During the Covid-19 pandemic, cardinal banks specified arsenic the U.S. Federal Reserve loosened fiscal and monetary policy. Now, these aforesaid fiscal institutions are seemingly engaging successful quantitative tightening (QT) practices. According to Nick Gerli, CEO and laminitis of Reventure Consulting, “the wealth proviso is officially contracting.” This has lone happened 4 times successful the past 150 years. Gerli warns that each clip it occurs, a slump takes spot with double-digit unemployment rates.

The Contraction of Money Supply and its Impact connected the Economy

Several marketplace analysts and economists are uncertain astir the aboriginal of the economy, portion galore judge things volition soon get worse owed to important ostentation and failures successful cardinal planning. When the Covid-19 pandemic hit, the U.S. authorities and galore different nation-states worldwide financed trillions of dollars successful indebtedness to prolong the economy. The indebtedness has grown to colossal levels, and galore judge it could descend respective Western economies. Speculators importune that this volition harm the dollar and that lone hard assets volition past the fallout.

In a caller interview astatine the 2023 BMO Metals, Mining, & Critical Minerals Conference, Rob McEwen, enforcement president of McEwen Mining, said, “Hard assets volition summation successful worth arsenic the dollar drops successful comparative worth to different currencies due to the fact that governments are irresponsible. They bargain from their citizens by printing excess wealth and borrowing successful ways they shouldn’t … Look astatine the magnitude of indebtedness astir of the Western satellite has close now; it’s enormous.”

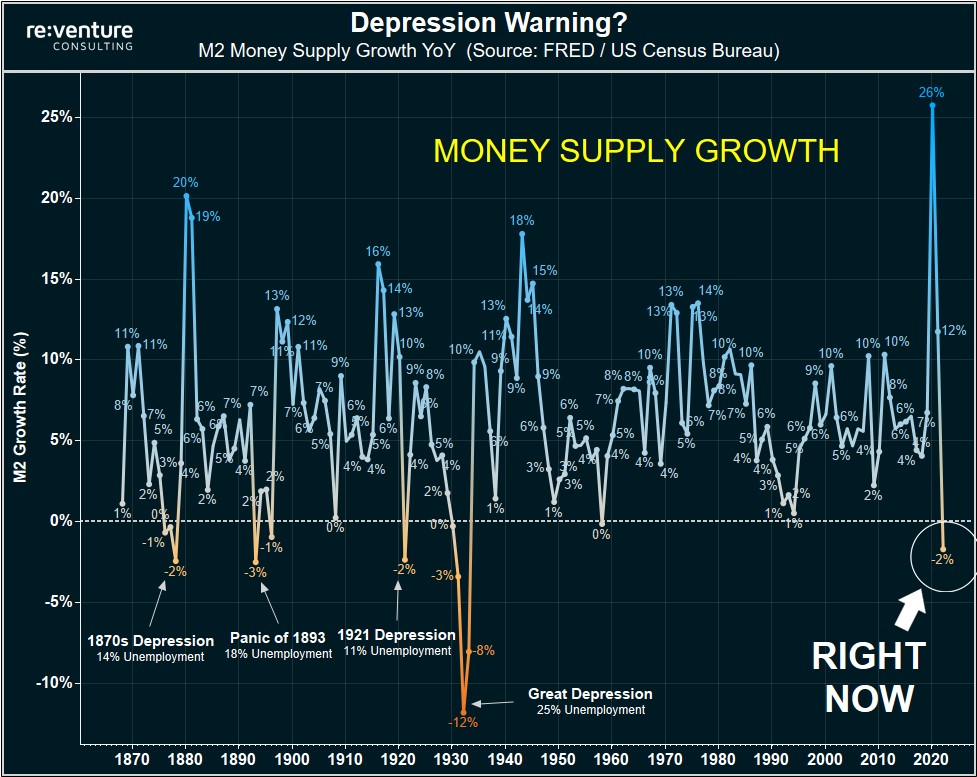

On March 8, 2023, Nick Gerli, CEO and laminitis of Reventure Consulting, warned that the wealth proviso is contracting. ‘The wealth proviso is officially contracting,’ Gerli said Wednesday. This has lone happened 4 erstwhile times successful the past 150 years, and each time, a slump with double-digit unemployment rates followed.

Picture shared by Gerli connected March 8, 2023. Gerli’s Reventure Consulting shares play insights connected existent property and finance.

Picture shared by Gerli connected March 8, 2023. Gerli’s Reventure Consulting shares play insights connected existent property and finance.The Reventure enforcement insists that erstwhile the wealth proviso contracts portion ostentation rises, it creates a “nasty combination” due to the fact that determination are less dollars disposable to wage for higher prices, yet starring to a deflationary crash.

Gerli added:

This is precisely what happened successful the slump of 1921. (NOT the Great Depression). This occurred aft WWI and the Spanish Flu. Where determination were years of precocious inflation/money proviso growth. And then…WHAM. 11% Deflation and the unemployment complaint skyrocketed. All it took was a -2% contraction successful the wealth proviso successful 1921 to origin that deflationary depression.

The Reventure enforcement noted that determination has already been a 2% contraction successful 2023. Gerli says that this suggests that ‘the resilience of our system and the existent ostentation mightiness not beryllium arsenic beardown arsenic radical think.’ However, Gerli admits that determination is inactive a important magnitude of wealth circulating successful the fiscal strategy successful 2023, with the wealth proviso being astir 35% higher than it was pre-pandemic, astatine $21 trillion. Despite this, past shows that conscionable a small nudge and slump and deflation could mount.

“[The] humanities grounds is clear: Depressions/Deflation don’t request a ‘linear’ alteration successful wealth proviso to occur— It conscionable needs to beryllium a small bit. 2-4% contraction YoY — And past problems occurs,” Gerli added.

Gerli thinks that radical are too focused connected complaint hikes and not paying attraction to quantitative tightening (QT) practices and the wealth supply. He thinks that astatine the existent pace, the wealth proviso volition shrink much portion recession fears are mounting and ostentation continues to persist. “That’s however you get a strategy meltdown and a deflationary depression,” Gerli stressed. The Reventure enforcement added that a deflationary slump successful 2023-24 is “not a guarantee.” Because governments are watching diligently, determination is simply a anticipation they mightiness “attempt to people wealth again, nonstop stimulus checks, and re-ignite inflation/economy,” according to Gerli.

Tags successful this story

BMO Metals, borrowing, Central Banks, central planning, Covid-19 pandemic., Critical Minerals Conference, debt, deflationary crash, Depression, Depression of 1921, Dollar, economists, excess money, Fiscal policy, Government, hard assets, historical record, inflation, market analysts, McEwen Mining, mining, Monetary Policy, money supply, Nick Gerli, Quantitative tightening, rate hikes, recession fears, Reventure Consulting, Rob McEwen, Spanish Flu, speculators, Stimulus Checks, system meltdown, trillions of dollars, U.S. Federal Reserve, unemployment rates, Western economies

What bash you deliberation the authorities should bash to code the imaginable contraction of the wealth proviso and the menace of deflationary depression? Share your thoughts successful the comments below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)