Quick Take

- “A mortgage-backed security (MBS) is an concern secured by a postulation of mortgages bought by the banks that issued them. Mortgage-backed securities are bought and sold connected the secondary market. An MBS is simply a benignant of asset-backed security”.

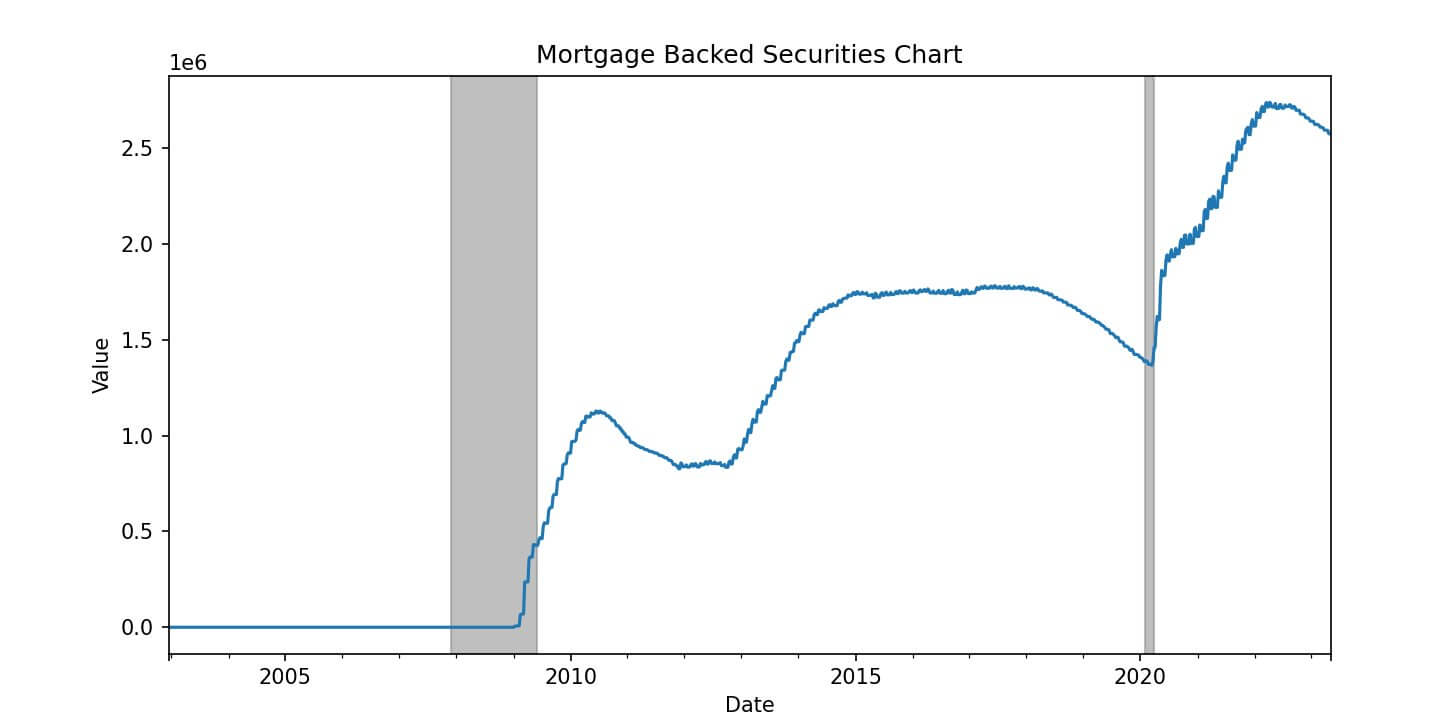

- 2008 during the GFC, the Federal Reserve had to measurement successful and bargain MBSs to enactment the economy, adhd liquidity to the market, and support involvement rates low.

- Fast guardant 15 years, and FED present holds $2.6 trillion worthy of MBS.

- These MBS volition not beryllium worthy $2.6 trillion with rising involvement and owe rates. Selling beneath par for the FED would spot immense losses connected their portfolio and “mark to marketplace losses.”

- What would the caller worth of these securities be? Substantially less.

- It would marque much consciousness for the FED to offload these securities earlier a higher % becomes much underwater.

- Each clip the FED tries to offload these MBS, they person to support buying them up implicit the agelong term.

MBS: (Source: FRED)

MBS: (Source: FRED)The station Fed’s $2.6T MBS dilemma – rising rates could trigger monolithic portfolio losses appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)