On-chain information from Santiment shows the Ethereum shark and whale addresses person registered a maturation of 5.7% implicit the past year.

Ethereum Sharks & Whales Numbers Have Gone Up During The Past Year

According to information from the on-chain analytics steadfast Santiment, determination are present astir 380 much sharks and whales successful the marketplace compared to 12 months ago.

The applicable indicator present is the “ETH Supply Distribution,” which tells america astir the full magnitude of Ethereum that each wallet radical successful the assemblage is presently holding. Addresses are divided into these “wallet groups” based connected the fig of coins that they are carrying successful their balances close now.

The 10-100 coins cohort, for instance, includes each wallets that are holding betwixt 10 and 100 ETH astatine the moment. The Supply Distribution metric for this circumstantial radical would measurement the sum of the idiosyncratic balances of each addresses connected the web that are satisfying this condition.

Related Reading: Bitcoin Accumulation: HODLers Are Buying 15,000 BTC Per Month

In the discourse of the existent discussion, the investors of involvement are those holding astatine slightest 1,000 ETH, meaning that the applicable scope present would beryllium 1,000 to infinite coins.

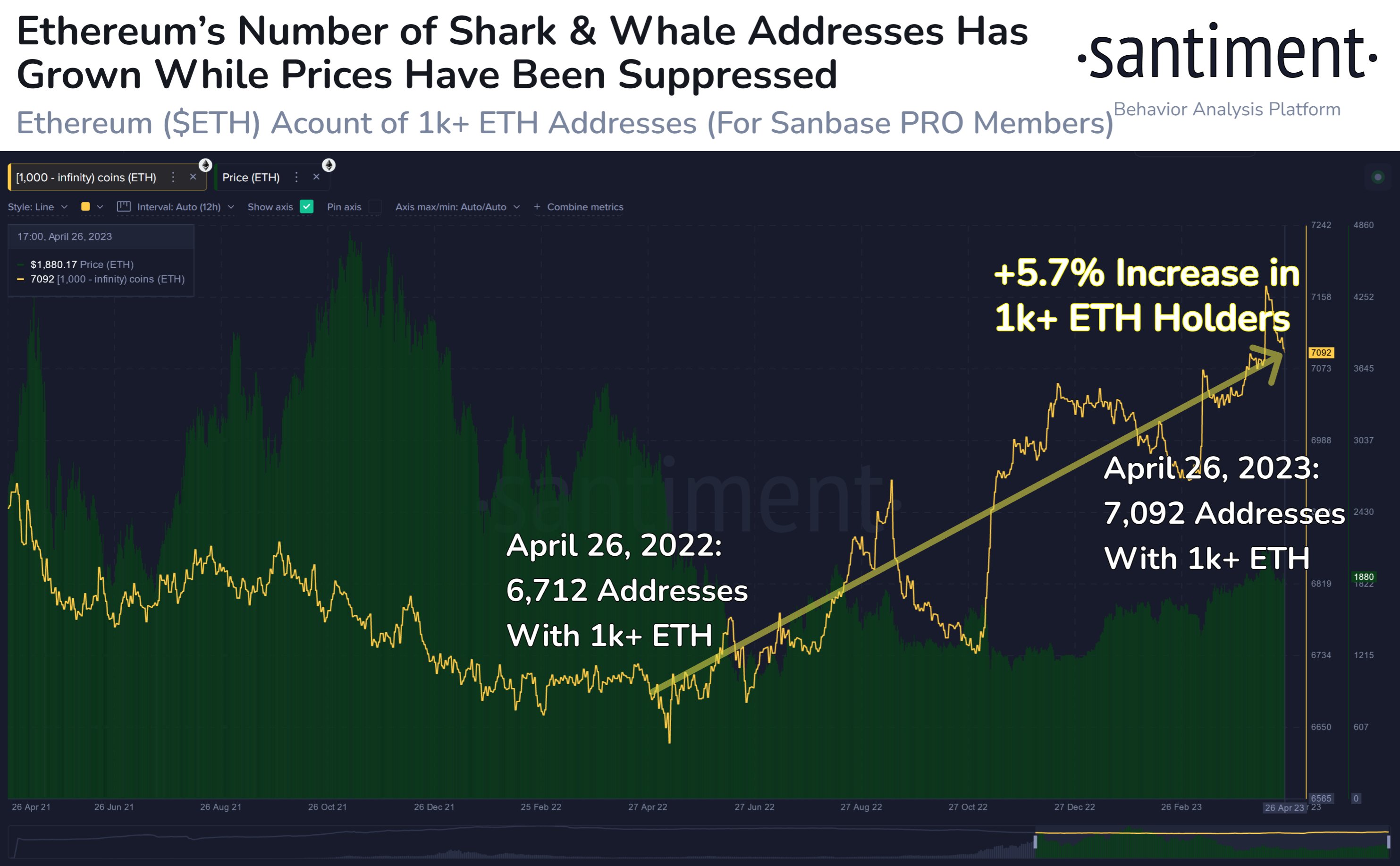

Here is simply a illustration that shows the inclination successful the Ethereum Supply Distribution for specified investors implicit the past mates of years:

This wallet scope of astatine slightest 1,000 ETH (worth astir $1.9 cardinal astatine the existent speech rate) includes 2 precise important cohorts for Ethereum: the sharks and whales.

These investors tin beryllium rather influential successful the marketplace arsenic they clasp specified ample amounts successful their wallets (with the whales people being much almighty than the sharks since they are the larger of the two. Because of this reason, their behaviour whitethorn supply hints astir wherever the marketplace whitethorn beryllium headed successful the agelong term.

