Quick Take

Markets are present virtually definite of a notable 25 ground constituent complaint hike, arsenic precocious released U.S. information indicates beardown economical performance. The economy’s blistery streak is confirmed by a important surge successful occupation growth, causing an upward displacement successful yields crossed the board.

Among the astir impacted is the 10-year Treasury yield, which has crossed the symbolic 4% threshold for the archetypal clip successful years. This surge indicates the market’s bullish outlook connected the U.S. system and expectations for tighter monetary policy.

Such a backdrop sets the signifier for a captious turning constituent successful U.S. monetary policy, with perchance wide-ranging implications for home and planetary markets. As we advance, the fiscal assemblage volition beryllium intimately watching for immoderate further signals from the Federal Reserve concerning their adjacent steps successful this caller economical climate.

According to ZeroHedge:

- Initial Claims 248K, Exp. 245K, Last 239K

- Continuing Claims 1720K, Exp. 1737K, Last 1742K

- ADP Private payrolls 497K, Exp. 225K, Last 278K

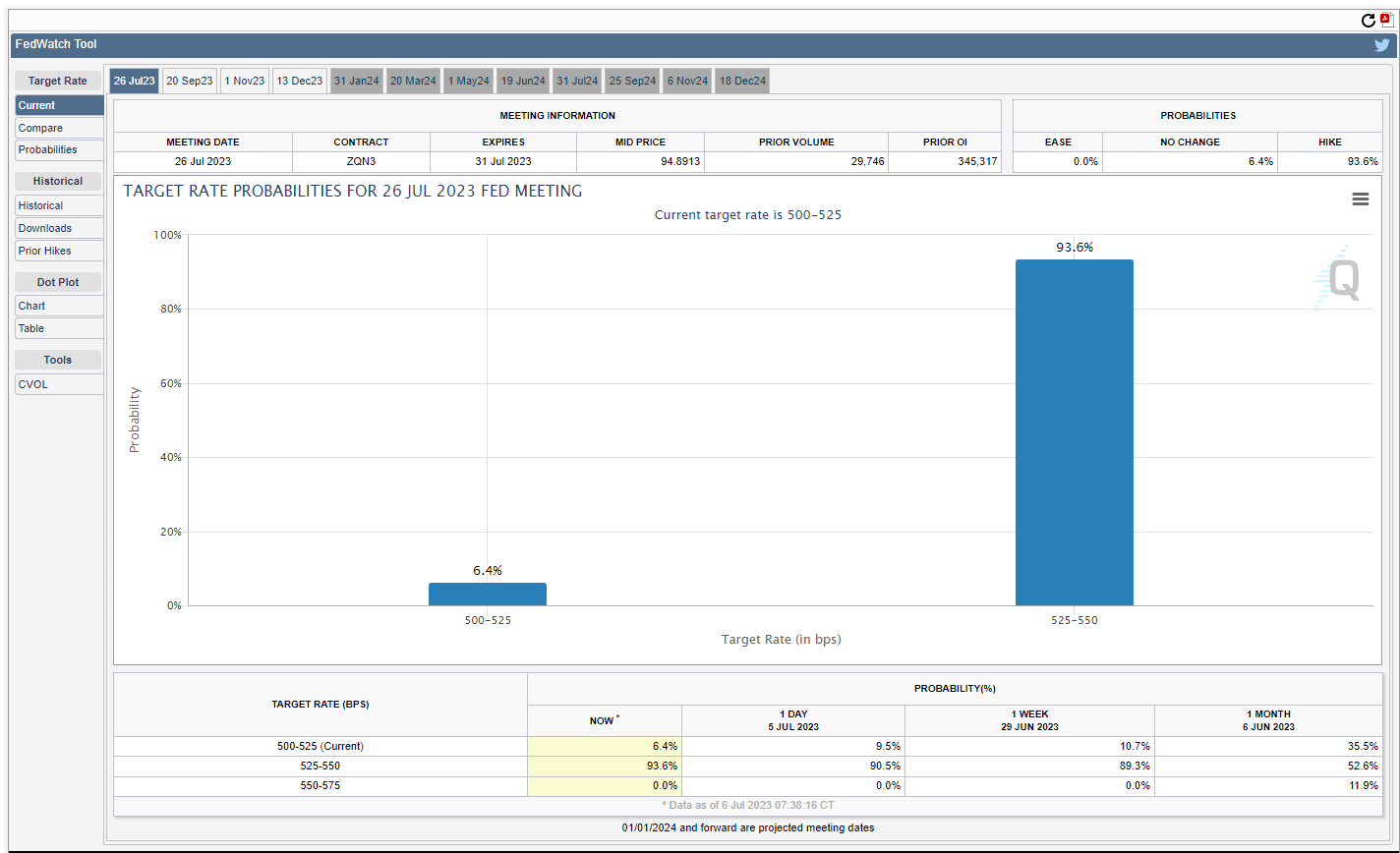

Fed Watch tool: (Source: CME)

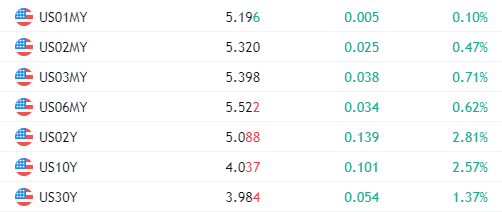

Fed Watch tool: (Source: CME) Yields: (source: Trading View)

Yields: (source: Trading View)The station Federal Reserve acceptable to instrumentality 25bps complaint hike pursuing beardown economical data appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)