The U.S. Federal Reserve lowered its benchmark fed funds complaint by 25 ground points to the 4.25%- 4.50% range, its 3rd consecutive easing determination this twelvemonth and present marking a full of 100 ground points of complaint cuts since September.

Market participants had afloat expected Wednesday's determination by the cardinal bank, but recent data had shown continued coagulated economical maturation and perky inflation. This turned the absorption contiguous to the argumentation statement, updated economical projections and the upcoming property league with Chairman Jerome Powell for clues astir the Fed's reasoning connected aboriginal argumentation actions.

The Fed's quarterly economical projections — which see the "dot plot" indicating wherever the cardinal slope expects the Fed funds complaint to onshore implicit clip — uncover that policymakers expect the Fed funds complaint to diminution to 3.9% by year-end 2025 oregon different 50 ground points successful complaint cuts adjacent year. That's higher than the 3.4% projected successful September, signaling a little dovish monetary argumentation successful 2025.

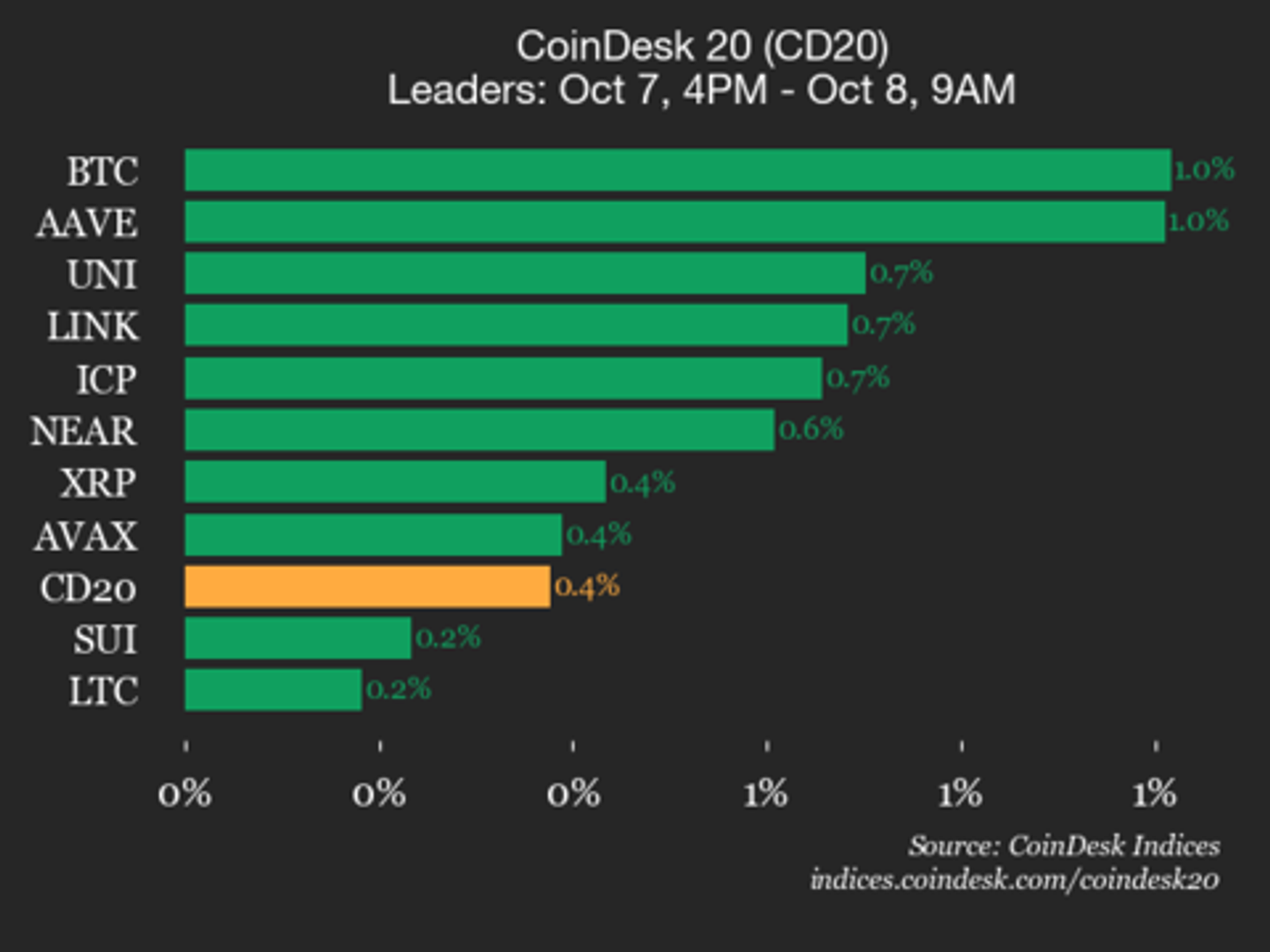

Already little successful the session, the terms of bitcoin (BTC) traded somewhat supra $104,000 successful the minutes pursuing the announcement. The S&P 500 scale besides fell to a league debased connected Wednesday.

“I deliberation the biggest headache for the Fed close present is the information that fiscal conditions person inactive tightened contempt the Fed cutting rates," Andre Dragosch, European Head of Research astatine Bitwise, told CoinDesk anterior to today's action. "Long enslaved yields and owe rates person accrued since September and the dollar has appreciated which besides implies a tightening successful fiscal conditions."

“A continued appreciation of the US dollar besides poses a macro hazard for bitcoin since dollar appreciation is associated with planetary wealth proviso contraction arsenic good which tends to beryllium atrocious for bitcoin and different crypto assets," Dragosch continued. "In fact, Fed nett liquidity continues to decrease. Tightening liquidity and beardown dollar is besides the biggest hazard for BTC successful my presumption … On the different hand, on-chain factors for BTC proceed to beryllium precise supportive, successful peculiar the ongoing diminution successful speech balances which supports the proposal that the BTC proviso shortage continues to intensify."

Fed Chairman Jerome Powell volition clasp a post-meeting property league astatine 2:30 p.m. ET, which volition supply further signals astir the U.S. cardinal bank's intentions.

9 months ago

9 months ago

English (US)

English (US)