Ethereum is connected the verge of reclaiming the $4,000 level arsenic it inches person to its all-time highs. The second-largest cryptocurrency by marketplace headdress has faced skepticism passim this cycle, with immoderate analysts predicting it would underperform compared to its erstwhile bull runs. However, Ethereum has amazed doubters, steadily climbing successful caller weeks contempt marketplace uncertainty.

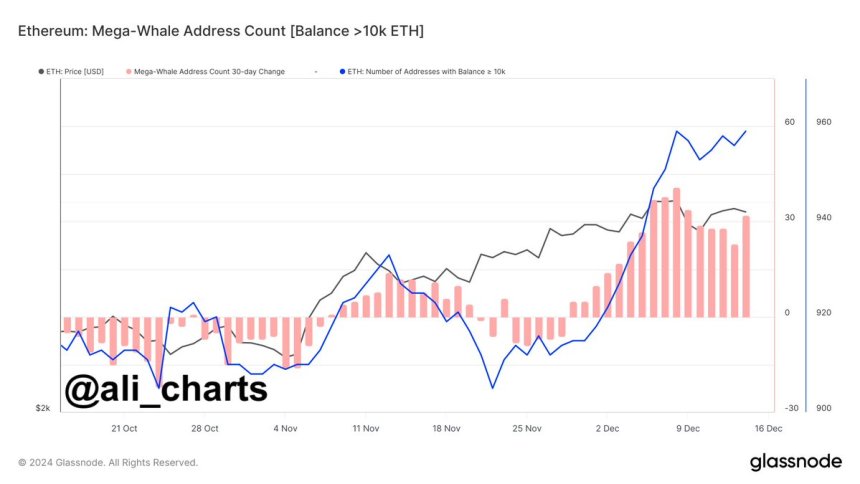

Key on-chain metrics from Glassnode uncover an important inclination that could substance further terms gains: Ethereum whales person been accumulating aggressively since precocious November. This signals increasing assurance among large holders, who are positioning themselves for imaginable upside. Historically, whale accumulation has often preceded important terms moves, hinting astatine the anticipation of a breakout successful the adjacent term.

While the marketplace remains divided connected Ethereum’s trajectory, its quality to prolong upward momentum adjacent the $4,000 people volition apt specify its show successful the weeks ahead. Breaking supra this captious absorption could unfastened the doorway to caller highs and further solidify ETH’s relation arsenic a person successful the ongoing bull cycle.

Ethereum Mega-Whale Balances Grow

Ethereum has experienced a steady, albeit modest, rally since November 5, but it seems the existent fireworks for ETH are yet to ignite. As Bitcoin soars into terms find and respective altcoins outperform expectations, Ethereum investors are searching for wide signals of an impending bull tally for the second-largest cryptocurrency.

Key on-chain information shared by apical analyst Ali Martinez connected X provides intriguing insights into Ethereum’s existent state. Martinez highlights that Ethereum whales—entities holding important amounts of ETH—have been accumulating aggressively since the terms broke supra the $3,330 level.

Ethereum Whales loading up | Source: Ali Martinez connected X

Ethereum Whales loading up | Source: Ali Martinez connected XThis accumulation inclination suggests that astute wealth is positioning itself for what could beryllium a monolithic upward determination successful the months ahead. Historically, whale accumulation has often been a precursor to beardown terms rallies, arsenic these ample investors thin to expect large marketplace shifts earlier retail traders.

However, the communicative isn’t wholly bullish. While whale accumulation whitethorn awesome confidence, it besides raises concerns astir a imaginable bull trap. These ample holders could rapidly pivot, offloading their ETH for different assets if marketplace conditions displacement oregon if Bitcoin’s dominance suppresses altcoin growth. Such a determination could drawback smaller investors disconnected guard, starring to crisp corrections.

For Ethereum, holding supra captious levels similar $3,800 portion breaking cardinal resistances could beryllium the catalyst needed to spark a existent bull run. Until then, ETH remains a watchlist favorite, balancing imaginable and uncertainty.

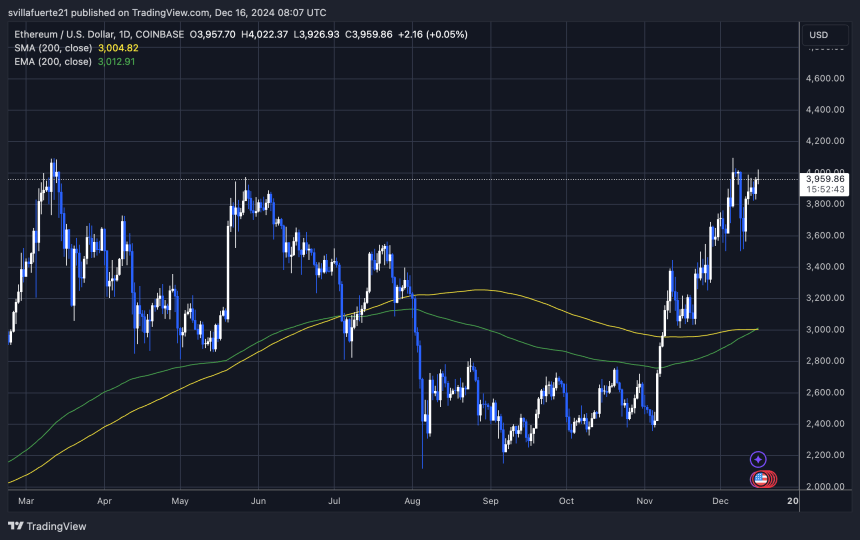

Price Testing Crucial Resistance

Ethereum (ETH) is trading astatine $3,950, struggling to interruption supra the important $4,000 absorption level for respective days. Despite this, the terms remains resilient, signaling beardown marketplace support. Clearing this level is indispensable to corroborate the continuation of the uptrend, arsenic $4,000 represents a intelligence obstruction and a cardinal absorption portion for the asset.

ETH investigating proviso astatine $4,000 | Source: ETHUSDT illustration connected TradingView

ETH investigating proviso astatine $4,000 | Source: ETHUSDT illustration connected TradingViewIf Ethereum fails to breach the $4,000 mark, a retrace toward little request zones astir $3,500 could beryllium expected. This level has served arsenic beardown enactment successful caller weeks, providing a cushion during periods of accrued selling pressure. A pullback to this country could let for renewed buying momentum, mounting the signifier for different effort to interruption higher.

However, caller marketplace dynamics suggest Ethereum whitethorn beryllium poised for a important determination upward. Bitcoin’s surge into terms find and increasing optimism astir altcoins person created a bullish environment. With whales continuing to accumulate ETH, arsenic highlighted by on-chain data, marketplace participants are progressively assured successful Ethereum’s quality to retest and surpass its all-time highs.

Featured representation from Dall-E, illustration from TradingView

8 months ago

8 months ago

English (US)

English (US)