A cardinal facet of the Ethereum ecosystem is its organisation and enactment crossed centralized (CEX) and decentralized exchanges (DEX). Analyzing this displacement is important for grasping the marketplace dynamics of the second-largest cryptocurrency and knowing its position.

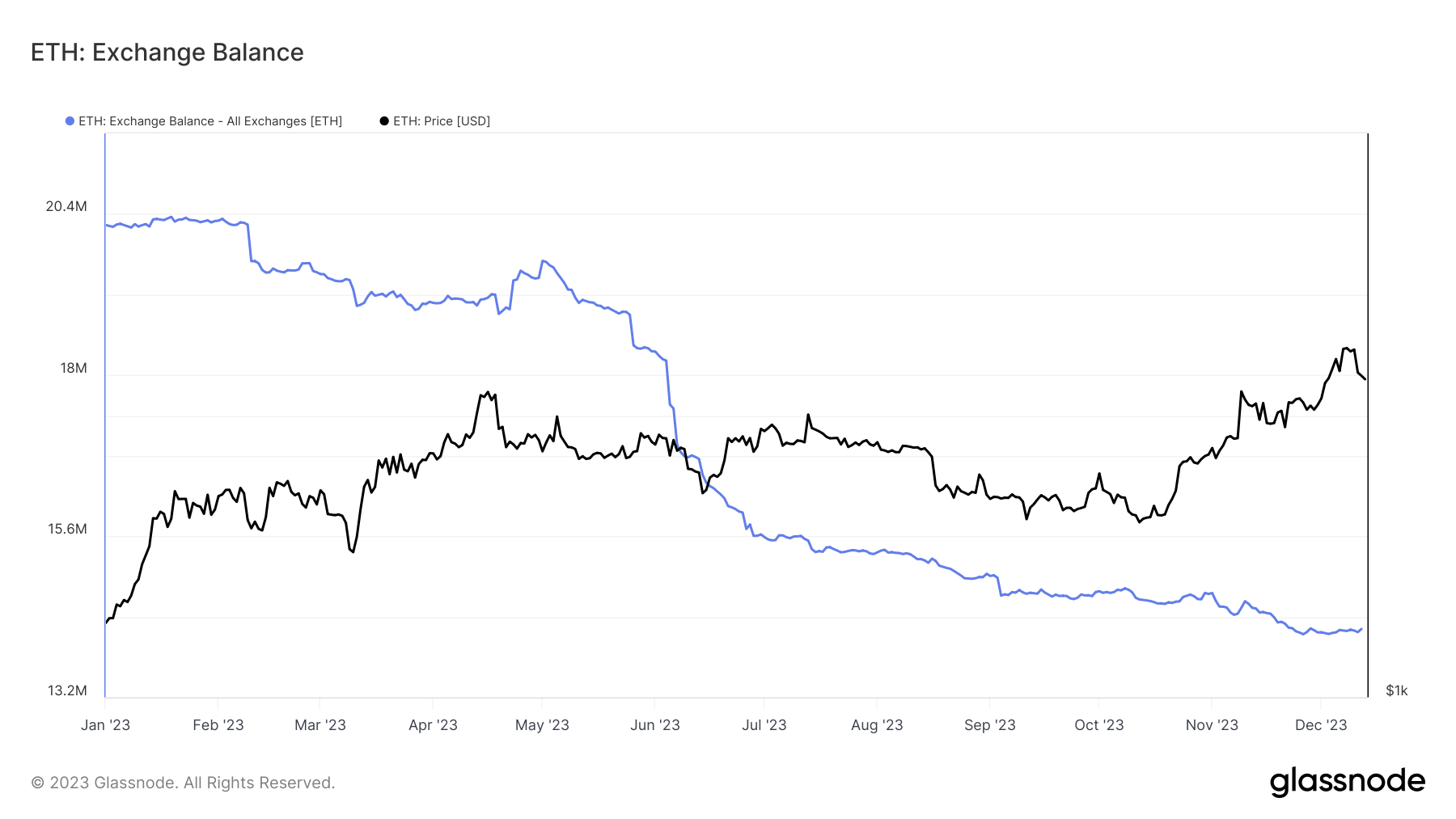

There has been a notable diminution successful Ethereum’s beingness connected centralized exchanges this year. From a precocious of 20.23 cardinal ETH connected Jan. 1, the equilibrium plunged to 14.21 cardinal by Dec. 12, marking a 29.68% decrease. This inclination mirrors Bitcoin’s withdrawal from exchanges but with a chiseled Ethereum flavor, emphasizing a pivot towards DeFi alternatively than acold storage. The play from Oct.11 to Dec. 12 unsocial saw a 2.87% driblet successful ETH balances connected CEXs.

Graph showing the Ethereum equilibrium held connected centralized exchanges successful 2023 (Source: Glassnode)

Graph showing the Ethereum equilibrium held connected centralized exchanges successful 2023 (Source: Glassnode)This diminution successful Ethereum proviso connected exchanges means that lone 11.81% of Ethereum’s full proviso remains connected centralized platforms, the lowest since July 2016. This fig was importantly higher astatine 16.78% astatine the commencement of the year.

