Europe remains fertile crushed for the cryptocurrency ecosystem to flourish successful examination to harsher regulatory environments, according to salient speakers astatine this year’s Blockchain Expo successful Amsterdam.

Cointelegraph attended the normal held astatine the RAI league halfway for the 2nd twelvemonth running, with the Blockchain Expo forming portion of the larger Tech Expo lawsuit being hosted successful the Netherlands.

The lawsuit has typically attracted salient mainstream manufacture players from the fiscal satellite to showcase however blockchain exertion is being leveraged to powerfulness innovative caller products and solutions crossed a myriad of industries.

From finance, logistics, wellness attraction and marketing, blockchain exertion and Web3 functionality continues to beryllium a cardinal country of maturation for antithetic manufacture players.

MiCA bodes good for organization adoption

Regulatory matters stay beforehand and center, arsenic was evident successful a fireside chat featuring Coinbase organization income co-head James Morek and Zodia Markets co-founder Nick Philpott.

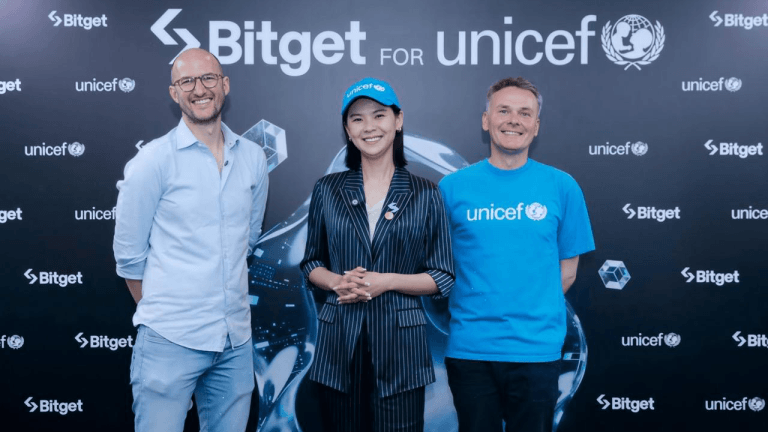

Trendmaster co-founder Chris Uhler, Zodia Markets co-founder Nick Philpott and Coinbase co-head of EMEA & APAC organization income James Morek onstage successful Amsterdam.

Trendmaster co-founder Chris Uhler, Zodia Markets co-founder Nick Philpott and Coinbase co-head of EMEA & APAC organization income James Morek onstage successful Amsterdam.Philpott, who established the institutional-grade cryptocurrency trading platform, described the European Union’s Markets successful Crypto-Assets (MiCA) regularisation arsenic a progressive regulatory measurement to usher the maturation of the assemblage portion protecting users.

“Institutions consciousness much comfy knowing that determination is simply a model wrong which they tin operate, which is astatine likelihood with what is happening successful countries similar America.”Philpott’s notation to the United States’ regulatory scenery centered connected the unreality of uncertainty that hangs implicit the cryptocurrency ecosystem. This has been chiefly driven by the Securities and Exchange Commission’s abstracted enforcement actions against cardinal manufacture players, including Coinbase, Ripple and Binance.US, for alleged securities violations.

Morek, who heads up Coinbase’s organization income successful the EMEA and APAC regions, besides highlighted the constitution of wide regulatory parameters crossed the EU and successful the United Kingdom which person helped crypto-related firms proceed to bash business.

Off-the-record conversations besides suggest that large players similar Coinbase proceed to pull involvement from organization clients looking to summation vulnerability oregon custody of definite cryptocurrencies extracurricular of the U.S.

Related: EU’s caller crypto law: How MiCA tin marque Europe a integer plus hub

This includes a myriad of imaginable clients, ranging from accepted money managers, ample corporates, backstage banks and a assortment of businesses. Morek told Cointelegraph that Coinbase presently serves implicit 1300 organization customers globally.

Legal frameworks that person agelong allowed companies to person some onshore and offshore entities proceed to beryllium an important constituent successful allowing cryptocurrency exchanges and companies to connection services successful antithetic jurisdictions.

Philpott besides highlighted the United Arab Emirates arsenic a fast-growing crypto and Web3 hub that is actively looking to pull the biggest firms successful the industry. The likes of Binance person already established a foothold successful the UAE, portion Coinbase was reportedly exploring mounting up a basal of operations successful the jurisdiction earlier successful 2023.

A tokenized future

Tokenization besides remains a drawcard for a assortment of institutions, including mainstream banks and fiscal firms looking to contented and negociate indebtedness and investments.

Cointelegraph besides spoke to Martijn Siebrand from Dutch slope ABN AMRO. Siebrand is the bank’s integer assets ecosystem manager and helium shared insights into ABN AMRO’s recent issuance of a integer greenish enslaved that made usage of Polygon’s layer-2 Ethereum scaling exertion to rise 5 cardinal euros ($5.3 million).

ABN AMRO's Martijn Siebrand fields questions from the assemblage during his presumption connected time 1 of the conference.

ABN AMRO's Martijn Siebrand fields questions from the assemblage during his presumption connected time 1 of the conference.Siebrand said that blockchain exertion is proving to beryllium a utile instrumentality for banks to amended service superior markets:

"It's funny, if we person present talks wrong the bank, radical accidental superior markets person been determination for a agelong clip already yet we haven't seen galore innovations. This could beryllium 1 large alteration wherever a batch of banks are investing in."Siebrand added that ABN Amro is already showcasing its blockchain-based integer enslaved exploits astatine conferences and exhibitions to some superior marketplace players similar mainstream banks arsenic good arsenic backstage companies looking to rise funds:

“We spot 2 tracks. We person the organization 1 serving accepted superior markets. But we besides person the accidental to assistance clients that are excessively large for crowdfunding but excessively tiny for superior markets.”Siebrand added that tokenized indebtedness offerings tin beryllium utile for companies that privation to debar selling equity. However, jurisdictional regulatory frameworks request to beryllium further developed earlier ABN AMRO tin make a moving roadmap to further its blockchain tokenization offerings:

“We deliberation that backstage markets involving backstage issuances, which are one-on-one oregon with 2 oregon 3 investors, that volition beryllium easier to to standard than the organization one.”NFTs stay invaluable for institutions

Mia Van, Mastercard’s EMEA blockchain and integer assets, delved into the worth that nonfungible tokens (NFTs) contiguous for organization users. The assemblage has produced $1.9 cardinal successful income volumes implicit the past twelvemonth according to Van, with the mean fig of Web3 wallets expanding contempt sellers dominating NFT marketplaces successful recent months.

According to Van, luxury brands specified arsenic Breitling and Louis Vuitton are actively utilizing NFTs to supply integer twins of items that besides beryllium their provenance. Meanwhile, mainstream brands similar Adidas and Nike proceed to research NFTs and metaverse activations that springiness users ownership of objects successful some the carnal satellite and metaverse environments.

Mastercard is besides becoming portion and parcel of the Web3 ecosystem. Earlier this year, Animoca Brands announced a $30 cardinal concern successful neobank level Hi. A unsocial offering of the level is simply a customizable NFT-styled crypto debit card. Users tin stylize their Mastercards with NFTs they digitally ain - allowing 1 to perchance amusement disconnected that prize Bored Ape in the carnal world.

Van would not beryllium drawn to remark connected Mastercard’s blockchain and integer plus strategy and partnerships.

Magazine: Blockchain detectives: Mt. Gox illness saw commencement of Chainalysis

1 year ago

1 year ago

English (US)

English (US)