Following the fallout implicit the past 2 weeks successful the U.S. banking industry, the Federal Reserve raised the national funds complaint by 25 ground points (bps) connected Wednesday, citing the request for the ostentation complaint to instrumentality to 2% implicit the agelong run.

Fed Raises Rate Despite Calamity successful the U.S. Banking Sector

It’s been a unsmooth 2 weeks for the U.S. system aft the autumn of Silvergate Bank, Silicon Valley Bank, and Signature Bank. After these slope failures took place, the Federal Reserve announced the creation of the Bank Term Funding Program (BTFP) and announced that uninsured depositors of Signature Bank and Silicon Valley would beryllium made whole. After the turmoil successful the banking industry, immoderate experts suspected the Fed would not rise the benchmark complaint this month.

On Wednesday astatine 2 p.m. Eastern Standard Time, the Federal Open Market Committee (FOMC) revealed that it would rise the complaint by 25bps. “The committee seeks to execute maximum employment and ostentation astatine the complaint of 2 percent implicit the longer run,” the FOMC said. “In enactment of these goals, the committee decided to rise the people scope for the national funds complaint to 4-3/4 to 5 percent. The committee volition intimately show incoming accusation and measure the implications for monetary policy.”

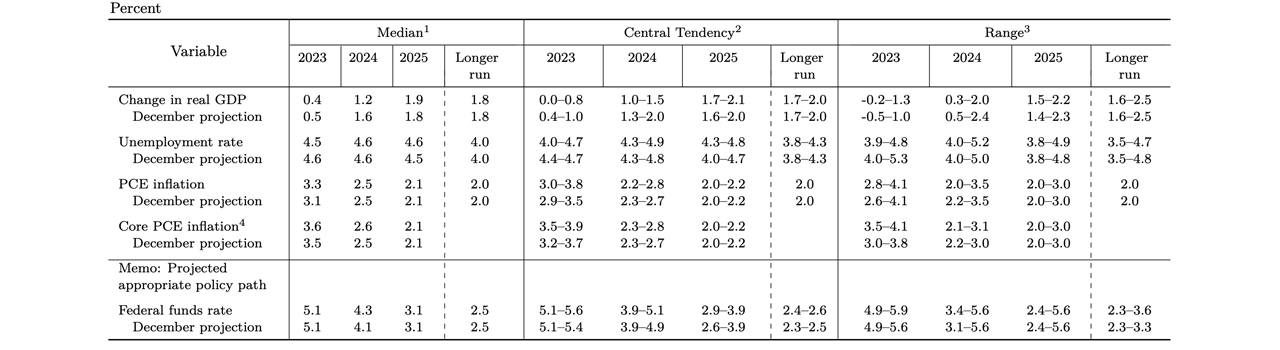

In addition, the Fed published the cardinal bank’s “Summary of Economic Projections,” which suggests the ostentation complaint tin scope 2.1% by 2025 and 2% implicit the longer run. By 2025, the FOMC projections spot the national funds complaint reduced down to 3.1%. Following the FOMC’s connection and projections report, equity markets jumped higher connected the news, with 3 retired of 4 of the U.S. benchmark indices successful the green.

Fed’s “Summary of Economic Projections.”

Fed’s “Summary of Economic Projections.”Crypto assets dropped aft the tiny summation from the Fed, with bitcoin (BTC) nearing the $29K scope astatine $28,700 astatine 2:15 p.m. Eastern Standard Time connected Wednesday. But by 2:45 p.m., BTC had rapidly dropped down to the $27,876 per portion range. At present, BTC’s USD worth is hovering conscionable supra the $28K zone.

While cryptos had a mixed absorption to the Fed news, precious metals held strong. Both golden and metallic jumped connected the Fed hike, rising 1.6% to 2.5% higher against the greenback. Overall, the FOMC connection noted that caller indicators person shown “modest maturation successful spending and production.”

Further, the Fed says that portion “job gains person picked up successful caller months and are moving astatine a robust pace, [and] the unemployment complaint has remained low, ostentation remains elevated.”

After the FOMC property statement, Fed seat Jerome Powell insisted the U.S. banking strategy “is dependable and resilient with beardown superior and liquidity.” Powell added, “we deliberation our monetary argumentation instrumentality works, and we deliberation … our complaint hikes were good telegraphed to the markets, and galore banks person managed to grip them.”

Tags successful this story

Asset Purchases, Bitcoin, Bond yields, Central Bank, economic analysis, economic data, economic growth, economic indicators, economic outlook, economic recovery, Economy, Fed, Fed Hike, Federal Reserve, Financial Markets, FOMC, FOMC statement, gold, Greenback, inflation, inflation rate, interest rates, jerome powell, market volatility, Monetary Policy, monetary stimulus, production, quantitative easing, rate hikes, silver, spending, Stock Market, unemployment rate

What bash you deliberation the Fed’s determination to rise involvement rates means for the U.S. economy? Share your thoughts astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)