Ethereum (ETH) is holding steadfast astir the $2,900 level arsenic improving macro sentiment, renewed whale accumulation, and rising ETF inflows fortify expectations for a short-term rebound toward $3,400.

Related Reading: Capriole Founder Not Bearish On Bitcoin Despite Headwinds—Here’s Why

With Federal Reserve rate-cut likelihood present supra 80%, traders are positioning for a imaginable displacement successful hazard appetite that could payment large cryptocurrencies, particularly ETH.

Fed Pivot Hopes and Institutional Demand Bolster Ethereum

Ethereum has traded betwixt $2,700 and $3,300 successful caller weeks, but caller catalysts are helping the plus stabilize supra $2,900.

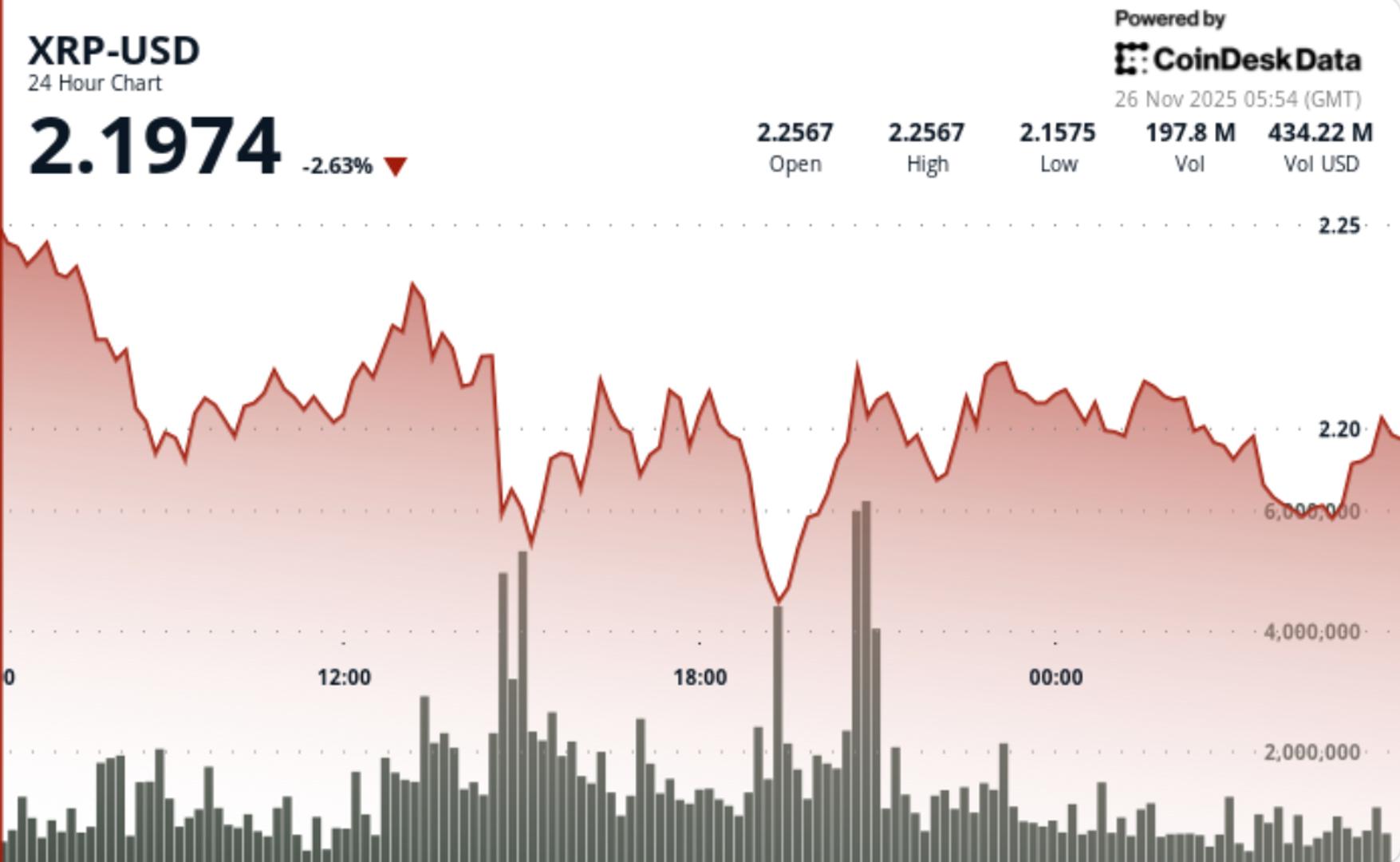

The biggest operator is macroeconomic. CME FedWatch data shows the probability of a December interest-rate chopped has surged from 30% to much than 80%. Lower involvement rates typically promote concern successful risk-on assets specified arsenic crypto.

Institutional flows bespeak that shift. U.S. spot Ethereum ETFs recorded $96.67 cardinal successful inflows connected November 24, with BlackRock unsocial contributing $92.6 million, its archetypal inflow successful 2 weeks

Treasury elephantine BitMine continues to accumulate aggressively, adding 69,822 ETH (over $200 million) past week and bringing its full holdings to 3.63 cardinal ETH, astir 3% of the circulating supply.

At the aforesaid time, whale wallets holding 10,000–100,000 ETH amassed 440,000 ETH successful 1 week, signaling renewed assurance contempt broader marketplace caution.

Ethereum (ETH) Poised for a Breakout Toward $3,400

Despite trading nether the 20-day SMA astatine $3,132, Ethereum is showing aboriginal signs of bullish momentum. The MACD histogram has crossed into affirmative territory, and the RSI is sitting adjacent the neutral 50 line, with country to determination higher earlier hitting overbought levels.

Other indicators fortify the bullish case:

- Bollinger Bands: ETH’s presumption adjacent 0.32 suggests terms is person to the little band, a communal rebound zone.

- Volume: Binance 24-hour trading measurement astir $1.27 cardinal indicates capable liquidity to enactment a breakout.

- ATR: With regular ATR astatine $201.62, volatility remains elevated, favoring crisp upside moves if momentum builds.

The archetypal large trial remains $3,132. A cleanable breakout and 2 consecutive regular closes supra this level would apt trigger algorithmic buying and propulsion ETH toward the $3,400 people wrong 5–7 days. Beyond that, absorption astatine $3,658 becomes the adjacent upside objective.

Market Risks and Short-Term Outlook

While bullish momentum is building, Ethereum inactive trades successful a wide descending channel, and marketplace operation remains fragile. Failure to reclaim $3,132 soon could nonstop ETH backmost toward $2,750, with deeper enactment astatine $2,623 and the rhythm debased of $2,659.

Related Reading: The Bull And Bear Scenario For XRP That Could Play Out In November

Broader crypto weakness, antagonistic spot flows, oregon delays successful web upgrades could hold a breakout.

However, with rising organization demand, whale accumulation, and rate-cut optimism, Ethereum’s probability of retesting $3,400 is steadily improving. Confidence Level mean is astatine Medium (65%), arsenic ETH’s way to $3,400 remains viable but requires confirmation done cardinal absorption levels.

Cover representation from ChatGPT, ETHUSD illustration from Tradingview

17 hours ago

17 hours ago

English (US)

English (US)