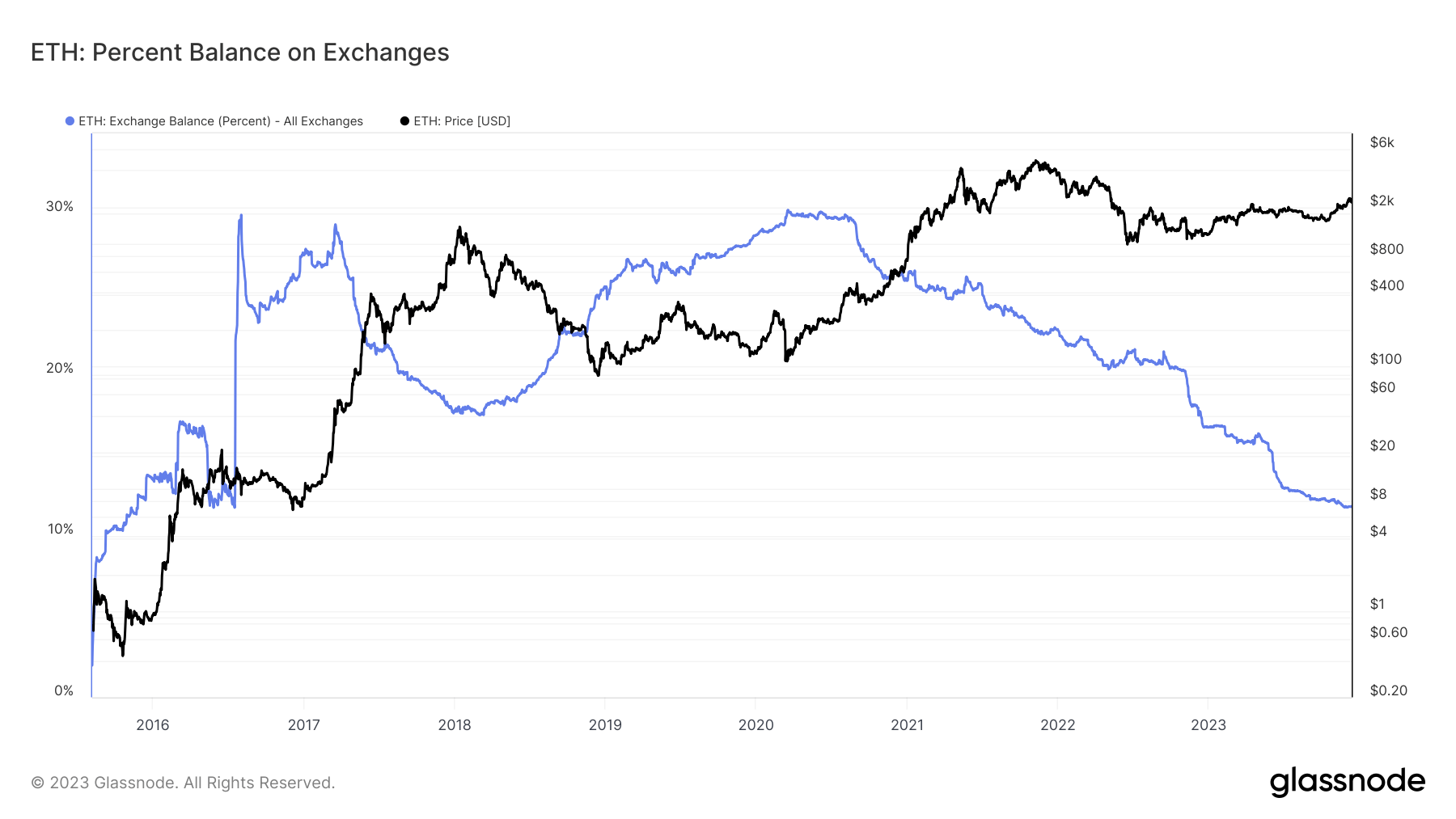

Graph showing the percent of Ethereum’s proviso held connected centralized exchanges from August 2015 to December 2023 (Source: Glassnode)

Graph showing the percent of Ethereum’s proviso held connected centralized exchanges from August 2015 to December 2023 (Source: Glassnode)The information points towards a discernible displacement successful capitalist penchant towards decentralized finance. This is highlighted by the important maturation successful Total Value Locked (TVL) wrong the Ethereum ecosystem, which soared from $22.16 cardinal astatine the opening of 2023 to $27.63 cardinal by Dec. 12. This summation successful TVL underpins a increasing assurance and superior committedness successful Ethereum-based DeFi.

