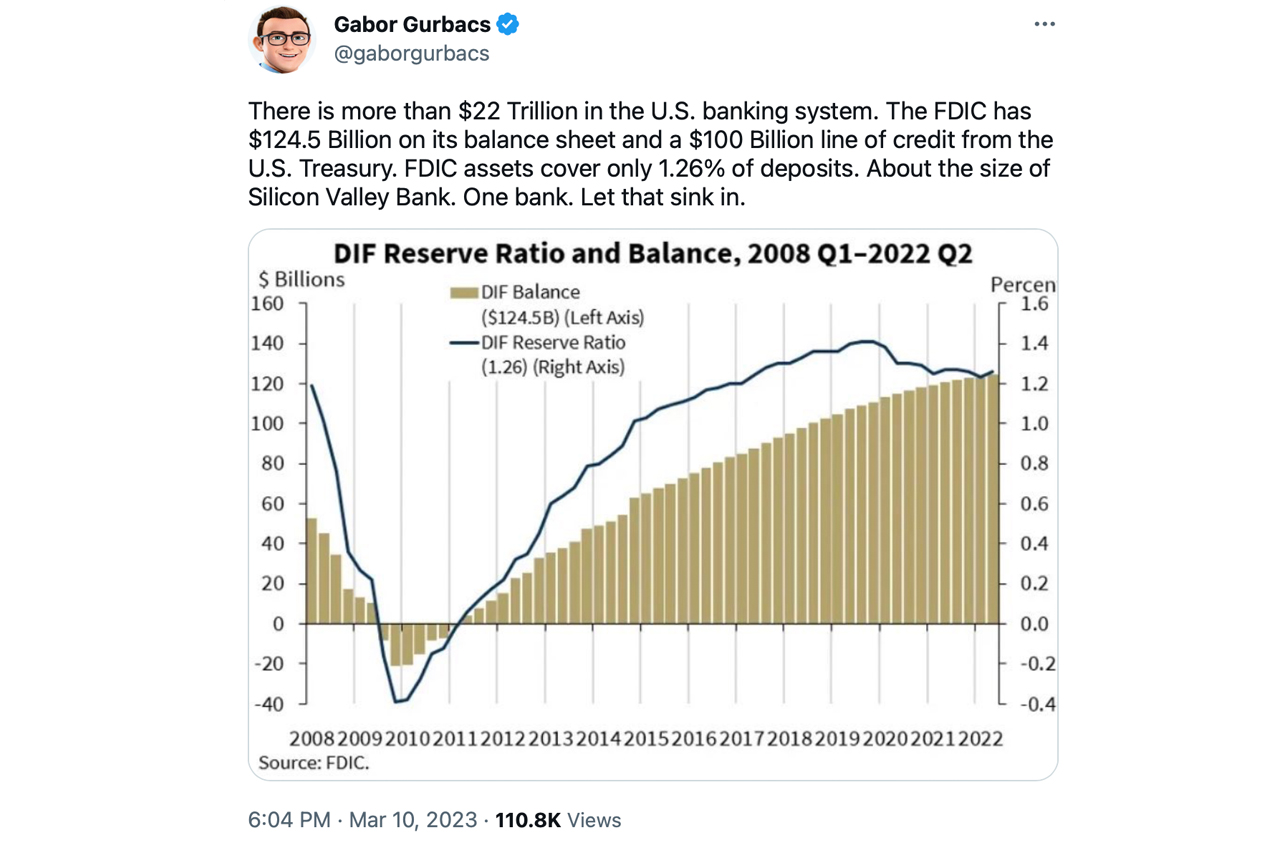

Silicon Valley Bank (SVB) has go the halfway of attraction aft its illness prompted the U.S. Federal Deposit Insurance Corporation (FDIC) to unopen the slope down connected Friday. It was the largest U.S. slope nonaccomplishment since 2008, and assorted alleged catalysts person been pointed to. Some judge task capitalists caused a slope run, portion others blasted the U.S. Federal Reserve’s complaint hikes. Economist and golden bug Peter Schiff said connected Friday that the U.S. banking strategy would acquisition much occupation ahead. He and respective speculators judge that these fiscal institutions clasp mountains of semipermanent treasuries.

Calls for SVB Intervention arsenic Market Observers Predict Larger Financial Collapse successful the U.S.

