Charles Edwards, the laminitis of Capriole Investments, has precocious provided an investigation successful Capriole’s Update #13, predicting a important upswing successful the Bitcoin terms to $58,000. His forecast is rooted successful a elaborate introspection of marketplace trends, ETF developments, method patterns, and cardinal indicators.

In-Depth Market Analysis Of The Bitcoin Market

The investigation begins with a elaborate look astatine the market’s caller behavior, focusing connected the aftermath of Bitcoin ETF launches. Edwards points out, “Two months of chop and ETF readings nether the microscope appears to beryllium resolving to the upside arsenic of writing.”

He highlights the important displacement successful momentum pursuing the archetypal “sell the news” absorption to the ETF launches, noting a sizeable alteration successful outflows from the Grayscale Bitcoin ETF. This change, according to Edwards, aligns with his erstwhile predictions.

Furthermore, Edwards highlights the massive occurrence of Blackrock and Fidelity’s Bitcoin ETFs (IBIT and FBTC), which person collectively absorbed implicit $6 cardinal successful assets successful little than a month. This accomplishment not lone underscores the ETFs’ historical motorboat occurrence but besides signals a broader acceptance of Bitcoin wrong the accepted concern sector.

“Bitcoin [is] the astir palmy ETF motorboat successful past by a precise wide margin,” Edwards notes, referencing information from Eric Balchunas to stress the unprecedented standard of Bitcoin’s introduction into the ETF market.

Here's a look astatine the Top 25 ETFs by assets aft 1 period connected the marketplace (out of 5,535 full launches successful 30yrs). $IBIT and $FBTC successful league of ain w/ implicit $3b each and they inactive person 2 days to go. $ARKB and $BITB besides made list. pic.twitter.com/Yyi1nxukUk

— Eric Balchunas (@EricBalchunas) February 8, 2024

A large milestone successful Bitcoin’s organization adoption is Fidelity’s determination to see Bitcoin successful its “All-in-One Conservative ETF.” Edwards considers this determination a important endorsement of Bitcoin’s worth arsenic an concern asset, stating, “Bitcoin is yet being acknowledged successful accepted concern vehicles.”

He predicts that this could acceptable a precedent, with astir large ETFs apt to allocate betwixt 1-5% to Bitcoin successful the adjacent 12-24 months, emphasizing the captious value of this improvement for Bitcoin’s mainstream acceptance.