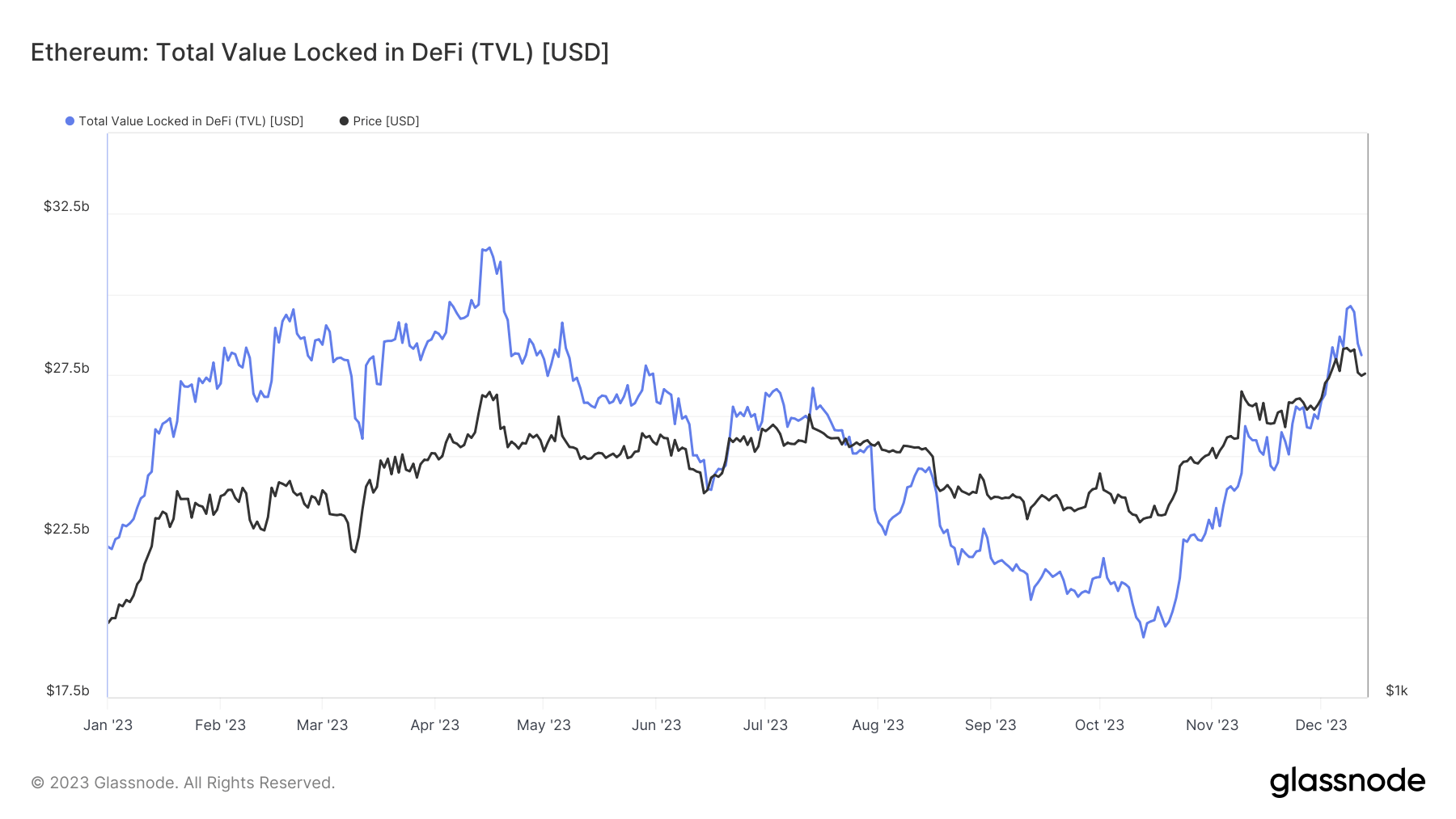

Graph showing the full worth locked (TVL) successful the Ethereum ecosystem successful 2023 (Source: Glassnode)

Graph showing the full worth locked (TVL) successful the Ethereum ecosystem successful 2023 (Source: Glassnode)Focusing connected Uniswap V3, the largest blue-chip level connected Ethereum, illustrates the maturation the DeFi assemblage has seen. On Dec. 12, Uniswap recorded 353,544 ETH successful trades and held a liquidity of 1.36 cardinal ETH.

