Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin returned to its acquainted terms scope implicit the week aft a dip past play brought its price to conscionable nether $99,000. This was followed by a bounce to the $106,000 terms level, which has fixed bulls a crushed to stay hopeful.

However, on-chain information shows immoderate deeper cracks are forming beneath the surface. The latest on-chain information from analytics steadfast Glassnode shows increasing signs of fatigue successful some spot and futures markets. These are conditions that whitethorn again origin Bitcoin terms to retest $99,000.

Price Support Holds, But Momentum is Clearly Fading

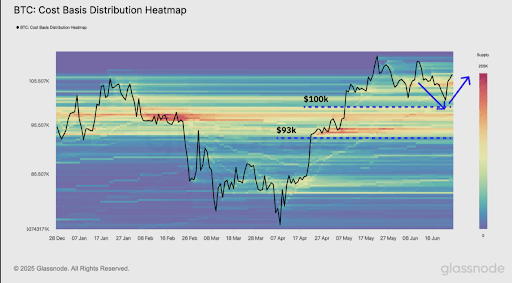

Bitcoin has gone done multiple terms swings successful caller days, but it has recovered its mode backmost to the constrictive $100,000 to $110,000 set that has defined marketplace operation since aboriginal May. On-chain information from Glassnode shows that beardown accumulation betwixt $93,000 and $100,000, which is disposable connected the Cumulative Volume Delta (CBD) Heatmap, has truthful acold served arsenic a buffer portion that helped Bitcoin’s prices bounce during the astir caller geopolitical volatility. However, marketplace measurement indicates that this structural enactment whitethorn soon look further pressure.

According to the latest play study by Glassnode, capitalist profitability and engagement surrounding Bitcoin are cooling rapidly. Specifically, a 3rd large question of profit-taking is causing the 30-day realized nett mean to taper, and on-chain enactment has decreased significantly. The 7-day moving mean of on-chain transportation measurement has dropped by astir 32%, from a highest of $76 cardinal successful precocious May to $52 cardinal implicit the caller weekend. Current spot measurement trading, which is present astatine conscionable $7.7 billion, is acold beneath the volumes seen during erstwhile rallies.

Source: Glassnode connected X

Source: Glassnode connected XThe deficiency of beardown buying enthusiasm connected the spot marketplace shows that bullish sentiment has been replaced by caution. As such, the hazard of a breakdown beneath $99,000 grows unless different question of request re-enters.

Futures Market Also Cooling Off

The slowdown successful sentiment is not constricted to the spot market. Although Bitcoin is attracting involvement connected derivatives exchanges, determination are wide signs that futures sentiment is waning. Open involvement dropped by 7% implicit the weekend, from 360,000 BTC to 334,000 BTC, and backing rates person been declining steadily since Bitcoin deed its Q1 2025 all-time high.

Futures marketplace participants had been precise progressive done Bitcoin’s ascent to $111,800 successful May, but their condemnation appears to beryllium fading now. A further denotation of a increasing reluctance to clasp agelong positions is the crisp diminution successful some the annualized backing complaint and the 3-month rolling basis.

Without stronger directional conviction, the futures markets whitethorn not supply the upside needed to propulsion Bitcoin to caller highs. This concern whitethorn alternatively lend to further downward pressure.

So far, Bitcoin has respected the $93,000 to $100,000 enactment zone, which was heavy accumulated during the Q1 2025 apical formation. However, with debased spot volumes, on-chain enactment slowing, and fading futures sentiment, this enactment could go tested again. If marketplace participants with a outgo ground successful this portion statesman to sell, the resulting unit could resistance Bitcoin beneath $99,000 again adjacent week.

At the clip of writing, Bitcoin is trading astatine $107,100.

Featured representation from Pixabay, illustration from Tradingview.com

4 months ago

4 months ago

English (US)

English (US)