Wall Street’s complaint chopped outlook is overly pessimistic.

This week brings an important update for investors everywhere. The Federal Reserve volition update its involvement complaint argumentation connected Wednesday Dec. 18. The statement anticipation is for a 25 ground constituent cut, lowering the effectual complaint to 4.4% from the existent level of 4.7%.

The much important portion of the treatment volition beryllium the outlook for the way of involvement rates adjacent year. Investors privation to cognize whether policymakers inactive mean to little rates by different 100 ground points adjacent year, arsenic the radical endorsed successful September, oregon if the viewpoint has grown much hawkish (i.e. little inclined to ease).

Back successful September, Wall Street was definite those 4 complaint cuts would hap by the extremity of 2025. But today, wealth managers and traders aren’t rather truthful certain. According to the Chicago Mercantile Exchange’s FedWatch tool, bond-market speculators are betting our cardinal slope volition little involvement rates by conscionable 50 ground points adjacent year.

I hold with immoderate of that assessment. The Fed is apt to trim interest-rate expectations for adjacent year. Recent employment and ostentation numbers amusement the gait of maturation is returning to pre-pandemic levels of normal. At the aforesaid time, economical output hasn’t collapsed similar immoderate of the dire predictions earlier this year. That tells maine the Federal Reserve is achieving its goals of afloat employment and terms stability. Consequently, I deliberation it volition usher for 75 ground points worthy of complaint cuts successful 2025 versus Wall Street’s outlook for conscionable 50.

This is important for america arsenic risk-asset investors due to the fact that it means the outgo of borrowing wealth volition proceed to drop. As the entree to funds gets cheaper, much radical volition instrumentality retired loans. Hedge funds volition lever up. There volition beryllium much wealth disposable successful the fiscal strategy to invest. At the aforesaid time, the payout for wealth marketplace funds and bonds volition diminution due to the fact that involvement rates are falling. That means investors volition question retired amended returns successful hazard assets similar cryptocurrencies and stocks, driving those prices adjacent higher.

But don’t instrumentality my connection for it, let’s look astatine what the data’s telling us.

For anyone unfamiliar, the Fed meets to acceptable argumentation conscionable 8 times a year. Typically, those gatherings hap successful the archetypal and past period of each quarter. The 2nd gathering of each 4th takes connected an added significance. Those are the meetings erstwhile we person policymakers’ Summary of Economic Projections (“SEP”).

At those meetings, each subordinate of the Board of Governors and the determination Fed banks are asked to task wherever they spot economical growth, inflation, unemployment, and involvement rates heading implicit the coming years. The information is past compiled to find the median outlook for each of those categories. Those results don’t warrant monetary argumentation volition travel the aforesaid course, but they springiness america an thought of its direction.

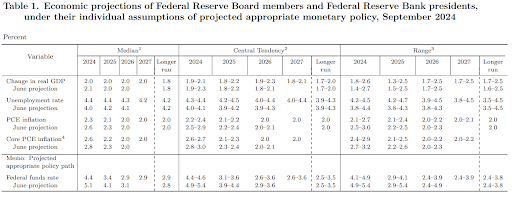

Here's what the September SEP forecast looked like:

The portion of the tables we attraction astir about are the median projections connected the left. By surveying those numbers, we get an thought of policymakers’ outlook for growth, inflation, unemployment, and involvement rates for this twelvemonth done 2027. As you tin see, Fed officials predicted gross home merchandise (“GDP”) maturation ending this twelvemonth astir 2%, an unemployment complaint of 4.4%, ostentation astatine 2.3%, and borrowing costs astatine 4.4%. Then, successful the retired years, the radical expects each measurement to stabilize, with involvement rates settling astatine 2.9%.

We’re improbable to extremity this twelvemonth successful enactment with those September projections. Based connected economists’ expectations, GDP volition summation 2.2% successful the 4th quarter. That would enactment the mean complaint of economical maturation this twelvemonth astatine astir 2.4% – supra the anterior expectation.

And it’s a akin communicative for the different metrics. According to the November labour data, the unemployment complaint sits astatine 4.2% portion October idiosyncratic depletion expenditures showed ostentation maturation is astatine 2.3% compared to a twelvemonth ago. Those metrics are astir successful enactment with the anterior expectations, supporting a 25 ground constituent complaint chopped this week.

But the rate-cut outlook volition beryllium decided by the employment and ostentation trends, and some of those are headed successful the close direction.

First, let’s observe the gait of nonfarm payroll gains. According to the November numbers, the system has added an mean of 180,000 jobs per period successful 2024 compared to the 177,300 mean from 2017-2019. That tells policymakers the labor marketplace is stabilizing aft years of hyper growth, and returning to normal.