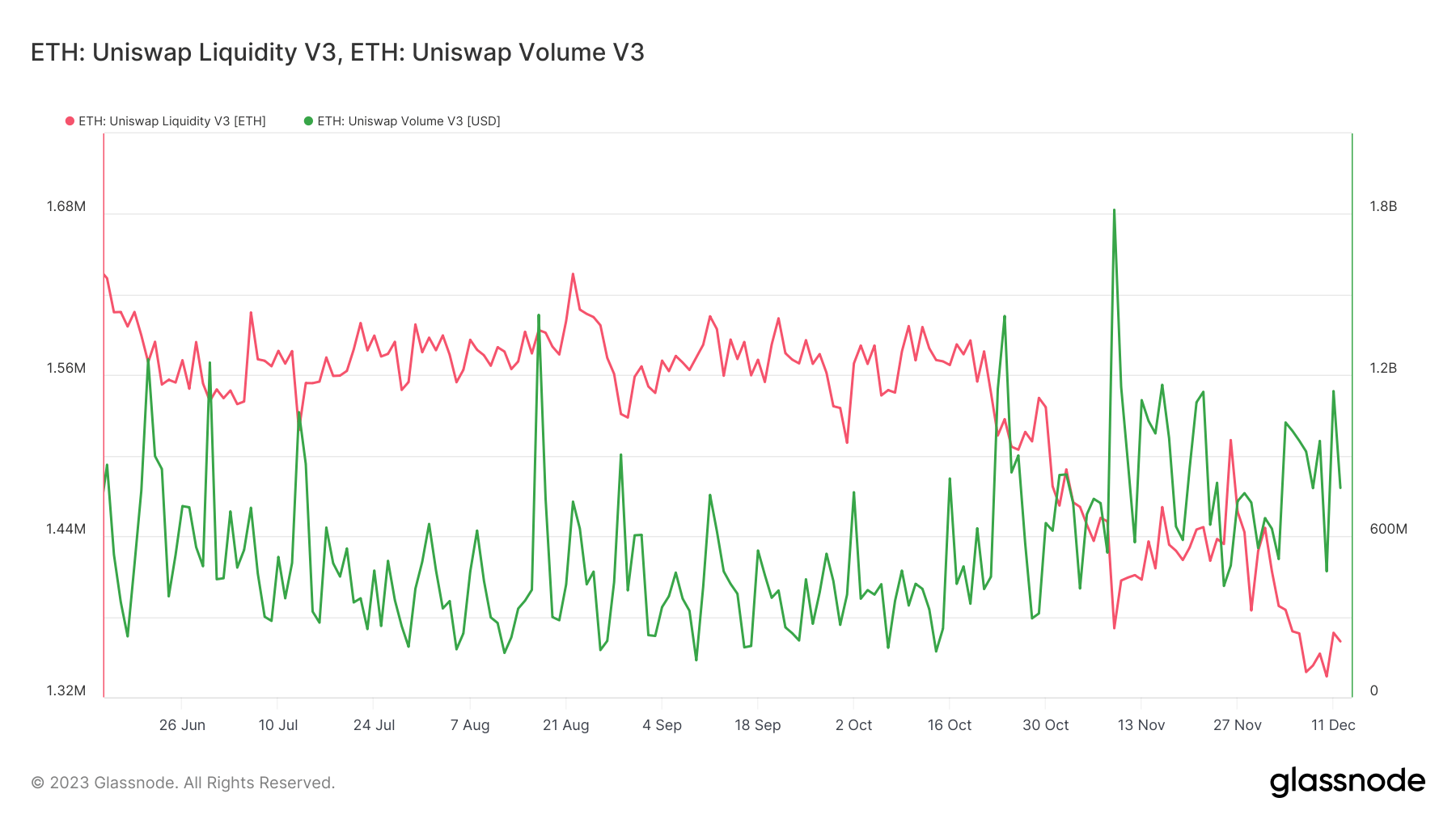

Graph showing the trading measurement and liquidity connected Uniswap V3 from June 15 to Dec. 12, 2023 (Source: Glassnode)

Graph showing the trading measurement and liquidity connected Uniswap V3 from June 15 to Dec. 12, 2023 (Source: Glassnode)This enactment connected a azygous level importantly overshadows that connected centralized exchanges, wherever interior and intra-exchange ETH transfers reached 124,146 ETH and 6,627 ETH, respectively, connected the aforesaid date.