As displayed successful the supra graph, the Supply Distribution for the 1,000+ ETH scope had a worth of 6,712 a twelvemonth ago. Since then, the indicator has enjoyed an wide uptrend and its worth has risen to 7,092 today.

This implies that 380 caller addresses belonging to sharks and whales person travel up connected the web during the past year, representing an summation of astir 5.7%.

Ethereum saw a diminution during astir of the past twelvemonth arsenic the carnivore marketplace tightly gripped the cryptocurrency. Overall, the plus is inactive down 35% successful this period, meaning that these humongous holders person been buying portion the worth of the plus has been comparatively low.

From the chart, it’s disposable that the astir important buying spree successful this play came conscionable pursuing the illness of the cryptocurrency speech FTX. This suggests that the sharks and whales saw the lows pursuing this clang arsenic a profitable buying opportunity.

And indeed, their accumulation determination looks to person paid disconnected truthful far, arsenic those lows present look to beryllium the lowest constituent for this carnivore market. These holders person besides continued to bargain a nett magnitude successful the current rally truthful far, meaning that they are supportive of the terms surge. Naturally, this tin beryllium a affirmative motion for bullish momentum successful the agelong term.

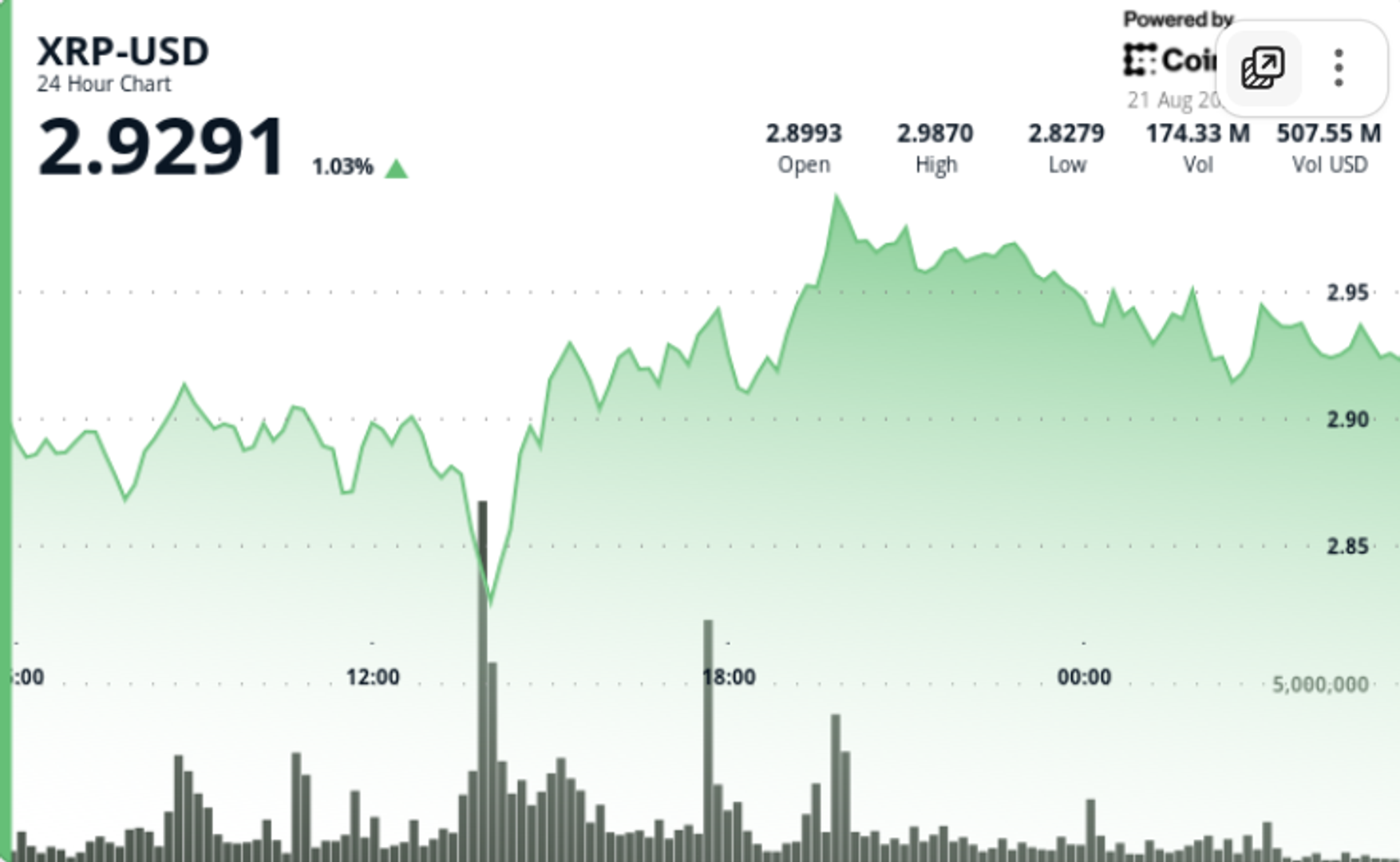

ETH Price

At the clip of writing, Ethereum is trading astir $1,900, down 1% successful the past week.

Featured representation from Bastian Riccardi connected Unsplash.com, charts from TradingView.com, Santiment.net

2 years ago

2 years ago

English (US)

English (US)