Over the past week, 2 U.S. banking institutions, Silvergate Bank and Silicon Valley Bank (SVB) failed. SVB’s collapse was the largest banking nonaccomplishment since Washington Mutual (Wamu) successful 2008, which was blamed connected expanding branches excessively rapidly and holding monolithic amounts of subprime mortgages lent to alleged unqualified buyers.

Before its collapse, Wamu held $188.3 cardinal successful deposits, portion SVB is estimated to person mislaid astir $175.4 cardinal successful deposits. However, portion SVB’s deposits astatine the extremity of December 2022 were $175.4 billion, customers attempted to remove $42 billion connected Thursday alone. It’s harmless to accidental that SVB’s demise was a batch faster than Wamu’s illness astatine the extremity of 2008.

Just days earlier its collapse, SVB attempted to fortify its equilibrium expanse by announcing the request to rise $2.25 billion. The slope besides sold its available-for-sale (AFS) enslaved portfolio for $21 billion, resulting successful a $1.8 cardinal nonaccomplishment from the sale. SVB is well-known for banking tech startups and task superior (VC) money, and immoderate marketplace observers judge that these clients caused a slope run.

“This was a hysteria-induced slope tally caused by VCs,” said Ryan Falvey, a fintech capitalist astatine Restive Ventures, successful an interrogation with CNBC connected Friday. “This is going to beryllium remembered arsenic 1 of the eventual cases of an manufacture cutting disconnected its chemoreceptor to spite its face,” helium added.

Other analysts and marketplace observers are blaming the illogical inverted output curve that agelong and short-term Treasuries are facing today, arsenic good arsenic the U.S. Federal Reserve rate hikes. Soona Amhaz, laminitis and managing spouse astatine Volt Capital, said: “The unfastened concealed is that technically astir U.S. banks are bankrupt close now, arsenic they’re each sitting connected long-duration treasuries that are underwater successful a 4% involvement complaint environment.”

Economist and golden bug Peter Schiff shares a akin presumption to Amhaz, expecting a overmuch larger fiscal illness successful the United States. “The U.S. banking strategy is connected the verge of a overmuch bigger illness than 2008. Banks ain semipermanent insubstantial astatine highly low-interest rates,” Schiff stated. He continued:

They can’t vie with short-term Treasuries. Mass withdrawals from depositors seeking higher yields volition effect successful a question of slope failures.

Craft Ventures enforcement David Sacks took to Twitter, calling connected Powell to intervene and forestall a imaginable contagion. “Where is Powell? Where is Yellen? Stop this situation NOW,” Sacks tweeted. “Announce that each depositors volition beryllium safe. Place SVB with a Top 4 bank. Do this earlier Monday’s opening, oregon determination volition beryllium contagion and the situation volition spread.”

Billionaire and Galaxy Digital laminitis Mike Novogratz besides weighed in, expressing astonishment that the Fed would fto depositors suffer wealth successful Silicon Valley Bank. “Are each banks going to beryllium treated similar hedge funds? Seems similar a argumentation mistake,” Novogratz stated. Shapeshift laminitis Erik Voorhees ridiculed the telephone for Fed involution connected Twitter, stating, “Fiat is fragile.”

SVB’s issues person impacted the crypto economy, peculiarly the stablecoin system backed by fiat reserves. Circle disclosed that it had $3.3 cardinal of currency supporting usd coin (USDC) trapped successful the bank, causing USDC to unpeg from the U.S. dollar parity. As of 10:30 a.m. connected March 11, 2023, USDC is trading for $0.912 per unit. This unpegging has besides led to 5 different stablecoins losing their pegs. Furthermore, connected Saturday, Coinbase, Binance, and Crypto.com temporarily suspended USDC trades and conversions.

Tags successful this story

Balance Sheet, Bank Failure, Bank Run, banking tech startups, Bankruptcy, collapse, contagion, deposits, Economist, FDIC, Fiat, Galaxy Digital, illogical inverted output curve, interest rates, long-duration treasuries, long-term treasuries, Peter Schiff, policy mistake, Powell, rate hikes, Shapeshift, short-term Treasuries, Silicon Valley Bank, Silvergate Bank, speculators, subprime mortgages, SVB, SVB deposits, U.S. Federal Deposit Insurance Corporation, U.S. Federal Reserve, unqualified buyers, Venture Capital, Venture Capitalists, Withdrawals, Yellen

What bash you deliberation astir the opinions surrounding the SVB failure? Share your thoughts successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)