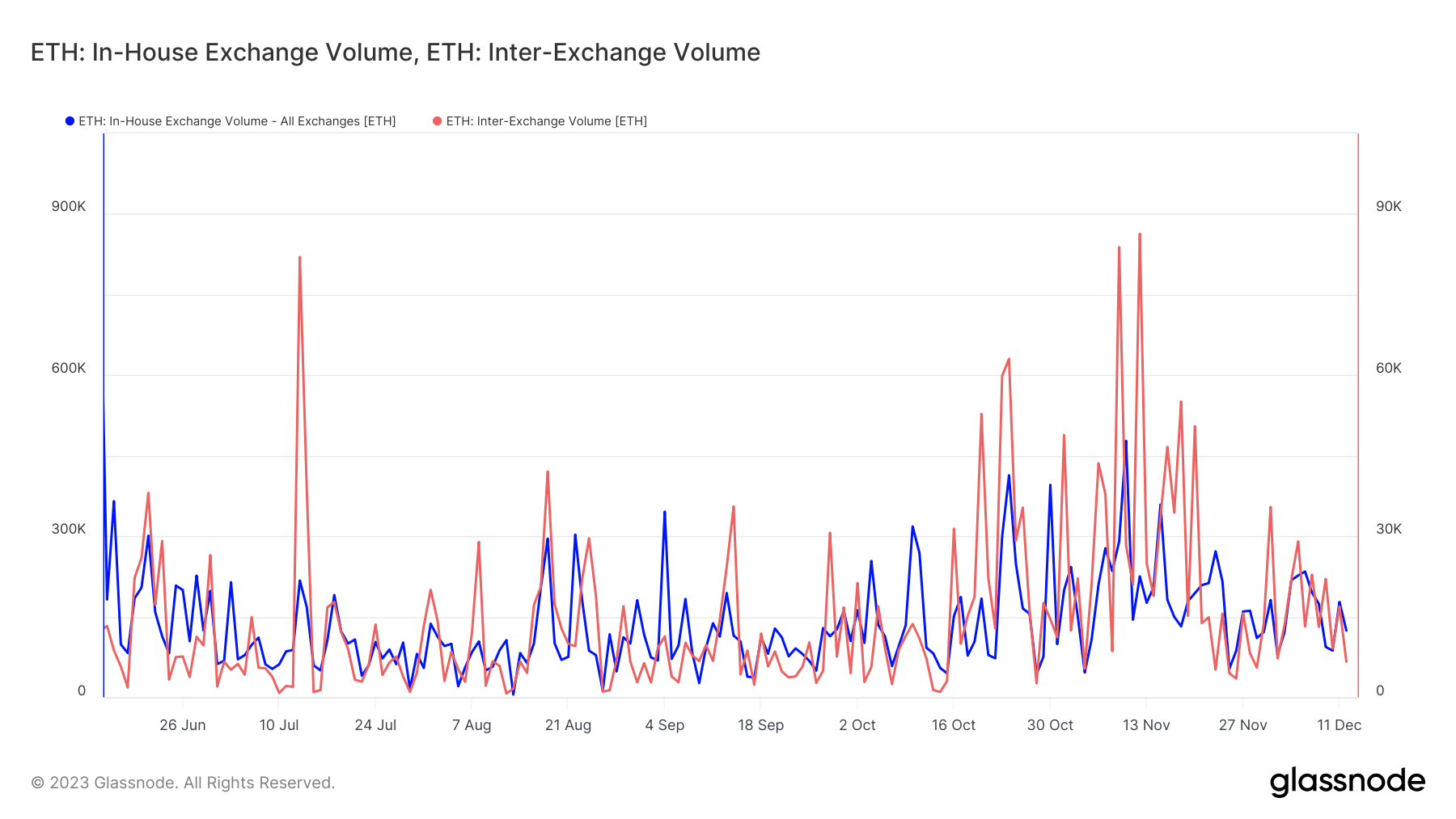

Graph showing the magnitude of ETH transferred betwixt wallets of the aforesaid speech (inter-exchange) and betwixt antithetic exchanges (intra-exchange) from June 15 to Dec. 12, 2023 (Source: Glassnode)defidefi