Technical Outlook And BTC Price Prediction

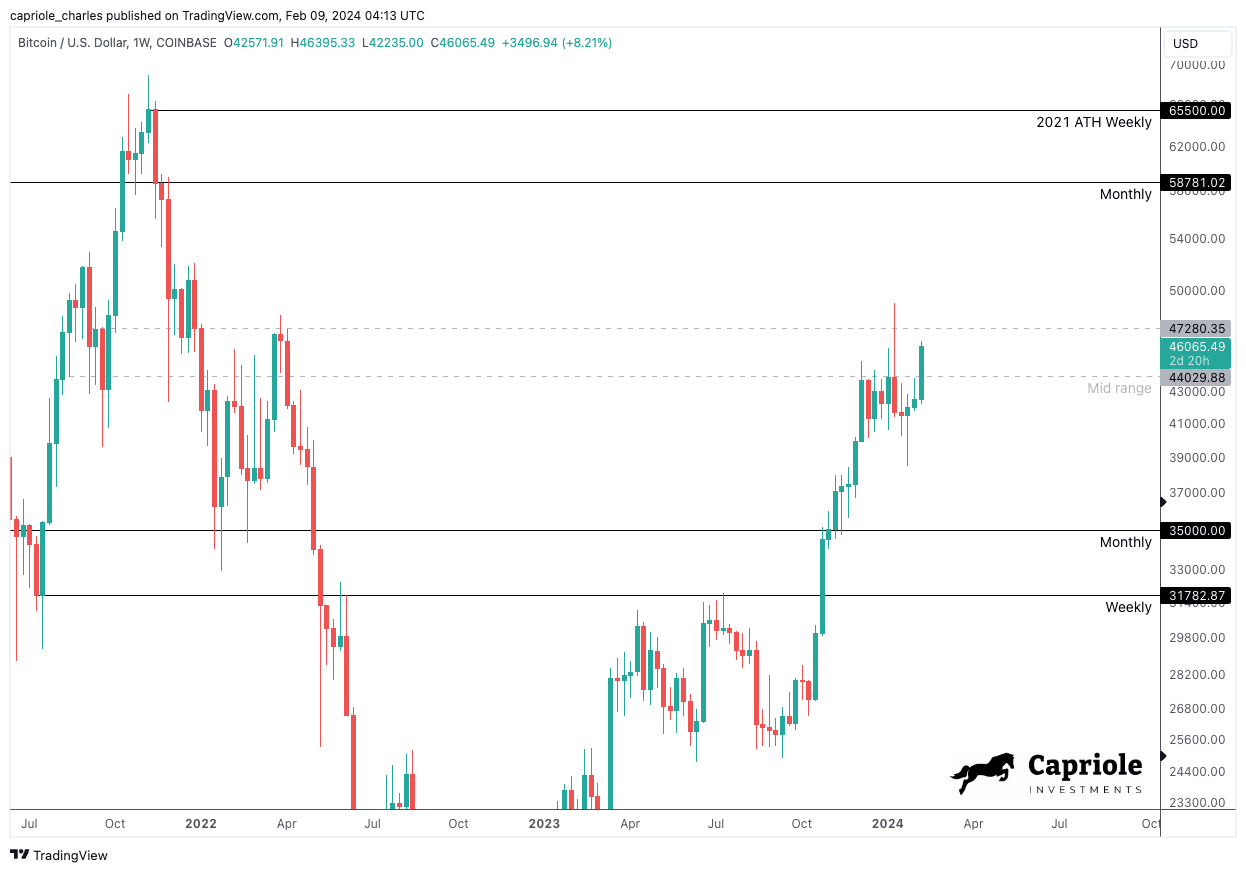

Turning to the method analysis, Edwards points retired the bullish inclination that has taken shape, with Bitcoin breaking past the $44,000 resistance level. This breakout, according to Edwards, is simply a beardown indicator of the market’s bullish sentiment and a precursor to further gains.

He notes, “The Weekly closing supra $47K mid-range bound connected Sunday would springiness a large method confirmation of a caller bullish trend,” highlighting the value of this level arsenic a determinant of the market’s direction.

Bitcoin terms investigation | Source: Capriole Investments

Bitcoin terms investigation | Source: Capriole InvestmentsFurthermore, Edwards elaborates connected the debased timeframe technicals, indicating a measured determination towards the monthly resistance, which presents an charismatic risk-to-reward (R:R) setup for investors. This method breakout, combined with the strategical absorption of risk, underscores the imaginable for important terms appreciation successful the adjacent term.

A cleanable breakout connected the regular timeframe of the $44K absorption is suggestive of a measured determination to Monthly resistance. This is simply a bully R:R setup. ‘Risk’ tin beryllium easy managed (a adjacent backmost into the scope astatine $44K would beryllium a logic stop) with “Reward” 3-4X higher astatine $58-65K.

