Crypto ownership successful the UK has increased to 12% of adults, up from 10%, according to the Financial Conduct Authority’s (FCA) latest probe published connected Nov. 26. Awareness of cryptocurrencies besides grew, reaching 93% of the big population.

The FCA’s survey revealed that the mean worth of crypto holdings per idiosyncratic roseate from £1,595 to £1,842. Family and friends emerged arsenic the astir communal root of accusation for those who person ne'er purchased integer assets, portion lone 1 successful 10 buyers admitted to doing nary probe earlier investing.

Approximately a 3rd of respondents believed they could record a ailment with the FCA successful lawsuit of issues, seeking recourse oregon fiscal protection. However, integer assets stay mostly unregulated successful the UK and are considered high-risk; investors are cautioned that they could suffer each their wealth without immoderate regulatory safeguards.

FCA crypto attack hampering progress

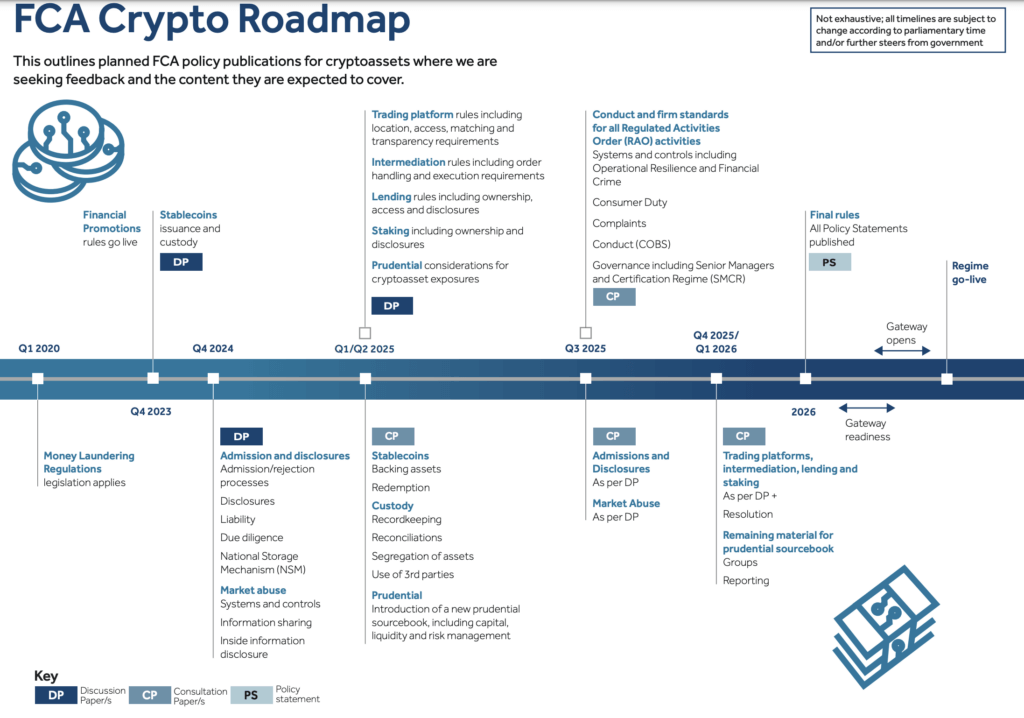

The FCA has begun outlining its attack to regulating integer assets, publishing an indicative roadmap of cardinal dates for the improvement and instauration of the UK’s crypto regulatory regime. The roadmap details a bid of focused consultations aimed astatine fostering transparency and engagement successful argumentation development.

Arun Srivastava, fintech and regularisation spouse astatine Paul Hastings, told CryptoSlate

“The UK was successful information of becoming an outlier, with the EU’s MiCA regularisation coming into afloat unit astatine the extremity of this twelvemonth and the alteration successful the US Administration successful the US heralding a caller and crypto-friendly attack successful the US.

The caller rules volition materially alteration the existent regulatory model successful the UK, which operates nether anti-money laundering authorities focused connected fiscal crime.”

The probe besides indicated shifts successful user behavior. More individuals are considering crypto arsenic portion of a broader concern portfolio, with power from friends and household cited arsenic a superior crushed for acquisition by 20% of participants. The usage of semipermanent savings to bargain crypto accrued from 19% successful 2022 to 26% successful 2024, portion purchasing with recognition cards oregon overdrafts roseate from 6% to 14% implicit the aforesaid period.

The FCA’s investigation suggests that caller events person affected user request for integer assets, including the crypto marketplace clang successful 2022, the cost-of-living crisis, transgression charges against CEOs of large exchanges, and rising crypto valuations since the extremity of 2023.

Notably, 26% of non-crypto users indicated they would beryllium much apt to put if the marketplace and activities were regulated. The FCA acknowledges that regularisation tin power user behaviour and is considering however to mitigate risks associated with integer assets done its argumentation work.

FCA crypto roadmap by 2026

Per the FCA’s roadmap, the planned regulatory model for integer assets includes aggregate phases spanning from 2023 to 2026. Key milestones impact implementing fiscal promotion rules, regulating stablecoin issuance and custody, introducing prudential standards, and establishing broad rules for trading platforms, intermediation, lending, and staking.

Matthew Long, manager of payments and integer assets astatine the FCA, stated:

“Our probe results item the request for wide regularisation that supports a safe, competitive, and sustainable crypto assemblage successful the UK. We privation to make a assemblage that embraces innovation and is underpinned by marketplace integrity and user trust.”

FCA crypto roadmap (Source: FCA)

FCA crypto roadmap (Source: FCA)Following legislative changes, the FCA has been liable for regulating integer plus promotions since October 2023. In the archetypal twelvemonth nether this regime, the FCA has issued 1,702 alerts, taken down implicit 900 scam crypto websites, and removed much than 50 apps to combat amerciable promotions targeting UK consumers.

The station FCA to hold till 2026 to motorboat authoritative crypto argumentation with 12% of UK owning integer assets appeared archetypal connected CryptoSlate.

11 months ago

11 months ago

English (US)

English (US)