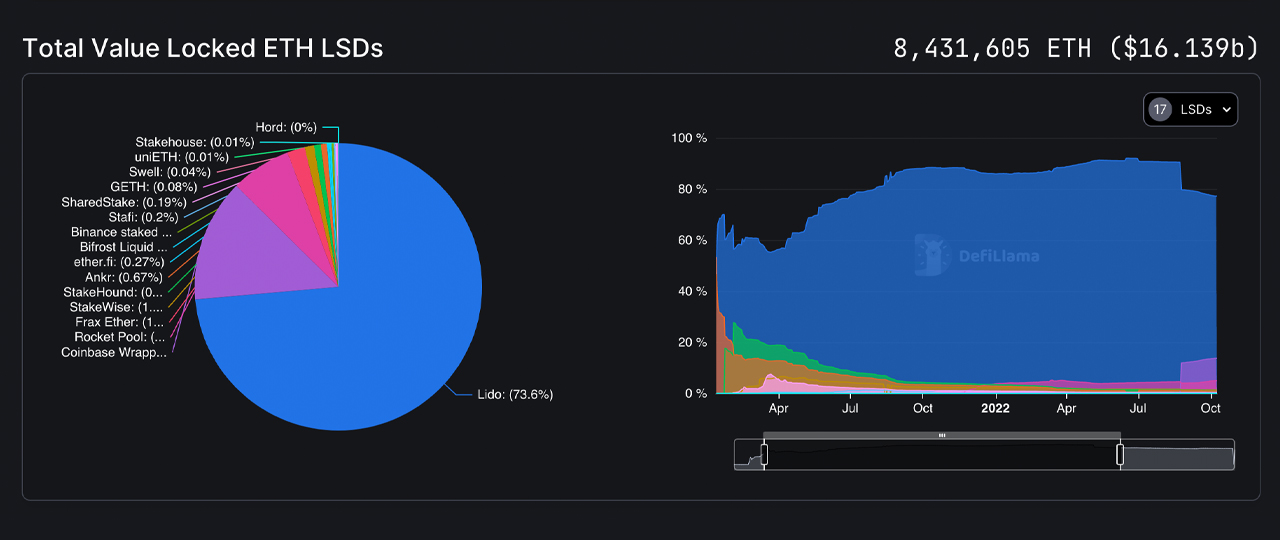

Just implicit 2 weeks person passed since Ethereum’s Shapella upgrade connected April 12, 2023, which occurred astatine artifact tallness 6,209,536, enabling stakers to retreat for the archetypal time. At the clip of the upgrade, somewhat implicit 8 cardinal ethereum was locked into liquid staking protocols. Since then, implicit 400,000 ether, valued astatine $763 million, has been added to 17 liquid staking platforms.

Ethereum Liquid Staking Platforms Continue to Swell

As of today, April 30, 2023, the full worth locked into liquid staking protocols specified arsenic Lido Finance, Coinbase’s Wrapped Staked Ether, Rocket Pool, Frax, Stakewise, Stakehound, Ankr, Ether.fi, and Bitfrost is conscionable implicit $16 billion.

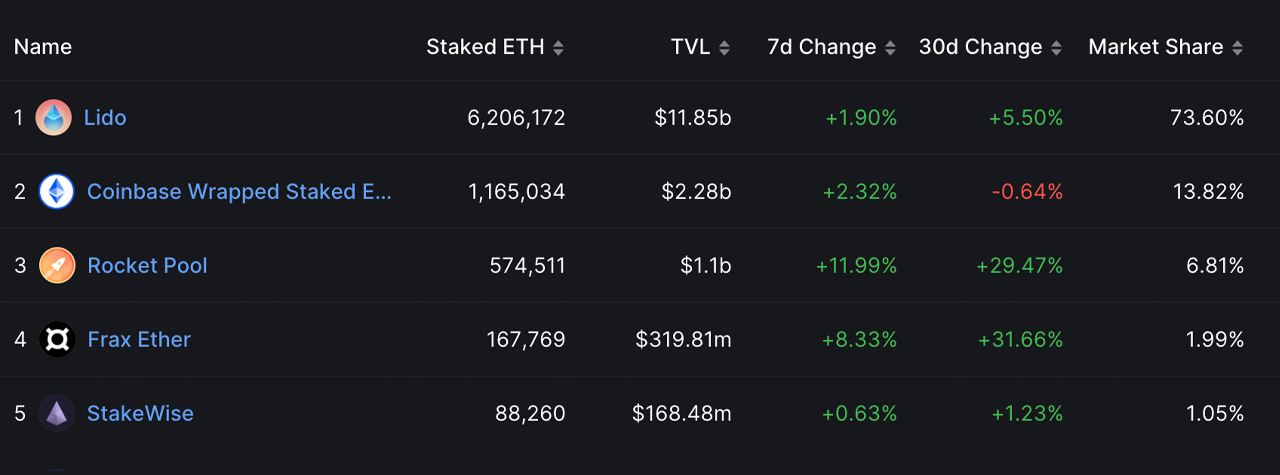

According to 30-day statistics, six retired of the apical 10 protocols, ranked by worth locked, person experienced gains implicit the past month, with 4 of them showing double-digit growth. At present, Lido dominates the $16 cardinal market, holding 73.6% oregon 6,206,101 of the 8,431,605 ethereum locked successful liquid staking protocols.

Data shows that conscionable aft the Shapella upgrade, 400,735 ethereum worthy $763,600,542 utilizing today’s ether speech rates has been added to the liquid staking cache. Lido’s 30-day metrics amusement an summation of 5.50% portion Coinbase’s liquid staking level saw a nonaccomplishment of 0.64% implicit the past month.

Rocket Pool’s full worth locked (TVL) jumped 29.24% successful 30 days portion Frax’s TVL roseate by 31.65%. Like Lido, Stakewise, the fifth-largest liquid staking protocol saw a humble 30-day summation rising 1.23% higher.

Recent information reveals that pursuing the Shapella upgrade, a notable 400,735 ethereum, totaling $763.6 cardinal successful value, has been added to the liquid staking cache. While Lido’s 30-day metrics picture an summation of 5.50%, Coinbase’s liquid staking level suffered a nonaccomplishment of 0.64% implicit the past month.

In the aforesaid period, Rocket Pool experienced a important 29.24% leap successful full worth locked (TVL), portion Frax’s TVL roseate by 31.65%. Similar to Lido’s tiny rise, Stakewise, the fifth-largest liquid staking protocol, witnessed a humble 1.23% summation implicit the past 30 days.

Binance has thrown its chapeau successful the ring, entering the fray with a recently launched liquid staking product, present lasting arsenic the tenth largest level nether Bitfrost. As of now, the protocol’s full worth locked (TVL) is astir $38.69 million, with 20,305 ether staked into the application.

Liquid staking protocols person gained important traction successful caller months providing users with the convenience of earning passive staking rewards portion inactive retaining power of their assets. The summation of 400,000 ether to the liquid staking TVL wrong conscionable 2 weeks of the Shapella upgrade underscores the increasing involvement and attraction this assemblage is receiving.

Tags successful this story

How bash you deliberation liquid staking protocols volition interaction the wide cryptocurrency marketplace and the aboriginal of staking? Share your thoughts astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 7,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)