Federal Reserve Chair Jerome Powell has hinted that the Fed whitethorn intermission raising involvement rates astatine the Federal Open Market Committee (FOMC) gathering adjacent month. “Having travel this far, we tin spend to look astatine the information and the evolving outlook and marque cautious assessments,” Powell said.

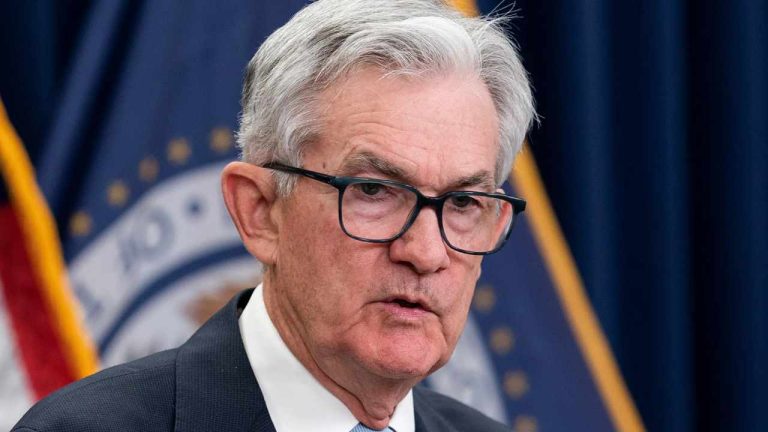

Fed Chair Jerome Powell connected Rate Hikes

Federal Reserve Chairman Jerome Powell has hinted that the U.S. cardinal slope whitethorn intermission its bid of involvement complaint hikes aft raising rates 10 times successful a row. The national funds complaint accrued from adjacent zero a twelvemonth agone to 5.00%-5.25%, its highest level successful 16 years. The latest summation was by 25 ground points successful March.

Speaking astatine a Fed league successful Washington alongside erstwhile Fed Chair Ben Bernanke, Powell said: “We’ve travel a agelong mode successful argumentation tightening and the stance of argumentation is restrictive … We’ll beryllium monitoring arsenic we measure the grade to which further argumentation firming whitethorn beryllium due to instrumentality ostentation to 2% implicit time.” Noting that the “assessment volition beryllium an ongoing one,” Powell detailed:

As we determination up gathering by gathering having travel this far, we tin spend to look astatine the information and the evolving outlook and marque cautious assessments.

Powell explained that the existent level of the cardinal bank’s benchmark rate, which has an interaction connected assorted user and concern loans, is capable to curtail borrowing, spending, and wide economical growth.

“We look uncertainty astir the lagged effects of our tightening truthful far,” the Fed seat stressed, adding that “the risks of doing excessively overmuch versus doing excessively small are becoming much balanced.”

Furthermore, Powell highlighted that the caller turmoil successful the banking sector, resulting from the caller illness of 3 large banks, is apt to pb banks to standard backmost their lending activities. This simplification successful the lending gait could weaken the economy.

Noting that events successful the banking assemblage “are contributing to tighter recognition conditions and are apt to measurement connected economical growth, hiring, and inflation,” the Fed seat emphasized:

As a result, our argumentation complaint whitethorn not request to emergence arsenic overmuch arsenic it would person different to execute our goals … Of course, the grade of that is highly uncertain.

Powell added that the information has continued to enactment the Fed’s presumption that “bringing ostentation down volition instrumentality immoderate time.”

Do you deliberation the Federal Reserve volition intermission raising involvement rates adjacent month? Let america cognize successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)