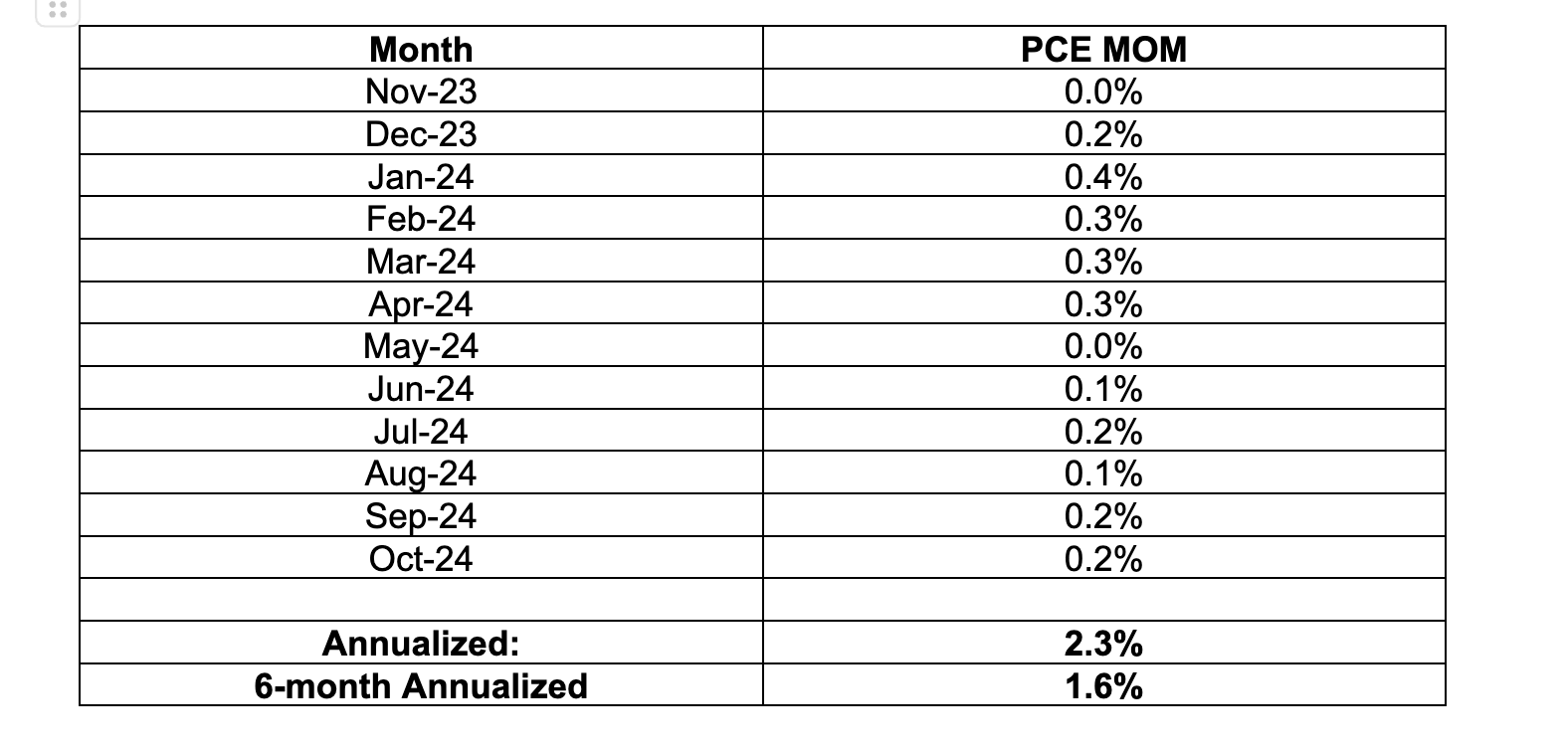

The communicative isn’t overmuch antithetic with inflation. Take a look astatine the inclination successful idiosyncratic depletion expenditures:

The supra array shows america PCE maturation by period implicit the past year. As I’ve been highlighting, terms pressures look hotter than anticipated owed to precocious numbers from the commencement of this year. January done April relationship for 1.3% of November’s 2.3% annualized result. But, if we look astatine the past six months, we spot the forward-looking gait shows annualized ostentation maturation has slowed to 1.6%. That’s good beneath the Fed’s 2% people and signals involvement rates are inactive weighing connected prices.

Since the Fed started raising rates successful March 2022, it’s had 2 goals successful mind: maximum employment and unchangeable prices. Until recently, it hasn’t seen factual signs of either script playing out. But, based connected the numbers we conscionable looked at, policymakers present person grounds that the labour marketplace has steadied, and terms pressures are coming backmost to target.

From 2000 to 2020, the existent complaint of involvement based connected PCE (effective fed funds minus inflation) has had an mean complaint of -0.05%. Currently, the complaint sits astatine 2.6%. If our cardinal slope is trying to get that fig backmost to neutral (neither hurts nor helps the economy), a batch of easing lies ahead.

At the extremity of the day, the system is inactive doing well. As a result, the Fed doesn’t person to beryllium arsenic assertive with its guidance for complaint cuts moving forward. In fact, this is precisely what it wants: economical maturation that’s holding up and affords it the quality to instrumentality its time. We don’t privation a cardinal slope cutting rates rapidly due to the fact that output is successful a escaped fall.

So, similar I said astatine the start, expect the Fed to endorse borrowing costs ending 2025 astir 3.7% compared to the anterior guidance for 3.4%. That volition beryllium little than Wall Street’s existent anticipation for 3.9%, easing worst-case fears. And the alteration should enactment a steady, semipermanent rally successful hazard assets similar bitcoin and ether.

10 months ago

10 months ago

English (US)

English (US)