Quick Take

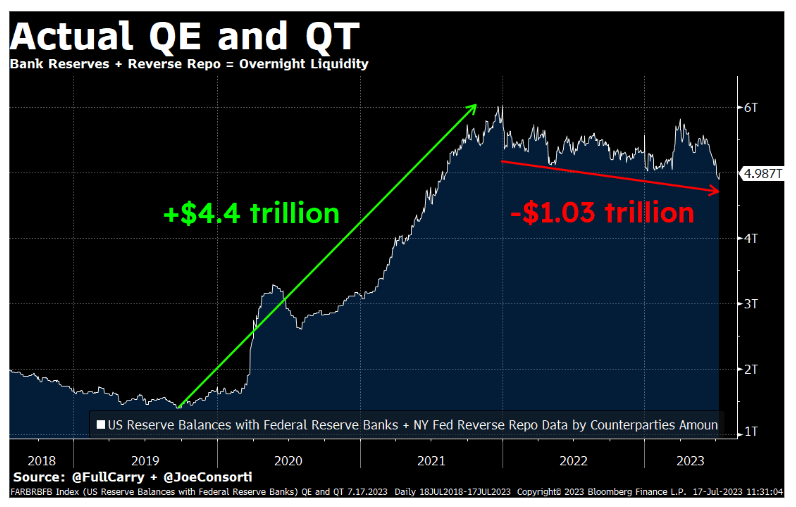

Recently, the Federal Reserve (Fed) has initiated a argumentation displacement that sees a alteration successful United States Dollar (USD) liquidity by 25%, according to expert Joe Consorti. This strategy contrasts markedly with the earlier Quantitative Easing (QE) policies. The effect is simply a important simplification successful the plus worth that banks utilize for indebtedness issuance, recognition extension, and self-financing.

To recognize this successful simpler terms, envision banks being fixed little wealth to operate. Their quality to widen loans, supply credit, and support self-sustainability is earnestly curtailed.

This argumentation displacement impacts not lone the wide liquidity but besides the overnight liquidity successful the fiscal system. Overnight liquidity, composed of slope reserves and funds obtained via reverse repurchase agreements (reverse repo), provides contiguous fiscal resources that banks tin usage to conscionable short-term obligations oregon instrumentality vantage of concern opportunities. By reducing the wide liquidity, the Fed besides limits the excavation of funds disposable for these short-term transactions.

The captious question that Consorti presents is: however acold tin the Fed propulsion this liquidity simplification earlier it leads to an economical downturn, oregon worse, a collapse? Liquidity, peculiarly overnight liquidity, plays a important relation successful maintaining economical stableness and fostering growth.

We’re venturing into uncharted territory with these changes. The result of this argumentation displacement volition unfold implicit time, leaving home and planetary economical sectors speculating and bracing for imaginable impacts.

QE/QT: (Source: Joe Consorti)

QE/QT: (Source: Joe Consorti)The station Federal reserve drains a 4th of USD liquidity: economical consequences await appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)