Fundamentals Turn Bullish

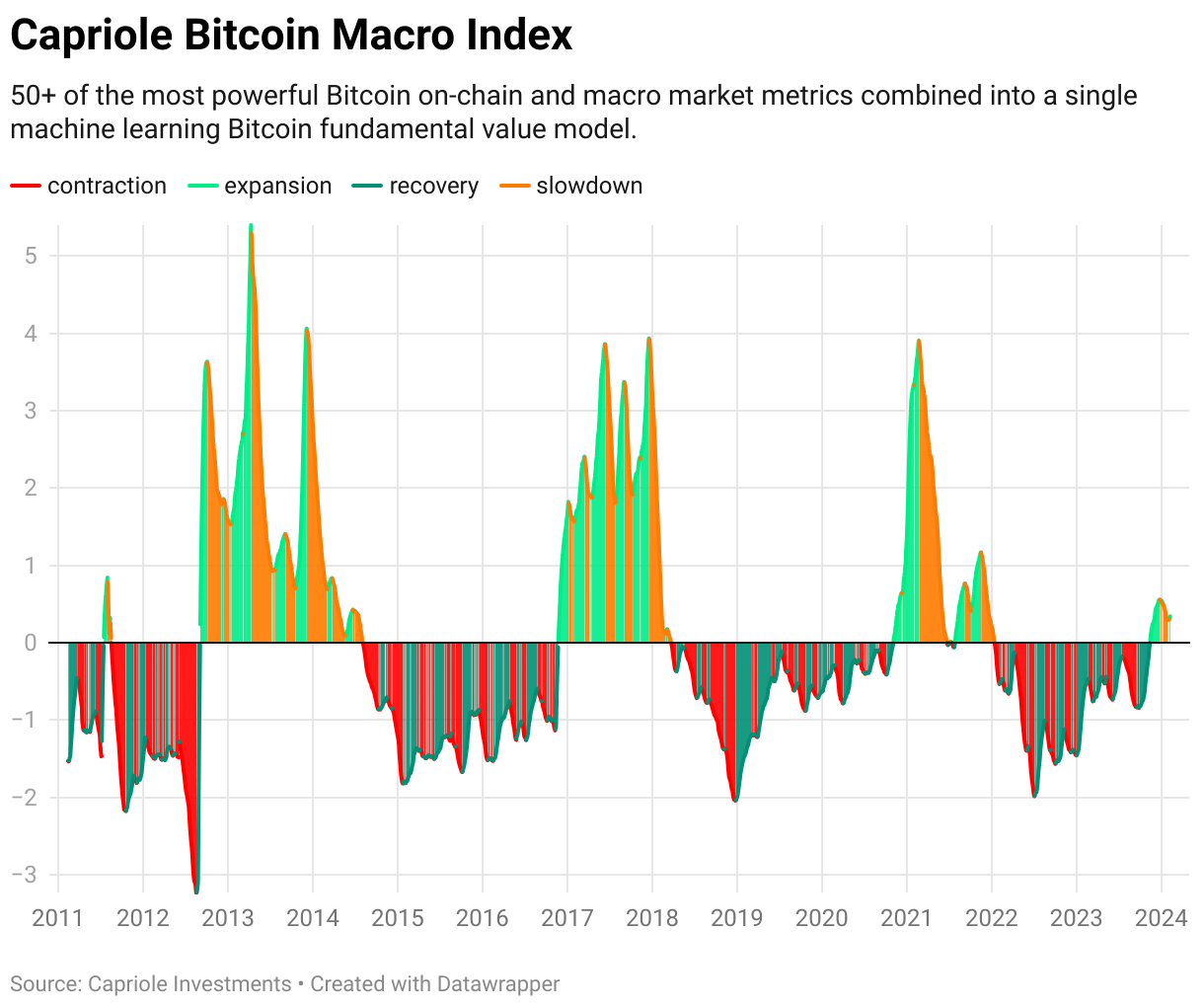

The instauration of Edwards’ bullish outlook is besides built connected a robust investigation of fundamentals and on-chain data. The Capriole’s Bitcoin Macro Index, which aggregates implicit 50 Bitcoin-related metrics into a azygous model, plays a important relation successful this analysis.

“The cardinal uptrend resumed connected Wednesday which is besides supportive of continuation of the method move. We privation to spot on-chain cardinal maturation proceed with terms to enactment confirmation of this mid-range breakout. Monday’s speechmaking volition beryllium peculiarly important,” Edwards states.

Capriole Bitcoin Macro Index | Source: Capriole Investments

Capriole Bitcoin Macro Index | Source: Capriole InvestmentsEdwards’ investigation concludes connected a bullish note, with a wide method breakout and a modulation of on-chain fundamentals into maturation territory. “ETF FUD cleared. A Technical breakout connected the regular timeframe and on-chain fundamentals transitioning into growth,” helium summarizes, pointing towards a beardown commencement to February and mounting an optimistic code for Bitcoin’s short-term future.

At property time, BTC traded astatine $46,790.

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)