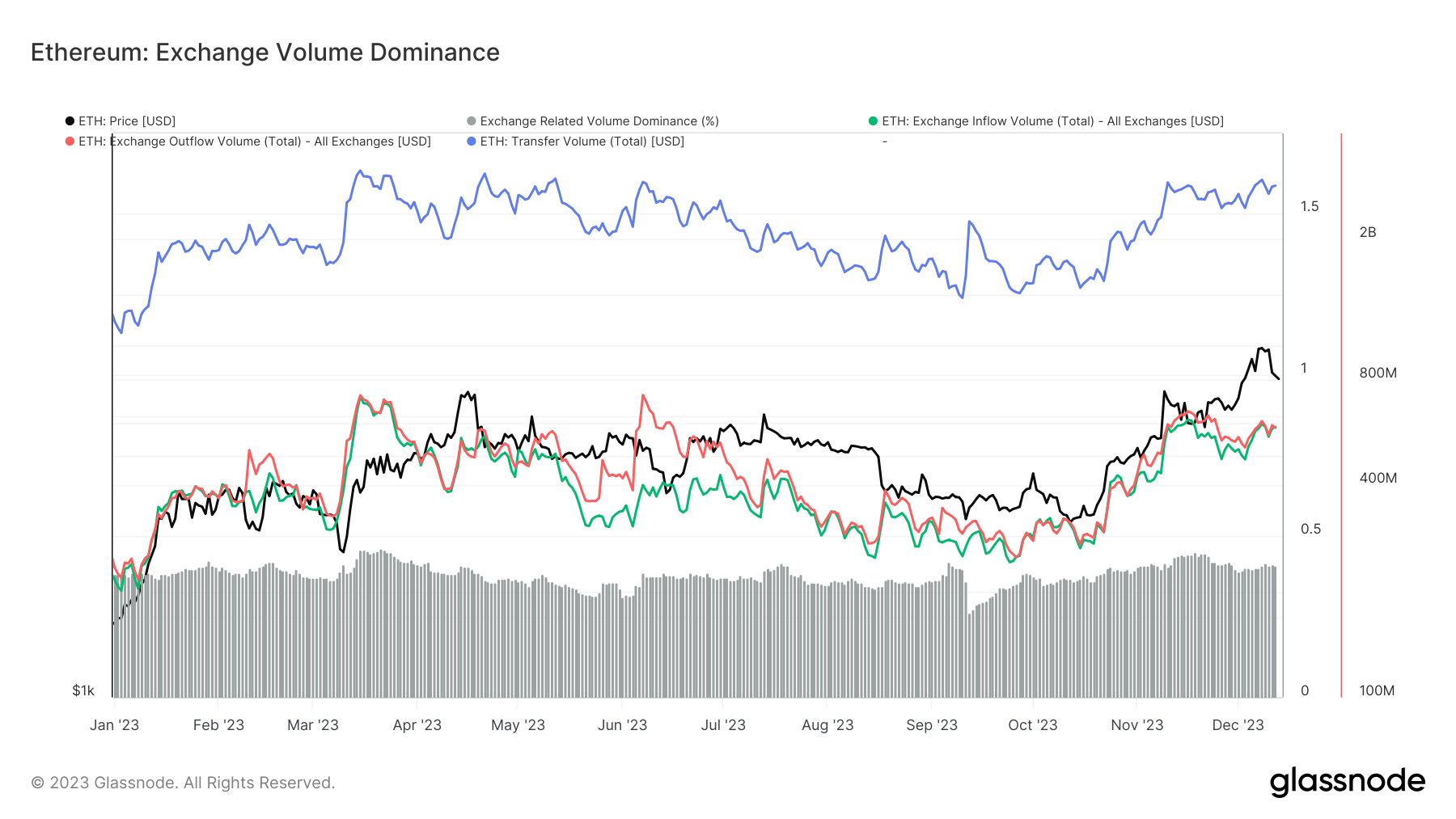

Graph showing the magnitude of ETH transferred betwixt wallets of the aforesaid speech (inter-exchange) and betwixt antithetic exchanges (intra-exchange) from June 15 to Dec. 12, 2023 (Source: Glassnode)defidefiAnother captious facet is the comparative dominance of ETH speech inflows and outflows compared to the wide Ethereum transaction volume. This metric roseate from 38.44% connected Jan. 1 to 41.14% by Dec. 12, contempt the wide simplification successful exchange-held ETH. This indicates that Ethereum transactions connected exchanges person go either much predominant oregon larger successful volume.

Graph showing the comparative dominance of ETH speech inflow and outflow volumes with respect to the planetary transportation measurement successful 2023 (Source: Glassnode)

Graph showing the comparative dominance of ETH speech inflow and outflow volumes with respect to the planetary transportation measurement successful 2023 (Source: Glassnode)In 2023, Ethereum saw a wide modulation distant from centralized exchanges. While the simplification successful exchange-held ETH suggests a question towards DeFi platforms oregon backstage wallets, the accrued comparative speech inflow/outflow volumes bespeak a much dynamic trading environment. The robust enactment connected Uniswap Version 3 further emphasizes the important relation of decentralized exchanges successful the Ethereum market. Additionally, the maturation successful TVL reflects an escalating assurance and concern successful the Ethereum-based DeFi sector.

The migration from centralized exchanges to decentralized concern points to a maturing marketplace wherever investors progressively prosecute with much analyzable and divers fiscal products.

The station Ethereum sees large displacement from centralized exchanges to DeFi appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)